Cheap car insurance Little Rock is a crucial concern for Arkansans. Navigating the local market can feel overwhelming, with a multitude of factors influencing rates. From traffic patterns to driver demographics, understanding these elements is key to finding the best deal. This comprehensive guide will delve into the specifics of car insurance in Little Rock, helping you secure the coverage you need without breaking the bank.

This guide covers everything from identifying cost-saving strategies and comparing insurance companies to understanding coverage options and navigating the claims process. We’ll also explore recent trends in the Little Rock market and provide tips for choosing the right provider. By the end of this guide, you’ll be equipped to confidently find the perfect cheap car insurance in Little Rock.

Affordable Car Insurance in Little Rock

Yo, peeps! Little Rock car insurance is a real thing, and it’s totally important to get the best deal you can. Finding cheap car insurance in this city isn’t rocket science, but knowing the ins and outs is key. This rundown will help you navigate the whole process, from understanding the market to comparing different companies.The car insurance scene in Little Rock, Arkansas, is pretty competitive, with a mix of big national players and local companies.

Factors like the area’s demographics, traffic patterns, and accident rates all play a role in how much your premiums will be. For example, areas with higher accident rates tend to have higher insurance costs. Also, younger drivers often pay more because they’re statistically more likely to get into accidents. It’s all about managing risk.

Car Insurance Rate Factors

Different factors affect how much you pay for car insurance. Demographics like age and driving history are huge. If you’re a new driver, you’ll probably pay more than a seasoned veteran. Traffic patterns also influence rates. Areas with heavy traffic and high accident rates will have higher premiums.

Accident rates are a significant factor. Areas with higher accident rates typically have more expensive car insurance premiums.

Types of Car Insurance Policies

There are different types of car insurance policies, and knowing them is super important for getting the right coverage. Liability insurance covers damages you cause to other people or their property. Collision insurance covers damage to your car in an accident, no matter who’s at fault. Comprehensive insurance covers damage to your car from things other than accidents, like weather events or vandalism.

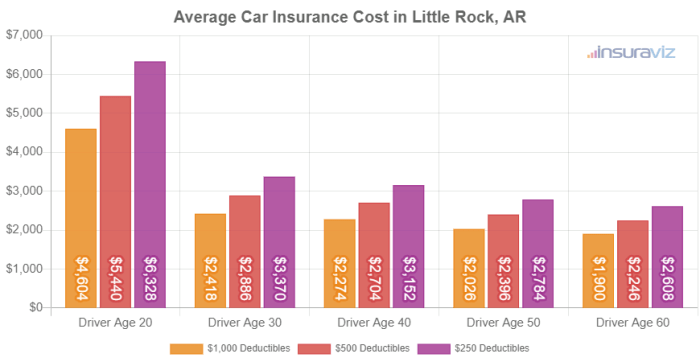

Average Car Insurance Costs in Little Rock

The average cost of car insurance in Little Rock is generally lower than in some major US cities, but it varies widely based on the factors mentioned before. For example, a 20-year-old with a new car in a high-accident area will pay more than a 40-year-old with a reliable older vehicle in a low-accident area. You gotta factor in your personal situation!

Car Insurance Company Comparison

| Company | Rates (Estimated) | Coverage Options | Customer Reviews |

|---|---|---|---|

| State Farm | $150-$250/month | Full coverage, discounts for good drivers | Mostly positive, known for good customer service |

| Geico | $125-$225/month | Good coverage, discounts for bundling | Mixed reviews, some complaints about claims process |

| Progressive | $140-$200/month | Discounts for safe driving habits | Positive reviews for online platform and discounts |

| Allstate | $135-$240/month | Various coverage levels | Mixed reviews, some complaints about customer service |

| Farmers Insurance | $160-$270/month | Strong in rural areas, discounts for homeowners | Generally positive, good local support |

Note: Rates are estimated and can vary greatly depending on individual factors. Always get quotes from multiple companies to compare.

Identifying Cost-Saving Strategies

Yo, peeps! Saving money on car insurance in Little Rock is totally doable. It’s like getting a secret weapon to your wallet. We’re breaking down how to snag some serious discounts, so you can keep more of your cash.Getting cheaper car insurance ain’t rocket science, but knowing the tricks is key. It’s all about being a smart shopper and playing the game right.

Following these tips can seriously slash your premium, which is basically like getting a raise without working harder.

Safe Driving Practices and Discounts

Safe driving habits are a major factor in getting a lower car insurance rate. Insurance companies love drivers who don’t cause accidents. This is like a reward system for responsible driving.

- Maintaining a clean driving record is crucial. Zero accidents and violations mean serious savings. Think of it as a gold star for good behavior.

- Defensive driving courses can further reduce your risk and show insurance companies you’re committed to safe driving. Taking these courses is like getting extra training for your driving skills.

- Following traffic laws and regulations consistently shows responsibility. It’s like a promise to stay safe on the road.

Student Discounts and Benefits, Cheap car insurance little rock

Being a good student can also score you major discounts on car insurance. Insurance companies recognize the value of responsible young drivers.

- Insurance companies often offer student discounts to drivers who maintain a certain GPA. It’s a win-win for both the student and the insurance company.

- Some companies may provide discounts to students enrolled in driver’s education programs. It’s like a bonus for extra training.

Impact of Driving History

Your driving history directly impacts your insurance rates. A clean record equals lower premiums, and vice versa. It’s like a report card for your driving skills.

- Accidents and violations increase your insurance rates significantly. It’s like a penalty for not following the rules.

- Maintaining a clean record is crucial for keeping premiums low. Think of it as investing in your driving future.

Bundling Insurance Policies

Bundling your car insurance with other policies like home or renters insurance can save you serious cash. It’s like a package deal for your insurance needs.

- Insurance companies often offer discounts for bundling policies. It’s like getting a discount for being a loyal customer.

- Bundling policies can save you money by combining your premiums into one payment. It’s like having one bill instead of multiple.

Insurance Provider Discount Programs

Different insurance providers offer various discount programs. Comparing these programs is key to finding the best deal.

- Some providers offer discounts for specific car features like anti-theft devices. It’s like getting a reward for having a secure car.

- Insurance companies may offer discounts for specific vehicles like fuel-efficient cars. It’s like rewarding environmentally friendly driving.

Discount Comparison Table

This table shows potential savings from various discount options. It’s a quick way to see the potential savings for different situations.

| Discount Category | Description | Potential Savings (Estimated) |

|---|---|---|

| Safe Driving | Clean driving record, defensive driving course | 5-15% |

| Student Discount | Maintaining a specific GPA | 5-10% |

| Bundling | Combining car, home, or renters insurance | 5-10% |

| Anti-theft Device | Installation of security features | 3-8% |

Comparing Insurance Companies in Little Rock

Yo, finding the right car insurance in Little Rock can be a total pain, but it doesn’t have to be a headache. Different companies offer totally different deals, so you gotta do your research to find the best fit for your needs. It’s like picking the coolest ride—you want something reliable and affordable, right?Insurance companies in Little Rock are all about the $$$, but some are way better than others when it comes to service and prices.

Figuring out which one’s the real MVP is key to saving some serious dough. Think of it as shopping for the best deal on the latest tech—you want the best features at the lowest price, right?

Prominent Car Insurance Companies

Little Rock’s got a bunch of major insurance players, and knowing who they are is the first step to comparing apples to apples. These companies are huge in the area, so you’re bound to find one that works for you.

- State Farm: A total classic, State Farm is practically a household name. They’re super established, so you know they’re legit.

- Geico: Geico is known for their super-low prices and catchy commercials. They’re pretty good at making it easy to compare policies.

- Progressive: Progressive is always trying to shake things up with new deals and online tools. They’re super user-friendly.

- Allstate: Allstate is a major player, offering a variety of coverage options.

- Farmers Insurance: Farmers Insurance is another reliable option, especially if you’re a farmer or live in a rural area.

Comparing Services Offered

Different companies have totally different ways of doing things. Some are all about the online experience, while others are more traditional. Knowing this is crucial when choosing.

- Online Platforms: Some companies, like Progressive, have amazing online tools to compare policies and even manage your account. Others, like State Farm, might have more of a traditional approach, but they’re still super helpful.

- Customer Support: Customer support is HUGE. If you have a question or need help, you want someone who’s responsive and helpful. Some companies have amazing customer service, while others might be a little slow to respond. Do your research on how each company handles customer service complaints.

Customer Reviews and Ratings

Reading reviews is like getting a sneak peek at what other people think. Websites like Yelp and the Better Business Bureau can give you some insight into the experiences other folks have had with different companies. You want to see what other people are saying about their experiences.

- Look for patterns: Are a lot of people complaining about the same thing? Maybe that’s a red flag.

- Consider the source: Make sure the reviews are from real people and not fake accounts.

Importance of Reading the Fine Print

Don’t just skim over the fine print—it’s the key to understanding exactly what you’re paying for. The fine print has all the important details about coverage, exclusions, and limits. It’s like the instructions for a super complicated video game—you gotta read them to play right.

- Look for hidden fees: Sometimes there are extra charges that aren’t obvious.

- Understand coverage limits: Make sure the coverage you’re getting is enough to protect you.

Coverage Options Comparison

Different companies offer various coverage options. This table summarizes the main ones:

| Insurance Company | Liability Coverage | Collision Coverage | Comprehensive Coverage |

|---|---|---|---|

| State Farm | Excellent | Good | Good |

| Geico | Good | Average | Average |

| Progressive | Excellent | Good | Good |

| Allstate | Excellent | Good | Good |

| Farmers Insurance | Good | Good | Good |

Understanding Insurance Coverage Options

Yo, so you tryna get the best car insurance deal in Little Rock? Knowing your coverage options is key, fam. Different policies have totally different stuff covered, so you gotta know what you’re getting into. This ain’t rocket science, but it’s important to understand the basics.

Different Types of Coverage

Insurance policies usually come with a bunch of different coverage types. Liability coverage is like, if you wreck someone else’s ride, it covers their damages. Collision coverage kicks in if your car gets wrecked in an accident, no matter who’s at fault. Comprehensive coverage is for stuff like weather damage, theft, or vandalism. It’s basically extra protection for your ride.

Importance of Understanding Policy Details

Read the fine print, people! Insurance policies can be super confusing, but understanding the details is crucial. Different companies have different rules and limits, so you gotta pay close attention to the specifics of your policy. This is how you avoid nasty surprises down the road. If you don’t get it, ask a trusted adult or insurance agent to help you figure it out.

Implications of Different Coverage Levels

Different coverage levels mean different amounts of protection. Higher levels usually cost more, but they offer more comprehensive protection. Lower levels are cheaper, but they offer less protection. Think of it like this: A basic policy is like a cheap burger—it’s quick and easy, but you might not get all the fixings. A premium policy is like a fancy steak—it costs more, but it’s way more satisfying.

Examples of Coverage Variations Between Policies

Insurance companies can totally vary their coverage options. For example, one policy might have a higher liability limit than another, or one might include roadside assistance, while another doesn’t. Some policies might have higher deductibles, which means you’ll pay more out-of-pocket if you file a claim. So, you gotta compare policies side-by-side to find the best fit for your needs.

Coverage Options: Benefits and Drawbacks

| Coverage Type | Benefits | Drawbacks |

|---|---|---|

| Liability | Covers damages to other people’s property or injuries if you’re at fault. | Doesn’t cover your own vehicle’s damage or injuries. |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | Can be expensive, especially with higher coverage limits. |

| Comprehensive | Covers damage to your vehicle from things like weather, theft, or vandalism. | Can be expensive, especially with higher coverage limits. |

This table gives a quick overview, but remember, each policy has its own unique stipulations. You gotta dig deeper into each policy to find the best fit for your wallet and needs. Don’t just settle for the first policy you see!

Tips for Choosing the Right Insurance Provider

Yo, finding the right car insurance in Little Rock is crucial, fam. It’s like picking the perfect ride – you gotta shop around and find the best deal. This ain’t no game, you need protection, and affordable rates are a must.

Comparing Quotes from Multiple Providers

Comparing quotes from multiple insurance providers is essential for finding the absolute best deal. Different companies have different pricing structures, so comparing apples to apples is key. Think of it like going to different stores to see which one has the lowest price on the same item.

Benefits of Multiple Quotes

Getting multiple quotes from various insurance companies gives you a wider range of options. This allows you to compare policies, coverage amounts, and premiums. You’ll be able to spot the real steals and save some serious cash. It’s like having a whole bunch of choices when you’re picking a new phone – you’re gonna find the one that’s perfect for you.

Comparing Policies and Features

When comparing policies, look closely at the coverage details. Things like liability limits, comprehensive coverage, and collision coverage are super important. Also, check out the deductibles, and make sure they fit your budget. Understanding the specifics of each policy will help you make the best decision.

Using Online Comparison Tools

Online comparison tools are your best friend when it comes to finding affordable car insurance in Little Rock. They let you compare quotes from various providers in a flash, saving you tons of time and effort. These tools are super user-friendly, and you can easily find the best rates with a few clicks.

Step-by-Step Guide for Finding the Best Car Insurance

| Step | Action |

|---|---|

| 1 | Gather your vehicle information (year, make, model, etc.) and your driving history (accidents, violations). |

| 2 | Visit the websites of various insurance providers in Little Rock. |

| 3 | Use online comparison tools to get quotes from multiple companies. Enter your information, and let the tool do the heavy lifting! |

| 4 | Carefully review each policy’s details, including coverage limits, deductibles, and premiums. |

| 5 | Compare the quotes side-by-side, paying close attention to the costs and features offered. |

| 6 | Choose the policy that best fits your needs and budget. |

Recent Trends in Little Rock Car Insurance

Yo, peeps! Little Rock car insurance is totally changing, and it’s not always clear what’s up. From new tech to weird weather, your rates are getting all kinds of wild. Let’s dive into the latest trends.Insurance rates in Little Rock are feeling the heat, fam. Sometimes they’re going up, sometimes they’re down, but it’s not always a straight line.

It’s all about a bunch of different factors that are constantly shifting.

Impact of New Technologies on Pricing

Self-driving cars and all that fancy tech are totally messing with insurance calculations. Companies are trying to figure out how much risk these new vehicles pose. If a self-driving car crashes, who’s responsible? It’s a whole new ballgame, and that’s affecting premiums. Some insurers are offering discounts for vehicles with advanced safety features, while others are charging more for those that are less safe or are new on the market.

Think about it: if a car can drive itself, is it reallythat* much safer? It’s a complicated question, and it’s totally impacting the prices you see.

Role of Insurance Regulations in Little Rock

Little Rock’s insurance regulations play a huge role in setting rates. State laws about things like minimum coverage requirements and how claims are handled can really influence how much you pay. If the laws change, so can your rates. For example, if there’s a new law requiring all cars to have certain safety features, insurance companies will have to adjust their calculations.

Sometimes these changes are for the better, but sometimes they just add more costs to your policy.

Influence of Weather Patterns and Local Events

Weather and local events, like major storms or accidents, are a huge deal in Little Rock. Severe weather events, like hailstorms or floods, can lead to a spike in claims. That means insurers have to pay out more, and that can drive up rates. Also, if a big accident happens, that can increase premiums for everyone in the area.

Think about a big fender bender on a busy highway, that will impact the whole area’s rates.

Relationship Between Vehicle Types and Insurance Costs

Different cars have different risks. A fancy sports car is going to cost more to insure than a basic sedan. The same goes for trucks or SUVs. Insurance companies look at factors like how much the car is worth, how easily it can be stolen, and how safe it is. It’s all about calculating the potential risk.

Sports cars often have higher insurance rates because of their higher speeds and potentially more accidents.

Recent Changes in Little Rock Car Insurance Market Trends

| Trend | Description | Impact on Rates |

|---|---|---|

| Increased use of telematics | Drivers using apps that track driving habits | Potentially lower rates for safe drivers |

| Rising repair costs | Parts and labor costs increasing | Higher rates due to increased claim costs |

| Focus on accident prevention | Insurers promoting safety courses and programs | Potential for lower rates with safer driving habits |

These trends show how Little Rock car insurance is changing. It’s not just about the price; it’s about the risks and how companies are adjusting to them.

Navigating the Claims Process in Little Rock: Cheap Car Insurance Little Rock

Yo, so you wrecked your ride? Filing a claim can seem like a total headache, but it doesn’t have to be a total drag. Knowing the steps can make it way less stressful. This rundown will break down the whole process, from the initial report to getting your dough back.

Steps in Filing a Claim

Filing a claim is like following a recipe. You gotta have all the right ingredients to get the outcome you want. First, you gotta contact your insurance company ASAP. Take pics of the damage, gather all your paperwork, and be ready to give ’em all the deets. This is super important for a smooth process.

Situations Requiring a Claim

A claim isn’t just for fender benders. Think accidents, theft, or even damage from a freak weather event. If your car’s totaled, you’re gonna need a claim. Also, if you’re involved in an accident and someone else’s insurance needs to pay, that’s a claim situation, too. You might even need a claim for damage caused by a tree falling on your car, or if someone hits your car in a parking lot.

Common Reasons for Claim Denial

Insurance companies aren’t just trying to be jerks. Sometimes, they deny claims because of missing paperwork, like not having your proof of insurance. Maybe you didn’t report the damage right away or didn’t cooperate fully. Also, if your claim involves something that isn’t covered under your policy, like intentional damage, that’s a definite no-go.

Maintaining Accurate Records

Keeping good records is key, fam. This means saving all your receipts, emails, and any notes about the incident. It’s like having a time capsule of the whole thing. This helps your claim move along quicker and reduces the chances of it getting rejected.

Role of Insurance Adjusters

Insurance adjusters are the middlemen in the claims process. They investigate the claim, look at the damage, and decide how much your claim is worth. They’ll try to figure out what happened and whether the claim is valid. They’re like detectives, but instead of catching criminals, they’re trying to figure out the cost of repairs.

Little Rock Claims Process Summary

| Step | Description |

|---|---|

| 1. Contact Insurance Company | Immediately report the accident or damage. |

| 2. Gather Information | Collect details like the date, time, location, and witnesses. |

| 3. Document Damage | Take pictures of the damage and note the extent of the damage. |

| 4. Submit Claim | Fill out the necessary forms and provide all required documentation. |

| 5. Adjuster Investigation | Insurance adjuster investigates the claim and assesses the damage. |

| 6. Evaluation and Settlement | Insurance company evaluates the claim and determines the settlement amount. |

Last Point

In conclusion, securing affordable car insurance in Little Rock involves careful research, comparison, and understanding of local factors. By understanding the market dynamics, exploring cost-saving strategies, and carefully comparing insurance providers, you can find the right coverage at a price that fits your budget. This guide serves as your roadmap to finding cheap car insurance Little Rock, empowering you to make informed decisions and protect yourself on the road.

Quick FAQs

What are the common factors influencing car insurance rates in Little Rock?

Several factors impact car insurance premiums in Little Rock, including driver demographics (age, history), local traffic patterns, accident rates, and even vehicle type. Understanding these elements will help you understand your potential rates.

What discounts are typically available for car insurance in Little Rock?

Many insurance providers offer discounts for safe drivers, good students, accident-free records, and bundling policies (e.g., car and home insurance). Research different providers to see which discounts are available and how much they can save you.

How can I compare car insurance quotes in Little Rock effectively?

Use online comparison tools to get quotes from multiple insurance companies. Compare coverage options, premiums, and customer reviews to find the best fit for your needs. Don’t hesitate to contact insurance agents directly for personalized assistance.

What are the steps involved in filing a car insurance claim in Little Rock?

The claims process usually involves reporting the incident, providing documentation, and cooperating with the insurance adjuster. Maintaining accurate records and understanding the specific steps Artikeld by your provider are crucial.