Employer paid qualified long term care insurance premiums are typically influenced by a complex interplay of factors, from policy coverage levels to the insured’s age and health. This overview explores the nuances of these plans, examining their benefits for employees and the considerations for employers offering them, ultimately highlighting the value proposition of long-term care insurance in today’s benefit landscape.

Different companies have varying approaches to these plans, with some offering comprehensive packages while others opt for more basic coverage. The premium costs are a key consideration, as they often depend on a number of factors, including the specific coverage offered and the individual’s health status.

Understanding Employer-Paid Long-Term Care Insurance Premiums

Employer-sponsored long-term care insurance is a valuable benefit that can help protect employees’ financial well-being during extended periods of illness or disability. It provides coverage for the costs of care, like nursing home stays or in-home assistance, that can be substantial. Many employers recognize the importance of this support and offer it as a perk to attract and retain top talent.This support can significantly ease the financial burden of long-term care needs.

By understanding how these plans work, employees can make informed decisions about their future care and financial security.

Employer-Sponsored Long-Term Care Insurance Plans

Employer-sponsored long-term care insurance plans vary in their offerings. Some plans are basic, covering only a limited period of care, while others are comprehensive, offering more extensive benefits. The specifics of each plan, including premium amounts, are tailored to meet the employer’s and employee’s needs.

Examples of Employer-Sponsored Plans

Different employers offer various long-term care insurance plans, ranging from basic coverage to more comprehensive options. A small business might offer a plan with a relatively lower premium, but limited coverage, while a larger corporation might provide a more robust plan with higher premiums and more comprehensive benefits. Examples of plans include plans covering skilled nursing facility care, assisted living, and home health care.

These plans may also specify the amount of daily or monthly care covered.

Typical Premium Structure

Premiums for employer-sponsored long-term care insurance plans are typically calculated based on factors like the employee’s age, health status, and the type and extent of coverage desired. The employer usually pays a significant portion, or sometimes the entire premium, making it an attractive employee benefit. This is a substantial financial support for the employee, helping them plan for their future.

Comparison of Plan Options

The table below demonstrates a comparison of different plan options, illustrating how premium costs and coverage vary. This information helps employees understand the trade-offs between premium payments and the benefits received.

| Plan Name | Premium (Annual) | Daily Benefit (USD) | Maximum Benefit (USD) | Coverage Duration (Years) |

|---|---|---|---|---|

| Basic Care | $1,000 | $100 | $50,000 | 5 |

| Comprehensive Care | $2,500 | $250 | $100,000 | 10 |

| Enhanced Care | $4,000 | $500 | $200,000 | 15 |

Factors Influencing Premium Costs

Understanding the factors influencing long-term care insurance premiums is crucial for making informed decisions. These factors directly impact the cost of coverage, allowing individuals and employers to anticipate and budget for these expenses. Careful consideration of these elements can lead to more appropriate and affordable insurance choices.

Policy Coverage Levels

The amount of coverage a policy provides significantly affects its premium. Higher coverage levels, encompassing a wider range of care needs and potentially longer durations of care, typically lead to increased premiums. This is because the insurance company assumes greater financial responsibility for more extensive care. For example, a policy covering 24/7 skilled nursing care for five years will cost more than one covering only assisted living for three years.

The more extensive the potential claim, the higher the risk for the insurance company, thus the higher the premium.

Insured’s Age and Health Status

The insured’s age and health status are key determinants in premium calculation. Older individuals are generally charged higher premiums because their likelihood of needing long-term care increases with age. Similarly, pre-existing health conditions, or a history of chronic illnesses, can impact premiums, as these conditions raise the risk of needing long-term care. For instance, an individual with a history of stroke may have a higher premium than someone with no such history.

Insurance Provider Variations

Different insurance providers use varying methodologies for calculating premiums. These methodologies take into account factors like claims experience, investment returns, and administrative costs. Consequently, premiums from one provider may differ from those of another even for similar coverage levels and insured characteristics. Comparing quotes from multiple providers is essential to find the most suitable and affordable option.

Table: Factors Influencing Long-Term Care Insurance Premiums

| Factor | Influence on Premium Amount |

|---|---|

| Policy Coverage Level | Higher coverage levels generally result in higher premiums. |

| Insured’s Age | Older individuals are typically charged higher premiums. |

| Insured’s Health Status | Pre-existing conditions and chronic illnesses may increase premiums. |

| Insurance Provider | Different providers use varying methodologies for premium calculation, impacting the final cost. |

| Geographic Location | Premiums can vary geographically based on local healthcare costs and demand. |

Benefits and Advantages of Employer-Paid Premiums

Employer-sponsored long-term care insurance, where premiums are paid by the company, offers significant advantages for employees. It’s a thoughtful benefit that can ease financial worries during a challenging time, allowing employees to focus on recovery and well-being.Employer-paid long-term care insurance can significantly reduce the financial strain on employees facing extended care needs. This can be a crucial lifeline, ensuring that employees don’t have to deplete their savings or sacrifice their financial security during critical periods.

Financial Relief for Employees

Employer-sponsored long-term care insurance helps shield employees from potentially crippling medical expenses. The premiums, covered by the employer, reduce the out-of-pocket costs for employees, freeing up their personal finances for other necessities. This can be particularly helpful for individuals with limited savings or those facing unexpected health challenges.

Peace of Mind and Reduced Stress

Knowing that long-term care expenses are covered can significantly reduce stress for employees. This peace of mind allows them to concentrate on their recovery or the care of a loved one without the constant worry of mounting financial burdens. It fosters a supportive and understanding work environment, recognizing the importance of employee well-being.

Enhanced Employee Retention and Morale

Offering employer-paid long-term care insurance can improve employee retention rates. Employees appreciate the thoughtful consideration of their well-being, which translates into higher job satisfaction and loyalty. This can lead to a more stable and productive workforce.

Potential Benefits of Employer-Sponsored Programs

- Reduced financial stress during challenging times.

- Protection of personal savings and financial security.

- Improved employee morale and job satisfaction.

- Increased employee retention and loyalty.

- Enhanced reputation and attractiveness as an employer.

A strong employer-sponsored program is a powerful tool to attract and retain top talent. The value of these programs goes beyond financial support; they demonstrate a company’s commitment to employee well-being.

Example Benefit Packages

| Benefit Package | Long-Term Care Insurance |

|---|---|

| Basic Package | No coverage |

| Standard Package | Limited coverage, employer pays a portion of the premium |

| Comprehensive Package | Comprehensive coverage, employer pays full premium |

The table above illustrates how different benefit packages can include varying levels of long-term care insurance coverage. Employees can benefit from a tailored package that meets their specific needs and circumstances.

Considerations for Employers Offering Paid Premiums

Offering long-term care insurance through employer-sponsored plans can be a valuable benefit for employees, promoting peace of mind and financial security. However, employers must carefully consider the financial and administrative implications of this offering.Providing this benefit requires a thoughtful assessment of its impact on the bottom line and a structured approach to administration. It’s important to weigh the potential benefits against the costs and complexities to ensure the program is financially sustainable and effectively managed.

Cost Implications for Employers

The cost of employer-paid long-term care insurance premiums varies significantly depending on several factors, including the plan’s benefits, the employee’s age and health status, and the insurance provider. Premiums are often calculated based on actuarial tables, considering the predicted likelihood of long-term care needs within the insured population. For example, a plan covering a wider range of services or with higher daily care limits will likely have higher premiums.

Employers should obtain quotes from multiple insurance providers to compare options and find the most cost-effective solution.

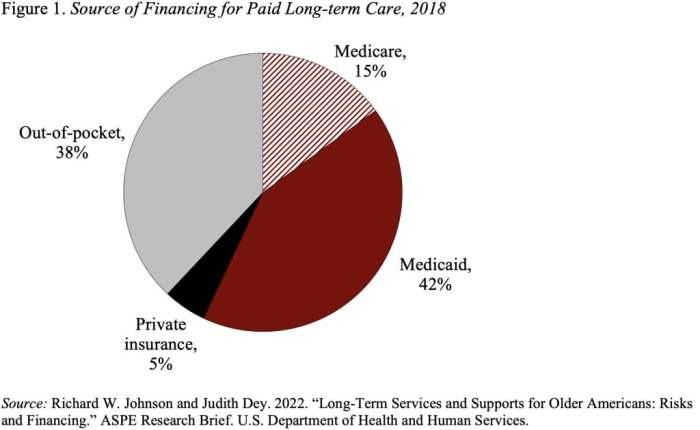

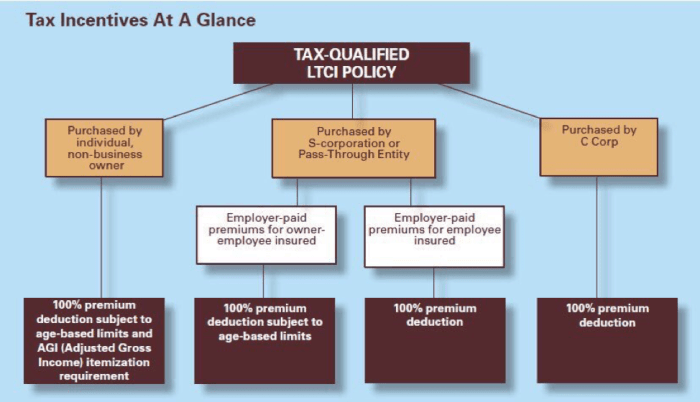

Tax Implications of Employer-Paid Premiums

Employer contributions to employee long-term care insurance premiums are generally tax-deductible for the employer, while the premiums are not typically taxable to the employee. This tax advantage can significantly reduce the overall cost of the benefit for the employer. However, it’s crucial to understand the specific tax regulations and consult with tax advisors to ensure compliance. The tax implications can vary by jurisdiction, and regulations may change over time.

Consult with qualified tax professionals for precise guidance.

Administrative Procedures for Managing Employer-Sponsored Plans

Managing an employer-sponsored long-term care insurance plan requires careful planning and ongoing administration. This includes enrollment processes, premium payment procedures, claim processing, and communication with employees. Employers should develop clear and concise policies and procedures to ensure the plan runs smoothly. Maintaining accurate records and ensuring timely processing of claims is critical. An efficient claims process minimizes disruptions for employees and facilitates timely payouts when needed.

Considerations for Employers Regarding Premium Costs and Administrative Responsibilities

- Carefully assess the potential cost of the plan, considering factors like employee demographics and anticipated claims frequency. Compare quotes from various insurance providers to identify the most suitable plan for the organization’s budget.

- Evaluate the administrative burden of managing the plan, including enrollment, premium collection, claim processing, and communication. Determine if existing administrative resources are sufficient, or if additional staff or systems are needed.

- Understand the tax implications of employer contributions to ensure compliance with tax regulations. Seek advice from qualified tax professionals to ensure the plan aligns with applicable tax laws and avoids potential penalties.

- Establish clear communication channels and resources for employees regarding the plan’s benefits, enrollment procedures, and claim process. Ensure that the plan aligns with company values and employee needs.

Comparing to Other Employee Benefits

Providing long-term care insurance as an employer benefit is a thoughtful consideration, but it’s important to understand how it stacks up against other common benefits. Employees often face choices between different types of coverage, and a clear understanding of the value proposition is key.Employer-sponsored benefits like health insurance and retirement plans are staples in many workplaces. Each type of benefit caters to a specific need, and employees often prioritize them based on their individual circumstances and financial goals.

Evaluating long-term care insurance within this context helps to understand its unique role.

Value Proposition of Long-Term Care Insurance

Long-term care insurance addresses a crucial but often overlooked aspect of employee well-being: future care needs. Unlike health insurance, which primarily focuses on short-term medical expenses, long-term care insurance provides coverage for the extended care often required in later life. This coverage can significantly ease the financial burden of long-term care services, ensuring a more comfortable and secure future.

Comparison to Other Benefits

This comparison highlights the distinct needs addressed by different employee benefits. Health insurance primarily focuses on current medical needs, retirement plans on future financial security, and long-term care insurance on potential future care expenses.

| Benefit Type | Primary Focus | Potential Trade-offs | Value Proposition |

|---|---|---|---|

| Health Insurance | Short-term medical expenses | May not cover long-term care needs. Premiums may be high, especially for extensive coverage. | Crucial for immediate medical needs. |

| Retirement Plans (e.g., 401(k)) | Future financial security | May not cover current or future care expenses. Returns are subject to market fluctuations. | Provides a foundation for retirement income. |

| Long-Term Care Insurance | Future care expenses | Premiums can be a significant cost. Coverage may not be comprehensive enough for all needs. | Protects against the financial burden of long-term care. |

Illustrative Example of Costs and Coverage, Employer paid qualified long term care insurance premiums are typically

Consider a hypothetical employee earning $60,000 per year. A basic health insurance plan might cost $200 per month. A 401(k) contribution of 5% of salary would be $300 per month. Long-term care insurance premiums, depending on the plan, could range from $50 to $200 per month, or more. The coverage amount varies widely depending on the specific plan and the amount of care it covers.

It is important to carefully consider the coverage and the premiums in comparison to other benefit choices. A key consideration is the total financial cost to the employer versus the value provided to the employee.

The relative costs and coverage of different benefits vary significantly based on individual needs, plan choices, and employer contributions. Carefully evaluating these factors is essential for making informed decisions.

Trends and Future Projections: Employer Paid Qualified Long Term Care Insurance Premiums Are Typically

Employer-sponsored long-term care insurance is evolving, mirroring broader shifts in employee benefits and societal needs. Understanding these trends is crucial for both employers and employees to make informed decisions about this vital coverage.The landscape of employee benefits is changing rapidly, with employers increasingly seeking ways to attract and retain top talent. Long-term care insurance, while often overlooked, is gaining recognition as a valuable employee benefit.

This recognition stems from the growing awareness of the rising costs of care and the potential financial burden on individuals.

Current Trends in Employer-Sponsored Long-Term Care Insurance

Employers are increasingly recognizing the importance of providing long-term care benefits. This trend is driven by the growing prevalence of chronic illnesses and the rising costs of healthcare. A key trend is the integration of long-term care insurance with other employee benefit packages. Many companies are now offering more comprehensive packages, including options for both employer and employee contributions.

Potential Future Projections for Employer-Paid Long-Term Care Insurance Premiums

Premiums for long-term care insurance are expected to continue to rise, reflecting the increasing costs of healthcare. Factors such as inflation, healthcare advancements, and demographic shifts will influence these premium adjustments. A possible future scenario involves employers increasing their contributions to offset these rising costs.

Insights on Potential Changes in the Landscape of Employee Benefits

The increasing prevalence of chronic diseases and the rising cost of healthcare will likely drive employers to place more emphasis on preventive care and wellness programs. This emphasis is also likely to extend to programs that support employees’ overall well-being, including mental health and financial literacy.

A Possible Scenario for the Future of Employer-Sponsored Long-Term Care Insurance

In the future, employers might offer a wider range of long-term care options, allowing employees to tailor coverage to their specific needs. This could include various benefit levels, different care types, or even choices regarding the location of care. Employers might also consider partnering with financial institutions to offer financial planning services alongside the insurance. This comprehensive approach could better address the financial anxieties related to long-term care.

Illustrative Case Studies

Employer-sponsored long-term care insurance plans can be a valuable asset for both employees and employers. These plans offer a practical solution to a significant concern, making a positive impact on the lives of employees. Illustrative case studies highlight how such plans can be successfully implemented and managed.These case studies demonstrate the positive effects of these plans on employees’ financial well-being and overall job satisfaction, ultimately benefiting both the individual and the company.

They also provide insights into the factors that contribute to the success of these plans, guiding employers in making informed decisions about their benefits packages.

Example of a Small Business Plan

A small business, “Tech Solutions,” recognized the growing need for long-term care among its employees. They implemented a plan where the company contributed 50% of the premium for basic coverage. This proactive approach proved to be highly effective. Employees appreciated the company’s support, and the plan significantly reduced financial stress related to potential long-term care needs.

A Mid-Sized Company’s Strategy

“Innovate Solutions,” a mid-sized tech firm, offered a more comprehensive long-term care insurance plan with multiple coverage options. The plan allowed employees to choose a plan that best fit their individual needs and budget, while the company’s contribution significantly reduced the overall cost for the employees. This flexibility resonated with employees and enhanced employee satisfaction.

Comparison of Two Similar Companies

Consider two companies in the same industry: “Global Tech” and “Innovate Solutions.” Both companies have similar employee demographics and employee needs. However, their employee benefit packages differ significantly. Global Tech offers a basic health insurance package, with no long-term care coverage. In contrast, Innovate Solutions includes long-term care insurance as a part of their benefits package, covering a significant portion of the premiums.

| Factor | Global Tech | Innovate Solutions |

|---|---|---|

| Long-Term Care Insurance | No | Yes (50% company contribution) |

| Employee Satisfaction | Average | High |

| Employee Retention | Lower | Higher |

| Company Image | Neutral | Positive |

This comparison highlights the tangible advantages of offering long-term care insurance as part of a comprehensive benefits package. Companies like Innovate Solutions see a direct correlation between employee benefits and positive outcomes, such as increased employee satisfaction and lower turnover rates.

Final Wrap-Up

In conclusion, employer-sponsored long-term care insurance presents a compelling option for both employees and employers. Understanding the factors influencing premiums, weighing the benefits against other options, and considering the long-term implications are crucial steps in navigating this complex landscape. The future of these plans seems poised for evolution, mirroring broader trends in employee benefits and reflecting a growing recognition of the importance of financial security in later life.

FAQ Summary

What are the typical tax implications for employees receiving employer-paid long-term care insurance?

The premiums are typically tax-deductible for the employer and not taxable income for the employee. Consult with a tax professional for personalized advice.

How do different insurance providers vary in their long-term care insurance plans?

Providers vary in their coverage levels, waiting periods, and maximum benefit amounts. Comparing plans and their associated premiums is essential.

What are some common complaints about employer-sponsored long-term care insurance?

Some common complaints revolve around limited coverage options, high premiums, and confusing plan details. Careful consideration of these aspects is essential before making a decision.

How does the insured’s health status affect long-term care insurance premiums?

Generally, individuals with pre-existing health conditions or higher risk factors will pay higher premiums. This is a standard actuarial practice.