Why is Michigan car insurance so expensive? It’s a question plaguing many Michiganders. This deep dive explores the factors behind Michigan’s hefty auto insurance premiums, comparing them to other states. We’ll uncover the unique regulations, claim histories, and market dynamics that contribute to the high costs.

Michigan’s insurance landscape is a complex mix of state regulations, driving behaviors, and market forces. Understanding these elements is key to navigating the often-confusing world of car insurance in the mitten state. This analysis will help you make informed decisions about your coverage.

Factors Influencing Michigan Auto Insurance Costs: Why Is Michigan Car Insurance So Expensive

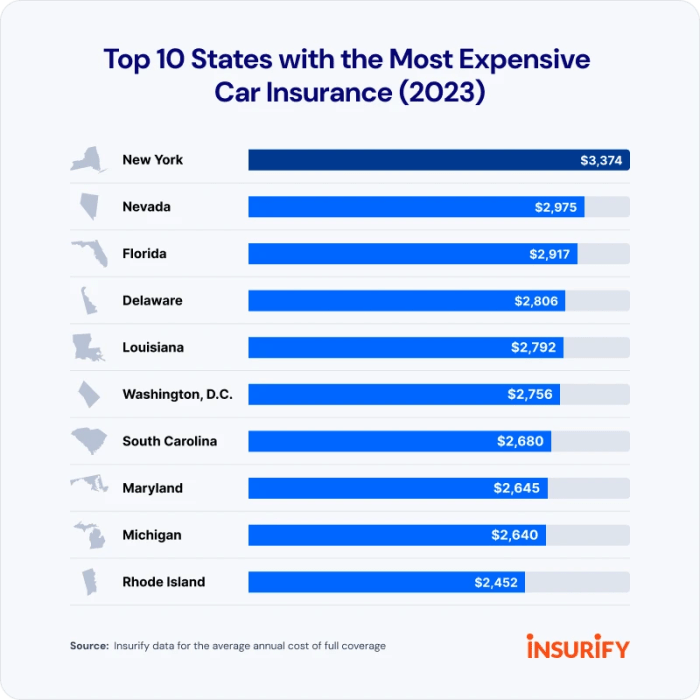

Michigan’s auto insurance premiums often rank among the highest in the nation, a situation influenced by a complex interplay of factors. These factors, while not unique to Michigan, manifest in ways that contribute to a higher cost of coverage. Understanding these elements is crucial for comprehending the challenges faced by Michigan drivers.

Geographic Factors and Claim Frequency

Michigan’s diverse geography plays a significant role in shaping insurance costs. The state’s mix of rural and urban areas, combined with its challenging winter conditions, contributes to a higher frequency of accidents and claims. Severe weather events, such as blizzards and ice storms, frequently disrupt transportation, leading to more accidents. Furthermore, the prevalence of icy roads and poor visibility increases the risk of collisions, thereby raising insurance rates for all drivers in the state.

This contrasts with states with less extreme weather patterns or a greater emphasis on driving on clear roads.

Driving Behaviors and Safety Record

Driving behaviors significantly impact insurance premiums in Michigan, as in other states. High rates of speeding, reckless driving, and aggressive maneuvers contribute to a higher risk profile for insurers. Michigan, like other states, implements a system where drivers with a history of traffic violations or accidents face higher premiums. This reflects the insurer’s need to manage risk effectively.

For example, a driver with multiple speeding tickets will likely face a higher premium than a driver with a clean record. Similarly, accidents, especially those resulting in injuries or significant property damage, will impact the driver’s insurance rates in the long term.

Demographic Factors and Driving History, Why is michigan car insurance so expensive

Demographics also contribute to Michigan’s auto insurance landscape. Age, location, and driving history all play a crucial role in determining premiums. Younger drivers, often perceived as higher risk, typically face significantly higher premiums. This is partly due to their inexperience and potentially higher propensity for accidents. Furthermore, drivers residing in areas with higher accident rates or crime rates might experience increased premiums.

The driving history of a driver, including any prior accidents or traffic violations, directly influences the premium. Insurers use this data to assess the risk associated with insuring a specific driver.

State Regulations and Financial Stability

Michigan’s specific regulations and the financial stability of insurance companies are crucial factors in determining premiums. The state’s regulations, while intended to protect consumers, may affect the overall cost of insurance. Differences in state regulations across the country contribute to the variation in insurance rates. For instance, states with stricter regulations on minimum coverage amounts may lead to higher premiums.

Insurers assess the financial health and stability of companies before offering coverage. Insurers with a stronger financial position may offer more competitive rates. The state’s regulations on the amount of coverage required for drivers also plays a role.

Table: Significant Factors Influencing Michigan Auto Insurance Costs

| Factor | Description | Impact on Premiums |

|---|---|---|

| Geographic Factors | Mix of rural and urban areas, challenging winter conditions | Higher claim frequency, increased risk of accidents |

| Driving Behaviors | Speeding, reckless driving, aggressive maneuvers | Increased risk profile, higher premiums |

| Demographic Factors | Age, location, driving history | Younger drivers and drivers in high-risk areas face higher premiums |

| State Regulations | Minimum coverage amounts, other regulations | Influence overall cost of insurance, potentially impacting rates |

| Financial Stability of Insurance Companies | Financial strength and stability of insurers | Stronger financial position can lead to more competitive rates |

Specific Regulations and Laws in Michigan

Michigan’s auto insurance landscape is shaped by a complex interplay of state regulations and laws, significantly impacting the premiums drivers pay. These regulations, often influenced by the need for financial responsibility and public safety, create a framework that insurers use to assess risk and calculate premiums. Understanding these specific regulations is crucial to comprehending the overall cost of insurance in the state.

Financial Responsibility Laws

Michigan’s financial responsibility laws mandate that drivers maintain adequate liability insurance coverage to protect themselves and others in case of accidents. Failure to comply results in penalties, including suspension of driving privileges. This legal requirement directly influences insurance premiums. Drivers with a history of accidents or violations, or those who have had their driving privileges suspended for failing to maintain sufficient insurance, face significantly higher premiums.

Insurers view these drivers as higher-risk individuals, necessitating a higher premium to offset the potential financial burden. The state’s financial responsibility laws, coupled with the penalties for non-compliance, create a system where maintaining insurance is crucial for both the driver and the insurance company.

No-Fault Insurance

Michigan’s no-fault insurance system plays a pivotal role in determining the cost of auto insurance. Under this system, the injured party in an accident receives compensation from their own insurer, regardless of fault. This system affects premiums by requiring insurers to cover claims for injuries and property damage regardless of fault. While protecting consumers, it does impact the cost of insurance, as insurers need to account for a wider range of potential claims in their premium calculations.

The no-fault system, by design, shifts the focus from determining fault to compensating the injured party promptly.

Minimum Coverage Requirements

Michigan has established minimum coverage requirements for auto insurance policies. These minimums, which vary based on the type of policy, influence the cost of insurance. Policies with lower minimums, though meeting the legal requirements, might expose the insured to greater risk should an accident occur. This directly impacts insurers, as they have to ensure that the premiums for these policies can still cover potential claims within the required minimums.

For example, policies falling below the minimum requirements could result in higher premiums to ensure the company can still meet its contractual obligations to the insured.

Table of Specific Regulations and Their Impact

| Regulation | Description | Impact on Cost |

|---|---|---|

| Financial Responsibility Laws | Drivers must maintain adequate liability insurance. | Higher premiums for drivers with a history of accidents or violations; higher premiums for policies falling below minimums. |

| No-Fault Insurance | Injured parties receive compensation from their own insurer, regardless of fault. | Increased premiums to cover potential claims, regardless of fault. |

| Minimum Coverage Requirements | State-mandated minimums for liability and other coverages. | Premiums may be lower if policies meet minimums, but higher risk to the insured if policies fall below minimums. |

| Recent Legislative Changes | Legislation impacting rate adjustments or specific coverages. | Changes can impact the cost based on the nature of the changes, such as introducing new regulations or modifying existing ones. |

Comparison to Other States

Michigan’s auto insurance regulations, including its no-fault system and minimum coverage requirements, differ from those in other states. This variation in regulations leads to differing premium structures. Comparing Michigan to states with similar demographics and accident rates, like those in the Midwest, reveals differences in premium levels, reflecting the unique characteristics of each state’s insurance market. This comparison underscores how specific regulations significantly impact the overall cost of insurance within a particular state.

Claims History and Frequency

Michigan’s auto insurance premiums are significantly influenced by the frequency and severity of claims filed. Understanding the relationship between claims history and insurance costs is crucial for assessing the overall insurance landscape and its impact on drivers. This section delves into the specifics of claim frequency in Michigan, comparing it to other states, and analyzing how accident severity and previous claims impact future premiums.

Relationship Between Claim Frequency and Insurance Costs

Claim frequency, the rate at which insurance claims are filed, is a major factor in determining insurance premiums. High claim frequency indicates a higher risk for insurers, prompting them to adjust premiums upward to cover potential losses. Conversely, low claim frequency suggests a lower risk, leading to potentially lower premiums. This correlation between claim frequency and insurance cost is a fundamental principle in actuarial science, which insurers use to assess risk and set appropriate premiums.

Comparison of Claims Frequency Data in Michigan to Other States

Direct, publicly available comparative data on claim frequency across states is often limited. However, general trends can be observed. Michigan, along with other states experiencing high population density, potentially higher rates of traffic congestion, or known weather patterns contributing to more accidents, often see higher claim frequencies compared to states with lower population density or less extreme weather.

Detailed analysis of specific claim data for Michigan requires accessing insurance industry reports and data sets, which may not be readily available to the public.

Impact of Accident Severity on Insurance Rates

The severity of accidents significantly impacts insurance rates. A minor fender bender results in a relatively low claim cost compared to a serious collision or a multi-vehicle accident. The severity of the accident, including the extent of injuries, property damage, and other factors, directly influences the claim amount. Insurers use statistical models to account for the severity of claims when calculating premiums, ensuring that premiums reflect the true risk associated with different types of accidents.

Impact of Previous Claims History on Future Premiums

A driver’s previous claims history is a crucial factor in determining future premiums. Drivers with a history of frequent claims are considered higher-risk, leading to higher premiums. Insurers analyze claim data to identify patterns and predict future claim frequency. The number of claims, the type of claims, and the time period over which claims occurred all contribute to the risk assessment.

For example, a driver with multiple claims within a short period may be assigned a higher risk rating than a driver with a single claim years ago.

Correlation Between Claims Frequency and Insurance Costs in Michigan

A direct, definitive correlation between claim frequency and insurance cost is complex to illustrate with a simple table, as various other factors influence pricing. However, a general trend is observable. Higher claim frequencies in Michigan often correlate with higher insurance costs. A simplified table can only represent a limited perspective.

| Claim Frequency (per 100 drivers) | Estimated Impact on Premium (approximate percentage increase) |

|---|---|

| Low (e.g., <10) | Minimal (0-5%) |

| Moderate (e.g., 10-20) | Moderate (5-15%) |

| High (e.g., >20) | Significant (15%+ increase) |

Visual Representation of Claim Data Over Time in Michigan

A visual representation of claim data over time in Michigan, potentially using a line graph, could show trends in claim frequency. The x-axis would represent time (e.g., years), and the y-axis would represent the number of claims per period (e.g., per 100 drivers). This visual aid could highlight periods of higher or lower claim frequency and potentially show correlations with external factors such as economic conditions, weather patterns, or changes in traffic laws.

Data would need to be carefully interpreted and presented with proper context to avoid misleading conclusions.

Availability and Competition in the Market

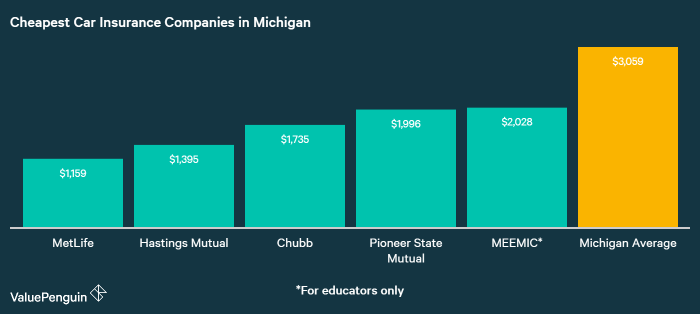

The availability and level of competition among insurance providers significantly impact Michigan auto insurance costs. A competitive market, with multiple providers offering various plans, typically leads to lower prices and more choices for consumers. Conversely, limited competition often results in higher premiums and reduced consumer options. Understanding these dynamics is crucial for comprehending the overall cost structure of Michigan auto insurance.The Michigan auto insurance market presents a mixed picture in terms of competition.

While several large national carriers operate in the state, the presence of smaller, regional insurers varies. This uneven distribution of providers can affect the overall competitive landscape, potentially impacting price sensitivity and consumer choice.

Level of Competition

The level of competition among insurance providers in Michigan varies by region and specific types of coverage. While major national players maintain a strong presence, smaller, locally focused companies may offer more tailored plans and potentially competitive rates. However, the lack of a highly fragmented market, unlike some other states, could limit the extent of price differentiation among providers.

Factors Influencing Availability

Several factors influence the availability of insurance options in Michigan. These include regulatory requirements, profitability considerations, and the presence of state-specific mandates. For example, mandatory minimum coverage requirements can impact the viability of some coverage options for smaller companies. The cost of claims processing and adjusting in Michigan, as well as the overall financial stability of insurers, also plays a role.

Pricing and Coverage Differences

Significant differences in pricing and coverage exist among various providers. These variations stem from factors such as risk assessment methodologies, underwriting practices, and claims experience. Insurers employ different algorithms to calculate risk profiles for individual drivers, and these algorithms may consider factors like driving history, location, vehicle type, and even age. These discrepancies can lead to substantial price variations for similar coverage.

Different providers may also offer various add-on coverages or discounts, further complicating comparisons.

Impact of Limited Competition

Limited competition directly impacts consumer choices and costs. When fewer providers are present, consumers face a reduced range of options and may be unable to secure the most favorable rates. This scenario can lead to higher premiums as providers can set prices with less concern for market pressures. It also limits consumers’ ability to shop around for the best deal.

Geographic Variations

Geographic variations in insurance availability and pricing are noticeable in Michigan. Areas with higher rates of accidents or specific demographic profiles might experience higher premiums compared to areas with lower accident rates. Rural areas, in particular, may have limited insurer availability, as the cost of servicing these regions can outweigh the potential profits.

Pricing Comparison

| Insurance Provider | Premium for Basic Liability Coverage (Example) | Premium for Comprehensive Coverage (Example) |

|---|---|---|

| Insurer A | $1,200 | $1,800 |

| Insurer B | $1,150 | $1,750 |

| Insurer C | $1,350 | $2,000 |

| Insurer D | $1,280 | $1,900 |

Note: These figures are illustrative examples and do not represent actual premiums. Premiums can vary significantly based on individual driver profiles and specific coverage selections. Data for this table is hypothetical and does not reflect specific market conditions.

Types of Coverage and Their Impact

Michigan auto insurance premiums are influenced significantly by the types of coverage selected. Understanding the various coverage options and their associated costs is crucial for making informed decisions. Different levels of coverage translate to varying levels of financial protection in the event of an accident or damage to your vehicle.

Overview of Available Coverage Types

Michigan drivers have access to a range of coverage types, each designed to address specific risks. Fundamental coverage options include liability, collision, and comprehensive. Liability coverage protects against damages you cause to others, while collision coverage pays for damages to your vehicle regardless of who is at fault. Comprehensive coverage, on the other hand, compensates for damage to your vehicle from non-collision events, such as theft, vandalism, or weather events.

Impact of Coverage Choices on Premiums

The selection of coverage types and levels directly impacts insurance premiums. Higher levels of coverage often result in higher premiums, as they provide broader financial protection. For example, a policy with higher liability limits and comprehensive coverage will generally be more expensive than one with only basic liability coverage. This is because the insurer assumes greater risk with more comprehensive coverage.

The cost of insurance is ultimately a balance between the level of protection desired and the associated financial burden.

Cost Implications of Different Coverage Levels

The cost of various coverage options varies considerably. Liability coverage, the most basic form of protection, generally carries the lowest premium. Adding collision and comprehensive coverage significantly increases the cost. The extent of the coverage (e.g., liability limits) further impacts the premium. Higher liability limits mean greater financial responsibility for the insurer, hence the higher premium.

Correlation Between Coverage and Claim Likelihood

A strong correlation exists between the choice of coverage and the likelihood of accidents and claims. Drivers with comprehensive and collision coverage are less likely to experience significant financial losses in the event of an accident or damage. Comprehensive and collision coverage often leads to fewer claims, as the insurance company directly compensates for damages to the insured vehicle, reducing the financial burden on the driver.

Drivers with only liability coverage are more vulnerable to substantial out-of-pocket expenses in the event of an accident.

Comparative Cost Analysis of Coverage Options

The table below presents a general comparison of coverage options and their estimated costs for a standard driver in Michigan. Note that these figures are estimates and actual costs may vary based on individual circumstances.

| Coverage Type | Description | Estimated Cost (per year) |

|---|---|---|

| Liability Only | Covers damages to others in an accident where you are at fault. | $500 – $1500 |

| Liability + Collision | Covers damages to your vehicle and to others in an accident where you are at fault. | $1000 – $2500 |

| Liability + Collision + Comprehensive | Covers damages to your vehicle and to others, regardless of fault, and for non-collision events. | $1500 – $3500 |

Note: These are estimates. Actual costs will depend on factors such as driving record, vehicle type, location, and deductibles.

Role of Insurance Companies in Michigan

Insurance companies play a critical role in the Michigan auto insurance market, acting as intermediaries between drivers and the potential financial risks associated with car accidents. Their operations encompass risk assessment, premium calculation, claims processing, and overall market stability. Understanding their practices and strategies is crucial in analyzing the high cost of insurance in the state.Pricing strategies employed by Michigan insurance companies are multifaceted and complex.

These strategies often involve a combination of factors, including actuarial analysis of accident data, demographics of drivers in specific areas, and the cost of claims settlements. Insurance companies aim to balance profitability with affordability, a balance often difficult to achieve in the context of high accident rates or specific regulatory requirements.

Pricing Strategies and Methods

Insurance companies use various methods to determine premiums, often incorporating a sophisticated blend of data points. A key factor is the analysis of historical claims data, which allows companies to identify high-risk drivers or geographic areas prone to accidents. Furthermore, driver demographics such as age, driving history, and location are factored into the calculation. Premium calculations also consider the type of vehicle insured, coverage levels selected, and the financial stability of the insurance company itself.

This intricate process ensures that companies are adequately compensated for the risk they assume.

Financial Stability and Reputation of Companies

The financial stability and reputation of insurance companies significantly influence the pricing of auto insurance in Michigan. Companies with a strong financial rating, as determined by independent agencies like A.M. Best or Standard & Poor’s, typically offer lower premiums due to their ability to handle potential claims. Conversely, companies with weaker ratings might charge higher premiums to compensate for a perceived higher risk of insolvency.

This risk assessment reflects the confidence of the insurance market and the consumers relying on these companies to fulfill their obligations.

Comparison of Pricing Strategies

Direct comparison of pricing strategies among Michigan insurance companies reveals considerable variance. Factors like the specific actuarial models employed, the target customer base, and the geographic focus of each company influence their pricing decisions. Some companies might focus on offering lower premiums for specific demographic groups, while others might prioritize comprehensive coverage packages at higher price points. The market competition is a critical element in this dynamic pricing landscape.

Examples of Company Practices Contributing to Costs

Several practices contribute to the cost of car insurance in Michigan. For example, the increasing cost of medical care following accidents directly impacts claims settlements, potentially increasing premiums. Similarly, rising fraud rates in insurance claims require companies to incorporate additional safeguards and adjust pricing accordingly. Furthermore, regulatory requirements, such as those related to minimum coverage levels, also play a significant role in influencing pricing.

Summary of Major Insurance Companies in Michigan

| Company | Financial Rating (e.g., A.M. Best) | Pricing Strategy Focus | Coverage Offerings |

|---|---|---|---|

| Company A | A++ | Competitive pricing, comprehensive coverage | Full coverage options, discounts for safe drivers |

| Company B | A+ | Emphasis on bundling insurance products | Variety of packages, focus on multi-policy discounts |

| Company C | A | Focus on specific demographics (young drivers, etc.) | Tailored coverage options, potential for higher premiums for specific groups |

Note: Financial ratings are illustrative and should be verified directly from reputable rating agencies. The table represents a generalized comparison and does not include every insurance company operating in Michigan. Pricing strategies and coverage offerings are subject to change.

Ending Remarks

In conclusion, Michigan’s car insurance costs stem from a combination of factors, including specific regulations, claim frequency, and market dynamics. While the reasons are multifaceted, understanding these elements can empower you to choose the right coverage at the right price. Armed with this knowledge, you can make savvy choices to navigate Michigan’s insurance market.

Questions and Answers

What about the effect of weather on insurance rates?

Michigan’s harsh winters and potentially hazardous road conditions contribute to higher insurance premiums. More accidents and claims related to winter driving can push up average costs for everyone.

How does my driving record affect my insurance?

A clean driving record with no accidents or traffic violations generally leads to lower premiums. Conversely, past incidents, like speeding tickets or accidents, significantly impact rates.

Are there any discounts available?

Yes, many insurers offer discounts for safe driving, good student status, and defensive driving courses. Investigating available discounts can potentially lower your premium.

How does competition affect insurance prices?

Limited competition in the insurance market can lead to higher prices for consumers. A more competitive market often results in more choices and better pricing.