American National car insurance quote – it’s like, totally crucial for any car owner, right? Finding the perfect policy can feel like navigating a maze, but don’t sweat it. This guide breaks down everything you need to know about getting the best deal from American National. We’ll cover everything from understanding the different types of policies to comparing prices and finding sweet savings.

From liability coverage to comprehensive insurance, we’ll explore the various options available and how they can protect your wheels. Plus, we’ll dish out the dirt on factors that influence your quote, like your driving record and the type of car you drive. Ready to level up your car insurance game? Let’s dive in!

Understanding the American National Car Insurance Landscape

American National Insurance Company offers a range of car insurance products to meet various needs. Their offerings are designed to provide comprehensive coverage, but the specific policies and premiums may vary based on factors like location, driving history, and vehicle type. This analysis will explore American National’s car insurance offerings, compare them to competitors, and review customer feedback.American National, like other major insurers, provides various types of auto insurance policies.

Understanding these different types is key to selecting the right coverage for your needs and budget. Each policy type provides a different level of protection and comes with a corresponding cost.

American National Car Insurance Offerings

American National provides a standard suite of car insurance products, including liability, collision, and comprehensive coverage. Liability insurance protects policyholders in the event they cause an accident and are held responsible for damages to others. Collision coverage pays for damages to your vehicle in an accident, regardless of who is at fault. Comprehensive coverage, meanwhile, protects against damages to your vehicle from events other than accidents, such as vandalism, theft, or weather-related damage.

These policies often come with varying deductibles, influencing the overall premium.

Types of Car Insurance Policies

- Liability Insurance: This policy covers damages you cause to other people or their property in an accident. It typically includes bodily injury liability and property damage liability. The amount of coverage will be specified in the policy.

- Collision Insurance: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision, regardless of who is at fault. It is important to note that collision coverage typically requires a deductible, which is the amount you pay out-of-pocket before the insurance company covers the remaining costs.

- Comprehensive Insurance: This broad coverage extends beyond accidents, safeguarding your vehicle against various incidents like vandalism, theft, hail damage, or fire. A deductible applies here as well, affecting the premium cost.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage to pay for your damages.

Comparison with Major Competitors

American National competes with well-established insurance companies. Factors like pricing, coverage options, and customer service differentiate one company from another. Direct comparisons are difficult without specific policy details, but general trends in the market are noticeable. For example, some competitors might offer more competitive rates for certain types of drivers, while others prioritize a particular aspect of customer service.

American National’s Reputation and Customer Reviews

American National’s reputation, like that of any insurance company, is largely shaped by customer reviews and experiences. These reviews can provide insights into the company’s service quality, claims handling processes, and overall customer satisfaction. A significant number of reviews can provide a comprehensive overview of the strengths and weaknesses of the company.

Policy Costs

| Policy Type | Estimated Cost (Example) |

|---|---|

| Liability Only | $500-$1500 annually |

| Collision & Comprehensive | $1000-$2500 annually |

| Full Coverage (Liability, Collision, Comprehensive) | $1500-$3000 annually |

Note: These are estimated costs and can vary significantly based on factors such as location, driving history, and vehicle type.

Factors Influencing Car Insurance Quotes

Understanding the factors that influence car insurance premiums is crucial for obtaining competitive rates. These factors are often intertwined, meaning one aspect can significantly impact another. Insurance companies carefully assess various elements to determine the appropriate risk level and consequently, the premium you pay.The evaluation process is designed to assess the likelihood of a claim. Factors like driving history, vehicle characteristics, and personal details play a key role in this assessment.

Insurance companies aim to balance the need to provide coverage with the necessity of maintaining sustainable business practices.

Driving History Impact

Driving history, including accidents and violations, significantly affects car insurance premiums. A history of accidents or traffic violations indicates a higher risk to the insurer. This is because past incidents demonstrate a higher probability of future claims. Insurance companies use this data to calculate the likelihood of a future claim. For example, a driver with a history of multiple accidents will likely have higher premiums compared to a driver with a clean driving record.

The severity of accidents and the frequency of violations also impact the premium. A minor fender bender might lead to a slightly higher premium, while a serious accident could lead to a substantial increase.

Vehicle Type Influence

The make, model, and year of a vehicle significantly impact insurance costs. Certain vehicles are inherently more prone to damage or theft, leading to higher premiums. High-performance sports cars, for example, tend to have higher premiums than more basic models. Furthermore, newer models often come with advanced safety features, which can potentially reduce the insurance premium. The value of the vehicle also plays a role.

A high-value vehicle, regardless of its make and model, may command a higher premium due to the potential for a higher claim amount in case of an accident or theft. Vehicles with a history of mechanical issues or recalled parts could also impact the premium.

Other Affecting Factors

Several other factors influence car insurance premiums beyond driving history and vehicle type. Location plays a critical role, with some areas having a higher risk of accidents due to factors like weather conditions or traffic density. Age and gender can also affect rates, although the impact of gender is typically decreasing. A younger driver is often considered a higher risk, while older drivers are generally viewed as lower risk.

Insurers take into account the characteristics of the driver. A driver with a higher credit score often receives lower rates, and this is an indication of responsible financial management.

Table: Driving Factors Impacting Insurance Costs

| Driving Factor | Impact on Insurance Cost | Example |

|---|---|---|

| Accident History (Multiple) | Higher premiums | A driver with three or more accidents in the past five years |

| Violation History (Severe) | Higher premiums | A driver with multiple speeding tickets or reckless driving convictions |

| Vehicle Value (High) | Higher premiums | A luxury sports car worth over $100,000 |

| Vehicle Age (New) | Potentially lower premiums | A brand new vehicle with advanced safety features |

Accessing and Evaluating Quotes

Getting a car insurance quote is a straightforward process, especially with the rise of online platforms. This section details how to navigate the process, ensuring you understand the information needed and how to compare quotes effectively. This knowledge empowers you to make an informed decision regarding your insurance needs.

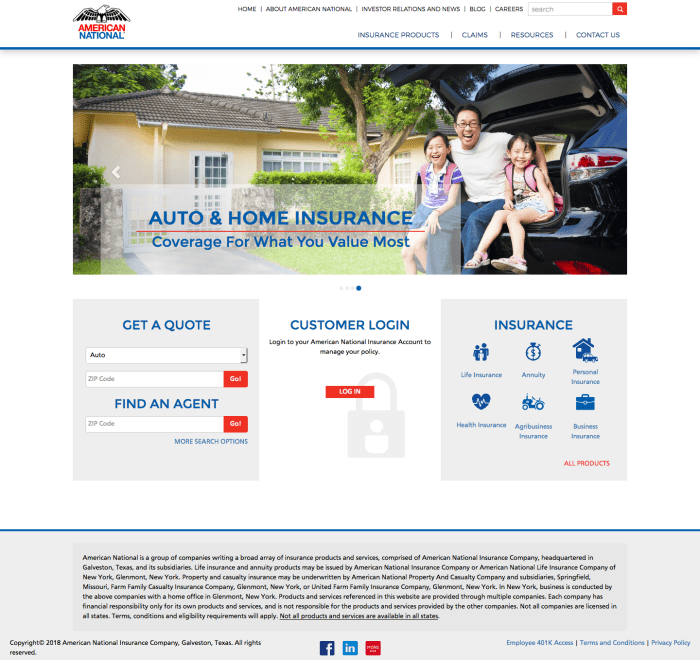

Obtaining an Online Quote

Online platforms streamline the process of obtaining a car insurance quote from American National or other providers. The process typically involves a few simple steps.

- Step-by-Step Guide: Visit the American National website or a third-party comparison site. Complete the online form, providing details such as your vehicle information (make, model, year), driving history (including any accidents or violations), and personal details (age, location, and driving habits). This form is often interactive, guiding you through the required fields. Be accurate and complete; inaccuracies can lead to an inaccurate quote.

Filling Out the Required Information

Accurately completing the online form is crucial for a precise quote. The information required generally includes vehicle details, driver information, and coverage preferences.

- Vehicle Details: Provide the make, model, year, and VIN (Vehicle Identification Number) of your car. Specify the vehicle’s use (personal, commercial, etc.) and any modifications.

- Driver Information: Input your age, driving history (including any accidents or violations), and driving habits. Be precise and truthful, as inaccuracies can affect the quote.

- Coverage Preferences: Select the desired coverage options, including liability, collision, comprehensive, and optional extras. Clearly understand each coverage type and its implications. This will affect the premium you pay.

Common Questions During the Quote Process

During the online quote process, you might encounter specific questions. These questions are designed to gather essential data for accurate risk assessment.

- Driving History: Questions regarding prior accidents or violations are common. Honest answers are essential for an accurate quote. Provide the specifics of any accidents or violations, including dates, locations, and circumstances.

- Vehicle Usage: Questions regarding the vehicle’s intended use (e.g., commuting, weekend trips) are also asked. These help determine the risk profile of your driving habits.

- Coverage Preferences: Questions regarding your desired coverage levels are frequently asked. Understanding different coverage options (e.g., liability, collision, comprehensive) helps you select the most appropriate coverage.

Comparing Online and Agent Quotes

Comparing online and agent-obtained quotes can provide insight into cost and service. The accuracy of quotes from both sources is generally comparable when all the necessary information is accurately provided.

- Online Quotes: Online quotes are often faster, as the process is automated. They offer immediate comparisons across multiple providers. The speed and ease of comparison are attractive, but careful review is still required.

- Agent Quotes: Agent quotes may offer personalized recommendations and explanations of various coverage options. This personalized approach can be beneficial, especially for complex needs. The time investment in speaking with an agent is a trade-off for personalized guidance.

Quote Comparison Websites

Third-party websites facilitate comparing quotes from multiple insurance providers. These platforms can be valuable tools in your decision-making process.

| Website | Features | Pros | Cons |

|---|---|---|---|

| Insurify | Extensive provider network | Large selection, easy comparison | May not provide personalized service |

| Policygenius | User-friendly interface | Clear presentation of options | May not offer every provider |

| NerdWallet | Comprehensive comparison tools | Helpful resources and explanations | May have limitations in some areas |

Key Considerations for Comparing Quotes

Comparing car insurance quotes is crucial for securing the best possible coverage at a competitive price. Understanding the factors influencing your quote, such as your driving history and vehicle type, is just the first step. The next step involves critically evaluating the different policies offered and recognizing potential hidden costs.Comparing quotes from multiple insurers is essential to ensure you aren’t overpaying for your coverage.

A thorough comparison of various policies helps identify the most advantageous options tailored to your specific needs and financial situation. Different insurance companies often employ varying pricing models and coverage stipulations, leading to significant cost differences.

Importance of Comparing Quotes from Multiple Providers

Comparing quotes from multiple insurance providers is crucial to finding the most competitive price for your coverage. Different insurers have different pricing models, and a single quote might not reflect the best possible rate. By comparing quotes, you can identify potential savings and select the most cost-effective policy. For example, Company A might offer a lower premium for a similar coverage package compared to Company B, ultimately saving you money.

Influence of Policy Deductibles and Coverage Limits on Costs

Deductibles and coverage limits directly affect the overall cost of your car insurance. A higher deductible typically results in a lower premium, but you’ll have to pay a larger out-of-pocket amount in the event of a claim. Conversely, higher coverage limits often lead to a higher premium, providing greater financial protection in case of a significant loss. A $1,000 deductible might mean a lower monthly payment, but a $5,000 claim would require you to pay $4,000 before insurance covers the rest.

Significance of Reading the Fine Print of Insurance Policies

Thorough review of the policy’s fine print is vital for understanding the complete scope of coverage. Many policies contain exclusions, limitations, and conditions that may not be immediately apparent. Reading these details prevents surprises and ensures you understand exactly what your policy covers and what it doesn’t. This includes understanding specific situations, like coverage for damage caused by weather events, accidents with uninsured drivers, or even policy limitations for specific types of vehicles.

Identifying Hidden Fees or Extra Charges in Policies

Carefully examining insurance policies for hidden fees or extra charges is essential to avoid unexpected costs. Review each policy’s details, scrutinizing for add-on fees or hidden costs that might be bundled with the base policy. Some insurers might charge extra for specific add-ons or for coverage in certain situations. Always compare policies side-by-side, meticulously examining the small print to avoid surprises.

Comparative Analysis of Policy Features and Costs Across Providers

A comprehensive comparison of policy features and costs across different insurance providers is facilitated by a tabular representation. This allows for a side-by-side analysis of different coverage options and their associated costs. This can help you easily spot differences and make an informed decision.

| Insurance Provider | Premium (Monthly) | Deductible | Coverage Limits (Liability) | Collision Coverage | Comprehensive Coverage |

|---|---|---|---|---|---|

| Company A | $150 | $500 | $100,000 | Yes | Yes |

| Company B | $175 | $1,000 | $250,000 | Yes | Yes |

| Company C | $125 | $1,000 | $50,000 | Yes | No |

Illustrative Examples of Car Insurance Policies

Understanding the nuances of car insurance policies is crucial for making informed decisions. Different policy types offer varying levels of protection and coverage, influencing the premium you pay. This section provides illustrative examples to clarify the differences.

Basic Car Insurance Policy

A basic policy typically covers the minimum liability requirements mandated by your state. This means you’re protected against financial responsibility if you’re at fault in an accident, but coverage is limited. It usually includes:

- Liability Coverage: Pays for damages to other people’s property and injuries to other people if you’re deemed at fault in an accident. This coverage is often the only protection you have if you’re responsible for the accident.

- Uninsured/Underinsured Motorist Coverage: This covers you if you’re involved in an accident with someone who doesn’t have insurance or whose insurance is insufficient to cover your damages. This is crucial for protecting yourself from financial risk in such situations.

Enhanced Coverage Policy

An enhanced policy extends beyond basic liability, providing more comprehensive protection. This type of policy typically includes:

- Collision Coverage: Pays for damage to your vehicle regardless of who caused the accident.

- Comprehensive Coverage: Covers damage to your vehicle from events other than collisions, such as theft, vandalism, hail, or fire.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Similar to basic policies, but often with higher limits.

Policy with High Deductible

A high-deductible policy reduces your premium by increasing the amount you’re responsible for paying out-of-pocket before insurance kicks in. This is a popular choice for those looking to save on premiums. The components include:

- Lower Premiums: The primary benefit of a high deductible policy is lower monthly payments.

- Higher Out-of-Pocket Expenses: If you have an accident, you’ll need to pay the deductible amount before insurance starts covering your expenses.

- Potential for significant savings: By opting for a high deductible, you can reduce your overall insurance costs.

Policy Including Roadside Assistance

Roadside assistance coverage is an optional add-on that can prove invaluable in emergency situations. This often includes:

- Towing: If your vehicle breaks down, roadside assistance will arrange for towing to a repair shop or designated location.

- Jump Starts: If your car battery dies, you can utilize roadside assistance to get it started.

- Lockout Service: If you lock your keys in your car, assistance can help gain access.

Comparison Table of Policy Levels

This table highlights the key differences between various policy levels. Different states have different minimum requirements, so always verify your state’s regulations.

| Policy Level | Liability Coverage | Collision Coverage | Comprehensive Coverage | Deductible |

|---|---|---|---|---|

| Basic | Minimum Required | No | No | Low |

| Enhanced | Above Minimum | Yes | Yes | Moderate |

| High Deductible | Above Minimum | Yes | Yes | High |

Tips for Saving Money on Car Insurance

Saving money on car insurance is achievable through proactive measures. Understanding the factors that influence premiums and taking steps to improve your driving record, coverage selections, and policy bundling can significantly reduce your insurance costs. American National offers various discounts that can further lower your premiums.

Improving Your Driving Record

Maintaining a clean driving record is paramount for lower car insurance premiums. Accidents and traffic violations directly impact your insurance rates. Consistent safe driving habits, including adhering to speed limits, avoiding aggressive maneuvers, and utilizing seat belts, can contribute to a favorable driving record. Avoiding distractions, such as using cell phones while driving, is also crucial for maintaining a safe driving record.

Selecting Appropriate Coverage Levels, American national car insurance quote

Carefully evaluating your needs and financial situation when selecting coverage levels can yield substantial savings. Comprehensive coverage, while offering broader protection, may not always be necessary. Understanding the differences between liability coverage, collision coverage, and comprehensive coverage is vital. Consider the value of your vehicle, your financial resources, and potential risks to determine the most suitable coverage levels without overpaying.

Bundling Insurance Policies

Bundling your car insurance with other policies, such as homeowners or renters insurance, can lead to substantial savings. This is often a result of a discounted rate for the combined policies. American National often provides bundled discounts for multiple policies.

Utilizing American National Discounts

American National offers various discounts to help policyholders save money. These discounts can vary depending on individual circumstances and the specifics of the policy. Understanding and taking advantage of available discounts is essential for optimizing savings.

Table of American National Discounts

| Discount Type | Description | Potential Savings |

|---|---|---|

| Good Student Discount | For students with a good academic record | Potentially 5-15% |

| Defensive Driving Course Discount | Completion of a defensive driving course | Potentially 5-10% |

| Multiple Policy Discount | Bundling car insurance with other policies | Potentially 5-15% |

| Accident-Free Discount | Maintaining an accident-free driving record | Potentially 5-10% |

| Safe Driver Recognition Program Discount | Participating in a safe driver recognition program | Potentially 5-10% |

| Paperless Billing Discount | Opting for paperless billing | Potentially 2-5% |

Ending Remarks

So, getting an American National car insurance quote is totally doable. Comparing quotes, understanding coverage options, and knowing how to save money are key. Remember to check the fine print and compare policies across providers to find the best fit for your needs. Ultimately, finding the right insurance is about getting the best protection without breaking the bank.

You’re all set to find the perfect policy that’s right for you!

FAQ Corner: American National Car Insurance Quote

Q: What if I have a bad driving record?

A: A less-than-perfect driving record might bump up your premiums, but it’s not the end of the world. American National often offers options for drivers with violations, so don’t despair! Shop around and see what deals they have.

Q: How does my car’s age affect the cost?

A: Older cars usually mean higher premiums. That’s because they might be harder to repair or have higher theft risks. New models usually get a lower rate.

Q: Can I bundle my insurance with other policies?

A: Often, bundling your home and auto insurance with American National can get you a sweet discount. It’s a win-win, saving you money and making things simpler!

Q: What are the hidden fees in car insurance?

A: Hidden fees can be sneaky, so always read the fine print! Look out for extra charges for specific add-ons or services. Compare policies carefully to catch these potential surprises.