Cheap car insurance Tyler TX is a critical need for drivers in the area. Tyler, TX, like many areas, presents a dynamic landscape of insurance providers, each vying for your attention with varying policies and rates. Finding the best bargain requires a savvy approach to comparison and understanding the factors that influence your premiums.

This comprehensive guide dives deep into the world of cheap car insurance in Tyler, TX. From comparing providers to understanding coverage options and negotiating rates, we’ll equip you with the tools and knowledge to navigate this complex market effectively. Prepare to unlock the secrets to securing affordable and comprehensive car insurance coverage.

Introduction to Cheap Car Insurance in Tyler, TX

The car insurance market in Tyler, Texas, like many other areas, is influenced by a variety of factors. Understanding these factors is crucial for securing affordable coverage while maintaining adequate protection. Competition among insurance providers plays a role, but specific local conditions, such as traffic patterns and accident rates, significantly affect premium costs.Factors such as driving history, vehicle type, and personal details are considered when evaluating potential policyholders.

Insurance companies aim to balance affordability with the need to provide financial protection in the event of an accident or damage to a vehicle. Finding “cheap” car insurance involves a delicate balancing act between cost and comprehensive coverage. Simply choosing the lowest price may not guarantee adequate protection.

Factors Affecting Car Insurance Rates in Tyler, TX

Several key factors contribute to the cost of car insurance in Tyler, Texas. These include the insured’s driving record, which reflects the likelihood of accidents. A clean driving record typically leads to lower premiums. Vehicle type also plays a role; higher-performance vehicles and older models, often with higher repair costs, generally command higher premiums. Additionally, the insured’s age, location within Tyler, and personal details, such as credit history, can influence rates.

Insurance companies use statistical models to assess risk based on these factors.

The Concept of “Cheap” Car Insurance

The term “cheap” car insurance is relative. It is crucial to recognize that lower premiums often come with reduced coverage. “Cheap” insurance may mean sacrificing liability coverage or comprehensive and collision coverage. For example, a policy with minimal liability coverage might appear inexpensive, but it could leave the policyholder vulnerable in the event of a significant accident.

Carefully evaluating coverage options is paramount. A policy that seems inexpensive initially could result in substantial out-of-pocket expenses if an accident occurs.

Comparing Car Insurance Quotes

Comparing quotes from multiple insurance providers is essential to finding the best value for coverage. Each company employs different rating models and factors, resulting in varied premiums for the same coverage. A comprehensive comparison is crucial to ensuring that the selected policy adequately meets the insured’s needs without unnecessary expense. By comparing quotes, policyholders can potentially save money while maintaining adequate protection.

Types of Car Insurance Policies

Understanding the different types of car insurance policies is vital for making informed decisions. This includes liability, comprehensive, and collision coverage.

| Policy Type | Description | Example |

|---|---|---|

| Liability | Covers damages or injuries to others in an accident where the policyholder is at fault. | Pays for another driver’s medical bills or vehicle repair if you cause an accident. |

| Comprehensive | Covers damages to the insured vehicle from events other than collisions, such as vandalism, theft, or weather-related damage. | Pays for damage to your vehicle if it is stolen. |

| Collision | Covers damages to the insured vehicle resulting from a collision, regardless of who is at fault. | Pays for your vehicle’s repair if you collide with another car, even if you are not at fault. |

Identifying Insurance Providers in Tyler, TX: Cheap Car Insurance Tyler Tx

Securing affordable car insurance in Tyler, TX, requires a comprehensive understanding of available providers and their offerings. This section details major insurance companies active in the region, their diverse insurance products, and methods for contacting local agents. A comparative analysis of provider reputations and average premium rates is also presented, allowing informed decision-making for prospective policyholders.

Major Insurance Providers in Tyler, TX

Several prominent insurance companies operate within Tyler, TX, each with a varying range of services and policy options. This includes both nationally recognized brands and locally established providers.

- State Farm

- Progressive

- Geico

- Allstate

- Farmers Insurance

- Liberty Mutual

- American Family Insurance

Insurance Products Offered by Major Providers

The insurance products offered by each company vary in scope. This includes coverage for different vehicle types, driving histories, and risk profiles.

| Insurance Provider | Types of Insurance Products |

|---|---|

| State Farm | Auto, Homeowners, Life, Business, and other supplemental products. |

| Progressive | Auto, Homeowners, and supplemental products tailored to specific needs. |

| Geico | Auto, renters, and supplemental products often featuring online/digital tools. |

| Allstate | Auto, Homeowners, Life, and other products often targeting broader consumer needs. |

| Farmers Insurance | Auto, Homeowners, and supplemental products often offering customized coverage. |

| Liberty Mutual | Auto, Homeowners, and business insurance products. |

| American Family Insurance | Auto, Homeowners, and supplemental products frequently offering value-added services. |

Locating Local Agents

Directly contacting local agents is crucial for personalized advice and policy tailoring. Each provider maintains a network of agents within the Tyler, TX area.

- Online Search: Use search engines to find local agents for each provider. Include the specific provider’s name and the region (e.g., “State Farm agents Tyler, TX”).

- Provider Websites: Most insurance companies have dedicated sections on their websites listing local agents and contact information.

- Referrals: Ask for referrals from trusted sources in the Tyler community for recommendations.

Provider Reputation and Customer Service

Reputation and customer service vary across different providers. Factors to consider include responsiveness to claims, handling of disputes, and overall customer satisfaction ratings.

Note: Customer satisfaction ratings and reputation data can be obtained through independent review platforms and online surveys.

Average Premium Rates

Average premium rates fluctuate based on factors like the insured vehicle’s age, model, and driver profile. Comparative pricing for each provider can be found through online quote comparison tools and agent consultations.

| Insurance Provider | Average Premium Rate (Estimated) |

|---|---|

| State Farm | $1,500-$2,000 annually (estimated) |

| Progressive | $1,200-$1,800 annually (estimated) |

| Geico | $1,000-$1,600 annually (estimated) |

| Allstate | $1,300-$1,900 annually (estimated) |

| Farmers Insurance | $1,400-$2,000 annually (estimated) |

| Liberty Mutual | $1,350-$1,950 annually (estimated) |

| American Family Insurance | $1,250-$1,850 annually (estimated) |

Factors Affecting Car Insurance Premiums in Tyler, TX

Car insurance premiums in Tyler, TX, like in other regions, are influenced by a variety of factors beyond the basic coverage selected. Understanding these elements is crucial for consumers seeking to secure affordable and adequate protection for their vehicles. Premiums are not static and can fluctuate based on these variables.

Driving Record Impact on Premiums

A driver’s history significantly impacts car insurance costs. A history of accidents or violations demonstrates a higher risk profile to insurers. This elevated risk translates to higher premiums. Insurance companies assess the frequency and severity of past incidents to determine the likelihood of future claims.

- Accident history: A driver with a history of accidents, regardless of fault, will typically pay higher premiums. The severity of the accidents, as well as the frequency, plays a significant role in the premium calculation. For example, a driver with two minor fender benders might pay slightly higher premiums than a driver with one major accident.

- Traffic violations: Traffic violations, including speeding tickets, reckless driving, and other moving violations, also increase insurance premiums. The type and severity of the violation directly impact the premium adjustment. A speeding ticket, for instance, will have a different impact than a DUI conviction.

Vehicle Type and Value Impact on Premiums

The type and value of the vehicle are key determinants in insurance pricing. Insurers assess the potential loss associated with different vehicle types and values, factoring in their vulnerability to damage or theft.

- Vehicle type: High-performance sports cars, luxury vehicles, and motorcycles often have higher premiums than standard sedans or trucks. This is because these vehicles are generally more expensive to repair or replace in the event of an accident. Sports cars, for example, may have unique parts that are costly to repair.

- Vehicle value: The higher the value of the vehicle, the higher the potential payout in the event of a total loss. Consequently, the premium will be higher. A classic car, for instance, will likely have a higher premium than a comparable everyday vehicle.

Driver Age and Gender Impact on Premiums

Insurance companies consider driver age and gender when calculating premiums. These factors are correlated with driving habits and accident rates. Younger drivers, particularly those in their teens and early twenties, are statistically more prone to accidents, which translates to higher premiums.

- Driver age: Younger drivers, due to inexperience and risk-taking behaviors, have a higher probability of accidents and claims. This directly influences the premium calculation, making them pay significantly higher premiums. Older drivers, conversely, tend to have a lower risk profile.

- Driver gender: While the difference is often minimal, in some areas, there might be a slight variation in premiums based on gender. These differences are often subtle and may not be statistically significant.

Insurance Rates for Different Coverage Levels

Different coverage levels influence premiums. Comprehensive and collision coverage, for instance, are more expensive than liability-only coverage. The more comprehensive the coverage, the higher the premium.

- Coverage levels: Coverage levels, including liability, collision, and comprehensive coverage, directly affect the premiums. Higher levels of coverage, providing broader protection, lead to higher premiums. Liability-only coverage is typically the most affordable, but it offers the least protection in case of accidents or damage.

Data on Insurance Costs for Different Vehicle Types

The table below provides an illustrative comparison of estimated insurance costs for various vehicle types. Note that these are estimates and actual premiums may vary based on individual factors.

| Vehicle Type | Estimated Premium (Illustrative) |

|---|---|

| Sedan | $1,200-$1,800 per year |

| SUV | $1,400-$2,000 per year |

| Sports Car | $1,800-$2,500 per year |

| Pickup Truck | $1,500-$2,200 per year |

Strategies for Finding Affordable Insurance

Securing affordable car insurance in Tyler, TX, requires proactive research and strategic comparison. Understanding the available methods and utilizing various tools are crucial for obtaining the most competitive rates. A systematic approach, combining online resources with direct engagement with providers, maximizes the likelihood of finding suitable coverage at a favorable price.

Utilizing Online Comparison Tools

Online comparison tools represent a highly effective method for evaluating insurance options. These platforms compile quotes from multiple insurance providers, streamlining the process of finding competitive rates. Users input their vehicle information, driving history, and desired coverage to receive customized quotes. This approach significantly reduces the time and effort required to compare diverse insurance options. By presenting a comprehensive overview of available policies, these tools empower consumers to make informed decisions.

Benefits of Bundling Insurance Policies

Bundling insurance policies, such as combining car insurance with homeowners or renters insurance, can often yield significant savings. Insurance providers frequently offer discounts for customers who consolidate their insurance needs under a single provider. This practice reduces administrative costs and streamlines claims processing, ultimately leading to reduced premiums for the customer. Such bundling can be highly advantageous in terms of both cost and administrative efficiency.

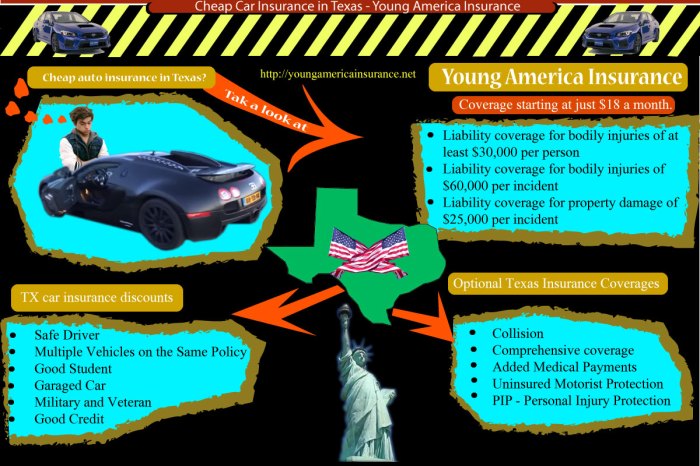

Impact of Discounts on Rates

Various discounts can significantly reduce car insurance premiums. Multi-car discounts, applicable when multiple vehicles are insured under the same policy, are common. Similarly, discounts are often available for safe driving habits, good student status, or anti-theft devices installed on the vehicle. These discounts can substantially impact the overall cost of insurance. For example, a customer with a clean driving record and multiple vehicles insured with the same provider could realize substantial savings.

Negotiating Insurance Rates with Providers

Direct communication with insurance providers can potentially lead to further reductions in premiums. Consumers should be prepared to discuss their driving history, any safety features installed on their vehicle, and desired coverage options. Demonstrating a clear understanding of their needs and actively seeking better rates can be beneficial. Presenting evidence of safe driving habits or additional security measures may strengthen the case for a rate reduction.

This approach should be conducted with professionalism and courtesy.

Available Discounts from Insurance Providers

| Insurance Provider | Multi-Car Discount | Good Student Discount | Safe Driving Discount | Anti-theft Device Discount |

|---|---|---|---|---|

| Progressive | Yes (up to 15%) | Yes (5-10%) | Yes (up to 10%) | Yes (up to 5%) |

| State Farm | Yes (up to 10%) | Yes (5-10%) | Yes (up to 15%) | Yes (up to 5%) |

| Allstate | Yes (up to 10%) | Yes (5-10%) | Yes (up to 10%) | Yes (up to 5%) |

| Geico | Yes (up to 15%) | Yes (5-10%) | Yes (up to 15%) | Yes (up to 5%) |

Note: Discounts may vary depending on individual circumstances and policy details. Contact providers directly for specific details and eligibility.

Understanding Coverage Options in Tyler, TX

Choosing the right car insurance coverage is crucial for protecting your financial well-being and ensuring legal compliance. Understanding the various options available and their implications is essential for making informed decisions. This section details the different types of coverage, their importance, and the cost-effectiveness of varying levels, ultimately helping you select the most appropriate protection for your needs.

Types of Car Insurance Coverage, Cheap car insurance tyler tx

Different coverage options address various potential risks associated with car ownership. Liability coverage protects you if you are at fault in an accident and cause damage to another person’s vehicle or injuries. Collision coverage pays for damage to your vehicle regardless of who is at fault, while comprehensive coverage addresses damages from events other than collisions, such as theft, vandalism, or weather-related damage.

Importance of Understanding Policy Exclusions

Insurance policies often contain exclusions that limit coverage. Understanding these exclusions is vital to avoid unpleasant surprises. For example, a policy might exclude coverage for damage caused by pre-existing conditions on the vehicle or damage arising from specific activities like racing or using the vehicle for commercial purposes. Carefully reviewing the policy wording and seeking clarification on any ambiguities is critical to prevent disputes.

Cost-Effectiveness of Different Coverage Levels

The cost of car insurance varies depending on the coverage levels selected. A policy with minimal coverage will generally be more affordable than one with extensive coverage. However, inadequate coverage can leave you financially vulnerable in the event of an accident or other damage. A balance must be struck between affordability and adequate protection.

Coverage Levels Typically Required by Law

State laws mandate minimum coverage levels for car insurance. In Tyler, TX, these minimum requirements typically include liability coverage, which protects others in the event of an accident where you are at fault. Exceeding the minimum coverage can enhance your protection.

Table Outlining Coverage Types and Cost Implications

| Coverage Type | Description | Typical Cost Implications |

|---|---|---|

| Liability | Covers damage to another person’s property or injuries caused by your vehicle when at fault. | Generally the lowest cost option, but may not cover all damages. |

| Collision | Covers damage to your vehicle regardless of who is at fault in an accident. | Higher cost than liability, but provides complete protection for your vehicle. |

| Comprehensive | Covers damage to your vehicle from events other than collisions, such as theft, vandalism, or weather damage. | Usually higher than collision coverage, but provides broader protection. |

| Uninsured/Underinsured Motorist | Covers damages if you are involved in an accident with a driver who has no insurance or insufficient coverage. | Adds a significant cost, but protects you in critical situations. |

Tips for Maintaining Affordable Insurance

Sustaining low car insurance premiums requires proactive measures beyond simply selecting a provider. Consistent adherence to safe driving practices, responsible vehicle maintenance, and smart risk mitigation strategies are crucial components of long-term affordability. These measures demonstrate responsible ownership and contribute to a reduced likelihood of accidents and claims, ultimately lowering insurance costs.Maintaining a favorable insurance profile is a continuous process that involves understanding and implementing various strategies.

A good driving record, coupled with proactive vehicle maintenance and sound risk management, creates a positive feedback loop for insurance premiums.

Strategies for Reducing Premiums

Effective strategies for reducing car insurance premiums hinge on demonstrating responsible ownership and safe driving habits. This proactive approach reduces the likelihood of accidents and claims, directly influencing premium costs. By minimizing risks, policyholders can achieve lower premiums.

- Maintaining a Good Driving Record: A clean driving record is paramount. Accidents, moving violations, and even speeding tickets can significantly impact premiums. Avoiding these infractions is crucial for preserving a favorable insurance profile.

- Practicing Safe Driving Habits: Safe driving practices are essential for reducing accident risk. These habits include adhering to speed limits, avoiding distracted driving, maintaining safe following distances, and being attentive to road conditions. Safe driving not only lowers the chance of accidents but also demonstrates responsible behavior to insurance companies.

- Implementing Vehicle Security Measures: Anti-theft measures, such as installing an alarm system, using a steering wheel lock, or parking in well-lit areas, reduce the risk of vehicle theft. This proactive measure directly contributes to a lower insurance premium.

- Prioritizing Regular Vehicle Maintenance: Regular maintenance, including oil changes, tire rotations, and brake inspections, extends the vehicle’s lifespan and reduces the likelihood of mechanical failures. Proper maintenance also helps prevent accidents caused by malfunctions, further contributing to a favorable insurance profile.

Impact of Tips on Premiums

Implementing these strategies can yield significant savings in car insurance premiums. A clean driving record, combined with safe driving practices and proactive vehicle maintenance, demonstrates responsible ownership, reducing the risk of claims. Insurance companies often reward this responsible behavior with lower premiums.

| Tip | Impact on Premiums |

|---|---|

| Maintaining a good driving record | Lower premiums due to reduced accident risk and fewer claims. |

| Practicing safe driving habits | Lower premiums by decreasing the likelihood of accidents. |

| Implementing vehicle security measures | Lower premiums due to a reduced risk of theft and damage. |

| Prioritizing regular vehicle maintenance | Lower premiums through reduced risk of mechanical failures and accidents. |

Resources for Further Information

Accessing comprehensive information is crucial for making informed decisions regarding car insurance in Tyler, TX. This section details reliable resources for consumers seeking additional guidance and support. Understanding the available options and potential costs is vital for securing suitable coverage at a competitive price.Thorough research empowers consumers to compare various insurance providers and tailor their policies to their specific needs.

Navigating the complexities of insurance can be simplified with readily available resources, ensuring a more transparent and effective process.

Reputable Websites for Car Insurance Information

Numerous websites offer valuable information on car insurance, including details on providers, coverage options, and rates. These resources can help consumers compare policies and identify potential savings. Utilizing reputable websites can provide objective information to assist in making well-informed choices.

- The Texas Department of Insurance website provides detailed information on insurance companies operating in the state. This includes consumer protection information and resources.

- Independent comparison websites allow users to input their vehicle information and driving history to receive quotes from multiple insurers. This helps in identifying potential cost savings.

- The National Association of Insurance Commissioners (NAIC) offers comprehensive resources and information on insurance practices across the United States. These resources are often helpful for understanding general insurance concepts.

Consumer Protection Agencies

Several agencies are dedicated to consumer protection in the insurance industry. These agencies provide crucial support for individuals facing issues or seeking guidance. Contacting these agencies can resolve disputes or answer questions about policies.

- The Texas Department of Insurance (TDI) acts as a primary resource for consumers, addressing complaints and offering assistance in insurance-related disputes. They offer a variety of resources for consumers seeking guidance and information.

- The Better Business Bureau (BBB) can provide insights into the reputations and practices of insurance companies in the area. The BBB provides an independent perspective on consumer reviews and business practices.

Local Consumer Guides on Insurance

Local consumer guides can provide valuable insights into car insurance providers and policies within the Tyler, TX area. These guides can highlight local insurance companies and their offerings.

- Newspapers and local publications often feature articles or segments about insurance, providing insights into current trends and policies. This can be useful for staying up-to-date on the market.

- Consumer protection organizations within the Tyler, TX community may offer guides or workshops related to car insurance. These resources can help consumers understand their rights and responsibilities.

Contacting the Texas Department of Insurance

The Texas Department of Insurance (TDI) is a vital resource for addressing insurance-related concerns. The TDI offers guidance and assistance to consumers.

- The TDI maintains a dedicated website with contact information, including email addresses and phone numbers. This enables direct communication with TDI representatives.

- Consumers can utilize the TDI’s online complaint system to file formal complaints about insurance companies or policies. This process helps in addressing concerns and resolving disputes.

Resources for Comparing Insurance Quotes

Comparing insurance quotes is essential for finding affordable coverage. Utilizing comparison tools can help consumers identify cost-effective options.

- Independent comparison websites often provide a user-friendly interface for inputting information and receiving quotes from various insurers. This allows consumers to efficiently compare rates and coverage options.

- Online comparison tools allow consumers to input their vehicle details, driving history, and desired coverage options to obtain tailored quotes from different providers. This helps to identify potential cost savings.

Conclusive Thoughts

In conclusion, securing cheap car insurance in Tyler, TX, is achievable with careful research and proactive steps. By understanding the market dynamics, comparing policies, and negotiating rates, you can unlock the best possible deal. This guide has provided the essential tools to help you navigate the world of auto insurance in Tyler, TX and make informed decisions. Remember, a thorough understanding of your coverage options is paramount to protecting your assets.

Frequently Asked Questions

What are the most common factors that affect car insurance rates in Tyler, TX?

Factors like your driving record (accidents, violations), vehicle type and value, driver age and gender, and coverage level all influence your premium. Even your location within Tyler, TX, might play a subtle role.

How can I find local agents for specific insurance providers in Tyler, TX?

Online searches, contacting the providers directly, or checking local directories are effective ways to locate local agents.

What discounts are typically available for car insurance in Tyler, TX?

Common discounts include multi-car discounts, good student discounts, and safe driver discounts. Many providers offer additional discounts based on factors such as anti-theft devices or vehicle maintenance records.

What are the typical coverage levels required by law in Tyler, TX?

Texas law mandates minimum liability coverage. However, additional coverages like comprehensive and collision are highly recommended for comprehensive protection.