Can your car get repossessed for not having insurance? This is a crucial question for anyone who owns a car, especially if they’re financing it. Understanding the laws and your rights is key to avoiding this stressful situation. The process can vary by state, so it’s vital to know the specifics.

Car repossession due to lack of insurance isn’t just a headache; it can seriously impact your credit score and financial stability. Knowing your rights and the steps to take can help you navigate this potentially challenging situation.

Introduction to Vehicle Repossession: Can Your Car Get Repossessed For Not Having Insurance

Vehicle repossession is a legal process where a lender, typically a bank or financial institution, reclaims a vehicle from the borrower due to default on loan payments. This action is often a last resort for creditors, but it is a serious consequence of failing to meet contractual obligations. Understanding the legal framework surrounding vehicle ownership and the repossession process is crucial for borrowers to avoid such a situation.The legal and contractual aspects of vehicle ownership are intricately linked to the loan agreement.

The loan agreement Artikels the terms of repayment, including the due dates and consequences of default. Failure to meet these obligations, such as missing payments, can trigger the repossession process. This process is governed by state and federal laws, which vary slightly but generally protect both the borrower’s rights and the lender’s interests.

Vehicle Repossession Process

The repossession process typically begins with a notice from the lender. This notice Artikels the specific breach of contract, the required action to remedy the situation, and the potential consequences of further default. The notice period varies by state but is usually a stipulated time frame within the loan agreement. If the borrower fails to respond or rectify the situation within the specified time, the lender may authorize a repossession agent to take possession of the vehicle.

This often involves a tow truck and a legally documented process, involving contacting the police in some instances.

Common Reasons for Vehicle Repossession

A variety of factors can lead to vehicle repossession. The following table Artikels some common reasons, including the frequently cited example of not having insurance.

| Reason | Explanation |

|---|---|

| Default on Loan Payments | The most common reason. Missed or late payments consistently trigger the repossession process, as Artikeld in the loan agreement. |

| Failure to Maintain Insurance | Many loan agreements require the borrower to maintain insurance coverage on the vehicle. Failure to do so constitutes a breach of contract and can lead to repossession. |

| Vehicle Damage or Modification | In some cases, significant damage or unauthorized modifications to the vehicle can result in repossession, as it affects the vehicle’s value or condition as collateral. |

| Violation of Loan Agreement Terms | Any violation of the loan agreement’s terms and conditions can trigger the repossession process, depending on the severity of the violation. |

| Unpaid Taxes or Liens | Outstanding taxes or liens against the vehicle can give the lender the right to repossess it. |

Insurance Requirements and Laws

Vehicle insurance isn’t just a good idea; it’s often a legal necessity. Failure to maintain adequate insurance can lead to serious consequences, including potential vehicle repossession. Understanding the nuances of insurance requirements across different jurisdictions is crucial for responsible vehicle ownership.Different states and localities have varying standards for vehicle insurance. These regulations are designed to protect drivers, passengers, and the general public.

The penalties for driving without insurance can range from hefty fines to the more severe step of vehicle repossession.

Importance of Vehicle Insurance

Maintaining vehicle insurance is paramount for safeguarding your financial well-being and protecting others on the road. Comprehensive insurance policies typically cover damage to your vehicle, liability for injuries to others, and potentially property damage. Without adequate coverage, you could be held responsible for significant financial burdens in the event of an accident or incident.

Legal Ramifications of Driving Without Insurance

Driving without insurance is a serious offense with severe consequences. These ramifications vary by jurisdiction but generally include substantial fines, penalties, and potential suspension of driving privileges. Furthermore, a driver lacking insurance may face legal action for damages incurred in an accident, including financial responsibilities.

Specific State Laws Regarding Insurance Requirements

State laws regarding vehicle insurance vary. Some states mandate minimum liability coverage, while others require comprehensive or collision coverage. Understanding the specific requirements in your jurisdiction is essential to avoid legal issues. For example, some states may have stricter requirements for young drivers or drivers with a history of accidents. It’s crucial to check your state’s Department of Motor Vehicles (DMV) website or contact them directly for the most current and precise information.

Procedures for Obtaining Proof of Insurance

Proof of insurance can be obtained in various ways. The most common method is a physical insurance card or a digital proof of insurance document provided by the insurer. Some states may also accept a copy of the insurance policy document or a confirmation from the insurance company. These documents serve as evidence of your insurance coverage.

How Insurance Companies Verify Policy Status

Insurance companies employ several methods to verify policy status. This typically involves checking databases, accessing policy information online, or contacting the policyholder directly. The verification process ensures that the driver has valid and active coverage, and this confirmation is a crucial element of the legal framework governing driving in many jurisdictions.

Comparison of Insurance Requirements Across Various States

| State | Minimum Liability Coverage | Additional Requirements |

|---|---|---|

| California | $15,000 bodily injury per person, $30,000 bodily injury per accident, $5,000 property damage | Uninsured/underinsured motorist coverage may be required. |

| Texas | $30,000 bodily injury per person, $60,000 bodily injury per accident, $25,000 property damage | Proof of insurance may be required for registration renewals. |

| New York | $25,000 bodily injury per person, $50,000 bodily injury per accident, $10,000 property damage | Specific requirements for uninsured/underinsured motorist coverage. |

Note: This table provides a simplified overview. Always consult your state’s DMV website or legal counsel for the most accurate and up-to-date information. Specific regulations and requirements can vary based on individual circumstances.

The Link Between Insurance and Repossession

Failing to maintain vehicle insurance can have severe consequences, potentially leading to the repossession of your car. This critical connection stems from the contractual obligations Artikeld in your loan agreement and the legal ramifications of driving uninsured. Understanding these links is crucial for avoiding financial hardship and the loss of your vehicle.Lack of insurance frequently triggers repossession proceedings, as it directly violates the terms of your loan agreement.

Lenders often stipulate that maintaining insurance is a condition of the loan, serving as a crucial safeguard against potential financial losses due to accidents or damages. The consequences for not adhering to this clause are typically severe, potentially leading to the swift repossession of the vehicle.

Insurance Clauses in Loan Agreements

Loan agreements typically contain specific clauses requiring the borrower to maintain comprehensive insurance coverage on the vehicle. These clauses are designed to protect the lender’s interest in the vehicle. The specific terms can vary, but they generally require the borrower to provide proof of insurance to the lender on a regular basis, often monthly or quarterly. Failure to provide proof of insurance is a breach of contract, justifying the lender’s right to repossess the vehicle.

The agreement often Artikels a clear timeframe for providing proof, after which the lender can initiate repossession procedures.

Common Scenarios of Repossession Due to Lack of Insurance

Several situations can lead to repossession due to lack of insurance. A common scenario involves a borrower failing to renew their insurance policy. Another situation arises when the borrower’s insurance policy lapses due to non-payment. In some cases, a change in ownership of the vehicle without notifying the lender, or the lender’s failure to receive proof of insurance, can also trigger repossession.

Further, an accident or damage to the vehicle, even if not the fault of the borrower, may lead to repossession if the vehicle is uninsured.

Factors Determining Repossession Likelihood

Several factors influence the likelihood of repossession for lack of insurance. The severity of the breach, whether it’s a missed payment or a complete lack of insurance, significantly impacts the lender’s decision. The lender’s internal policies and procedures also play a role. The borrower’s history with the lender, including payment history and any previous breaches of contract, can also influence the lender’s decision.

The value of the vehicle and the amount still owed on the loan also impact the lender’s willingness to pursue repossession.

Repossession Process: With and Without Insurance

The repossession process itself can vary depending on the presence of insurance. With insurance, the lender’s interest is potentially protected through insurance claims, though this may not always be sufficient to cover the loan balance. Without insurance, the lender has significantly less recourse, leading to a quicker and more direct repossession process. The lender will prioritize recovering the value of the vehicle to offset the outstanding loan amount, and in many cases, the repossession process will move swiftly to recoup losses.

Impact of Insurance Status on Repossession

| Insurance Status | Impact on Repossession |

|---|---|

| Insured | Repossession may be delayed if insurance claim covers damages; however, if the claim does not cover the loan balance, repossession may still proceed. |

| Uninsured | Repossession process is often quicker and more direct, as the lender has limited recourse for recovering losses from damage. |

Avoiding Repossession Due to Lack of Insurance

Maintaining vehicle insurance is crucial for preventing repossession. Failure to maintain coverage can lead to swift and often costly consequences, including the loss of your vehicle. Understanding proactive measures and having a plan in place can significantly mitigate these risks.

Strategies for Maintaining Insurance Coverage

Proactive measures are key to avoiding insurance lapses. Regular reminders, automated payment systems, and setting calendar alerts for renewal dates are helpful tools. Reviewing your policy annually and adjusting coverage as needed ensures your insurance aligns with your current driving needs and financial situation. Furthermore, understanding your policy’s terms and conditions, including the specific requirements for maintaining coverage, is essential.

Temporary Insurance Solutions

Temporary insurance solutions can bridge gaps during renewal periods or when a policy is canceled. Short-term policies, interim coverage, or supplemental policies offer options for maintaining vehicle protection while your regular policy is being processed or waiting for a new one to be in place. Consider contacting your current insurer or exploring other providers for these temporary solutions.

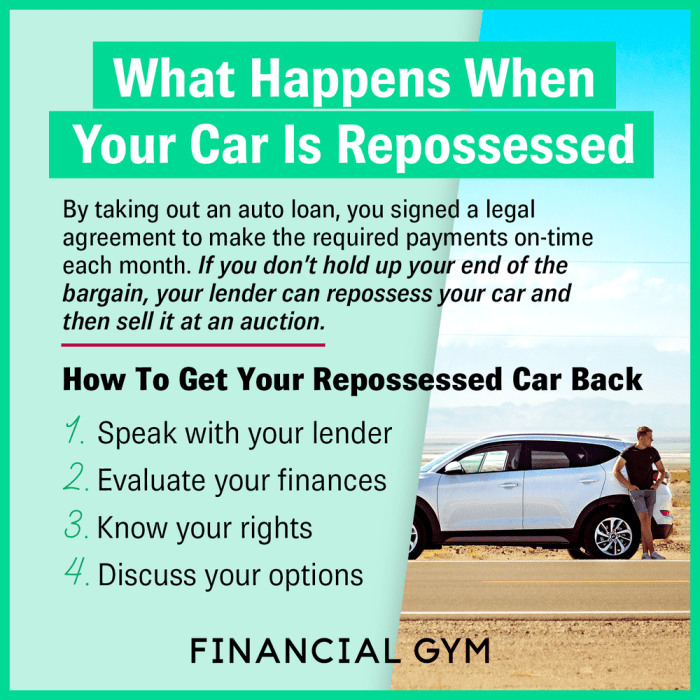

Steps to Take When Facing Potential Repossession

When facing potential repossession due to an insurance lapse, swift action is crucial. Immediately contact your insurance provider to explore options for reinstatement or a temporary solution. Negotiating with the lender or financing institution to understand their repossession policy and explore possible extensions or payment plans can be beneficial. If you have limited options, exploring alternative transportation methods can provide temporary relief and reduce stress.

Importance of Timely Insurance Renewal

Timely renewal of your vehicle insurance is critical. Setting reminders and ensuring funds are available to cover premiums prevents unexpected lapses. Proactive planning, such as budgeting for insurance premiums, can help avoid potential financial strain and disruptions to your driving habits.

Examples of Proactive Repossession Avoidance

A proactive approach involves scheduling regular insurance renewals, utilizing automatic payments, and regularly reviewing policy coverage. Individuals who have pre-authorized payments or utilize online portals for policy management are less likely to experience lapses. Maintaining a record of insurance documents, including policy details and payment confirmations, provides crucial evidence and peace of mind.

Step-by-Step Procedure for Handling Insurance Lapses, Can your car get repossessed for not having insurance

- Assess the situation: Determine the cause of the lapse, the specific requirements of your lender, and the timeline for potential repossession.

- Contact your insurance provider: Initiate a conversation to explore options for reinstatement, temporary coverage, or alternative policies.

- Communicate with your lender: Inform them of the situation and discuss possible extensions or payment plans.

- Seek alternative transportation: If possible, explore options such as using public transport, carpooling, or borrowing a vehicle.

- Review your budget: Assess your financial situation and allocate resources to ensure timely insurance payments in the future.

Cost Comparison Between Maintaining Insurance and Facing Repossession

| Factor | Maintaining Insurance | Facing Repossession |

|---|---|---|

| Insurance Premium | Ongoing monthly/annual cost | Zero, initially |

| Vehicle Value | Protected | Potentially significantly reduced due to repossession costs and potential sale price reduction. |

| Legal Fees | Nil | Potentially substantial legal fees if repossession is challenged. |

| Time and Effort | Regular policy review and payments | Significant time spent dealing with repossession procedures. |

| Financial Penalties | May involve late payment fees if not paid on time | Potentially significant penalties if not paid on time or the loan is defaulted. |

Maintaining vehicle insurance is a crucial investment that protects both your vehicle and your financial well-being.

Consequences of Vehicle Repossession

Repossession of a vehicle, often a last resort for creditors, carries significant consequences beyond the loss of the car. These consequences can ripple through a person’s financial life, impacting their creditworthiness and overall stability. Understanding these repercussions is crucial for making informed decisions about vehicle financing and insurance.

Impact on Credit History

Repossession marks a significant negative event on a borrower’s credit report. Credit bureaus record this as a late payment or default, severely impacting future borrowing opportunities. This negative mark remains on a credit report for a considerable period, often seven to ten years, potentially hindering access to loans, mortgages, and even rental applications. The severity of this impact depends on the individual’s overall credit history and the amount owed.

Financial Instability

Beyond the immediate loss of the vehicle, repossession significantly disrupts financial stability. The borrower may experience a sudden increase in financial obligations, including potential fees and court costs associated with the repossession process. This sudden financial strain can create further hardship, leading to difficulties in meeting other financial responsibilities, such as rent, utilities, and other essential expenses.

Financial Penalties Associated with Repossession

The financial penalties associated with repossession can be substantial. These include the outstanding loan balance, repossession fees, storage fees, towing fees, and, in some cases, legal fees. For example, a borrower who owes $10,000 on a vehicle might face not only the $10,000 principal but also additional fees, potentially adding thousands more to the total cost.

Steps to Mitigate Negative Impact on Credit

Taking proactive steps to address the negative impact of repossession is essential. These steps include disputing inaccurate information on credit reports, exploring options for debt consolidation or settlement, and diligently making timely payments on all other debts to show responsible financial management. Regular monitoring of credit reports is crucial for early identification of errors or inaccuracies.

Negative Effects of Repossession – A Summary

| Aspect | Negative Effect |

|---|---|

| Credit History | Significant negative mark on credit report, impacting future borrowing opportunities. |

| Financial Stability | Sudden increase in financial obligations (fees, court costs), leading to difficulties meeting other financial responsibilities. |

| Financial Penalties | Outstanding loan balance, repossession fees, storage fees, towing fees, and legal fees can be substantial. |

| Credit Score | Significant drop in credit score, potentially impacting future loan applications and credit lines. |

| Financial Burden | Increased financial burden and stress due to the added financial obligations. |

Illustrative Scenarios

Car repossession due to lack of insurance is a serious consequence that can significantly impact a person’s financial well-being and credit history. Understanding these scenarios helps to grasp the potential ramifications and proactive measures to avoid such situations. These examples highlight the importance of maintaining vehicle insurance to protect both the owner and their financial standing.

Scenario of Repossession Due to Lack of Insurance

A young professional, Sarah, recently lost her job. Unable to afford her monthly car payments and, more importantly, her insurance premiums, she allowed her insurance coverage to lapse. A few weeks later, Sarah received a notice from the lender stating that her vehicle would be repossessed due to the non-payment of the loan and the lack of insurance.

The repo company subsequently towed her vehicle from her driveway. This action highlights the critical link between vehicle insurance and loan agreements, as lenders often require insurance to protect their investment.

Scenario of Avoiding Repossession

A responsible homeowner, David, diligently manages his finances. Recognizing the importance of maintaining insurance coverage, he sets up automatic payments for his vehicle insurance. Even when facing unexpected financial challenges, he ensures his policy remains active, avoiding any lapse in coverage. This proactive approach safeguards his vehicle from repossession and maintains a positive credit history.

Impact on Credit History

A lapse in vehicle insurance coverage, leading to repossession, significantly harms credit history. Credit bureaus record such events, impacting credit scores. The negative mark can persist for several years, making it difficult to secure loans, leases, or even rental agreements in the future. This negative mark on credit history can be quite detrimental, making future financial endeavors more challenging and expensive.

Timeline of a Repossession Event

| Stage | Description |

|---|---|

| Notice of Default | The lender sends a formal notice to the borrower informing them of the breach of contract (non-payment and/or lack of insurance). |

| Grace Period | A designated timeframe is often provided for the borrower to rectify the situation. |

| Repossession | If the borrower fails to resolve the issue within the grace period, the lender authorizes a repossession agent to seize the vehicle. |

| Legal Proceedings | The legal process typically involves a court hearing to determine ownership and any outstanding balances. |

| Sale | The repossessed vehicle is often sold at an auction to recoup the lender’s losses. |

Legal Process in a Repossession Case

The legal process varies by jurisdiction, but typically involves a notice of default, a grace period, and potentially a court hearing. Lenders must follow specific legal procedures to ensure the repossession is legitimate and does not violate the borrower’s rights. Borrowers have the right to contest the repossession process in court if they believe it was not handled correctly.

This often includes reviewing the documentation, understanding the lender’s procedures, and possibly seeking legal counsel.

Additional Factors Affecting Vehicle Repossession

Beyond the fundamental requirement of insurance, several other factors can trigger a vehicle repossession. These factors often intertwine with insurance status, creating a complex web of circumstances that can lead to the loss of a vehicle. Understanding these additional influences is crucial for responsible vehicle ownership.

Role of Lenders and Dealerships

Lenders and dealerships play a critical role in the repossession process. They are often responsible for initiating the repossession procedure when loan agreements are violated. Dealerships, particularly those involved in financing, are obligated to follow established protocols and laws regarding repossession. Failure to adhere to these protocols can lead to legal repercussions.

- Loan Terms and Conditions: Loan agreements typically Artikel specific stipulations regarding insurance, payments, and maintenance. A breach of these terms, regardless of insurance status, can trigger repossession. Examples include missing payments or allowing the vehicle’s condition to deteriorate significantly, even if insurance is maintained.

- Repossession Procedures: Lenders and dealerships are required to adhere to specific legal procedures when initiating a repossession. These procedures aim to ensure fairness and due process for the vehicle owner. Failure to follow these procedures can lead to legal challenges to the repossession.

- Communication and Notice: Lenders and dealerships are usually required to provide the vehicle owner with prior notice before initiating the repossession process. This notice typically Artikels the reasons for repossession and the steps the owner can take to avoid it. This notification aspect is critical for legal compliance.

Impact of Different Loan Types on Insurance Requirements

Different types of loans have varying insurance requirements. Secured loans, for example, often mandate specific insurance coverage levels, while unsecured loans might have less stringent requirements. The specific terms and conditions of each loan will dictate the precise insurance obligations.

- Secured Loans: These loans, where the vehicle serves as collateral, usually have more demanding insurance requirements. The lender’s security interest in the vehicle often dictates a minimum level of insurance coverage, potentially even requiring collision, comprehensive, and liability insurance.

- Unsecured Loans: These loans often have less stringent insurance requirements, though lenders may still require a certain level of liability coverage. The lack of collateral typically results in less stringent requirements.

Role of Local Law Enforcement in Repossession

Local law enforcement agencies often play a supporting role in the repossession process. Their involvement is typically limited to enforcing the law and ensuring the process complies with legal standards. They don’t typically initiate the repossession but are crucial in ensuring that the process is conducted lawfully.

- Enforcement of Laws: Law enforcement officers are tasked with enforcing the legal aspects of vehicle repossession. This includes ensuring that the repossession adheres to local and state laws, preventing unlawful actions during the process.

- Verification of Legal Documents: Law enforcement might verify the legitimacy of the repossession documents presented by the repossession agent, ensuring the documents are valid and legally compliant.

Importance of Communication with Lenders and Dealerships

Maintaining open communication with lenders and dealerships is crucial in avoiding repossession. Early communication about any financial difficulties can often lead to alternative solutions that avoid the need for repossession.

- Proactive Communication: If facing financial challenges, contacting the lender or dealership promptly to discuss potential solutions is essential. This could involve negotiating payment plans or exploring options like temporary loan modifications.

- Addressing Issues Early: Addressing any issues with payments or insurance promptly can often prevent escalating situations that could lead to repossession. Proactive communication is a key preventative measure.

Wrap-Up

In short, ensuring you maintain your car insurance is paramount to protecting your vehicle and your financial well-being. Understanding the repossession process, the legal aspects, and the steps to take to avoid it is vital. This information empowers you to make informed decisions and avoid potential financial repercussions. Always consult with a legal professional for personalized advice if you’re facing a repossession threat.

Commonly Asked Questions

Can a lender repossess my car if I have a lapse in insurance, even if it’s temporary?

Yes, a lender can initiate repossession procedures if your insurance lapses, even if it’s a temporary lapse. Check your loan agreement for specific clauses.

How can I find out if my state requires proof of insurance?

Contact your state’s Department of Motor Vehicles (DMV) or equivalent agency for specific regulations regarding proof of insurance.

What are the typical steps involved in a car repossession process?

Repossession typically involves notification, attempts to contact the owner, and ultimately, towing the vehicle if necessary. The specifics vary by state and lender.

What are the financial penalties for a car repossession?

Repossession penalties include the costs of towing, storage, and legal fees. There’s also the damage to your credit score.