How to open a Peruvian bank account for retirement visa sets the stage for a detailed exploration of the requirements and procedures involved in establishing financial stability for retirement in Peru. This comprehensive guide navigates the complexities of the application process, from initial documentation to ongoing financial management strategies.

The process encompasses a range of considerations, including the necessary documents, financial requirements, and legal procedures specific to obtaining a Peruvian retirement visa. Understanding the intricacies of opening a bank account, managing finances, and navigating the cultural and logistical aspects of living in Peru are crucial for a smooth transition into retirement. The guide also explores the diverse financial and lifestyle factors retirees should consider when making this significant life change.

Prerequisites for Retirement Visa Application

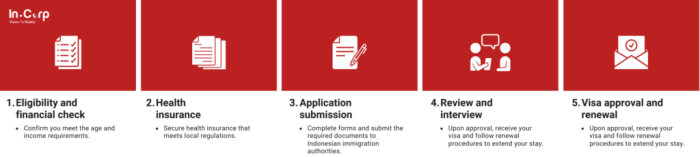

Embarking on a new chapter in Peru, a land brimming with vibrant culture and ancient history, requires a well-defined path. A retirement visa, a gateway to this enriching experience, necessitates careful preparation and meticulous adherence to Peruvian immigration regulations. This journey, a testament to your spiritual growth and desire for a fulfilling retirement, demands a profound understanding of the necessary prerequisites.The Peruvian retirement visa process, a gateway to a serene and fulfilling life, is a testament to your desire for growth and change.

Each step, meticulously crafted, paves the way for a meaningful transition. Comprehending the essential documents, financial requirements, and health insurance provisions will illuminate the path towards a prosperous and satisfying retirement in Peru.

Required Documents

Understanding the specific documents needed for a Peruvian retirement visa application is crucial. This comprehensive list ensures a smooth and efficient application process, aligning with Peruvian immigration procedures. The meticulous collection of these documents is vital for a swift and successful application.

- Passport: A valid passport with a minimum validity period exceeding the intended stay in Peru.

- Proof of Age: Birth certificate or other official documentation confirming age, vital for demonstrating eligibility criteria.

- Financial Proof: Demonstrating sufficient financial resources to sustain yourself in Peru, this is a critical factor for visa approval. Various financial documents, such as bank statements and investment records, may be necessary.

- Health Insurance: Evidence of comprehensive health insurance coverage, crucial for ensuring access to medical care in Peru. A detailed explanation of the coverage and limits is necessary.

- Criminal Background Check: A clean criminal record is a fundamental requirement, showcasing a history of adherence to the law.

- Proof of Residence: Documentation proving your current residence, confirming your established ties to your home country.

- Application Form: Complete and accurate submission of the official application form is critical to the process.

- Photographs: Conforming to Peruvian immigration specifications, photographs are an essential aspect of the application process.

Financial Requirements

The financial stipulations for obtaining a Peruvian retirement visa are designed to ensure your ability to self-sustain during your stay. The financial requirements demonstrate your commitment to contributing positively to the Peruvian economy and society. This ensures a positive contribution to Peruvian society.

- Minimum Monthly Income: A minimum monthly income is often required to prove your ability to support yourself without reliance on public assistance.

- Bank Statements: Comprehensive bank statements detailing your assets and income streams are crucial for demonstrating your financial stability.

- Investment Records: Investment records, if applicable, demonstrate your overall financial health and capacity to support yourself in Peru.

- Proof of Savings: Demonstrating sufficient savings to cover living expenses during the initial period of your stay in Peru.

Health Insurance Stipulations

Adequate health insurance coverage is paramount for ensuring your well-being during your stay in Peru. This critical aspect of the application process safeguards your health and ensures access to necessary medical care.

- Comprehensive Coverage: Comprehensive health insurance plans are typically required, encompassing a broad range of medical expenses.

- Minimum Coverage Amount: A minimum coverage amount, determined by Peruvian immigration regulations, must be present to ensure financial protection during medical emergencies.

- Insurance Provider Details: Details regarding the insurance provider and policy number are necessary for verification purposes.

Application Process Variations by Nationality, How to open a peruvian bank account for retirement visa

The application process for a Peruvian retirement visa can vary slightly based on your nationality. This variation stems from specific requirements set forth by Peruvian immigration laws.

| Nationality | Specific Documents |

|---|---|

| US Citizens | Passport, birth certificate, proof of financial resources, health insurance, criminal background check, and application form. |

| Canadian Citizens | Passport, birth certificate, proof of financial resources, health insurance, criminal background check, and application form. |

| European Union Citizens | Passport, birth certificate, proof of financial resources, health insurance, criminal background check, and application form. |

Opening a Bank Account in Peru

Embarking on a new chapter in Peru, a land of vibrant culture and ancient wisdom, requires a solid financial foundation. Opening a bank account is a crucial step in establishing this foundation, allowing you to navigate your retirement with ease and peace of mind. This process, while seemingly mundane, is a significant act of spiritual alignment, reflecting your commitment to your financial well-being.Opening a bank account in Peru is more than just a transaction; it’s a ritual of financial empowerment.

This process allows you to safeguard your resources, facilitating smooth transactions and fostering a sense of security. Understanding the various account types and procedures is key to achieving this alignment.

Types of Bank Accounts for Retirement Visa Applicants

Different bank accounts cater to specific needs. For retirement visa applicants, several options exist. A basic savings account offers a safe haven for your funds, accumulating interest and providing a stable base for your financial journey. A checking account allows for convenient transactions, such as bill payments and direct deposits. A combination account often combines savings and checking features, offering a balance of security and accessibility.

A higher-tier account, potentially including features like international money transfers, may be suitable for those expecting regular transfers or significant international transactions. Consider your specific needs to choose the account that best resonates with your financial goals and spiritual values.

Step-by-Step Guide to Opening a Bank Account

Opening a bank account in Peru is a straightforward process. Firstly, gather your necessary identification documents. Secondly, visit a branch of your chosen bank. Thirdly, complete the required application forms. Fourthly, submit the documents and be prepared to answer questions about your identity and purpose for opening the account.

Fifthly, upon successful verification, you will receive your bank account details. Finally, familiarize yourself with the account’s functionalities and terms. This structured approach ensures a smooth and efficient process.

Account Verification Procedures

Thorough account verification is a crucial security measure. Banks typically verify your identity through various procedures, including document matching and potentially, in-person verification. This verification process safeguards your funds and maintains the integrity of the banking system. Be prepared to provide accurate and complete information to expedite the process and maintain trust with the financial institution.

Required Identification Documents

For account setup, various identification documents are required. These documents serve as proof of your identity and residency, ensuring the security of your financial transactions. Typically, these documents include a valid passport, a recent utility bill, and proof of residency in Peru. These documents are crucial to the process and must be presented accurately.

Potential Fees Associated with Opening and Maintaining a Bank Account

Opening a bank account may involve initial setup fees. Ongoing fees may apply for maintaining the account, such as monthly service charges or minimum balance requirements. Carefully review the terms and conditions offered by different banks to understand the potential costs involved. This knowledge empowers you to make informed decisions.

Comparison of Services Offered by Different Peruvian Banks

Different Peruvian banks offer a variety of services. Factors such as transaction limits, international money transfer capabilities, and online banking platforms vary between banks. Understanding the services offered by each bank allows you to select an institution that best suits your needs. Consider the specific services required for your retirement and choose a bank that aligns with your requirements.

Bank Fees and Services Table

| Bank Name | Opening Fee (USD) | Monthly Fee (USD) | Minimum Balance (USD) | Online Banking | International Transfers |

|---|---|---|---|---|---|

| Banco de Crédito del Perú | 10 | 5 | 100 | Yes | Yes |

| Interbank | 5 | 0 | 50 | Yes | Yes |

| BBVA Continental | 15 | 10 | 200 | Yes | Yes |

This table provides a concise overview of potential fees and services offered by some Peruvian banks. Remember to consult the bank’s official website for the most up-to-date information. Seek clarity on the terms to ensure you understand the implications of any associated fees.

Financial Management for Retirement in Peru

Embarking on a new chapter in Peru, filled with golden years and vibrant experiences, demands a profound understanding of financial stewardship. This journey requires careful planning and insightful strategies to ensure a comfortable and fulfilling retirement. Your financial well-being is not just about numbers; it’s about aligning your resources with your dreams and ensuring a serene and prosperous future.A well-structured financial plan is the cornerstone of a successful retirement.

It empowers you to navigate the complexities of currency fluctuations, tax implications, and investment opportunities, ultimately safeguarding your financial freedom and enabling you to embrace the adventures that await.

Essential Financial Considerations for Retirees in Peru

A robust financial plan for retirement in Peru requires a thorough evaluation of your current assets, anticipated expenses, and long-term goals. This assessment provides a clear roadmap for navigating the financial landscape. Careful consideration must be given to factors such as inflation, healthcare costs, and potential lifestyle adjustments.

Best Investment Strategies for Peruvian Retirement Accounts

Diversification is key to mitigating risks and maximizing returns. A well-diversified portfolio across various asset classes, including stocks, bonds, and real estate, can offer a balanced approach to investment. Exploring opportunities in Peruvian equities can provide exposure to the local market, potentially offering attractive returns. Consider consulting with a financial advisor to develop a personalized investment strategy aligned with your risk tolerance and financial objectives.

Financial Advisors Specializing in Retirement Planning for Expats in Peru

Finding a financial advisor with expertise in expat retirement planning is crucial. These advisors understand the unique challenges and opportunities faced by retirees relocating to Peru. They can provide guidance on investment strategies tailored to your specific needs, navigate the complexities of international taxation, and ensure your financial future is secure.

- Recommendation: Research advisors who have a proven track record of success with expat clients in Peru.

- Key Considerations: Verify the advisor’s certifications, experience, and understanding of international tax laws.

- Additional Tip: Seek referrals from other expat communities in Peru.

Currency Exchange Rates and their Impact on Retirement Funds

Fluctuations in currency exchange rates can significantly impact retirement funds held in foreign accounts. Understanding these rates and their potential effects is vital for proactive financial management. Regular monitoring of exchange rates and their impact on your portfolio is essential. Utilizing tools and resources to track these rates will allow for informed adjustments to your investment strategies.

| Currency | Exchange Rate (per 1 Peruvian Sol) |

|---|---|

| US Dollar (USD) | Example: 3.75 |

| Euro (EUR) | Example: 4.20 |

| British Pound (GBP) | Example: 4.90 |

Note: Exchange rates are dynamic and can vary significantly based on market conditions. This example table provides a snapshot, and it is crucial to consult real-time data sources.

Tax Implications for Retirees Holding Foreign Accounts in Peru

Peruvian tax laws govern the taxation of foreign accounts held by retirees. Understanding these implications is essential for ensuring compliance and avoiding potential penalties. Consult with a tax advisor to gain a comprehensive understanding of your tax obligations.

Potential Tax Benefits for Retirees in Peru

Peru offers certain tax benefits to retirees, such as specific deductions or exemptions. These can significantly reduce your tax burden and maximize your retirement savings. Understanding these benefits can lead to substantial financial advantages.

Legal and Administrative Procedures

Embarking on this journey to a new life in Peru requires a deep understanding of the legal framework. This understanding, combined with a commitment to the process, will pave the way for a smooth transition. Let your inner compass guide you through these legal intricacies.The Peruvian immigration system, while designed for the smooth entry of those seeking a retirement lifestyle, demands meticulous attention to detail.

The path to a residence permit is not paved with ease, but rather sculpted with care and meticulous planning. This section details the critical steps to ensure a harmonious and legal settlement.

Registering with Peruvian Immigration Authorities

The initial step involves registering with the Peruvian immigration authorities. This entails submitting the necessary documentation, adhering to the specified procedures, and understanding the requirements Artikeld by the Peruvian immigration office. Accurate and complete documentation is crucial for a swift and efficient process.

Obtaining a Residence Permit in Peru

A residence permit is the cornerstone of your legal presence in Peru. The application process involves careful preparation, a thorough understanding of the requirements, and precise completion of all necessary forms. The Peruvian immigration office will assess the submitted documentation for compliance with established guidelines.

Legal Framework Governing Retirement Visas in Peru

Peruvian law provides a specific framework for retirement visas. This framework Artikels the eligibility criteria, the procedures, and the specific requirements for obtaining the visa. It’s imperative to consult the official government websites and legal documents for the most up-to-date information. The legal framework is designed to ensure the orderly integration of retirees into Peruvian society.

Importance of Legal Representation

Navigating the intricacies of Peruvian immigration law can be challenging. A legal representative can be invaluable in ensuring compliance with all regulations and procedures. This professional guidance can save you time, prevent errors, and offer crucial support during the application process.

Penalties for Non-Compliance with Peruvian Immigration Laws

Non-compliance with Peruvian immigration laws can lead to serious consequences. Penalties can vary from fines to deportation. Thorough understanding of the regulations is essential to avoid these penalties. It is wise to consult with legal experts to ensure adherence to all applicable laws.

Resources Available to Assist with Legal Matters in Peru

Numerous resources are available to assist with legal matters in Peru. These resources include legal aid organizations, law firms specializing in immigration law, and government agencies that provide information and support. Seeking guidance from these sources can provide valuable assistance throughout the application process.

Key Legal Requirements and Procedures

| Requirement | Procedure |

|---|---|

| Complete application forms | Accurate and timely completion of forms provided by Peruvian immigration authorities. |

| Provide supporting documents | Submission of necessary documents, such as proof of funds, medical records, and criminal background checks. |

| Meet eligibility criteria | Satisfying all the requirements for a retirement visa, including financial stability and health status. |

| Pay required fees | Prompt payment of all applicable fees as stipulated by Peruvian immigration regulations. |

| Attend required interviews | Attending scheduled interviews with immigration officers to discuss the application and provide further details. |

Living Expenses and Cost of Living in Peru

Embarking on a new chapter in Peru, especially for retirement, requires a clear understanding of living expenses. This knowledge empowers you to plan effectively, ensuring a fulfilling and financially secure retirement journey. The cost of living varies considerably across Peru, influenced by factors such as location, lifestyle choices, and individual needs. Embrace this exploration with an open heart and a spirit of discovery.A mindful approach to budgeting is crucial for a comfortable retirement.

Understanding the average expenses for retirees allows you to craft a personalized financial plan that aligns with your aspirations and resources. This knowledge empowers you to make informed decisions about your housing, food, transportation, and entertainment choices.

Average Monthly Expenses for Retirees

A realistic estimate for average monthly expenses for retirees in Peru varies widely. Factors such as housing location, dietary preferences, and recreational activities significantly impact the total cost. While there isn’t a single definitive figure, research suggests that a comfortable retirement in a moderate-sized city might range from approximately US$1,000 to US$2,500 per month. This includes housing, food, transportation, healthcare, and entertainment.

Costs of Housing, Food, Transportation, and Entertainment in Different Cities

The cost of living in Peru’s major cities reflects the diverse economic landscape. Lima, as the capital, generally has higher expenses compared to other regions. In smaller cities and towns, costs tend to be more moderate.

Housing

Housing costs in Lima can range from US$500 to US$2,000 or more per month, depending on the size and location of the property. Outside Lima, options are typically more affordable, with apartments or houses in the range of US$300 to US$1,000. Consider factors such as proximity to amenities, safety, and the desired lifestyle when making your selection.

Food

Food costs in Peru vary considerably. Eating at restaurants can range from US$10 to US$50 or more per meal, while grocery shopping can be budget-friendly. A balanced diet and careful planning can help keep food costs manageable. Exploring local markets and trying regional specialties is a great way to immerse yourself in Peruvian cuisine while remaining mindful of your budget.

Transportation

Transportation costs in Peru depend on the chosen mode and location. Public transportation systems, such as buses and trains, are generally affordable, often costing less than US$5 per day. If you prefer a car, consider the cost of fuel and parking. Consider the convenience and practicality of transportation options when evaluating different areas.

Entertainment

Entertainment costs vary widely, from free activities like exploring parks and museums to more expensive options like attending concerts or shows. Cultural events and festivals often provide opportunities for affordable entertainment. Researching local events and taking advantage of free or low-cost activities can help you manage entertainment expenses effectively.

Cultural Differences Impacting Daily Expenses

Peruvian culture emphasizes hospitality and social interaction. This can lead to unexpected expenses, such as invitations to social gatherings or celebrations. Understanding these cultural norms helps you adapt to the social fabric of Peru while staying mindful of your budget. This also allows you to better integrate into the community.

Resources for Comparing Living Costs

Numerous online resources can help you compare living costs across Peruvian cities. Websites dedicated to cost of living comparisons provide valuable insights. Conducting research on these platforms allows you to assess the financial realities of different locations.

Comparing Cost of Living in Different Regions

Peru’s diverse geography and regional economies lead to varying costs of living. The Andean highlands, for example, often have lower costs compared to coastal cities. The Amazon region presents unique considerations, with expenses potentially different from the rest of the country. Be prepared for these differences in cost when evaluating potential retirement locations.

Affordable Housing Options for Retirees

Many affordable housing options exist for retirees in Peru. Consider shared accommodations, smaller apartments, or houses in less-centralized locations. Exploring these possibilities can significantly reduce living expenses. Remember to prioritize safety and security when evaluating housing options.

Finding Accommodation and Services

Embarking on a new chapter in Peru, a land brimming with vibrant culture and breathtaking landscapes, requires thoughtful consideration of your surroundings. Finding the right home base and essential services will ensure a harmonious transition into your retirement, allowing you to embrace the tranquility and fulfillment this new adventure offers. Let your spirit guide you as you discover the ideal haven for your golden years.Finding suitable accommodation and essential services in Peru for your retirement is a journey of discovery, a testament to your ability to embrace new experiences and create a vibrant life.

A well-chosen location and reliable services will not only enhance your quality of life but also provide a strong foundation for your journey.

Best Neighborhoods for Retirees

Peru offers a variety of neighborhoods suited for retirees, each with its unique charm and appeal. Consider areas known for their tranquility, walkability, and access to amenities. Areas with a strong expat community can offer a sense of familiarity and support. For example, Miraflores and Barranco in Lima provide a blend of modern conveniences and a rich cultural heritage, while smaller towns in the Andes or coastal regions offer a more secluded and serene atmosphere.

Reliable Real Estate Agents

Connecting with trustworthy real estate agents is paramount to navigating the Peruvian property market. These professionals can provide invaluable insights into available properties, negotiate favorable deals, and assist with the entire process. Seek out agents specializing in long-term rentals or property purchases, who understand the needs and preferences of retirees. Referrals from established expat communities or trusted sources can be a valuable resource in your search.

For instance, a well-recommended agent could provide detailed information on properties, discuss financing options, and help you avoid potential pitfalls.

Healthcare Facilities and Services

Healthcare is a critical component of a comfortable retirement. Ensure you have access to reputable medical facilities and healthcare providers. Consider the availability of English-speaking doctors and the proximity of hospitals, clinics, and pharmacies. Inquire about insurance options that are compatible with Peruvian healthcare systems. For example, having a primary care physician who understands your medical history and preferences will make your well-being a priority.

Educational Institutions and Recreational Activities

To maintain an active and fulfilling life, explore educational opportunities and recreational activities available in your chosen location. Attend language classes, cultural workshops, or take advantage of the rich artistic and historical heritage of the region. Many areas have clubs, organizations, or sports facilities, which can be a source of social interaction and engagement. For instance, consider joining a book club, enrolling in a cooking class, or taking up hiking to connect with the local environment.

Accommodation Options and Prices

| Accommodation Type | Approximate Price Range (USD/month) |

|---|---|

| Apartment in a central location | $800 – $2,000 |

| House in a quieter neighborhood | $1,000 – $3,000 |

| Boutique hotel or guesthouse | $500 – $1,500 |

| Shared accommodation with other retirees | $400 – $800 |

These are approximate figures, and actual prices may vary depending on the specific location, size, amenities, and time of year.

Local Services for Expats

A supportive network of local services can greatly enhance your expat experience. Seek out shops, restaurants, and businesses catering to the needs of expats. Look for grocery stores carrying familiar products, pharmacies stocking international medications, and reliable transportation services. This will ensure a smooth transition and enable you to connect with the local community. For example, a local market selling international food items will help maintain familiarity with your tastes, and a reliable taxi service will ensure easy access to different parts of the city.

Cultural Adaptation and Integration: How To Open A Peruvian Bank Account For Retirement Visa

Embarking on a new life in a foreign land, like Peru, is a profound journey of self-discovery and spiritual growth. Embrace this adventure with an open heart, a curious mind, and a willingness to learn. Peruvian culture, rich in history and vibrant traditions, offers a tapestry of experiences waiting to be woven into your new life. Cultivate a spirit of respect and understanding to navigate this new environment with grace and joy.Understanding the cultural landscape is key to a fulfilling retirement experience.

This section will guide you through the nuances of Peruvian society, helping you navigate customs and etiquette with ease. It also addresses the opportunities for meaningful social interaction and community involvement, enabling you to forge connections and build a supportive network. Embrace the challenges and opportunities that come with cultural integration; this journey will be transformative.

Peruvian Cultural Nuances

Peruvian society is a beautiful blend of indigenous traditions, Spanish colonial influences, and modern global trends. This rich tapestry contributes to a unique cultural landscape. Respect for elders, strong family ties, and a deep connection to the land are prominent aspects of Peruvian culture. Hospitality is deeply ingrained in Peruvian values, often manifested in warm greetings and generous offers of assistance.

Understanding these foundational elements fosters meaningful interactions and respect for the local community.

Understanding Peruvian Customs and Etiquette

Peruvian customs and etiquette often differ from those in your home country. Respect for elders is paramount, reflected in formal greetings and deference shown to those of advanced age. Personal space is often considered more intimate than in some Western cultures. This doesn’t indicate disrespect; rather, it emphasizes the importance of close-knit relationships. Addressing individuals formally using “usted” is customary in professional settings and when meeting elders.

Learning these subtle distinctions ensures respectful communication and fosters harmony within the local community.

Practical Tips for Adapting to the Local Environment

Immerse yourself in the local culture by actively engaging with the environment. Learn a few basic Spanish phrases, not only to facilitate communication but also to show respect. Participate in local events, festivals, and markets to gain firsthand insights into Peruvian customs and traditions. Observe how locals interact, and adapt your behavior accordingly, remembering that cultural norms differ from your homeland.

Seek opportunities to engage in meaningful interactions, which will accelerate your cultural integration.

Language Learning Resources for Retirees

Language learning resources are readily available in Peru. Many organizations offer language courses tailored to various levels, ensuring a supportive and encouraging environment for retirees. Consider taking Spanish classes to improve your communication skills and enhance your understanding of the local culture. Online resources, language exchange programs, and local tutors provide avenues to enhance your proficiency. Embrace these opportunities to bridge the communication gap and enrich your experiences.

Opportunities for Social Interaction and Community Involvement

Peru offers numerous avenues for social interaction and community involvement. Joining clubs, attending local events, and volunteering are excellent ways to connect with fellow retirees and contribute to the local community. Explore opportunities in local community centers, churches, or volunteer organizations. This fosters a sense of belonging and facilitates a meaningful transition into your new life.

Challenges and Opportunities for Cultural Integration

Cultural integration presents both challenges and opportunities. Adjusting to a new culture may require patience and understanding. Language barriers can occasionally arise, but these are often overcome through persistence and a willingness to learn. Differences in communication styles, customs, and expectations can sometimes create misunderstandings. These differences, however, can offer valuable insights into diverse perspectives and broaden your worldview.

These challenges are often overshadowed by the rich opportunities for personal growth, cultural exchange, and the joy of experiencing a new culture.

Final Wrap-Up

In conclusion, successfully obtaining a Peruvian retirement visa and establishing a bank account requires careful planning and attention to detail. This guide provides a comprehensive overview of the key steps involved, from initial visa application prerequisites to ongoing financial management strategies. By understanding the specific requirements, financial considerations, and cultural nuances of living in Peru, retirees can navigate this significant life change with greater confidence and preparedness.

Remember to consult with relevant professionals for personalized advice tailored to your specific circumstances.

Key Questions Answered

What are the minimum financial requirements for a Peruvian retirement visa?

The minimum financial requirements for a Peruvian retirement visa vary depending on the applicant’s nationality and specific circumstances. Applicants are generally required to demonstrate sufficient funds to support themselves financially during their stay in Peru. This typically involves providing proof of sufficient savings or investments. Specific amounts and requirements can be found on the official Peruvian Ministry of Foreign Affairs website or from a qualified immigration lawyer.

What types of bank accounts are suitable for retirement visa applicants?

Various bank accounts are suitable for retirement visa applicants in Peru. Checking accounts, savings accounts, and possibly even specialized accounts for retirees can all be options. The specific type of account may depend on individual financial needs and the requirements set by the Peruvian bank.

What are the common fees associated with opening and maintaining a bank account in Peru?

Fees for opening and maintaining a bank account in Peru can vary significantly between different banks. These fees can include account opening fees, monthly maintenance fees, transaction fees, and international transfer fees. It’s essential to compare the services and fees offered by different Peruvian banks before making a decision.

What are the potential tax implications for retirees holding foreign accounts in Peru?

Peruvian tax laws may apply to foreign accounts held by retirees. It is crucial to consult with a Peruvian tax advisor or accountant to understand the specific tax implications and potential benefits applicable to your situation. Failure to comply with Peruvian tax regulations could lead to penalties or other issues.