Car insurance for undocumented immigrants is a tricky situation. It’s a real issue, affecting many folks. Finding coverage can be tough, with varying rules across states. Some states might have policies specifically for them, but others might not. Different providers have different approaches, too.

Knowing your rights and options is key, so you can stay safe on the road.

This discussion dives deep into the legal and financial hurdles undocumented immigrants face when trying to get car insurance. We’ll explore the challenges, the available options, and the potential financial impacts. It’s a crucial topic, especially considering the legal and practical implications of driving without insurance.

Availability of Car Insurance

Navigating the world of car insurance as an undocumented immigrant can be tricky. The legal landscape varies significantly by state, and insurance providers often have different policies. This lack of consistent national rules makes it crucial to understand the nuances of the situation to find the best possible coverage.

General Legal and Regulatory Landscape

The lack of a federal law specifically addressing car insurance for undocumented immigrants means states have adopted various approaches. Some states have laws that explicitly prohibit insurers from denying coverage based on immigration status, while others have more permissive stances, allowing insurers to use immigration status as a factor in coverage decisions. This creates a complex and often unpredictable situation, requiring individuals to research the specific laws in their state.

Varying Approaches by State

State laws significantly impact the availability of car insurance for undocumented immigrants. Some states have specific laws prohibiting discrimination based on immigration status, while others may allow insurers to consider immigration status in their underwriting process. The lack of a consistent national standard makes it challenging to determine the precise rules in each jurisdiction.

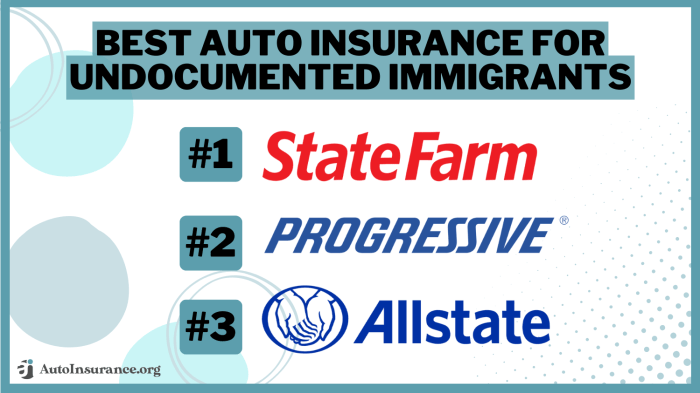

Insurance Providers and Their Approaches

Several factors influence insurance providers’ decisions on offering coverage to undocumented immigrants. The primary concern is often the risk assessment and potential financial liability if a claim is made. Insurance companies might consider the immigration status of a potential client as a factor in determining the level of risk, leading to higher premiums or denial of coverage altogether.

However, some insurers are proactively seeking to serve this demographic, offering tailored products or partnering with organizations to help navigate the complexities of the insurance process.

Reasons for Policy Availability/Unavailability

Several factors contribute to insurance companies’ decisions regarding coverage for undocumented immigrants. The lack of a national standard means that some states may have laws that prohibit insurers from considering immigration status, leading to greater availability. Conversely, other states may permit insurers to consider this factor in their underwriting process, leading to fewer options. Furthermore, insurers must consider the potential for claims and the potential financial liability, which is often dependent on the individual’s driving record and other risk factors.

Comparative Analysis of Insurance Policies by State

| State | Policy Availability | Coverage Details | Restrictions |

|---|---|---|---|

| California | Generally available, but policies might vary. | Comprehensive coverage, potentially with higher premiums. | Insurers may assess risk based on driving history and other factors. |

| Texas | Limited availability, with some providers offering coverage. | Coverage may be restricted compared to other states. | Policies might have specific clauses regarding legal status. |

| Florida | Policies may be available through specific providers. | Coverage terms may vary based on the insurer. | Potential for higher premiums due to increased risk assessment. |

| New York | Policies generally available, with some variations in terms. | Comprehensive coverage is possible. | Insurance companies might conduct thorough background checks. |

This table is a snapshot and should not be considered exhaustive. The insurance landscape is dynamic, and policies can change over time. It is crucial to contact specific providers in each state for the most up-to-date information and personalized guidance. It’s always recommended to contact an insurance broker specializing in this area for a personalized consultation.

Challenges and Barriers

Undocumented immigrants face significant hurdles in accessing essential services, and car insurance is no exception. These obstacles often stem from a lack of legal documentation, which impacts their ability to demonstrate financial responsibility and prove their identity to insurance companies. This, in turn, creates a complex and often frustrating experience in securing the necessary coverage to protect themselves and others on the road.

Navigating the legal and financial maze of obtaining car insurance is a significant challenge for this population.

Legal Obstacles to Insurance

Many insurance companies require specific documentation to assess risk and approve coverage. Undocumented immigrants frequently lack the necessary legal documents, such as driver’s licenses or state-issued identification cards. This lack of documentation creates a significant hurdle in proving their identity and eligibility for insurance. Furthermore, the legal status of the applicant can influence underwriting decisions, sometimes leading to higher premiums or outright denial of coverage.

The absence of legal residency status often limits access to standard insurance options.

Financial Barriers to Insurance

Beyond legal issues, financial limitations can also hinder access to car insurance. Undocumented immigrants may have limited access to traditional financial resources, such as credit histories, which insurance companies often use to assess risk. This lack of a credit history can lead to higher premiums or difficulties in obtaining coverage. Additionally, the financial pressures of supporting a family or navigating a complex legal status can further limit the ability to afford insurance premiums.

Existing Insurance Options and Their Limitations

Insurance options for undocumented immigrants are often limited, frequently focusing on policies that offer lower coverage or higher premiums. Many insurance companies may have specific exclusions or restrictions for this population. Limited options can lead to inadequate protection and potentially higher costs compared to coverage available to those with legal documentation. The lack of standardization and clarity in coverage terms can also create uncertainty and ambiguity for the consumer.

Potential Discrimination and Prejudice

Unfortunately, undocumented immigrants may face discrimination and prejudice when applying for car insurance. Insurance companies may have implicit biases or stereotypes that influence their decisions, leading to unfair denial of coverage or inflated premiums. These situations can be exacerbated by a lack of clear regulations and oversight in the insurance industry. It’s important to recognize that such discrimination is illegal in many instances and can be challenged through appropriate legal channels.

Importance of Understanding Challenges

Developing effective solutions to address the challenges faced by undocumented immigrants in accessing car insurance requires a deep understanding of the obstacles they encounter. This includes recognizing the legal and financial limitations, the potential for discrimination, and the complexities of existing insurance options. By acknowledging these barriers, policymakers, insurance companies, and advocates can work together to create more inclusive and equitable access to essential protections, such as car insurance.

Comparative Analysis of Challenges by State

| State | Challenge Type | Description | Potential Impact |

|---|---|---|---|

| California | Legal Obstacles | Stricter documentation requirements for driver’s licenses and proof of identity can be challenging for undocumented immigrants. | Increased difficulty in obtaining coverage, potentially leading to higher premiums or denial of coverage. |

| Texas | Financial Barriers | Limited access to traditional financial resources, like credit histories, can result in higher premiums or difficulties in securing coverage. | Significant financial burden in securing affordable coverage. |

| New York | Potential Discrimination | The possibility of implicit bias and stereotypes influencing insurance company decisions can lead to unfair treatment. | Potential for unfair premiums or denial of coverage based on perceived risk rather than actual driving record. |

| Florida | Existing Insurance Options | Limited availability of policies specifically designed for undocumented immigrants, potentially resulting in lower coverage or higher premiums. | Inability to obtain adequate coverage and potentially higher cost compared to documented residents. |

Alternative Solutions and Options: Car Insurance For Undocumented Immigrants

Getting car insurance for undocumented immigrants is a complex issue, but there are alternative solutions beyond the traditional insurance models. The current system often leaves a significant portion of the population vulnerable, with significant financial implications and safety concerns. Innovative approaches and partnerships can provide a pathway towards more equitable access.This section will explore alternative models, focusing on solutions that have shown promise in other regions and how they might be adapted for the US context.

We will also examine the crucial role of advocacy groups and nonprofits in advocating for and implementing these alternatives.

Potential Alternative Solutions

A variety of innovative solutions are emerging to address the lack of traditional insurance options for undocumented immigrants. These solutions often leverage community-based partnerships, government subsidies, and alternative insurance structures.

- Community-Based Insurance Pools: These pools utilize a shared risk approach, where individuals contribute premiums based on their driving history and vehicle type. The pool could be managed by community organizations or non-profits, potentially providing lower premiums than individual policies. This model often relies on community trust and a willingness to share information, and can provide a valuable starting point for establishing a network of support.

Such initiatives could address concerns about the lack of verifiable driving records, potentially by utilizing alternative verification methods, or through partnerships with organizations that collect this information in a secure manner. An example could be a pool specifically for migrant agricultural workers, who often operate in specific geographic areas.

- Government Subsidies and Partnerships: Governments can potentially partner with non-profits to offer subsidized insurance options. This could involve a tiered approach, with lower premiums for individuals who meet specific criteria, like those with clean driving records or low-income status. Many countries have successfully implemented government-sponsored insurance programs for specific demographics. In the US, such initiatives might be more successful through partnerships with state-level organizations, utilizing existing frameworks like those already in place for other insurance programs.

- Micro-Insurance and Peer-to-Peer Platforms: These innovative solutions leverage technology and peer-to-peer networks to create more affordable insurance options. Micro-insurance providers could offer smaller policies tailored to the specific needs of low-income individuals or immigrants, while peer-to-peer platforms could connect individuals with shared risk profiles. A key element in this model is data security and user privacy. This would require careful consideration of data protection regulations and transparency protocols.

In certain regions, this model is successful due to a large community network.

Examples from Other Countries

Many countries have addressed similar insurance challenges for marginalized communities.

- South Africa: Specific programs have been implemented to ensure access to vehicle insurance for low-income communities, often involving community-based organizations and subsidized premiums.

- Canada: Innovative models like community-based insurance programs are being explored for various vulnerable groups, addressing similar concerns about access to insurance. These models often involve partnerships with local governments and community organizations.

Feasibility and Implications in the US

Implementing these solutions in the US requires careful consideration of legal and regulatory frameworks. The existing regulatory landscape may pose obstacles, and navigating complex bureaucratic processes could prove challenging.

Role of Advocacy Groups and Non-Profits, Car insurance for undocumented immigrants

Advocacy groups and non-profits play a crucial role in advocating for and implementing these alternative solutions. Their expertise in community outreach and advocacy is essential for overcoming bureaucratic hurdles and building trust.

- Advocacy Efforts: Groups are often at the forefront of advocating for policy changes and promoting awareness of the insurance gap faced by undocumented immigrants.

- Pilot Programs: Non-profits frequently lead pilot programs to test and refine alternative models in specific communities. These initiatives can provide valuable data and insights into the practical application of innovative solutions.

Comparative Analysis of Alternative Solutions

| Solution | Description | Potential Benefits | Potential Drawbacks |

|---|---|---|---|

| Community-Based Insurance Pools | Shared risk, community-managed premiums | Lower premiums, community support | Requires trust, potential challenges with data verification |

| Government Subsidies | Government funding for insurance | Wider access, affordability | Requires policy changes, potential bureaucratic hurdles |

| Micro-Insurance and Peer-to-Peer Platforms | Technology-based solutions | Accessibility, affordability | Data security concerns, regulatory compliance |

Coverage Types and Limitations

Getting car insurance can be a nightmare, especially when you’re undocumented. Navigating the complexities of the insurance landscape, while trying to maintain your financial stability and peace of mind, is challenging enough without added obstacles. Let’s dive into the types of coverage typically offered and the limitations often encountered by this community.

Types of Coverage Offered

Insurance policies typically include liability, collision, and comprehensive coverage. Liability coverage protects you if you cause an accident and are legally responsible for damages to another person’s property or injuries to another person. Collision coverage pays for damages to your vehicle if it’s involved in an accident, regardless of who’s at fault. Comprehensive coverage, also known as “other than collision,” protects against losses from events other than collisions, like vandalism, theft, or weather damage.

Understanding the nuances of each type is crucial for making informed decisions.

Common Limitations and Exclusions

Undocumented immigrants often face significant limitations in accessing standard car insurance policies. These limitations frequently stem from the lack of legal documentation, which insurance companies often view as a risk factor. Insurance companies might impose stricter requirements, higher premiums, or outright refuse coverage. Policies for undocumented immigrants may have limitations on coverage amounts, types of vehicles, or geographic areas.

Coverage might also be limited for specific types of damage.

Specific Examples of Limited or Unavailable Coverage

Imagine a scenario where an undocumented immigrant is involved in a minor fender bender. While their liability coverage might be sufficient to cover the other driver’s damages, their collision coverage might not cover the repair costs for their vehicle. This highlights the critical need for comprehensive coverage that addresses all types of incidents. Another example is a situation where an undocumented immigrant’s car is stolen; their comprehensive coverage might not be sufficient to cover the replacement cost.

Insurance companies might exclude coverage for damage caused by certain events or circumstances. This can severely impact an individual’s financial well-being and ability to maintain their vehicle.

Impact on Daily Lives and Financial Well-being

These limitations can severely restrict the daily lives and financial well-being of undocumented immigrants. The inability to secure adequate car insurance can result in financial hardship, potential legal issues, and difficulties in navigating daily transportation needs. This can further limit their opportunities and overall quality of life. The inability to afford sufficient coverage can lead to increased risk of financial instability and even homelessness.

Table of Coverage Types and Limitations

| Coverage Type | Description | Typical Limitations for Undocumented Immigrants | Examples |

|---|---|---|---|

| Liability | Protects against financial responsibility for damages caused to others. | Potential for higher premiums, limited coverage amounts, or exclusion of specific claims. | Damage to another person’s car in an accident where the undocumented immigrant is at fault. |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | Potentially higher premiums or limitations on coverage amounts, depending on the vehicle. | Repair costs for a car damaged in an accident, even if the immigrant was not at fault. |

| Comprehensive | Covers damage to your vehicle from events other than collisions (e.g., vandalism, theft, weather). | May not cover damages caused by specific circumstances, or limited coverage amounts. | Replacement cost for a stolen car, or damage from a severe storm. |

Financial Implications

Driving without car insurance for undocumented immigrants can lead to a cascade of financial hardship. The lack of coverage creates a significant vulnerability, turning a simple accident or fender bender into a potential financial catastrophe. Understanding the potential costs and consequences is crucial for making informed decisions about transportation and safety.

Financial Costs of Accidents Without Insurance

The absence of insurance dramatically escalates the financial burden of an accident. Without coverage, the driver is responsible for all repair costs, medical expenses for those involved, and potential legal fees. This can quickly drain savings and create insurmountable debt.

Fines and Legal Actions

Driving without insurance often results in substantial fines, ranging from hundreds to thousands of dollars. Beyond the fines, there are additional legal repercussions, such as court appearances and potential license suspension or revocation. These legal actions can further complicate the financial situation. This is often compounded by the difficulty in navigating the legal system without legal representation, which can add to the financial burden.

Examples of Financial Situations and Outcomes

Imagine a scenario where an undocumented immigrant is involved in a minor fender bender. Without insurance, they might be responsible for thousands of dollars in repairs to their own car and the other vehicle. Medical expenses for injuries sustained could further deplete their resources. Even a seemingly minor incident can quickly spiral into a significant financial crisis.

Potential Financial Implications in Different Accident Scenarios

| Scenario | Financial Impact | Potential Legal Consequences |

|---|---|---|

| Minor fender bender, no injuries | Potential costs for repairs to both vehicles, which could exceed several thousand dollars. | Possible fines for driving without insurance, potential court appearance. |

| Accident resulting in moderate injuries | Significant medical expenses, potential lost wages, extensive vehicle repairs, and potential legal fees. | Higher fines, potential court appearances, and potential license suspension or revocation. |

| Serious accident resulting in serious injuries | Potentially life-altering medical expenses, significant vehicle damage, lost wages, extensive legal fees, and potential long-term care costs. | High fines, lengthy court proceedings, and possible criminal charges if negligence is determined. |

“The financial implications of driving without insurance for undocumented immigrants can be devastating, transforming a simple accident into a significant financial crisis.”

Public Awareness and Education

Ignorance is often the biggest barrier to solving problems. When it comes to car insurance for undocumented immigrants, a lack of public understanding often leads to misconceptions and, unfortunately, a lack of access to essential coverage. This needs to change. Effective public awareness campaigns can help bridge the gap between misinformation and accurate information, promoting understanding and potentially even creating more supportive environments for those seeking coverage.Raising public awareness is crucial for creating a more inclusive and equitable system.

By educating the public about the options, challenges, and solutions, we can move beyond the stereotypes and fear-mongering that often surround this issue. This will also encourage responsible behavior from those who might otherwise have negative perceptions of this demographic.

Importance of Public Awareness Campaigns

Public awareness campaigns are vital for addressing the complex issue of car insurance for undocumented immigrants. They can help dispel myths and misconceptions, leading to more informed public discourse. This increased understanding will foster a more empathetic environment, promoting a more inclusive approach to insurance access. Furthermore, public awareness campaigns can educate individuals and communities about the specific challenges undocumented immigrants face in obtaining insurance, prompting greater support and advocacy.

Target Audiences for Educational Initiatives

Effective public awareness campaigns need to target specific audiences to maximize impact. These groups include:

- Insurance Professionals: Educating insurance agents, brokers, and adjusters about the specific needs and regulations regarding undocumented immigrants can ensure that they are well-equipped to provide accurate and compassionate service. This includes providing the necessary knowledge to address any potential biases or discrimination.

- Community Leaders and Influencers: Engaging community leaders, faith leaders, and prominent figures can amplify the message and foster dialogue within their networks. This will promote empathy and understanding within the community, creating a supportive environment.

- Policymakers and Lawmakers: Providing policymakers with accurate data and insights into the challenges and potential solutions is crucial for influencing legislative changes and creating a more supportive policy environment. This includes presenting evidence of the financial and social benefits of providing access to insurance for this group.

- The General Public: This is a key audience. By engaging the general public through diverse channels like social media, community events, and educational materials, we can foster a more informed and empathetic perspective. This broad approach can combat negative stereotypes and foster a sense of shared responsibility.

Effective Strategies for Raising Awareness

Several strategies can be employed to effectively raise awareness and promote understanding:

- Interactive Workshops and Seminars: Hosting interactive workshops and seminars for various audiences, especially insurance professionals and community leaders, can facilitate dialogue and provide practical information.

- Social Media Campaigns: Leveraging social media platforms to disseminate information, share personal stories, and engage in conversations can reach a vast audience quickly and effectively.

- Community Events and Outreach Programs: Organizing community events and outreach programs in diverse neighborhoods can help build trust and encourage participation.

- Partnership with Community Organizations: Collaborating with community organizations and advocacy groups that work with immigrant populations can ensure that information reaches the target audience effectively.

Educational Plan Artikel

A comprehensive public awareness plan should incorporate various strategies, including:

- Phase 1: Research and Assessment: Conducting thorough research to understand the existing knowledge, misconceptions, and concerns within the target audiences.

- Phase 2: Development of Educational Materials: Creating a variety of educational materials (e.g., brochures, pamphlets, videos) to cater to different learning styles and demographics.

- Phase 3: Dissemination of Information: Using a multi-channel approach, including social media, community events, partnerships with organizations, and presentations to policymakers.

- Phase 4: Monitoring and Evaluation: Tracking the impact of the campaign by gathering feedback, measuring participation, and adjusting the strategy based on results.

Epilogue

In short, navigating car insurance as an undocumented immigrant is a complex issue with no easy answers. While access to coverage varies significantly by state, and some providers might offer special policies, challenges often arise due to legal restrictions and potential discrimination. Exploring alternative solutions and advocating for better access are vital. This discussion highlights the importance of understanding these complexities and working towards more inclusive solutions for this vulnerable population.

Clarifying Questions

Q: Can undocumented immigrants get car insurance in any state?

A: No, unfortunately, not everywhere. Laws and policies vary significantly from state to state. Some states might have specific policies or programs to assist undocumented immigrants, while others might have stricter rules. Researching your specific state is key.

Q: What are the common reasons insurance companies might deny coverage to undocumented immigrants?

A: Insurance companies sometimes cite legal restrictions and difficulties in verifying immigration status as reasons for denying coverage. This often creates a major barrier to obtaining insurance. The process can also be more time-consuming and complex compared to citizens’ applications.

Q: Are there any alternative insurance options for undocumented immigrants?

A: Yes, there are some alternative solutions. These may involve community-based programs, advocacy groups, or innovative insurance models. There might be non-profit organizations or government initiatives designed to help fill the gap.

Q: What are the financial implications of driving without insurance as an undocumented immigrant?

A: Driving without insurance exposes you to hefty fines, potential legal action, and financial liability in case of an accident. This can significantly impact your finances and create a lot of stress. It’s essential to have coverage for peace of mind.