Does health insurance cover car accident injuries? This is a crucial question for anyone involved in a car accident. Understanding the specifics of your policy is key, as coverage can vary significantly. We’ll delve into the details, examining what’s typically covered, what’s excluded, and the role of other insurance types.

This exploration will clarify how health insurance operates in the event of a car accident. We’ll look at examples of covered medical treatments, discuss potential limitations, and provide a clear comparison of different health insurance plans.

Insurance Coverage Overview

Yo, peeps! Health insurance, it’s like a safety net for your health woes. It’s a contract between you and the insurance company, where they agree to pay for certain medical expenses in exchange for your premiums. Understanding how it works is key, especially when dealing with stuff like car accidents.Health insurance works by covering a portion of your medical bills.

It’s not a free-for-all, though. There are rules and regulations, and different plans have different levels of coverage. Basically, the insurance company steps in to help with the costs of treatment, preventing you from having to foot the entire bill.

General Principles of Health Insurance Coverage

Health insurance coverage is generally based on the principle of risk sharing. Insurance companies pool premiums from many individuals to cover the potential medical expenses of a few who might need significant care. The more people involved, the more robust the pool, and the better the coverage for everyone. This way, it’s a collective effort to handle unforeseen health crises.

How Health Insurance Covers Medical Expenses

Typically, health insurance covers a range of medical expenses, from doctor visits to hospital stays. The extent of coverage varies depending on the plan. The process usually involves you getting treatment, submitting receipts, and the insurance company verifying and paying their portion. Think of it as a system of reimbursements based on the specifics of your plan.

Examples of Covered Medical Treatments

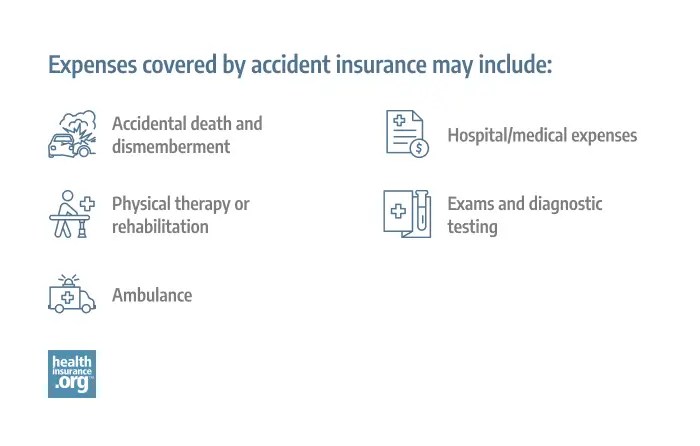

A wide array of treatments are typically covered, such as doctor visits, lab tests, surgeries, hospital stays, physical therapy, and even mental health services. Specific treatments may have limitations based on the plan, though. Things like prescription drugs, dental care, and vision care often have separate coverage or limitations.

Exclusions from Health Insurance Coverage

It’s crucial to understand what’s not covered. Exclusions can vary widely between plans, but they often include pre-existing conditions (depending on the specific plan), cosmetic procedures, experimental treatments, and some alternative therapies. Always check your policy documents for a clear picture of what’s excluded.

Comparison of Health Insurance Plans, Does health insurance cover car accident

| Plan Type | Accident-Related Medical Expense Coverage | Premiums | Deductibles |

|---|---|---|---|

| Basic Plan | Covers essential medical services, but with potential high out-of-pocket expenses. | Lower | Higher |

| Bronze Plan | Moderate coverage, often with a higher deductible and co-pays. | Moderate | Moderate |

| Silver Plan | Good balance of coverage and cost. | Higher | Moderate |

| Gold Plan | Comprehensive coverage with lower out-of-pocket expenses. | Highest | Lowest |

| Platinum Plan | Highest coverage, very low out-of-pocket expenses. | Highest | Lowest |

Different plans have different approaches to coverage, affecting the amount you pay and the amount the insurance company covers. The table above provides a basic overview, but always consult your specific policy details.

Car Accident-Specific Coverage

Yo, peeps! Navigating car accident insurance can be a real headache. This section breaks down the different types of coverage, helping you understand what’s covered and what’s not when things go sideways on the road. Let’s get into it!

Medical Coverage vs. Personal Injury Protection (PIP)

Medical coverage and PIP are both crucial for car accident victims, but they have key differences. Medical coverage typically pays for your own medical bills directly resulting from the accident, whereas PIP covers your medical expenses regardless of who was at fault. Essentially, PIP is like a safety net, covering your own injuries without the need to prove fault.

Think of it like this: Medical coverage is for the

- costs* of your injuries, and PIP is for the

- protection* of your well-being.

Comparing Insurance Policy Handling of Accident Injuries

Different insurance policies handle accident injuries differently. Some policies might prioritize medical coverage over PIP, while others might have more comprehensive PIP plans. It’s like comparing different restaurants – some have a wider variety of options on their menu, while others might have specific dishes you might prefer. Understanding the specifics of your policy is key to knowing what you’re entitled to.

Covered Accidents under Health Insurance

Typical health insurance policies usually cover medical expenses resulting from a car accident, but there are important caveats. Generally, they cover injuries that are directly related to the accident, such as broken bones, soft tissue damage, or head injuries. The crucial part is that the injury must be a direct consequence of the accident. Think of it like a chain reaction: the accident is the initial event, and the injuries are the subsequent effects.

The Role of Liability Insurance

Liability insurance comes into play when someone else is at fault for the accident. It covers the medical expenses of the injured party in such scenarios, acting as a safeguard for the other driver’s liability. Imagine a scenario where you’re hit by a driver who wasn’t paying attention; liability insurance is there to ensure the injured party gets compensated.

Pre-Existing Conditions and Accident Coverage

Pre-existing conditions can affect coverage for accident-related injuries. Sometimes, the insurance might not cover pre-existing conditions that are aggravated by the accident. It’s like a pre-existing problem getting worse due to a specific event. It’s crucial to understand your policy’s specifics on this matter.

Limitations of Health Insurance in Car Accidents

Health insurance coverage for car accidents isn’t always limitless. There are often deductibles, co-pays, and out-of-pocket maximums that can affect the amount your insurance will cover. Also, some injuries might fall outside the scope of what your policy considers covered. This is like a budget; you might have a certain amount of money available, but there are limits to how much you can spend.

Typical Scenarios and Health Insurance Coverage

| Scenario | Likely Health Insurance Coverage? |

|---|---|

| Broken arm in a car accident | Likely yes, if the break is directly related to the accident. |

| Pre-existing back pain aggravated by a car accident | Likely yes, but coverage might be limited depending on the policy and severity of aggravation. |

| Whiplash resulting from a rear-end collision | Likely yes, if the whiplash is directly linked to the collision. |

| Mental health issues arising from a traumatic accident | Potentially yes, depending on the policy and severity. |

| Injuries from an accident where the driver was intoxicated | Likely yes, but policy terms and conditions will apply. |

Coverage Considerations and Limitations

Hey Pontianak peeps! Navigating health insurance after a car crash can be a real headache. Understanding the nitty-gritty details is key to knowing what you’re truly covered for. This section dives deep into the factors that influence your coverage, the role of those pesky deductibles and co-pays, and the whole claims process. We’ll also break down how different injuries are treated, the role of other insurance, and the wild variations between states and insurance companies.

Get ready to level up your knowledge!This section highlights the crucial factors influencing health insurance coverage for car accident injuries. These factors aren’t always obvious, so let’s unpack them!

Factors Influencing Coverage Extent

Factors like your pre-existing conditions, the severity of your injuries, and the specific treatment plan can significantly impact the amount of coverage you receive. Your insurance company will likely review your medical records to assess the necessity and appropriateness of the treatment you received. Insurance providers often have specific guidelines regarding treatments deemed medically necessary or experimental, which may impact the coverage amount.

For instance, a simple sprain might have a lower coverage limit than a severe spinal cord injury.

Deductibles and Co-pays in Car Accident Claims

Deductibles and co-pays are like those pesky hidden fees in your insurance plan. They’re the upfront costs you have to pay before your insurance kicks in. In a car accident, these can add up fast. A deductible is a fixed amount you pay out-of-pocket before insurance starts covering costs. A co-pay is a set amount you pay each time you see a doctor or get a procedure.

It’s essential to know these amounts before the accident, as they’ll impact your out-of-pocket expenses. For example, a $500 deductible might seem small, but it could quickly climb if you need extensive physical therapy sessions or multiple doctor visits.

Claims Process for Health Insurance

The claims process for health insurance related to car accidents generally involves reporting the accident to your insurance provider, gathering necessary medical documentation (like doctor’s notes and bills), and filling out claim forms. Be prepared for potential delays and paperwork. Your insurance company will likely want to verify the cause of the accident and the extent of your injuries, which might involve contacting the other party’s insurance company.

Coverage for Different Types of Injuries

Different types of injuries from a car accident have different coverage implications. Broken bones, for instance, typically have more straightforward coverage than soft tissue damage or head injuries. Soft tissue injuries, like sprains and strains, can have more variable coverage, as the diagnosis and treatment can be complex. Head injuries, due to their potential long-term implications, may require extensive and specialized care, potentially resulting in higher claims amounts.

The specific treatment and rehabilitation costs will significantly influence the total amount covered.

Role of Other Insurance Policies

Other insurance policies, such as auto insurance, may also play a role in covering expenses related to a car accident. This is often determined by the specifics of the policy and the circumstances of the accident. If the other driver was at fault, their insurance might cover some of your medical expenses. Understanding the intricacies of auto insurance policies and their applicability in the case of a car accident is crucial.

Variations in Coverage Between States and Providers

Health insurance coverage for car accident injuries can differ significantly between states and insurance providers. Some states may have stricter regulations regarding coverage, while others may offer more comprehensive plans. Insurance providers may have varying policies regarding pre-existing conditions, treatment types, or the time frame for coverage. Researching your specific policy details and understanding state-level regulations is crucial.

Potential Out-of-Pocket Costs

| Scenario | Potential Out-of-Pocket Costs |

|---|---|

| Minor soft tissue injury (sprain): | $200-$500 (deductible and co-pays) |

| Broken arm requiring surgery: | $1,000-$3,000 (deductible, co-pays, and potential hospital charges) |

| Moderate head injury with ongoing therapy: | $5,000-$15,000+ (deductibles, co-pays, therapy sessions, and potential long-term care) |

This table illustrates potential scenarios and corresponding costs. Remember, these are estimates and actual costs may vary significantly based on individual circumstances. Always consult your insurance policy and medical providers for specific details.

Additional Information and Resources

Hey Pontianak peeps! Navigating health insurance after a car crash can feel like a jungle. But fear not, we’re breaking down the resources and scenarios to help you understand your rights and options. Knowing your rights is key, especially when dealing with insurance companies.Understanding your health insurance coverage after a car accident is crucial. This involves not just the basics, but also knowing the potential pitfalls and how to protect yourself.

From figuring out what’s covered to handling claims, this section gives you the lowdown to make sure you’re not left hanging.

Finding More About Coverage

Numerous resources are available to delve deeper into your health insurance coverage. Your insurance provider’s website is a fantastic starting point, filled with policy details and FAQs. Online forums dedicated to health insurance can also provide insights from other people in similar situations. Checking with your local consumer protection agency or a legal aid society might be beneficial, too.

These resources offer a broader perspective on your options and legal rights.

Specific Scenarios

Understanding when health insurance

- might* or

- might not* cover accident-related expenses is vital. For example, if your injury requires surgery, it’s likely your insurance will cover the procedure. However, if the injury is deemed to be self-inflicted (and not proven otherwise) coverage could be denied. Likewise, cosmetic procedures for accident-related injuries are often not covered. Always double-check your policy for specific exclusions.

A trip to the emergency room for a whiplash injury likely will be covered, while a cosmetic treatment for a minor scar will likely not be. This underscores the importance of knowing your policy’s specific terms.

Reviewing Your Policy

Thoroughly reviewing your health insurance policy details is paramount. This is your personal guide to understanding what’s covered and what isn’t. Look for specifics on car accident coverage, including exclusions, limits, and pre-authorization requirements. Paying attention to these details prevents unpleasant surprises down the line. Failing to read your policy could mean you’re stuck with unexpected costs.

Understanding your rights and responsibilities will help you feel more in control of the situation.

Common Questions and Answers

| Question | Answer |

|---|---|

| Does health insurance cover all car accident-related medical expenses? | No, insurance policies often have exclusions and limitations. Check your policy details for specific coverage. |

| What if my claim is denied? | If your claim is denied, carefully review the denial letter. It will explain the reason. If you disagree, you might need to appeal or seek legal counsel. |

| How do I keep records of medical expenses? | Maintain detailed records of all medical bills, receipts, and treatment notes. This documentation is crucial for supporting your claim. |

| What role does an attorney play in these cases? | An attorney can represent you in dealing with insurance companies and navigating the legal process if your claim is denied or complex. |

Legal Implications of Denied Claims

Denial of a claim can have legal implications. Review the denial letter carefully to understand the grounds for denial. If you disagree, you might need to consider legal options.

If your claim is denied, a thorough review of the denial letter is crucial. Understanding the reasons for denial will help determine the next steps. Potential legal action might be necessary in some cases, depending on the circumstances. Legal implications depend heavily on the specific situation and details of your policy.

Importance of Keeping Records

Maintaining detailed records of medical expenses and treatments is crucial. This includes receipts, doctor’s notes, and any other supporting documentation. Accurate records help substantiate your claim and expedite the process. Comprehensive records demonstrate the extent of your injuries and treatments, strengthening your case. Don’t underestimate the power of proper record-keeping.

Role of an Attorney

In complex car accident cases involving health insurance claims, an attorney can provide invaluable assistance. An attorney can negotiate with insurance companies, represent your interests, and ensure your rights are protected throughout the process. Attorneys are experienced in navigating insurance claim procedures and can help you understand your options and rights. They can guide you through the process, ensuring your claim is handled fairly and efficiently.

Closing Notes

In conclusion, determining if your health insurance covers car accident expenses depends on various factors, including your specific policy, the nature of the injuries, and pre-existing conditions. Reviewing your policy thoroughly is essential, and consulting with a healthcare professional or insurance representative can provide additional guidance. Understanding the limitations and seeking expert advice can help navigate the complexities of these claims.

FAQ Resource: Does Health Insurance Cover Car Accident

Does health insurance cover ambulance fees after a car accident?

Often, ambulance fees are covered, but check your policy specifics. Emergency medical services are frequently included, but there might be exceptions.

What if my injuries are from a fender bender?

Even minor accidents can lead to substantial medical bills. Your health insurance coverage will depend on the severity of your injuries and your policy’s specifics.

How do pre-existing conditions affect my claim?

Pre-existing conditions might influence your claim, impacting the extent of coverage for accident-related injuries.

What is the role of liability insurance in this?

Liability insurance covers injuries to others in the accident. Your health insurance might cover your own injuries regardless of fault.