How can I find out if someone has car insurance? This guide delves into the murky world of verifying someone’s car insurance, from public records to shady third-party sites. We’ll navigate the legalities, ethical minefields, and practical pitfalls, giving you the lowdown on safe and effective ways to get the info you need.

From checking for insurance stickers to using online databases, we’ll unpack a whole range of methods. We’ll also look at the potential risks and rewards of each approach, ensuring you’re fully clued up before you start digging.

Methods for Checking Insurance Information

Determining whether an individual possesses car insurance is crucial in various contexts, from assessing liability in accidents to evaluating creditworthiness. Accurate verification is essential to avoid misjudgments and ensure responsible decision-making. This process requires careful consideration of available methods and their inherent limitations.Accurate verification of car insurance is essential in various situations. This often involves a nuanced approach, weighing the advantages and disadvantages of different methods to obtain accurate information, while respecting legal and ethical boundaries.

Public Records Searches

Public records searches, while often accessible, may not always provide comprehensive insurance information. Such searches might reveal the existence of a registered vehicle but may not include details about insurance coverage. Their limitations stem from the varying levels of detail maintained in different jurisdictions and the fact that insurance policies are not always part of public records. Cost is generally minimal, and accessibility depends on local regulations.

Privacy concerns may arise, as the information revealed might be broader than strictly necessary.

Online Databases and Lookup Services

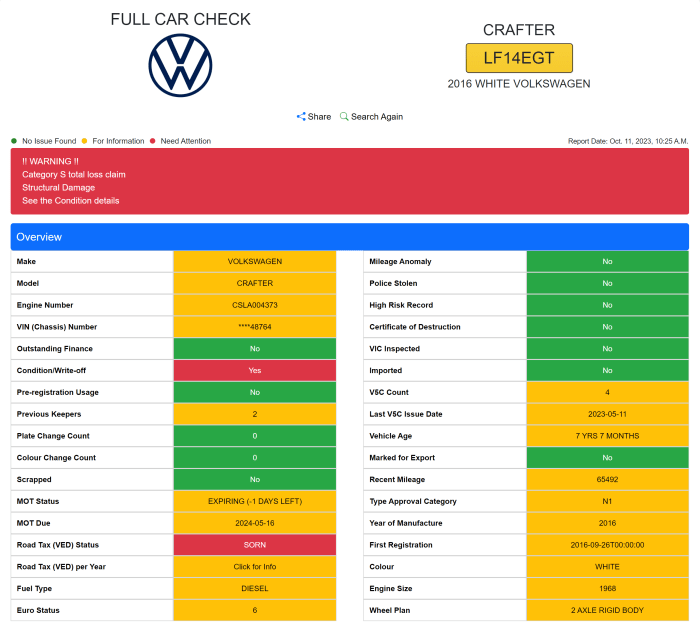

Several online databases and lookup services provide access to insurance information. These platforms typically allow users to enter a vehicle identification number (VIN) or other identifying details to access policy details. This method often offers convenience and speed, making it suitable for quick checks. However, access to these services may have costs, which vary widely. Accessibility is contingent on the user’s ability to access and utilize online resources, while privacy depends on the platform’s security measures.

Direct Inquiries

Direct inquiries to the insurance company involved are often the most reliable method. This involves contacting the insurer directly for verification. However, this method might be less accessible or require more effort. Pros include the possibility of obtaining detailed and accurate information. Cons include the potential for delays and difficulties in contacting the insurance company.

This method typically requires more time and resources than other options. Privacy concerns are minimized as long as the individual being checked is properly identified.

Comparison of Methods

| Method | Pros | Cons | Cost | Accessibility | Privacy |

|---|---|---|---|---|---|

| Public Records Searches | Low cost, readily available in some jurisdictions | Limited information, may not include insurance details | Minimal | High | Potential for broader data exposure |

| Online Databases/Lookup Services | Convenience, speed | Costly, may not be comprehensive | Variable | High (internet access required) | Dependent on platform security |

| Direct Inquiries | Potentially most accurate, detailed information | Time-consuming, potentially difficult | Potentially high | Variable | Minimized with proper identification |

Legal and Ethical Implications

Obtaining someone’s insurance information without their consent is a serious ethical and legal concern. It is essential to recognize that such actions are generally inappropriate and could lead to legal repercussions. Individuals should respect the privacy of others and only access information through authorized channels. This is especially crucial in situations involving financial transactions, legal disputes, or personal matters.

Violation of privacy could lead to significant legal challenges and financial penalties.

“Unauthorized access to personal information, including insurance details, is unethical and often illegal.”

Public Records Access

Public records related to car insurance are not uniformly accessible across jurisdictions. The availability and scope of these records vary significantly, often dictated by local laws, regulations, and public interest considerations. This necessitates a nuanced understanding of specific jurisdictions when seeking such information.The concept of public records in the context of car insurance typically revolves around documents that are maintained by government agencies or entities, which are often involved in regulating or overseeing insurance activities.

These records may not necessarily be readily available for the general public.

Availability of Public Records by Jurisdiction, How can i find out if someone has car insurance

Access to public records related to car insurance is subject to the legal frameworks governing public records in each jurisdiction. These frameworks define what types of information are considered public records and the conditions under which they can be accessed.

- In some jurisdictions, details about insurance claims, including the amounts paid, may be accessible through specific public record requests. However, personal information about policyholders, such as their names and addresses, is often protected by privacy laws.

- Other jurisdictions may restrict the release of any information related to insurance policies or claims due to concerns about the privacy of individuals and the potential for misuse of this data.

- The availability of public records pertaining to insurance fraud investigations is often limited, subject to legal requirements and the specific details of the investigation.

Types of Publicly Accessible Information

The types of publicly accessible information related to car insurance vary. Information might include data on insurance policies that are part of the regulatory oversight process or documents related to insurance-related investigations.

- Regulatory filings, such as insurance company financial reports or policy rate filings, may be accessible under specific circumstances, though they may not directly reveal information about individual policies.

- Court records pertaining to insurance-related lawsuits or disputes might contain some publicly accessible information, though specific details may be redacted.

- Data regarding insurance fraud investigations, if publicly available, would typically contain only aggregate data or general trends, and not specific details about individual cases.

Limitations and Restrictions

Accessing public records related to car insurance is often subject to limitations and restrictions. These restrictions aim to balance public access with the need to protect individual privacy and the integrity of the insurance industry.

- Privacy laws and regulations are often invoked to protect personal information about policyholders, such as names, addresses, and policy details.

- Certain types of records, such as those related to ongoing investigations or sensitive legal matters, may be restricted to prevent harm or disruption.

- Fees and procedural requirements may apply to accessing public records, potentially limiting access for individuals or organizations lacking resources.

Comparative Analysis of Public Record Availability

| Country/Region | Public Record Availability | Limitations |

|---|---|---|

| United States (selected states) | Variable | Privacy laws, differing state regulations, potential for redaction of sensitive data. |

| United Kingdom | Limited | Strict data protection laws, complex procedures for accessing records. |

| Canada (selected provinces) | Variable | Provincial variations in freedom of information laws, privacy protections. |

Insurance Company Policies

Insurance companies maintain stringent policies regarding the release of customer information, dictated by a complex interplay of legal requirements and internal privacy guidelines. These policies are crucial for safeguarding customer data while enabling legitimate requests for information. Understanding these policies is essential for individuals seeking access to their insurance records or those involved in legal proceedings requiring such information.Insurance companies must balance the need to provide necessary information to authorized parties with the right to privacy of their customers.

This necessitates a careful consideration of various factors including the nature of the request, the identity of the requester, and the specific information being sought. Compliance with legal requirements and internal policies is paramount to maintain trust and prevent potential legal ramifications.

Policies Regarding Information Release

Insurance companies typically establish specific policies governing the sharing of customer information. These policies often Artikel the conditions under which information can be disclosed, the types of information that can be shared, and the procedures for requesting such information. Strict adherence to these policies is crucial for ensuring compliance with privacy regulations and maintaining customer trust.

Comparison of Privacy Policies

A comparative analysis of insurance provider policies reveals varying approaches to information sharing. This disparity often stems from differences in company culture, legal jurisdictions, and the complexity of individual customer data.

| Insurance Provider | Information Sharing Policy | Contact Information |

|---|---|---|

| Example Provider 1 | Limited sharing, primarily to authorized parties with valid documentation supporting the request. | Website, phone number |

| Example Provider 2 | Strict restrictions on information sharing, requiring specific legal mandates or court orders for disclosure. | Website, email address |

| Example Provider 3 | Comprehensive policy outlining specific procedures for various types of information requests, including requests from legal representatives. | Website, phone number, dedicated email address for inquiries |

Legal Requirements Governing Information Sharing

The sharing of insurance information is governed by a multitude of legal regulations, primarily focusing on data privacy and consumer protection. These regulations vary depending on the jurisdiction, but generally mandate that insurance companies obtain explicit consent from the customer before sharing sensitive information or adhere to court orders or subpoenas. Compliance with these laws is essential to avoid penalties and maintain the company’s reputation.

For example, the Health Insurance Portability and Accountability Act (HIPAA) in the United States plays a significant role in protecting health-related information, which may be contained in some insurance policies.

Procedures for Requesting Insurance Information

Individuals seeking insurance information from a company should adhere to the specific procedures Artikeld in the insurance provider’s policy. These procedures often involve completing a formal request form, providing identification documents, and adhering to any deadlines specified by the company. A well-documented and structured approach enhances the chances of a successful request and minimizes any potential delays. Companies typically provide detailed information on their websites, which Artikels the procedures and required documentation.

Thorough understanding of the policy and procedures is vital to avoid complications.

Potential Pitfalls and Risks: How Can I Find Out If Someone Has Car Insurance

Accessing someone’s insurance information without their explicit consent carries significant legal and ethical ramifications. This unauthorized access can expose individuals to substantial risks, ranging from civil penalties to criminal charges. Understanding these potential pitfalls is crucial for maintaining ethical conduct and legal compliance when dealing with personal data.Obtaining insurance information illegally can lead to severe consequences, including legal action, financial penalties, and reputational damage.

The potential for harm extends beyond the individual directly targeted; it also affects the broader principles of data privacy and responsible information handling. Careful consideration of the legal and ethical implications is essential before any attempt to access such sensitive data.

Legal Consequences of Unauthorized Access

Unauthorized access to insurance information constitutes a violation of privacy laws and regulations, potentially leading to significant legal repercussions. These consequences can range from civil lawsuits for damages to criminal charges, depending on the severity of the violation and applicable jurisdiction. Penalties can include hefty fines, injunctions, and even imprisonment.

- Violation of privacy laws, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States or the General Data Protection Regulation (GDPR) in Europe, often carries severe penalties. These laws protect sensitive personal information, including insurance details.

- Accessing insurance information without consent may constitute a breach of contract with the insurance company, potentially exposing the individual to financial liability if the company incurs losses due to the unauthorized disclosure.

- In some jurisdictions, unauthorized access to insurance information may be classified as a crime, with corresponding penalties including fines and imprisonment. The specific legal implications depend on the extent of the violation, the specific laws in place, and the intent behind the action.

Ethical Considerations in Information Access

Ethical considerations regarding the acquisition of personal data are paramount. The act of accessing someone’s insurance information without their consent directly contradicts ethical principles of respect for individual autonomy, confidentiality, and the responsible handling of sensitive data. Ethical conduct prioritizes the protection of personal information and upholds the individual’s right to privacy.

- The principle of informed consent dictates that individuals have the right to know how their data will be used and to control who has access to it. Accessing insurance information without this consent undermines this fundamental principle.

- The unauthorized access and use of insurance information can damage the reputation of individuals and organizations involved. Maintaining trust and integrity is critical in handling personal data, and unethical practices can result in significant reputational harm.

- Individuals should always adhere to professional codes of conduct and ethical guidelines, which often include strict prohibitions against the unauthorized access or disclosure of personal information.

Comparison of Legal and Ethical Strategies

A crucial aspect is understanding and utilizing legal and ethical strategies for obtaining information. This comparison emphasizes the significance of complying with applicable laws and ethical standards. Examples of legal and ethical strategies include obtaining explicit consent, using legally permissible data access methods, and adhering to professional codes of conduct.

- Seeking legal counsel to understand the relevant laws and regulations is crucial. Consulting with a lawyer familiar with data privacy laws can help individuals navigate the legal complexities and avoid potential pitfalls.

- Directly contacting the insurance company and requesting information through the proper channels, often requiring appropriate identification and authorization, is a critical legal and ethical approach.

- Using public records access methods when permitted and adhering to all legal restrictions and requirements related to the specific records is an essential part of the process. Careful consideration and adherence to the stipulations of the relevant laws and regulations are crucial.

Examples of Legal Trouble from Unauthorized Access

Unauthorized access to insurance information can lead to substantial legal trouble. This can range from civil lawsuits for damages to criminal charges, depending on the specific context.

- A case where an individual illegally obtained insurance information to commit fraud and cause financial harm to the insurance company or the insured person illustrates the severe legal ramifications.

- An employee accessing an individual’s insurance records without consent to fulfill personal gain, which could result in penalties or criminal charges, demonstrates the severity of unauthorized access.

- In cases of identity theft or insurance fraud, where an individual utilizes someone else’s insurance information without consent, substantial legal repercussions may follow. The potential for financial harm and reputational damage is significant.

Alternative Approaches

Alternative methods for verifying insurance coverage offer practical, albeit potentially less precise, avenues for assessment. These approaches, while not always foolproof, can supplement more formal verification methods and provide a preliminary indication of insurance status. Their accuracy and reliability, however, are contingent on the specific context and available data.These alternative methods provide an initial screening process, offering a way to narrow down potential leads before proceeding with more intensive and potentially costly formal verification procedures.

The accuracy and reliability of these methods vary considerably, and users should exercise caution when interpreting the results obtained from them.

Visual Inspection of Vehicles

Visual inspection of vehicles for insurance stickers or decals is a quick and readily accessible preliminary step. Identifying such indicators can provide a preliminary assessment of whether insurance coverage might exist. However, the presence of these markers does not guarantee the validity or completeness of the coverage. The lack of these markers does not definitively preclude insurance.

Third-Party Verification Services

Third-party verification services specialize in providing insurance information. These services often employ databases and sophisticated search algorithms to retrieve insurance details. Their accuracy depends on the completeness and reliability of the databases they access. Furthermore, the cost of such services should be considered, as they can vary considerably based on the level of detail and service required.

Vehicle Registration Records

Accessing vehicle registration records can provide information regarding the registered owner and, in some cases, details about the associated insurance policy. These records, if accessible, may show the registered insurance provider. However, the level of detail varies significantly based on jurisdiction and data availability. The reliability of this method hinges on the accuracy and timeliness of the vehicle registration database.

Steps for Verifying Insurance Using Alternative Methods

- Visual Inspection of Vehicle: Examine the vehicle for visible insurance stickers or decals. Note that the presence of such markings is not a conclusive indication of insurance, while the absence does not definitively rule it out.

- Third-Party Verification Services: Utilize third-party verification services that specialize in insurance information. These services may require payment and are subject to the accuracy of their databases. Compare prices and evaluate service options carefully.

- Vehicle Registration Records: Access vehicle registration records, if permitted, to check for the registered owner and associated insurance information. The comprehensiveness of the details may vary significantly depending on the specific jurisdiction.

Outcome Summary

In conclusion, finding out if someone has car insurance involves navigating a complex web of legal and ethical considerations. While some methods offer straightforward access, others carry significant risks. Ultimately, understanding the potential pitfalls and choosing ethical and legal methods is key. Remember, always be respectful of privacy and avoid any illegal activities.

FAQ

Can I just ask the person directly?

Legally, you’re generally fine to ask someone if they have insurance. However, it’s not an official verification. This is a low-risk option, but it doesn’t offer the hard proof other methods provide.

What if I’m in a different country?

Public record access varies greatly between countries. Some have more readily available information, while others have extremely strict regulations. Always check the local laws and regulations before pursuing any method.

Are there any free online tools to check insurance?

Yes, but be cautious. Some websites offer insurance lookup services, but the accuracy and legitimacy can be questionable. Always compare findings with multiple sources before making any judgments.

What happens if I try to access someone’s insurance illegally?

Violating privacy laws carries severe legal consequences. You could face hefty fines or even criminal charges. It’s vital to use only legitimate and ethical methods.