Does your car insurance address have to match your registration? This crucial question impacts coverage and claim processing. Understanding the rules, potential exceptions, and company policies is vital for drivers to ensure their insurance accurately reflects their vehicle’s registration.

Mismatched addresses can lead to complications, including claim denials and delays. This guide provides a comprehensive overview of the requirements, potential issues, and solutions for maintaining accurate records.

Insurance Requirements

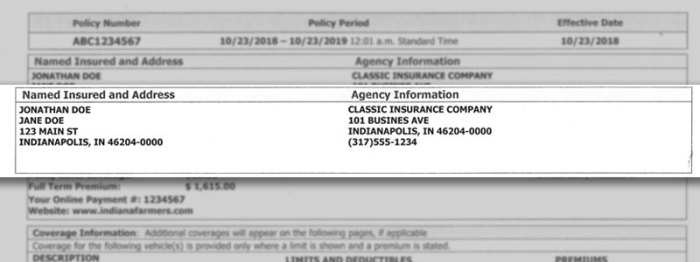

Car insurance policies, a crucial component of vehicle ownership, often stipulate that the policyholder’s address must align with the registered address of the vehicle. This requirement, while seemingly straightforward, carries significant implications for policyholders and insurers. Understanding these implications is vital for maintaining valid insurance coverage and avoiding potential legal issues.

General Requirements for Matching Insurance and Registration Addresses

Insurance companies typically require a match between the policyholder’s address and the vehicle’s registered address to ensure accurate claims processing and to fulfill their obligations under the policy. This requirement reflects a fundamental principle of risk assessment. Discrepancies can lead to complications in verifying the policyholder’s identity and the vehicle’s location, thereby increasing the risk of fraud and misrepresentation.

Furthermore, accurate address information is critical for proper service and communication regarding the policy.

Legal Implications of Mismatched Addresses

Discrepancies between the policyholder’s insurance address and the vehicle’s registered address can lead to legal ramifications. In certain jurisdictions, insurance policies with mismatched addresses may be deemed invalid or unenforceable. This lack of validity can have serious consequences in the event of an accident or claim, potentially hindering the policyholder’s ability to access coverage. The exact legal standing varies by jurisdiction.

For example, some states might consider such a mismatch as a violation of specific regulations, resulting in penalties or fines.

Consequences for Policyholders with Differing Addresses

Policyholders with differing insurance and vehicle registration addresses face potential consequences if the discrepancy is not properly addressed. Claims processing may be delayed or denied due to the mismatch. The policyholder could also be liable for any damages or liabilities incurred as a result of the incorrect address. Furthermore, the insurance company might refuse to cover claims arising from incidents related to the vehicle, due to the lack of proper registration.

Common Reasons for Discrepancies

Various reasons might lead to a difference between the insurance address and the vehicle registration address. Policyholders may relocate while maintaining their vehicle registration at their previous address. Students living away from home or individuals renting properties might also have insurance addresses that differ from their vehicle registration. In some cases, individuals might deliberately provide an address other than their primary residence for reasons of privacy or personal circumstances.

Exceptions to the Rule

While a match between insurance and registration addresses is generally required, there are potential exceptions. Certain circumstances might justify a mismatch. For example, individuals living in temporary or mobile housing, such as military personnel or those in temporary accommodations, may be exempt from strict address matching requirements. Specific regulations might allow for exceptions in cases of shared ownership of a vehicle, where the addresses of different owners differ.

Procedures for Updating Address Changes

| Type of Change | Vehicle Registration Procedure | Insurance Policy Procedure |

|---|---|---|

| Change of Residence | Contact the relevant motor vehicle department. Fill out the required forms and provide supporting documentation. A fee might be applicable. | Contact the insurance provider to update the policyholder’s address. Provide a copy of the updated vehicle registration document. |

| Temporary Address | Some jurisdictions might have specific procedures for temporary addresses. Verification might be required. | Communicate the temporary address to the insurance company. The company might require additional verification steps. |

Updating both vehicle registration and insurance policy addresses is crucial for maintaining accurate records and ensuring valid coverage. Following the appropriate procedures Artikeld by the relevant authorities and insurance provider is essential.

Insurance Company Policies

Insurance companies employ various strategies to ensure policyholders accurately represent their address information. Maintaining accurate address data is critical for effective claims processing, fraud prevention, and upholding contractual obligations. Discrepancies between declared and actual addresses can lead to policy denials, reduced claim payouts, or even legal repercussions. Understanding these procedures is vital for policyholders to maintain valid coverage and avoid potential issues.Insurance companies employ a multifaceted approach to verify address accuracy.

This includes a combination of automated checks and potentially, manual reviews, depending on the nature of the discrepancy. The level of scrutiny applied can vary significantly based on the insurance company and the specific policy. This can encompass the comparison of information against publicly available records, internal databases, and in some cases, even physical verification.

Verification Methods Used by Insurance Companies

Insurance companies employ a range of methods to confirm address accuracy. These methods range from simple data matching to more complex procedures, such as contacting the policyholder to validate the address. Automated systems often perform initial checks against databases like the postal service’s records. If discrepancies are found, the company may contact the policyholder to resolve the issue or request additional documentation.

In some instances, physical verification may be required, especially in high-risk cases. The specifics of these methods are often kept proprietary, reflecting the insurance industry’s concern for protecting sensitive data.

Comparison of Procedures Across Different Insurance Companies

Different insurance companies adopt varied approaches to address verification. Some companies may have more stringent verification requirements than others, particularly for high-value policies or those with a history of fraudulent activity. Some insurers may focus on automated checks while others might have more human-driven approaches, particularly when dealing with complex or unusual cases. The degree of scrutiny can also depend on the policy type, such as auto insurance, homeowners insurance, or life insurance.

Differences in policyholder demographics and regional variations may also play a role in the company’s verification procedures.

Policy Clauses Regarding Address Discrepancies

Policy clauses often contain specific language addressing discrepancies between the insured’s address on the policy and the address on registration documents. These clauses generally Artikel the consequences of such discrepancies. Some policies explicitly state that coverage may be invalidated or reduced if the addresses do not match. This is frequently detailed in the policy’s “Conditions” or “Declarations” section, requiring careful review by the policyholder.

Furthermore, discrepancies may lead to delays in claims processing or even rejection of claims.

Address Change Reporting Procedures and Policies

Insurance companies have established procedures for reporting address changes. These typically involve submitting written notification through various channels, such as online portals, mail, or phone calls. The process often requires providing specific information, including the policy number, old address, and new address. The company may require supporting documentation to validate the change, such as a copy of a utility bill or a lease agreement.

Policyholders should refer to the policy documents or the company’s website for specific instructions.

Implications of Not Reporting Address Changes on Time

Failure to report address changes promptly can have significant implications. If the insurance company is unaware of the change, correspondence may be sent to the old address, leading to delays in receiving important information, such as policy updates, renewal notices, or claims-related correspondence. This can have detrimental consequences, such as missed renewal deadlines or missed opportunities to address potential issues before they escalate.

This could even lead to policy cancellations or difficulties in making claims.

Typical Policy Terms Regarding Address Changes, Does your car insurance address have to match your registration

| Policy Term | Effect on Coverage |

|---|---|

| Address Change Notification Period | Policyholders must report address changes within a specified timeframe. Failure to comply may result in coverage lapses. |

| Documentation Requirements | Insurance companies may require supporting documents to verify address changes, such as utility bills or lease agreements. The requirements vary by insurer. |

| Effect of Unreported Changes | Unreported address changes may lead to delayed communications, policy cancellations, or claim denials. |

| Policy Renewal | Address discrepancies may impact policy renewal, possibly requiring reapplication or resubmission of documents to verify the address. |

Registration Requirements: Does Your Car Insurance Address Have To Match Your Registration

Vehicle registration is a critical component of the legal framework governing the ownership and operation of motor vehicles. Accurate and up-to-date registration information, including the address, is vital for maintaining compliance with regulations and ensuring efficient administration of related services, such as insurance and driver’s licensing. Failure to comply with registration address requirements can lead to significant penalties.Maintaining accurate address information on vehicle registration records is essential for numerous reasons, including facilitating communication regarding vehicle-related issues, enabling law enforcement agencies to properly identify and track vehicles, and ensuring accurate records for potential tax liabilities.

The procedures for updating registration information vary by jurisdiction, requiring careful attention to specific regulations and documentation.

Regulations Governing Vehicle Registration and Address Matching

Vehicle registration regulations are jurisdiction-specific, encompassing a wide range of requirements. These regulations dictate the permissible discrepancies between the registered address and the owner’s actual residence. Some jurisdictions may allow for a certain degree of flexibility, while others maintain stricter adherence to matching requirements. Understanding these regulations is crucial to avoid penalties and maintain compliance.

Penalties for Non-Compliance with Registration Address Requirements

Non-compliance with registration address requirements can result in various penalties, ranging from fines to suspension of registration or driver’s license. These penalties are designed to encourage accurate record-keeping and discourage misrepresentation of address information. The severity of penalties often correlates with the frequency or nature of violations.

Methods for Updating Vehicle Registration Address Information

Various methods exist for updating vehicle registration address information. These methods often include online portals, in-person visits to licensing offices, and mail-in applications. Each method typically has specific guidelines and required documentation, which must be carefully followed to ensure a smooth and successful update.

Step-by-Step Procedure for Updating Vehicle Registration Information

Updating vehicle registration information typically involves several steps. First, gather the necessary documents, including the vehicle registration certificate, proof of residency, and a completed application form. Second, submit the documents to the relevant authority. Third, await confirmation of the updated information. The specific steps may vary by jurisdiction.

Forms and Documents Required for Address Changes on Vehicle Registration

Specific forms and documents are required for address changes on vehicle registration. These typically include a completed application form, proof of residency, such as a utility bill or lease agreement, and the vehicle registration certificate. Failure to provide the necessary documents may lead to delays or rejection of the application.

Comparison of State/Country Regulations on Vehicle Registration Address Matching

| Jurisdiction | Address Matching Requirements | Penalties for Non-Compliance | Methods for Updating Address |

|---|---|---|---|

| State A | Strict matching required; address must precisely match registered voter or other official records. | Fines, potential suspension of registration, potential driver’s license suspension. | Online portal, in-person application, mail-in application. |

| State B | Moderate matching; address must generally align with current residence, but some flexibility may be allowed. | Fines, potential suspension of registration, potential driver’s license suspension. | Online portal, in-person application, mail-in application. |

| Country X | Strict matching; address must precisely match national ID or other official records. | Fines, potential suspension of registration, potential driver’s license suspension. | Online portal, in-person application, mail-in application. |

Note: This table provides a generalized comparison. Specific requirements may vary.

Address Discrepancies and Solutions

Discrepancies between a driver’s insurance address and vehicle registration address can lead to significant complications, particularly when filing claims or renewing policies. Understanding these potential issues and the steps to resolve them is crucial for maintaining valid insurance coverage and avoiding costly delays or denials. Addressing these discrepancies proactively safeguards against unforeseen problems and ensures smooth administrative processes.This section delves into the challenges of mismatched addresses, outlining common problems, solutions, and preventative measures.

The focus is on the practical implications of these discrepancies, the impact on insurance claims, and the crucial importance of maintaining accurate records.

Potential Challenges of Mismatched Addresses

Discrepancies between insurance and registration addresses can create numerous obstacles for drivers. These include delays in claim processing, increased paperwork requirements, and potential denials of coverage. Insurance companies rely on address accuracy to verify policyholders’ eligibility and identify potential risks. Inconsistencies can create red flags, triggering additional scrutiny and potentially delaying the resolution of claims.

Common Issues Encountered by Drivers with Mismatched Addresses

Drivers with mismatched addresses often experience several common issues:

- Claims denials or delays due to address discrepancies.

- Difficulty in updating insurance policies with address changes.

- Problems with policy renewals and payment processing.

- Increased paperwork and administrative burden.

- Potential for fraudulent activity being suspected if an address discrepancy is not addressed promptly.

Solutions for Resolving Discrepancies

Several solutions exist for resolving discrepancies between insurance and registration addresses. These solutions range from simple updates to more complex procedures depending on the specific nature of the mismatch.

- Updating Insurance Records: Contact the insurance company immediately to inform them of the address change. This typically involves submitting updated documentation, such as a copy of a utility bill or lease agreement, verifying the change with a new document.

- Updating Registration Records: Contact the relevant DMV or equivalent agency to update the vehicle’s registration address. This usually involves submitting the required paperwork and paying any associated fees.

- Maintaining Accurate Records: Keeping accurate records of all address changes is essential. This includes both personal and vehicle-related documents. A well-maintained record helps to ensure that all parties have access to the most up-to-date information.

Flowchart for Resolving Address Discrepancies

| Step | Action |

|---|---|

| 1 | Identify the discrepancy. |

| 2 | Contact your insurance company to notify them of the change. |

| 3 | Gather necessary documentation, such as a recent utility bill or lease agreement, for verification purposes. |

| 4 | Contact your state’s Department of Motor Vehicles (DMV) or equivalent agency to update your vehicle registration address. |

| 5 | Maintain accurate records of all address changes for both insurance and registration. |

| 6 | Review and confirm both records reflect the correct and updated address. |

Impact on Claims Processing

Address discrepancies can significantly impact claim processing. Claims might be denied, delayed, or require additional verification steps. Insurance companies often have specific procedures for handling address changes to maintain the accuracy of their records. A delayed or denied claim can lead to financial hardship for the insured.

Examples of Address Discrepancies and Resolution

- Example 1: A driver moves to a new city and forgets to update their insurance address. Their claim is denied due to address mismatch. The driver must contact their insurance company and provide proof of the address change to rectify the situation.

- Example 2: A driver updates their insurance address but forgets to update their vehicle registration. The insurance company may flag the claim for review due to the address inconsistency. The driver must update the registration and inform both the insurance company and DMV.

Determining if an Address Mismatch Affects Coverage

A mismatched address can negatively impact insurance coverage. The extent of the impact depends on the severity of the discrepancy and the specific insurance policy. If there’s a significant discrepancy between the addresses, it could invalidate the coverage or lead to the policy being suspended. The best way to determine the impact is to consult with the insurance provider.

Illustrative Scenarios

Address discrepancies between insurance policies and vehicle registrations can lead to significant complications, especially when it comes to claims. Understanding these scenarios is crucial for both policyholders and insurance companies to ensure fair and accurate processing of claims. These scenarios highlight the importance of maintaining accurate and updated information.

Scenario of Claim Denial Due to Address Mismatch

A policyholder, Sarah, lives at 123 Main Street, but her car insurance policy lists her address as 456 Oak Avenue. When Sarah’s car is involved in an accident, the insurance company, upon investigating, finds a discrepancy between her reported address and the address on the vehicle registration. Due to this mismatch, the insurance company may deny Sarah’s claim, citing policy violations or lack of proof of residency.

This denial could result in Sarah having to bear the costs of the damages herself, potentially leading to significant financial hardship.

Impact of Address Change on Insurance Coverage

A real-world scenario illustrates how an address change affects coverage. Mark, a policyholder, recently moved from San Francisco to Los Angeles. He failed to update his insurance policy with his new address. His coverage remained limited to the previous location. If a claim occurred in Los Angeles, the insurance company might not be obligated to provide coverage, as the policy was not updated to reflect the current address.

Reporting an Address Change to the Insurance Company

Updating an address with the insurance company is straightforward. Policyholders should contact their insurance provider via phone, email, or online portal, depending on the company’s preferred method. They should provide the new address, the effective date of the change, and any other necessary information as required by the company. Documentation, such as a utility bill or lease agreement, may be requested to verify the new address.

This demonstrates the importance of proactive communication with the insurance provider.

Impact of Address Change on Renewal Process

An address change can affect the renewal process. If the change is not reported before the renewal date, the policyholder might experience delays in the renewal process, potentially leading to gaps in coverage. In some cases, the company may adjust premium rates or even decline to renew the policy if the change is significant and unanticipated. This emphasizes the need for timely address updates.

Impact of Address Changes on Coverage if a Vehicle is Transferred

If a vehicle is transferred to another person, the insurance policy should be updated to reflect the new owner’s details, including the address. Failure to do so could lead to coverage issues for the new owner. The original owner’s policy might not extend to the new owner or the vehicle, if the change isn’t reflected in the policy.

Table of Scenarios with Potential Consequences for Address Discrepancies

| Scenario | Potential Consequences |

|---|---|

| Policyholder fails to update address after moving | Claim denial, delayed renewal, incorrect premium calculation, potential gaps in coverage. |

| Vehicle transferred without updating insurance address | Lack of coverage for the new owner, potential liability issues for the previous owner. |

| Address discrepancy during claim investigation | Claim denial, additional investigation delays, increased claim processing time. |

| Address mismatch discovered during policy renewal | Policy renewal rejection, premium adjustment, potential policy cancellation. |

Final Conclusion

In conclusion, maintaining a consistent address between your car insurance and vehicle registration is paramount. This guide has explored the complexities and potential pitfalls of mismatched addresses, highlighting the importance of accurate records and timely reporting of any changes. Drivers should meticulously review their policies and state regulations to ensure compliance and avoid potential complications.

FAQs

Does insurance coverage automatically adjust when I move?

No, insurance coverage isn’t automatically updated when you move. You must notify your insurer of the change of address. Failure to do so could affect claim processing.

What are the penalties for not reporting an address change to my insurance company?

Penalties for failing to report address changes vary by insurance company and jurisdiction. Consequences can range from claim denials to voiding the policy entirely. It’s best to review your policy terms.

How long does it typically take to update my vehicle registration address?

The time to update vehicle registration depends on the state/country and the specific method used. Some states offer online services, which may expedite the process. Check with your local DMV or equivalent agency for the exact timeframe.

Can I have different addresses for my car registration and home address?

In some cases, it’s possible to have different addresses for registration and home. However, insurance policies usually require the address associated with the vehicle’s registration to be consistent with the address on the insurance policy, to avoid any issues with claims or policy renewal.