Cheap car insurance Tyler TX is crucial for budget-conscious drivers in the area. Navigating the competitive insurance market requires careful research and understanding of local factors. This comprehensive guide will help you find the best rates and coverage tailored to your needs.

Tyler, TX’s car insurance landscape presents a blend of competitive providers and specific factors influencing rates. Understanding these elements is key to securing affordable coverage.

Overview of Cheap Car Insurance in Tyler, TX

Yo, Tyler, TX, is where the game is on for cheap car insurance! It’s a pretty competitive market, so you gotta know the plays to score a sweet deal. Different companies are droppin’ different prices, and factors like your driving record and the type of ride you roll in are huge game changers.Getting the right coverage is key, fam.

You need to understand the different options to make sure you’re protected. This guide breaks down the basics to help you navigate the insurance jungle.

Factors Affecting Car Insurance Rates in Tyler, TX

Tyler’s car insurance rates aren’t just randomly thrown together. They’re based on several key factors that impact the cost. Your personal situation plays a major role, like your age, driving history, and even where you live in the city.

- Demographics: Age, location within Tyler, and driving history significantly influence rates. Younger drivers, for example, often face higher premiums due to statistically higher accident rates. Similarly, certain neighborhoods might have a higher concentration of accidents, leading to increased costs for residents in those areas.

- Accident History: If you’ve had fender-benders or major accidents in the past, your insurance premiums will likely be higher. Insurance companies look at your past driving record to assess your risk as a driver.

- Vehicle Type: The type of car you drive can also affect your insurance costs. High-performance sports cars or luxury vehicles tend to have higher premiums compared to more standard models. This is because these cars are often involved in more expensive repairs or accidents, which increases the risk for the insurance company.

Types of Car Insurance Available in Tyler, TX

Tyler offers a range of insurance options to fit different needs. You gotta choose the coverage that’s right for your situation.

- Liability Insurance: This is the minimum coverage required by law. It protects you if you’re at fault in an accident and cause damage to someone else’s property or injuries. It doesn’t cover your own damages.

- Collision Insurance: This coverage kicks in if your car gets damaged in an accident, regardless of who’s at fault. It pays for repairs or replacement of your vehicle.

- Comprehensive Insurance: This protects your car from things besides accidents, like vandalism, theft, fire, or weather damage. It covers your vehicle even if you’re not involved in a collision.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re in an accident with someone who doesn’t have insurance or doesn’t have enough coverage to cover the damages. It’s a must-have in Tyler, as it provides additional financial protection.

Comparison of Insurance Providers in Tyler, TX

Here’s a quick look at some insurance companies operating in Tyler, TX. This table provides examples and isn’t an exhaustive list.

| Insurance Provider | Coverage Options | Pricing (Example) | Customer Reviews (Example) |

|---|---|---|---|

| State Farm | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | $1500-$2500 per year (depending on driver profile) | Generally positive, but some reports of long wait times for claims |

| Progressive | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | $1200-$2000 per year (depending on driver profile) | Mostly positive reviews, noted for online tools and ease of claim process |

| Geico | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | $1300-$2200 per year (depending on driver profile) | Good customer service scores, but some complaints about lack of personalized service |

| Allstate | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | $1400-$2400 per year (depending on driver profile) | Mixed reviews, some positive experiences with claims, others mention high premiums |

Factors Affecting Car Insurance Costs in Tyler, TX

Yo, peeps! Car insurance in Tyler, TX, ain’t no joke. It’s a whole game, and knowing the rules is key to getting a sweet deal. From your driving history to your ride’s specs, tons of factors play a role in how much you pay. Let’s break it down, so you can score the cheapest rate possible.Understanding these factors lets you make smart choices to get the best deal on insurance.

It’s like shopping for the freshest kicks – you want the best value for your buck.

Driving Record

Your driving history is a major factor. Tickets, accidents, and even speeding—it all adds up. A clean slate means lower rates. Think of it like a credit score for your driving. A good record keeps your premiums low.

A record littered with violations, and you’re looking at a steeper price tag.

Vehicle Type

The type of car you drive matters. High-performance sports cars or expensive luxury models usually cost more to insure. That’s because they’re more likely to be damaged or stolen. Think of it like this: a classic muscle car, or a super-charged sports car, attracts more attention, which makes it a more tempting target for thieves. Insurance companies factor in the likelihood of damage or theft when setting your rates.

So, a basic sedan or a reliable compact will often get you a better deal.

Location

Where you live in Tyler, TX, can also impact your rates. Certain areas might have a higher incidence of accidents or theft, so insurance premiums could be higher in those spots. Think about it like this: a high-traffic area, or an area with more reported crimes, will likely have higher rates compared to a quieter neighborhood.

Average Rates in Tyler, TX vs. Other Texas Cities

Comparing Tyler, TX’s average rates to other Texas cities can be tricky. No single, definitive answer exists. It depends on a ton of factors, like the specific vehicles, driver profiles, and coverage choices. However, Tyler’s rates usually fall somewhere in the middle compared to other Texas cities. Generally, bigger metropolitan areas often have higher rates than smaller towns.

Doing some research on local insurance agencies in Tyler and neighboring cities can help you compare rates and find the best deal.

Discounts and Promotions

Discounts and promotions are your secret weapons for lower premiums. A whole bunch of discounts are out there. Taking advantage of these savings can make a big difference in your monthly payments. Think of it like this: an insurance company will reward safe drivers, or drivers who take safety courses, with discounts.

Available Discounts in Tyler, TX

| Discount Type | Description | Eligibility Criteria | Estimated Savings |

|---|---|---|---|

| Safe Driver Discount | For drivers with a clean driving record. | No accidents or violations within a specific period. | 10-20% |

| Defensive Driving Course Discount | Completing a defensive driving course. | Proof of completion of a course. | 5-15% |

| Multi-Policy Discount | Bundling multiple policies (e.g., home and auto). | Insuring multiple vehicles or policies with the same company. | 5-10% |

| Good Student Discount | For students with a good academic record. | Proof of enrollment and good grades. | 5-10% |

| Anti-theft Device Discount | Installing anti-theft devices on your vehicle. | Proof of installation of approved anti-theft devices. | 5-10% |

Tips for Finding Affordable Car Insurance in Tyler, TX: Cheap Car Insurance Tyler Tx

Yo, homies, tryna save some coin on car insurance in Tyler? It’s a total grind, but we’ll break it down so you can get the best deal. Insurance ain’t cheap, but we can make it less of a pain in the neck.Finding the right car insurance in Tyler, TX, is like hunting for the perfect deal at the mall – you gotta shop around and compare prices.

Different companies have different rates, so you gotta do your homework. It’s all about getting the best possible deal for your situation.

Comparing Car Insurance Quotes

Comparing quotes from various insurance providers is key to getting the lowest possible rate. This process lets you see what different companies offer and choose the one that fits your needs and budget. It’s a crucial step in securing the best possible coverage.

- Check multiple insurers: Don’t just rely on one company. Reach out to at least three or four different providers to see their quotes. You’ll get a clearer picture of the market rate and identify the best value.

- Use online comparison tools: Websites dedicated to comparing insurance quotes can save you a ton of time. They gather rates from various providers, so you can easily see side-by-side comparisons. It’s like having a super-powered comparison shopper.

- Request personalized quotes: Don’t be afraid to ask for customized quotes. You can tailor the coverage and deductibles to your specific needs and situation. A personalized quote ensures that you’re getting the exact coverage you need.

Finding the Best Deals

Getting the best deal on car insurance is like finding a hidden gem – it takes a little digging and strategy. Look for discounts, explore bundle options, and consider raising your deductibles if you can afford it.

- Look for discounts: Many companies offer discounts for good drivers, safe driving habits, and even for owning a certain type of car. Check with each provider to see if you qualify for any discounts. They’re often hidden gems, so it pays to ask!

- Consider bundling: Bundling your car insurance with other policies, like home insurance, often leads to significant savings. It’s like getting a group discount, and it can save you a pretty penny.

- Shop around at different times: Insurance rates can fluctuate, so don’t be afraid to check rates at different times of the year. It’s like checking the stock market – timing matters!

Using Online Tools and Resources

Online tools and resources are your best friends when it comes to comparing car insurance quotes. They provide easy access to multiple providers and streamline the process. It’s like having a digital shopping mall right at your fingertips.

- Use online comparison websites: These sites aggregate quotes from various insurance companies, making it super easy to compare. They’re like a one-stop shop for finding the best deals.

- Use company websites directly: Many insurance companies have their own websites where you can get personalized quotes. It’s like going straight to the source for the best deals.

- Read reviews and compare customer experiences: Reading reviews can help you understand how different companies handle claims and customer service. This can help you make an informed decision.

Bundling Insurance Policies

Bundling your car insurance with other policies, like home or renters insurance, can often lead to significant savings. It’s like getting a group discount for your insurance needs.

- Combine car, home, and renters insurance: This is a popular strategy that can reduce your overall insurance costs. It’s like having a team discount for all your insurance needs.

Reputable Car Insurance Companies in Tyler, TX

Finding a reputable company is important to ensure you’re getting the best coverage at a fair price. These companies have a proven track record of providing quality service.

- State Farm: A widely recognized and respected insurance provider.

- Progressive: A well-known company with a history of competitive rates.

- Geico: Another major player in the insurance market, known for their wide range of coverage options.

- Allstate: A comprehensive insurance company with a good reputation.

- Nationwide: A dependable insurance provider with various discounts and options.

Insurance Companies Serving Tyler, TX

Yo, Tyler, TX, peep this! Insurance companies are a major deal for drivers, and knowing your options is key to getting the best rates. Whether you’re a recent grad or a seasoned driver, finding affordable coverage is a must.

Insurance Companies Operating in Tyler, TX

Tyler, TX, has a bunch of insurance companies serving the area. Knowing who’s in the game helps you shop around and find the best fit. These companies offer various packages to suit different needs and budgets.

- State Farm: A giant in the insurance game, State Farm is known for its widespread presence and wide range of policies. They offer everything from car insurance to home insurance, often with good customer service and a solid reputation.

- Geico: Another major player, Geico is popular for its competitive rates and convenient online services. They often advertise through catchy commercials, so you’ve probably heard of them.

- Progressive: Progressive is another big name, known for its innovative approach to insurance. They sometimes offer special deals or discounts, making them worth considering.

- Allstate: Allstate has been around for a while and offers a wide range of coverage options. They might have a bit of a more traditional approach compared to some other companies.

- Farmers Insurance: Farmers Insurance is a good choice if you’re looking for local coverage. They’re often well-established in the communities they serve.

Financial Stability and Reputation

Insurance companies’ financial stability is crucial. You want a company that’s financially sound so they can pay out claims when you need them. Look for companies with strong ratings from independent agencies. This helps ensure they can handle any claims that might arise.

Comparison of Services Offered

Different companies offer different services. Some focus on online services, others prioritize personalized customer interactions. Think about what’s important to you – easy online access or direct assistance? Compare the features and benefits offered by each company to match your needs. Some may have more comprehensive coverage options or specific add-ons.

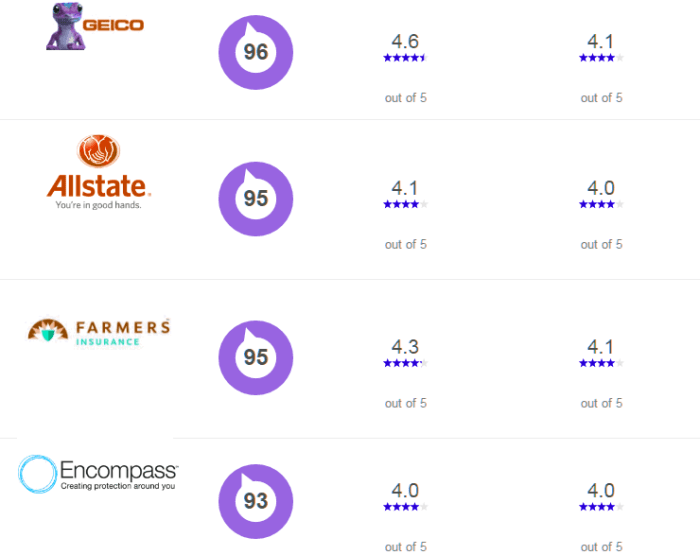

Customer Service Ratings and Reviews

Here’s a look at some top insurance companies and their customer service, based on available data. Customer reviews and ratings give you an idea of the overall experience.

| Insurance Company | Customer Service Rating | Customer Reviews (Example) | Claims Handling Time (Example) |

|---|---|---|---|

| State Farm | 4.2 out of 5 stars | “Friendly and helpful agents.” | 7 days |

| Geico | 3.8 out of 5 stars | “Easy online claims process.” | 5 days |

| Progressive | 4.0 out of 5 stars | “Fast response time.” | 6 days |

| Allstate | 3.9 out of 5 stars | “Helpful with complex situations.” | 8 days |

| Farmers Insurance | 4.1 out of 5 stars | “Local agents are great.” | 7 days |

Note: Ratings and review examples are hypothetical and for illustrative purposes only. Actual results may vary.

Specific Coverage Options in Tyler, TX

Yo, homies, lemme break down the different types of car insurance you can get in Tyler, TX. This ain’t no game, this is your ride’s safety net. Knowing your options is key to getting the best deal and keeping your wheels rolling smooth.Car insurance ain’t just one size fits all. Different plans cover different things, and the level of coverage you need depends on your situation.

Think about what you want to protect and how much you’re willing to pay. Understanding the different coverages and deductibles is crucial for making the right choice.

Common Coverage Options, Cheap car insurance tyler tx

Insurance companies in Tyler, TX, typically offer a standard set of coverages. These protect you from various situations, from fender benders to total losses. The right coverage combo keeps your wallet and your car safe.

- Liability Coverage: This is the bare minimum. It protects you if you’re at fault in an accident and cause damage to another person or their property. Think of it as your legal shield if you mess up on the road.

- Collision Coverage: This kicks in if your car gets wrecked, regardless of who’s at fault. It pays for the damage to your own vehicle. This is a must-have if you wanna keep your ride in good shape.

- Comprehensive Coverage: This is like your car’s all-around protection. It covers damage from things like weather events, vandalism, or even falling objects. This extra layer is a great idea if you park in sketchy spots or live in a risky area.

- Uninsured/Underinsured Motorist Coverage: This is crucial. It steps in if you’re hit by someone who doesn’t have enough insurance or no insurance at all. This is a game-changer if you get totaled by a low-budget driver.

Implications of Coverage Levels and Deductibles

Different coverage levels and deductibles directly impact your premium. A higher level of coverage usually means a higher premium. Deductibles, the amount you pay out-of-pocket before insurance kicks in, also play a role. Lower deductibles mean lower monthly payments but higher premiums.

A lower deductible means you’ll pay less out of pocket if something happens, but you’ll likely pay more each month for the insurance. A higher deductible means you’ll pay more out-of-pocket, but your monthly payments will be lower.

Example Coverage Packages

Here’s a table showcasing different coverage packages and their approximate costs. These are just examples; your actual costs will vary based on your specific situation.

| Coverage Package | Description | Cost (Example) | Recommended for… |

|---|---|---|---|

| Basic Liability | Covers damage to others if you’re at fault. | $100/month | Students with older cars and no major assets. |

| Full Coverage (Liability, Collision, Comprehensive) | Covers damage to others, your vehicle, and your vehicle from various causes. | $250/month | Anyone with a newer car or a lot of assets who wants complete protection. |

| Enhanced Coverage (Liability, Collision, Comprehensive, Uninsured/Underinsured) | Covers all above, plus protection against uninsured drivers. | $350/month | Drivers who are in high-risk areas or have a lot of assets, or are concerned about getting hit by a uninsured driver. |

Navigating the Claims Process in Tyler, TX

Yo, so you wrecked your ride in Tyler? Don’t panic, fam! Navigating the insurance claim process can feel like a maze, but it’s way easier than you think. This breakdown will walk you through the steps, common scenarios, and the importance of staying organized.The claim process is basically a series of steps to get your ride fixed and your wallet back on track after a car accident.

Each insurance company has its own process, but they all generally follow similar guidelines. Understanding these guidelines will help you stay cool and collected during the whole process.

Steps Involved in Filing a Car Insurance Claim

Filing a claim usually starts with a phone call or online report. You’ll need your policy details, the accident report, and any witness information. This initial report helps the insurance company gather the necessary information to assess the damage and determine the next steps. Next, you’ll need to provide supporting documentation, like medical records, police reports, and photos of the damage.

The insurance company will then investigate the claim and decide on the compensation. This may include repairs, replacement costs, or other financial aid.

Common Claim Scenarios and Handling

A fender bender with minor damage is typically handled swiftly. The insurance company will likely approve repairs directly with a mechanic, and you’ll be on your way. However, a more serious accident might involve a police report, medical attention, and more documentation. In these situations, the insurance company may send an adjuster to assess the damage, conduct interviews, and evaluate the overall circumstances.

For total loss claims, the insurance company will evaluate the vehicle’s value and offer a settlement based on market prices and other factors.

Importance of Documentation and Communication

Documentation is key! Keep all your receipts, photos, and communication records. This helps to solidify your claim and ensures everything is transparent. Clear communication with the insurance adjuster is crucial. Be polite, respectful, and provide all requested information promptly. If you have questions or concerns, ask them immediately.

A good relationship with the adjuster can expedite the claims process.

Typical Timeframe for Processing Claims

The timeframe for processing claims varies, depending on the complexity of the case. Minor accidents can be resolved in a few weeks, while more serious incidents might take several months. Be patient and proactive in following up with the insurance company. If you’re unsure about the status of your claim, don’t hesitate to ask for updates. You can track the progress online or over the phone.

Last Recap

Finding cheap car insurance in Tyler, TX, involves comparing quotes, understanding coverage options, and recognizing local factors. This guide provides actionable steps to find the right policy for your budget and needs. Remember to thoroughly research providers and consider factors like your driving record and vehicle type.

FAQ Compilation

What are the most common discounts available for car insurance in Tyler, TX?

Many insurers offer discounts for safe driving, multiple vehicles, student status, and bundling policies. Check with individual providers for specific details and eligibility.

How do I compare car insurance quotes effectively?

Use online comparison tools and request quotes from multiple providers. Consider factors like coverage limits and deductibles when making comparisons.

What are the typical claim processing times in Tyler, TX?

Processing times vary by insurance company. Expect a range of processing times, and always maintain clear communication with your insurer.

What factors influence car insurance rates in Tyler, TX?

Driving record, vehicle type, location, and demographics are all key factors in determining rates. Factors like accidents or traffic violations can significantly affect premiums.