Can I get USAA car insurance for my girlfriend’s car? This is a common question, especially if you’re looking for affordable and reliable coverage. It’s totally understandable to want the best deal, but USAA has specific rules about insuring someone else’s ride. So, let’s dive into the nitty-gritty details, figuring out if it’s even possible and what you need to know.

Basically, USAA is a pretty cool insurance option, but it’s not always a straightforward yes or no when it comes to covering a non-member’s car. Things like your girlfriend’s driving record, the car’s condition, and where she parks it all play a role. Let’s break it down, shall we?

Eligibility Criteria: Can I Get Usaa Car Insurance For My Girlfriend’s Car

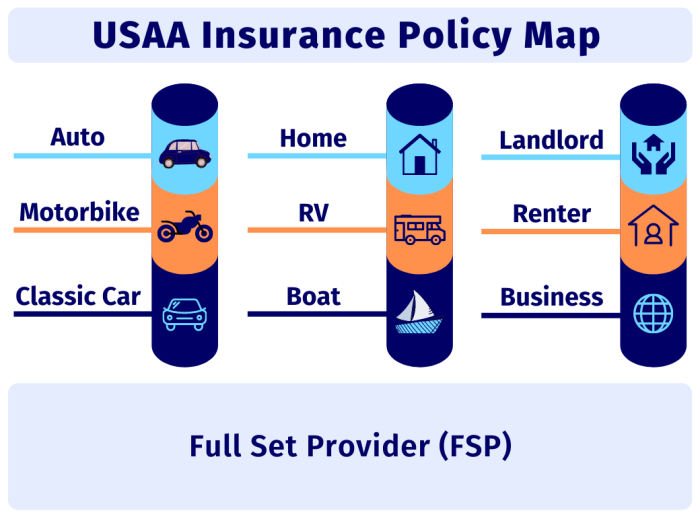

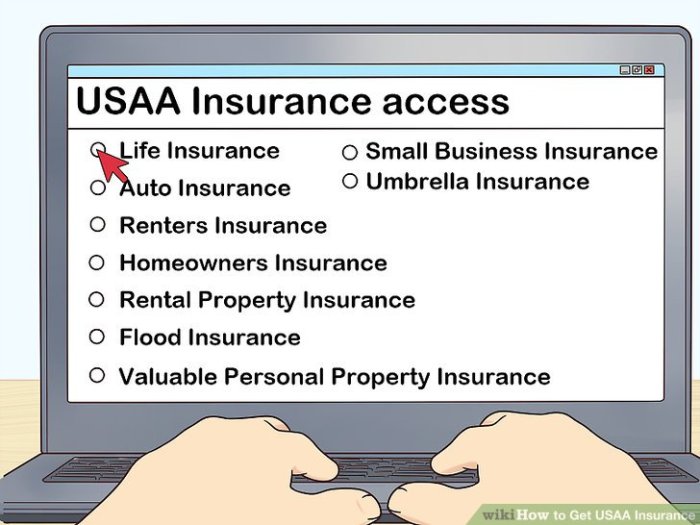

USAA car insurance, while primarily designed for members of the United States Auto Association, does occasionally offer coverage to non-members under specific circumstances. Understanding these criteria is crucial for determining if coverage is a viable option for a non-member’s vehicle.

USAA Eligibility Requirements for Non-Members

USAA’s policies for non-members are significantly different from those for family members. Coverage is typically limited and requires a compelling reason for consideration beyond the usual circumstances. The key factors influencing eligibility for a non-member’s vehicle are often the applicant’s existing relationship with USAA, the vehicle’s characteristics, and the particular circumstances of the application.

Factors Influencing Eligibility

Several factors influence the eligibility of a non-member’s vehicle for USAA insurance. These factors are assessed holistically to determine if the applicant meets the criteria for consideration.

- Relationship with USAA: A pre-existing relationship with USAA, such as a prior insurance policy or a significant financial relationship, might increase the chances of approval. For example, a non-member who has been a USAA bank customer for years might be viewed more favorably than a completely new applicant.

- Vehicle Characteristics: The vehicle’s make, model, year, and value can impact eligibility. USAA might have restrictions on specific types of vehicles or models. Factors such as the vehicle’s history and maintenance records are also often considered.

- Application Circumstances: The specific reasons for needing coverage for a non-member’s vehicle may influence eligibility. A clear and compelling explanation for the need, such as a temporary need for coverage or a unique situation, might increase the likelihood of approval.

Applying for Coverage

The process for applying for coverage for a non-member’s vehicle varies from the standard USAA application procedure. Detailed information about the vehicle, the applicant, and the specific need for coverage is essential.

- Detailed Information: Complete and accurate information about the vehicle and the applicant is required. This may include the vehicle identification number (VIN), the applicant’s driving record, and any relevant financial information.

- Application Submission: The application process is usually conducted through a dedicated channel or form designed for non-members. A complete application, including supporting documents, is necessary for processing.

- Review and Approval: USAA carefully reviews each application, considering all factors. The review process may take some time. The applicant will receive notification of the decision regarding the application.

Restrictions and Limitations

There are likely restrictions and limitations on coverage for non-member vehicles. These might include policy limits, exclusions, or specific terms and conditions. A careful review of the details and fine print is recommended.

- Policy Limits: The coverage amount for non-member vehicles may be lower than for a member’s vehicle. This limit may be based on the vehicle’s value or the applicant’s circumstances.

- Exclusions: Certain types of coverage might be excluded or have limitations for non-member vehicles. These exclusions could apply to specific activities or scenarios.

- Terms and Conditions: Non-member policies will likely have different terms and conditions compared to policies for USAA members. These conditions could include deductibles, premium rates, and other details.

Comparison of Eligibility Rules

The eligibility rules for family members differ significantly from those for non-family members. Family members often have more favorable treatment in terms of coverage and access to benefits.

- Family Members: Family members typically benefit from more favorable eligibility criteria and often have access to broader coverage options.

- Non-Family Members: Non-family members are assessed on a case-by-case basis, and coverage is usually more limited compared to USAA members or family members.

Insurance Coverage Options

Securing appropriate insurance coverage is crucial for protecting your girlfriend’s car. Understanding the various options available and their associated costs is vital for making an informed decision. This section details the different types of coverage offered by USAA, focusing on those relevant to a non-member’s vehicle, along with helpful add-on options.

Comparison of Car Insurance Coverage Options

Different coverage options cater to varying needs and risk tolerances. A comprehensive comparison helps in choosing the right mix of protection.

| Coverage Type | Description | Premium Implications |

|---|---|---|

| Liability Coverage | Protects you if you’re at fault for causing an accident, covering the other driver’s damages. | Generally the lowest premium, as it offers the least protection. |

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of who is at fault. | Higher premium than liability, as it offers broader protection. |

| Comprehensive Coverage | Protects against damage from events other than collisions, like vandalism, theft, or weather damage. | Premium increases with this coverage, as it covers a wider range of potential risks. |

| Uninsured/Underinsured Motorist Coverage | Covers you if you’re in an accident with a driver who doesn’t have insurance or has insufficient coverage. | Premium increases, as it safeguards against a crucial gap in liability. |

USAA Insurance Coverage for Non-Members

USAA, while primarily for members of the US Armed Forces and their families, offers some coverage options for non-members. These options might differ in terms of specific details and pricing from the standard policies offered to members. Crucially, specific details and pricing will depend on the vehicle and its history.

Add-on Coverages

Certain add-on coverages can significantly enhance the protection offered by basic insurance policies.

- Roadside Assistance: Provides help with flat tires, jump-starts, or lockouts. This coverage can be valuable in unexpected situations and typically comes at an additional cost.

- Rental Car Coverage: Covers the cost of a rental car if your vehicle is damaged or involved in an accident requiring repair. This option is particularly beneficial for individuals who rely heavily on their car for transportation. The premium for rental car coverage varies based on the length of the rental period and the rental car’s daily rate.

- Gap Insurance: Covers the difference between the actual cash value of a vehicle and its outstanding loan balance. This is beneficial if the vehicle is totaled and the loan amount exceeds its value. It protects against financial losses in such cases.

Deductibles and Coverage Options

Different coverage options often come with varying deductibles. The deductible is the amount you pay out-of-pocket before the insurance company starts covering costs.

| Coverage Option | Example Deductibles |

|---|---|

| Collision Coverage | $500, $1000, $2500, $5000 |

| Comprehensive Coverage | $500, $1000, $2500 |

| Uninsured/Underinsured Motorist Coverage | $500, $1000, $2500 |

Note: The specific deductibles and associated costs will vary depending on factors such as the make, model, and year of the car, as well as the driver’s history and location. A thorough comparison of quotes from different insurers is recommended.

Premium Calculation and Factors

Understanding the factors that influence car insurance premiums is crucial for making informed decisions. This section details the key components USAA, and other insurers, use to determine the cost of coverage for your girlfriend’s vehicle. Knowing these factors empowers you to assess the potential expenses and explore options for potentially reducing premiums.

Factors Determining Car Insurance Premiums

Various elements play a role in shaping the cost of car insurance. These include characteristics of the vehicle, the driver, and the driving environment. A comprehensive understanding of these factors helps in making well-informed choices regarding insurance coverage.

- Vehicle Characteristics: The make, model, and year of a vehicle significantly impact its insurance premium. Vehicles perceived as more prone to theft or damage, or with advanced features that may be costly to repair, will typically command higher premiums. For example, a high-performance sports car will likely have a higher premium compared to a standard sedan, due to higher repair costs and potential for accidents.

Similarly, older vehicles with fewer safety features might have higher premiums.

- Driver History: A driver’s driving record is a critical factor in premium calculation. A clean driving record with no accidents or violations results in lower premiums. Conversely, drivers with a history of accidents or traffic violations face higher premiums to reflect the increased risk. A driver with multiple moving violations, for instance, will likely see a higher premium compared to a driver with a clean record.

- Vehicle Location and Usage: The location where the vehicle is primarily driven and the frequency of its use also affect the premium. Areas with higher accident rates or higher theft rates will typically have higher premiums. Similarly, a vehicle used for frequent long-distance driving or for commercial purposes might have higher premiums than one used primarily for local trips.

USAA Premium Calculation for Non-Members

USAA, as a member-based organization, employs a specific formula for determining premiums. For non-members, the calculation process is typically similar to other insurance providers. This involves an evaluation of various factors to assess the risk associated with insuring the vehicle and driver.

- Risk Assessment: USAA, and other companies, assess the risk involved in insuring the vehicle and the driver based on the factors previously discussed. This includes analyzing the driver’s driving history, the vehicle’s make, model, and year, and the location and usage of the vehicle. Sophisticated algorithms are used to determine the premium amount.

- Premium Calculation Formula (Illustrative): While the exact formula is proprietary, it often involves a weighted average of the various risk factors. For example, a poor driving record might have a higher weight in the calculation than a newer vehicle. Factors such as the vehicle’s theft risk or potential for damage are also likely included in the calculation.

- Example: A non-member with a clean driving record insuring a standard sedan in a low-risk area might pay a lower premium than a member with a history of accidents or a non-member insuring a sports car in a high-theft area.

Impact of Make, Model, and Year

The make, model, and year of a vehicle directly impact the cost of insurance. This is due to factors such as repair costs, theft rates, and safety features. Cars with high repair costs, a higher likelihood of being stolen, or fewer safety features typically have higher premiums.

Effect of Driving Record and History

A driver’s driving history is a critical component in determining insurance premiums. Accidents, violations, and claims significantly affect the cost. Drivers with clean records enjoy lower premiums. For instance, a driver with a history of accidents will pay a higher premium.

Vehicle Location and Usage

The location where the vehicle is driven and the frequency of its use influence the premium. Areas with higher accident rates and theft rates will have higher premiums. Frequent long-distance driving or commercial use will also typically result in a higher premium.

Application and Documentation Process

Applying for USAA car insurance for a non-member’s vehicle involves a slightly different process than for a member’s vehicle. This section details the steps and required documentation to ensure a smooth application. Understanding these procedures is crucial for a successful application.The application process for non-members requires careful attention to detail and accurate submission of all necessary documents. Failure to provide complete and accurate information may delay the processing of your application.

Application Steps for Non-Members

The application process for non-members typically involves several key steps. Firstly, you need to gather the required documents. Secondly, complete the application form accurately. Thirdly, submit the completed application and documents to USAA.

Required Documentation, Can i get usaa car insurance for my girlfriend’s car

This section Artikels the essential documents needed for a non-member’s application. Providing all required documentation is vital for the smooth processing of your application.

| Document Type | Description | Purpose |

|---|---|---|

| Proof of Vehicle Ownership | Valid vehicle title or registration. | Demonstrates legal ownership of the vehicle. |

| Proof of Insurance (if applicable) | Copy of current insurance policy (if any) for the vehicle. | Provides information about existing coverage, if any. |

| Driver’s License | Valid driver’s license for the primary driver. | Verifies the identity and driving history of the primary driver. |

| Vehicle Information | Details such as year, make, model, VIN, and mileage of the vehicle. | Provides accurate vehicle specifications for the insurance policy. |

| Payment Information | Bank account details for premium payments. | Facilitates the payment of insurance premiums. |

| Contact Information | Phone number, email address, and mailing address. | Ensures proper communication with USAA. |

Completing the Application Form

The application form for non-members often requires filling in personal details about the vehicle owner and the vehicle itself. Carefully review the form and ensure accuracy in all fields. This will prevent errors and expedite the application process.

- Review the form carefully: Ensure that all the information provided is accurate and complete. Double-check for any errors before submitting.

- Provide accurate vehicle information: Ensure that the year, make, model, VIN, and mileage of the vehicle are precisely documented.

- Accurate contact information: Provide the correct contact details to enable USAA to reach you for any inquiries.

- Submit all necessary documents: Make sure you have attached all the required documents listed in the previous section.

Summary of Non-Member Application Process

The application process for non-members differs slightly from that of USAA members. Crucially, you must furnish evidence of vehicle ownership, driver’s license, and vehicle details. Accurate completion of the application form and timely submission of all required documents are vital for a smooth and efficient processing. USAA’s non-member application process is designed to efficiently assess risk and provide insurance coverage.

Alternatives and Comparison

Considering USAA car insurance for your girlfriend’s vehicle is a sound choice, but exploring alternative providers can help you compare coverage and pricing. This section Artikels several options for non-members, highlighting their advantages and disadvantages, and providing a framework for evaluating the best fit for your needs.

Alternative Insurance Providers

Several reputable insurance companies offer competitive rates and coverage options. Evaluating alternatives provides a broader perspective and helps determine the most suitable plan for your girlfriend’s vehicle.

- State Farm: Known for its extensive network of agents and personalized service, State Farm provides comprehensive coverage options. A significant advantage is its wide availability and established reputation, although pricing might vary depending on factors like the vehicle’s make and model, and your girlfriend’s driving history.

- Progressive: Progressive often offers competitive rates, particularly through its online platform and usage-based programs. This can translate to lower premiums for safe drivers, but may not be as comprehensive in terms of personalized customer service as some other providers.

- Geico: Geico is recognized for its online accessibility and competitive pricing, making it a popular choice for cost-conscious drivers. It often utilizes discounts and online tools to lower premiums, but may have limitations in terms of the level of customized service or coverage options compared to some competitors.

- Allstate: Allstate provides a wide range of coverage options and often offers comprehensive protection packages. While it may have a slightly higher average premium compared to some competitors, its comprehensive approach might suit those seeking extensive protection.

Evaluation Criteria

A crucial aspect of choosing the right insurance is evaluating the available options against your specific needs. Several factors influence the decision, including the vehicle’s value, coverage requirements, and the driver’s driving record.

- Coverage Options: Compare the available coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist protection, across different providers. Assess if the offered coverage adequately addresses your financial needs.

- Pricing: Carefully analyze the premium structure for each provider, considering the different options and their associated costs. Evaluate the factors influencing premium variations, such as the vehicle’s model, usage, and driver profile.

- Customer Service: Assess the customer service reputation of each provider, considering factors like claim processing time, agent availability, and online support channels. Look for providers known for responsive and helpful customer service.

- Discounts: Inquire about available discounts for safe drivers, bundled services, and other qualifying factors to identify potential savings.

Comparative Analysis

The following table illustrates a simplified comparison of different insurance providers. Real-world pricing and coverage details can vary significantly depending on individual circumstances.

| Insurance Provider | Coverage Options (Example) | Estimated Premium (Example – per year) | Advantages | Disadvantages |

|---|---|---|---|---|

| USAA | Comprehensive liability, collision, comprehensive | $1,500 | Excellent customer service, often competitive pricing for members | Limited to USAA members |

| State Farm | Comprehensive liability, collision, comprehensive | $1,600 | Extensive network of agents, good coverage options | Pricing may vary significantly |

| Progressive | Comprehensive liability, collision, comprehensive | $1,400 | Competitive pricing, usage-based discounts | May have limited personalized service |

| Geico | Comprehensive liability, collision, comprehensive | $1,300 | Competitive pricing, online accessibility | May have limited customization |

| Allstate | Comprehensive liability, collision, comprehensive | $1,700 | Wide range of coverage options, comprehensive protection | Potentially higher premiums than competitors |

Additional Considerations

Purchasing USAA car insurance for a non-member’s vehicle involves several key considerations beyond the standard eligibility criteria. Understanding these factors will help ensure a smooth process and a suitable policy for your girlfriend’s car.A thorough evaluation of various elements, including driving history, policy terms, and claim procedures, is crucial for a well-informed decision. These aspects can significantly impact the premium and overall insurance experience.

Driving Record Implications

The girlfriend’s driving record directly affects the insurance premium. A clean record typically results in lower premiums. Conversely, a history of accidents or violations will likely increase the cost. USAA uses a comprehensive assessment of driving history, including the frequency and severity of incidents. This may involve reviewing tickets, accidents, and claims data to establish an accurate risk profile.

For instance, a driver with a history of speeding tickets might experience a higher premium compared to a driver with a spotless record.

Importance of Policy Terms and Conditions

Thoroughly reviewing the policy terms and conditions is essential. These documents Artikel the specific coverage, exclusions, and limitations. Understanding these details prevents surprises and ensures the policy aligns with your needs. For example, understanding the deductible amount and its application to claims is vital. The policy should explicitly state the conditions under which coverage applies and the specific circumstances where coverage might be denied.

Claim Procedures

Understanding the claim procedure is crucial for a smooth process in the event of an accident or damage. A clear understanding of the steps involved in filing a claim is critical. USAA provides detailed guidelines on how to file a claim, including reporting requirements, documentation needed, and the timeline for processing. This includes instructions on how to contact USAA directly, reporting the incident to the relevant authorities, and the expected response times from USAA.

Knowing these steps ensures a streamlined process.

Contacting USAA Customer Service

USAA provides various avenues for contacting customer service. Understanding these methods allows for efficient communication and resolution of questions about coverage. This includes accessing online resources, contacting customer service representatives via phone, or submitting inquiries through the USAA website. Knowing these channels is vital for addressing specific concerns or clarifying aspects of the policy. Knowing the available contact options ensures timely and efficient resolution of queries.

Outcome Summary

So, getting USAA car insurance for your girlfriend’s car isn’t a guaranteed thing. It depends on a bunch of factors. We’ve covered the eligibility requirements, options, costs, and the whole application process. Hopefully, this info has cleared up any confusion and given you a solid idea of what to expect. Now, you can make an informed decision about the best insurance for your girlfriend’s ride.

Peace out!

FAQ Corner

Can I use my own USAA policy to cover my girlfriend’s car?

Nah, USAA policies usually aren’t designed for covering other people’s vehicles unless they meet specific conditions. It’s best to check directly with USAA.

What if my girlfriend isn’t a USAA member?

That could make it a bit trickier. USAA has rules for insuring non-members, so you’ll have to check their eligibility criteria. It’s often more complex than just adding a new car.

How does USAA calculate the premium for a non-member’s vehicle?

The premium depends on several factors like the car’s make, model, and year, the driver’s history, and the location. USAA considers these things when setting the cost.

Are there any discounts available for a non-member’s vehicle?

It depends. USAA might offer some discounts based on specific factors. It’s worth checking with them directly.