Michigan car insurance increase 2024 is a significant concern for drivers across the state. Rising premiums are impacting affordability and driving behavior. Factors like inflation, accident rates, and changing regulations are all playing a role in this upward trend. Understanding the nuances behind these increases is crucial for navigating the complexities of the insurance market and mitigating potential financial burdens.

This comprehensive analysis explores the multifaceted drivers behind the predicted rise in Michigan car insurance premiums for 2024. We’ll delve into the historical context, examine potential catalysts for increased rates, and investigate the specific factors impacting various demographics. Furthermore, we’ll equip readers with strategies to manage these rising costs and navigate the increasingly complex landscape of car insurance in Michigan.

Overview of Michigan Car Insurance Market

The Michigan car insurance landscape has undergone significant shifts in recent years, mirroring broader economic trends and evolving driving habits. Premiums have exhibited a complex pattern, influenced by a variety of factors. Understanding these factors and comparing Michigan’s rates to those in other states provides valuable context for interpreting the current market conditions.Michigan’s car insurance rates have demonstrated a fluctuating history, with periods of both increases and decreases.

The state’s unique mix of demographics, driving conditions, and regulatory environment plays a crucial role in shaping these fluctuations. Understanding the historical context allows for a more nuanced assessment of current trends and future projections.

Historical Overview of Michigan Car Insurance Premiums

Michigan’s car insurance premiums have been subject to a wide range of influences, from economic downturns to legislative changes. Analyzing historical data provides insights into the factors contributing to these fluctuations.

Factors Influencing Michigan Car Insurance Rates

Several factors have consistently influenced Michigan’s car insurance premiums. These include:

- Frequency and Severity of Accidents: The number and severity of traffic accidents directly correlate with insurance costs. Increased accident rates lead to higher claims payouts, consequently raising premiums for all policyholders. For example, increased distracted driving incidents, due to mobile phone usage, have been shown to significantly impact accident rates.

- Economic Conditions: The state’s overall economic climate has a direct bearing on insurance rates. During periods of economic prosperity, people tend to drive more, increasing demand for insurance. Conversely, economic downturns can impact individuals’ ability to afford insurance, leading to potential changes in rates.

- Legislative Changes: Modifications to state laws regarding insurance requirements and coverage can significantly impact rates. For example, the introduction of new safety regulations or changes to no-fault laws can directly impact premium amounts.

- Claims Costs: The costs associated with claims processing and payouts play a pivotal role in determining insurance rates. Claims involving extensive damages or medical expenses can drive up overall costs.

- Driver Demographics: Factors like the age, driving history, and location of drivers can also affect insurance premiums. Younger drivers, for instance, tend to have higher accident rates and therefore pay higher premiums.

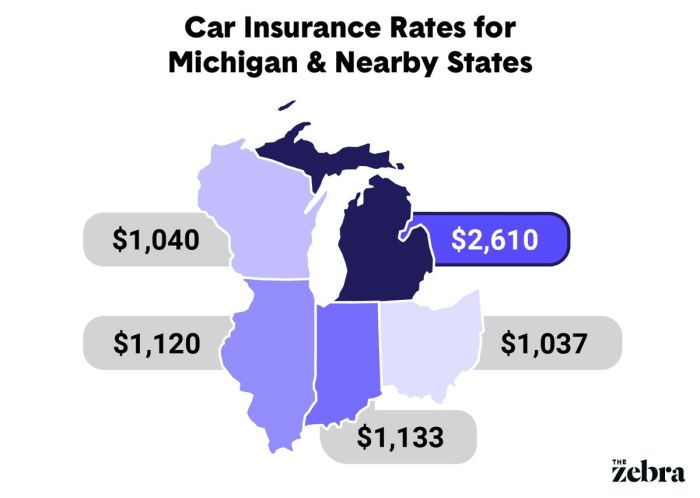

Comparison of Michigan Car Insurance Rates to Other States

Michigan’s car insurance rates are frequently compared to those in neighboring and other states. This comparative analysis reveals both similarities and distinctions. Michigan’s rates can be affected by factors like average annual miles driven, state regulations, and the cost of healthcare, among others.

- Average Rates: Michigan’s average rates generally fall within the national range, although specific rates can vary based on individual factors.

- State Regulations: Differences in state regulations regarding insurance coverage and requirements can significantly influence the cost of premiums across states. These regulations often vary greatly, impacting rates in different regions.

- Cost of Healthcare: The cost of healthcare can directly influence insurance rates, particularly in states with higher medical costs. Higher medical expenses in claims are a significant factor in overall insurance costs.

Economic Climate in Michigan and its Potential Impact on Insurance Costs

Michigan’s economic climate, including its employment rates, industry mix, and income levels, can influence insurance costs. Economic downturns can potentially decrease consumer spending, which can, in turn, impact the demand for insurance. Conversely, periods of economic growth may result in increased driving activity, and hence, higher insurance premiums.

Key Trends Observed in Michigan’s Car Insurance Market

The Michigan car insurance market has experienced several key trends:

- Shifting Demographics: The changing demographics of the state, including the increasing number of young drivers or drivers with specific risk factors, have a direct impact on premiums.

- Technological Advancements: Technological advancements, such as telematics-based insurance programs, are changing how insurance is evaluated and priced, potentially lowering rates for safe drivers.

- Increasing Awareness of Insurance Options: Consumers are increasingly aware of various insurance options, leading to more informed decisions regarding coverage and costs.

Potential Drivers of Increased Rates in 2024

Michigan’s auto insurance landscape is poised for a period of potential premium adjustments in 2024. Several factors are converging to create a complex picture, influencing the affordability and accessibility of coverage for drivers. Understanding these dynamics is crucial for both consumers and insurance providers.The current economic climate, coupled with evolving regulations and claims trends, is shaping the future of auto insurance costs in Michigan.

Inflation’s relentless climb and its impact on repair costs, alongside a rise in accidents, are significant concerns. Further complicating matters are changes in state laws and the shifting availability of insurance providers, all of which contribute to the anticipated fluctuations in insurance rates.

Inflation’s Impact on Insurance Costs

Rising inflation directly impacts the cost of repairs and parts needed for vehicles damaged in accidents. The increased prices of materials, labor, and replacement components translate directly into higher insurance claims. This inflationary pressure is not unique to Michigan; similar trends are observed across various US regions. For example, the cost of a standard repair job might increase by 15-20% year-over-year due to inflation.

This, in turn, forces insurance companies to adjust their premiums to maintain profitability.

Rising Accident Rates in Michigan

A discernible increase in accident rates in Michigan is another potential driver of premium increases. Several contributing factors may be at play, including changing driving habits, road conditions, and driver behavior. The frequency of accidents directly influences the amount of claims that insurance companies have to settle. A sustained rise in accident rates will almost certainly lead to higher premiums to offset the cost of increased claims.

Data from the Michigan State Police or other similar agencies could offer insight into these trends.

Changes in State Regulations and Laws

State regulations and laws play a crucial role in shaping the landscape of Michigan’s auto insurance market. Any adjustments in these areas, either in existing regulations or the introduction of new ones, can impact premiums. For example, new regulations regarding distracted driving, or enhanced safety features in vehicles, may introduce additional costs for insurers. A comprehensive review of recently enacted or proposed legislation, like mandatory driver education programs or enhanced inspection standards, would be beneficial.

Changes in the Availability of Insurance Providers

The availability of insurance providers in Michigan is another key factor. A decrease in the number of insurers operating in the state, or a reduction in competition, may result in a reduction of competitive pricing, which ultimately could drive premiums up. A scarcity of providers might force the remaining companies to adjust their rates in order to remain financially viable.

Potential Impacts of Natural Disasters on Michigan’s Car Insurance Market

While Michigan is not a high-risk area for major natural disasters, the possibility of severe weather events, like heavy storms, floods, or hailstorms, exists. These events can lead to a significant spike in claims, especially in areas prone to such incidents. The impact of these events on insurance rates depends on the frequency and severity of these occurrences.

For example, hailstorms can cause widespread damage to vehicles, resulting in a substantial increase in claims and, consequently, premiums.

Comparison with Similar Trends in Other Regions

Similar trends in other regions, such as the increasing costs of repairs and parts, or the rise in accident rates, are indicative of broader national economic pressures. Analyzing these trends across various regions allows for a more nuanced understanding of the factors contributing to rising premiums. A comparison of Michigan’s data with those of neighboring states or other regions with comparable demographics would reveal valuable insights.

Specific Factors Impacting Rates in 2024

Michigan’s car insurance landscape is poised for shifts in 2024, driven by a complex interplay of factors. Changes in driving habits, repair costs, technological advancements, and claims trends are all contributing to the evolving pricing structure. Understanding these nuances is crucial for both consumers and insurance providers.The dynamic nature of the modern insurance market necessitates a keen awareness of these forces.

Adapting to these shifts will be critical for maintaining affordability and ensuring a robust and resilient insurance ecosystem in Michigan.

Vehicle Usage Patterns and Their Impact

Shifting patterns in vehicle usage are significantly affecting insurance premiums. The rise of remote work has led to a reduction in daily commutes for many, yet increased weekend driving and occasional longer trips. This change in usage patterns is not uniformly distributed, with varying impacts across different demographics and regions. While some areas might experience a decrease in premiums due to reduced commuting, others might see an increase due to increased weekend driving or higher-risk longer trips.

This variability underscores the importance of localized data analysis in determining the precise effects on premiums.

Repair Costs and Availability

The availability and costs of auto repairs play a pivotal role in insurance rates. Shortages of skilled mechanics, parts, and inflation-driven price increases for materials are all contributing to higher repair costs. These escalating costs translate directly into higher insurance premiums, as insurers need to factor in the potential for more extensive and expensive claims. Examples include the rise in the price of parts like catalytic converters and the increased labor costs for repairs, necessitating increased reserve funds for insurers.

Impact of New Car Technologies

The proliferation of new car technologies, including advanced driver-assistance systems (ADAS), is having a complex effect on insurance rates. While ADAS features can reduce accidents, the increased cost of these features can lead to a rise in insurance premiums, depending on the specific technology and coverage. Furthermore, the increased complexity of modern vehicles can make repairs more expensive and time-consuming, contributing to the overall cost of claims.

Claims Frequency and Severity

Claims frequency and severity are crucial factors in calculating insurance rates. An increase in accidents, whether due to increased driving or other factors, will inevitably lead to higher claims frequency, thus impacting the average cost of premiums. Accidents with higher severity, leading to significant property damage or personal injury, can further exacerbate this trend, placing a greater financial burden on insurers and potentially raising premiums for all drivers.

Data analysis on accident patterns and severity levels is vital to anticipate and address these trends.

Driver Behavior Changes

Driver behavior is a key component in assessing risk and determining insurance premiums. Changes in driver behavior, such as increased distracted driving, aggressive driving, or the influence of alcohol, can contribute to a rise in accidents and claims frequency. These factors are all taken into account by insurance providers to adjust their risk assessments and potentially increase premiums.

Rising Labor Costs and Their Impact

Rising labor costs directly impact insurance claims and repairs. Increased wages for mechanics, technicians, and other repair personnel contribute to the overall cost of repairing vehicles. This added expense is reflected in the insurance premiums, as insurers need to account for these cost increases in their pricing models. Examples include increased labor rates for auto body repairs and the costs associated with specialized equipment required for electric vehicle repairs.

Electric Vehicles and Their Influence

The increasing adoption of electric vehicles (EVs) presents a unique set of challenges for the insurance industry. While EVs generally have fewer moving parts and therefore potentially fewer repair needs, their battery systems require specialized knowledge and equipment. The potential for damage to high-value batteries and the need for specialized repair procedures can significantly influence the cost of claims, potentially increasing premiums.

The limited number of repair facilities equipped to handle EVs is another factor that contributes to this trend.

Insurance Company Financial Performance

Insurance company financial performance directly affects premiums. Factors like profitability, investment returns, and regulatory requirements influence the premiums charged. Strong financial performance by insurance companies might translate to lower premiums, while weaker financial performance can result in higher premiums to maintain solvency. The insurance market in Michigan will be closely monitored, considering the financial standing of major insurers in the state.

Impact on Consumers

The impending increase in Michigan car insurance rates in 2024 presents a significant challenge for average drivers. This rise, fueled by a confluence of factors, will undoubtedly impact the financial well-being of many Michiganders, particularly those in lower-income brackets. Understanding the potential ramifications is crucial for proactive measures and informed decision-making.The financial strain of increased insurance premiums will likely be felt disproportionately across different demographics.

Those with lower incomes and limited financial buffers will face the most immediate and severe consequences. This could lead to a domino effect, potentially impacting their ability to maintain transportation, affecting their job opportunities, and impacting their overall financial stability.

Affordability for Different Demographics

The rising cost of car insurance will disproportionately impact those with lower incomes, potentially exacerbating existing economic disparities. Lower-income families, already stretched thin, will struggle to absorb the increased premiums, potentially leading to delayed or forgone maintenance, reduced driving frequency, and increased risk of accidents due to deferred repairs. For those reliant on their vehicles for employment, the cost increase could mean a decrease in earning potential or even job loss.

Conversely, higher-income individuals may be better equipped to manage the increased costs, but the overall burden on the state’s economic structure will still be significant.

Potential Consumer Reactions

Consumers facing higher insurance premiums are likely to react in various ways. Some may seek out alternative transportation options, such as public transportation or ride-sharing services, to reduce the financial burden. Others may opt for cost-saving measures like reducing driving frequency or driving less risky routes. A significant portion of drivers might explore different insurance providers to compare quotes and find more affordable options.

Another reaction might be a shift towards purchasing less expensive vehicles, but this can impact the safety of the driver and other road users.

Actions to Manage Insurance Costs

Consumers can take proactive steps to mitigate the impact of increased insurance costs. Comparing quotes from multiple insurance providers is crucial, ensuring they are getting the best possible rates. Maintaining a clean driving record is paramount, as accident history significantly impacts premiums. Taking defensive driving courses can also reduce premiums and improve driving skills. Ensuring vehicles are well-maintained and properly insured can also help in mitigating risks.

Finally, exploring discounts available, such as those for safe driving or for multiple vehicles, can offer significant savings.

Mitigating Increased Insurance Costs

Insurance companies can employ strategies to mitigate the effects of rising costs, such as investing in innovative safety technologies, promoting defensive driving initiatives, and partnering with local organizations to improve road safety. The state government can also play a role in providing financial assistance programs for those facing hardship due to increased premiums. These initiatives could include subsidies, tax breaks, or other financial relief options.

Impact on the Michigan Economy

The increased cost of car insurance in Michigan will undoubtedly affect the state’s economy. Reduced disposable income for consumers could lead to decreased spending in various sectors. Increased reliance on public transportation or ride-sharing services could affect the profitability of car-related businesses. The overall impact on employment and economic growth will depend on the extent of the increase and the measures taken to mitigate the negative consequences.

The potential economic fallout from increased car insurance rates could ripple throughout the Michigan economy, affecting everything from local businesses to major industries.

Strategies for Navigating Rate Increases

Navigating rising Michigan car insurance rates requires proactive measures and a strategic approach. Consumers need to understand the factors driving these increases and employ effective strategies to find the most cost-effective coverage. This proactive approach empowers consumers to make informed decisions and secure the best possible insurance policies.Understanding the nuances of the Michigan car insurance market is key to navigating the complexities of rising rates.

By employing comparative analysis and leveraging available resources, consumers can effectively mitigate the impact of these increases. This involves a comprehensive understanding of various factors, from policy specifics to provider-specific offerings.

Comparing Insurance Rates

A critical step in mitigating rising rates is comparing insurance rates across different providers. This allows consumers to identify the most competitive pricing and tailor their coverage to their specific needs and budget. By evaluating quotes from multiple companies, consumers can select the most affordable option. This comparison is not merely about price; it also encompasses the quality of coverage and the reputation of the insurance provider.

Insurance Provider Comparison Table (Example)

| Insurance Provider | Base Rate (per year) | Discounts Available | Coverage Options | Customer Service Rating |

|---|---|---|---|---|

| Progressive | $1,200 | Multi-car, Good Student, Defensive Driving | Comprehensive, Collision, Liability | 4.5 stars |

| State Farm | $1,350 | Multi-car, Good Student, Accident Forgiveness | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist | 4.7 stars |

| Allstate | $1,150 | Multi-car, Safe Driver, Bundled Services | Comprehensive, Collision, Liability | 4.3 stars |

Note: Rates are hypothetical examples and may vary based on individual factors.

The Role of Discounts and Risk-Reducing Measures, Michigan car insurance increase 2024

Discounts play a significant role in reducing insurance premiums. By identifying and utilizing available discounts, consumers can substantially lower their costs. These discounts are often tied to factors like safe driving records, bundled services, or the presence of multiple vehicles insured with the same company. Furthermore, proactive risk-reducing measures, such as defensive driving courses or maintaining a clean driving record, can directly influence premiums.

Detailed Comparison of Coverage Options

Different coverage options cater to varying needs and risk tolerances. Understanding the specific components of each coverage type is essential. Liability coverage protects against damage to others, while comprehensive and collision coverage protects the insured vehicle. Uninsured/underinsured motorist coverage is crucial for protection against accidents involving at-fault drivers with insufficient coverage.

Example Table of Available Discounts in Michigan

| Discount Type | Description | Potential Savings |

|---|---|---|

| Good Student | For students with good grades | 10-20% |

| Multi-Car | Insuring multiple vehicles with the same company | 5-15% |

| Safe Driver | For drivers with a clean driving record | 5-10% |

| Bundled Services | Bundling insurance with other services like home insurance | 5-10% |

Tips to Lower Insurance Premiums

Several practical steps can help consumers reduce their insurance premiums. These measures involve proactive steps to minimize risk and optimize coverage. Maintaining a clean driving record, installing anti-theft devices, and ensuring adequate security measures can contribute to lower premiums. Furthermore, reviewing and adjusting coverage levels to align with individual needs can also lead to cost savings.

- Maintain a clean driving record: Avoid accidents and traffic violations to maintain a favorable driving history, which is often reflected in lower premiums.

- Install anti-theft devices: Security measures can significantly reduce the risk of theft, potentially leading to lower premiums.

- Review and adjust coverage: Evaluate your coverage needs and adjust policies to remove unnecessary coverage and reduce premiums.

- Shop around for quotes: Regularly compare rates from different insurance providers to ensure you’re getting the most competitive pricing.

Visual Representation of Data: Michigan Car Insurance Increase 2024

Unveiling the intricate tapestry of Michigan’s car insurance market requires a visual approach. Graphs and charts transform complex data into easily digestible insights, allowing us to grasp the historical trends, regional variations, and contributing factors driving rate increases. This section provides a visual representation of the data, offering a clear picture of the current state and anticipated future of car insurance premiums in Michigan.

Historical Trends in Michigan Car Insurance Premiums

Visualizing historical trends in Michigan car insurance premiums is crucial for understanding the current landscape. A line graph depicting premium changes over time (e.g., 2010-2023) would clearly illustrate the upward or downward trajectory. This graph should highlight periods of significant fluctuation, potentially linked to economic shifts, legislative changes, or major accident trends. For example, a steep incline between 2020 and 2023 could be attributed to increased accident rates following the pandemic, or a rising cost of repair materials.

This visual tool would offer a valuable benchmark for evaluating the 2024 increase.

Comparison of Car Insurance Rates Across Michigan Cities

A bar chart comparing car insurance rates across different Michigan cities would provide a geographically-focused view. Each bar would represent a specific city, with the height directly correlating to the average premium. This visual representation would highlight the discrepancies in rates between urban and rural areas, potentially revealing correlations with population density, accident frequency, or specific risk factors unique to particular cities.

For example, Detroit might show higher premiums compared to Traverse City due to varying crime rates or accident statistics.

Factors Contributing to Michigan Car Insurance Increases

A pie chart illustrating the factors contributing to Michigan car insurance increases would break down the components. Each slice would represent a contributing factor, such as rising repair costs, increasing frequency of accidents, or changes in liability claims. The relative size of each slice would demonstrate the magnitude of each influence. For instance, a large slice representing rising repair costs would indicate that this factor plays a dominant role in premium increases.

Predicted Increase in Rates for 2024

A line graph projecting the predicted increase in rates for 2024 would be a valuable forecasting tool. The graph would display the anticipated premium increase over time, potentially illustrating different scenarios based on various assumptions. This could incorporate factors like projected inflation rates, accident trends, or changes in legislation. For example, the graph might show a projected increase of 10-15% in rates for 2024, compared to 2023.

Impact of Risk Factors on Premiums

A scatter plot illustrating the impact of different risk factors on premiums would visually represent the relationship between these factors. This plot would feature each risk factor (e.g., driving record, age, vehicle type) as a point on a graph. The x-axis could represent the risk factor, and the y-axis could represent the corresponding premium. This would visually illustrate the correlation between a driver’s risk profile and the resulting premium, providing an easily comprehensible overview of the complex relationship.

For example, a driver with a poor driving record might be plotted with a significantly higher premium than a driver with a clean record.

Epilogue

In conclusion, the Michigan car insurance increase in 2024 presents a complex and multifaceted challenge for drivers. Understanding the interplay of economic forces, regulatory changes, and evolving driving behaviors is critical for mitigating the impact on individual budgets and the broader Michigan economy. This analysis has highlighted the key factors behind the projected increase and provided actionable strategies for consumers to navigate these challenging times.

FAQ Summary

What are the most common reasons for the increase in car insurance rates in Michigan in 2024?

Several factors contribute to the projected increase, including inflation, rising accident rates, changes in state regulations, and the impact of new technologies on vehicle usage and repair costs. Additionally, the economic climate in Michigan and the performance of insurance companies also play a significant role.

How will this increase affect different demographics in Michigan?

The impact will vary based on factors like location, driving history, and vehicle type. Lower-income drivers and those in specific high-risk areas may experience a disproportionately higher burden. Furthermore, the affordability of various coverage options may become a critical issue.

Are there any discounts available to help mitigate the impact of rising car insurance premiums in Michigan?

Yes, various discounts are available, such as those for safe driving, multi-car policies, and anti-theft devices. Consumers should actively explore these options and compare rates from different providers to find the most affordable coverage.

What are some steps I can take to lower my car insurance premiums in Michigan?

Maintaining a good driving record, installing anti-theft devices, and exploring discounts are key strategies. Comparing quotes from multiple insurance providers and reviewing your current coverage options are also important steps.