How much does it cost to start a nonprofit organization? Starting a non-profit is a big deal, but the upfront costs can be surprisingly high. From legal fees and incorporation to licenses and potential tax-exempt status, it’s not just about passion – it’s about practicality. This overview dives into the nitty-gritty, exploring the initial setup costs, ongoing operational expenses, fundraising strategies, staff and volunteer needs, technology and infrastructure, legal compliance, and program costs.

It’s a real-world look at the financial side of making a difference.

Understanding the financial landscape of non-profit startups is crucial. Different types of non-profits have varying needs, and factors like size and scope significantly impact the budget. This exploration provides a clear picture of the potential expenses involved in launching and sustaining a successful non-profit. From calculating the cost of various fundraising approaches to assessing the pros and cons of different staffing models, this breakdown provides actionable insights for aspiring non-profit leaders.

Initial Setup Costs: How Much Does It Cost To Start A Nonprofit Organization

Establishing a nonprofit organization necessitates careful consideration of initial setup costs. These expenses, encompassing legal and administrative procedures, are crucial for a smooth launch and long-term sustainability. Understanding these costs enables potential founders to develop realistic budgets and explore funding opportunities.The initial setup phase often involves substantial legal and administrative expenses, which can vary significantly depending on the complexity of the organization’s structure and the jurisdiction in which it operates.

Thorough financial planning and proactive cost management strategies are essential for ensuring the organization’s viability.

Legal and Incorporation Costs

Initial legal costs typically encompass attorney fees for drafting articles of incorporation, bylaws, and other essential legal documents. These costs can vary greatly based on the complexity of the organization’s structure, the chosen state of incorporation, and the experience level of the legal counsel. Small organizations might incur fees in the range of a few hundred dollars to a few thousand, while larger or more complex organizations could face costs exceeding tens of thousands.

Incorporation fees themselves, imposed by the state, represent a further element of these initial expenses.

Required Licenses and Permits

Nonprofit organizations frequently require specific licenses and permits, depending on their activities and the applicable regulations in their jurisdiction. These requirements can range from general business licenses to permits associated with specific operations, such as fundraising or providing services to vulnerable populations. Obtaining these permits and licenses can entail fees and administrative procedures. For example, a nonprofit focused on environmental advocacy might need permits for public gatherings or educational outreach programs.

Cost Comparison Across Nonprofit Types

| Nonprofit Type | Typical Legal Fees | Incorporation Costs | Licenses/Permits |

|---|---|---|---|

| 501(c)(3) (Charitable) | $500 – $5,000+ | $50 – $500+ | Variable, based on activities |

| 501(c)(4) (Social Welfare) | $500 – $5,000+ | $50 – $500+ | Variable, based on activities |

| Other Types | Variable, based on complexity | Variable, based on complexity | Variable, based on activities |

Note: The figures in the table represent estimations and can differ significantly depending on the specifics of each organization.

Minimizing Initial Setup Costs

Several strategies can be employed to minimize initial setup costs. One approach is to leverage pro bono legal services offered by attorneys or law firms specializing in nonprofit law. Another strategy involves utilizing online resources and templates for creating basic legal documents. Furthermore, collaborating with experienced nonprofit advisors or mentors can provide valuable guidance and support. These advisors can offer insights into streamlining processes and navigating regulatory requirements.

Tax-Exempt Status Costs

Securing tax-exempt status under Section 501(c)(3) or similar provisions typically entails additional costs. These costs may involve filing IRS Form 1023, which requires a detailed description of the organization’s mission, structure, and financial projections. Professional assistance from tax advisors or consultants might be necessary for navigating the complex application process.

Funding Initial Setup Costs

Securing funding for initial setup costs can be accomplished through a variety of avenues. Grants from foundations, government agencies, and corporations can provide substantial support. Fundraising efforts, including individual donations and crowdfunding campaigns, are also viable options. Furthermore, personal investment from founders or key stakeholders can play a crucial role in covering initial expenses. Some organizations may explore the possibility of seeking loans from banks or other lending institutions.

- Grants: Foundations, government agencies, and corporations frequently offer grants specifically designed to support nonprofit organizations in their initial stages. Researching relevant grant opportunities is crucial.

- Donations: Individual donors and community members can contribute to the initial setup costs through direct donations.

- Crowdfunding: Online platforms facilitate fundraising campaigns to gather support from a wider network of potential donors.

- Personal Investment: Founders and key stakeholders can provide personal investment to cover initial setup expenses.

- Loans: Loans from banks or other lending institutions can be an option, but repayment plans should be carefully considered.

Ongoing Operational Expenses

Nonprofit organizations face unique challenges in managing their ongoing operational expenses. These expenses, which include salaries, rent, utilities, and program costs, are crucial to sustaining operations and achieving their mission. Understanding these costs, particularly the difference between small and large nonprofits, is vital for effective budgeting and resource allocation. Efficient management of these recurring expenditures is essential for long-term sustainability.

Recurring Expenses, How much does it cost to start a nonprofit organization

Understanding the recurring expenses of a nonprofit is critical for proper financial planning. These costs, while seemingly straightforward, can vary significantly based on the size and scope of the organization. Salaries for staff, rent for office space, and utilities for operation are fundamental elements. Program costs, which encompass materials, equipment, and personnel directly involved in implementing the organization’s mission, are also essential recurring expenditures.

Comparison of Operational Costs: Small vs. Large Nonprofits

The operational cost structure differs significantly between small and large nonprofits. Small nonprofits, often with limited staff and programs, typically experience lower overall expenses for salaries, rent, and utilities. Conversely, large nonprofits, with extensive staff, complex programs, and potentially multiple locations, face substantially higher recurring expenses. These differences must be considered when evaluating financial health and developing budgets.

For example, a small environmental advocacy group might spend primarily on volunteer coordination and educational materials, while a large national conservation organization may incur significant costs for research, advocacy campaigns, and staff salaries.

Fundraising Methods and Costs

Effective fundraising is crucial for nonprofits to sustain operations. Various methods exist, each with varying levels of cost associated.

- Grant Writing: Grant writing involves significant time and effort in proposal development. While the grants themselves are typically free, the cost includes staff time, research, and potential consultant fees. For example, a successful grant application might involve multiple staff members dedicating several hours each week over months to complete a proposal.

- Donations/Individual Giving: This method often relies on direct outreach to individuals and can include website development and maintenance for online donation platforms, which can involve recurring costs. Costs associated with maintaining donor databases and tracking donations also need consideration. A successful crowdfunding campaign might require substantial investment in marketing and social media management.

- Corporate Sponsorships: Securing corporate sponsorships involves outreach, relationship building, and potential negotiation costs. These can include staff time dedicated to relationship development and the costs of organizing events for sponsors.

- Fundraising Events: Organizing fundraising events, such as galas or walks, incurs costs related to venue rentals, marketing, catering, and event staff. For example, a large-scale gala might require significant expenses for venue rental, catering, and promotional materials.

Fundraising Methods and Costs

| Fundraising Method | Associated Costs |

|---|---|

| Grant Writing | Staff time, research, potential consultant fees |

| Donations/Individual Giving | Website maintenance, donor database management, donation processing fees |

| Corporate Sponsorships | Outreach, relationship building, event organization |

| Fundraising Events | Venue rental, marketing, catering, event staff |

Cost-Saving Strategies

Implementing cost-saving strategies is essential for the long-term viability of a nonprofit. Careful budgeting and strategic resource allocation can help reduce recurring expenses without compromising the organization’s mission.

- Negotiate favorable contracts: Negotiating favorable contracts for rent, utilities, and other services can significantly reduce ongoing costs. For example, a nonprofit might negotiate a lower rent rate for office space or a better deal for internet service.

- Leverage volunteer resources: Utilizing volunteer labor can reduce payroll expenses and allow for greater flexibility in program implementation. Nonprofits often find valuable assistance from volunteers for administrative tasks, outreach, and event support.

- Optimize program delivery: Evaluating and streamlining program delivery methods can lead to cost reductions in materials, equipment, or personnel. For example, a nonprofit might explore more cost-effective ways to deliver educational workshops or training programs.

- Explore alternative funding sources: Diversifying funding sources can mitigate reliance on a single source of revenue. This might involve exploring new grant opportunities or developing innovative fundraising strategies.

Budget Template for a Nonprofit

A detailed budget template for a nonprofit should include projected revenue and expenses for a specific period. The template should Artikel categories such as program costs, salaries, rent, utilities, and fundraising expenses. The template should clearly distinguish between one-time and recurring expenses. Regular review and adjustments to the budget are essential for adapting to changing circumstances and ensuring financial stability.

A robust budget template should allow for accurate tracking of income and expenditures, enabling effective resource management. A well-structured template allows for efficient monitoring of progress toward financial goals.

Fundraising and Donations

Securing funding is crucial for the long-term sustainability of a nonprofit organization. Effective fundraising strategies not only provide essential resources but also build public awareness and support for the organization’s mission. A well-structured fundraising plan is vital to achieving these goals. This plan should detail the various methods, anticipated costs, and expected outcomes.Successful fundraising involves a multifaceted approach tailored to the specific needs and goals of the organization.

It requires careful consideration of various methods, including grants, donations, and events, along with the associated costs and potential returns.

Grant Acquisition Strategies

Grant applications require meticulous planning and preparation. A comprehensive understanding of the criteria for grant awards is paramount. Researching and identifying potential funders whose missions align with the organization’s objectives is essential. This often involves a significant investment of time and resources, including personnel dedicated to grant writing and research.

- Identifying Funding Sources: Thorough research into potential funders is crucial. This involves examining grant guidelines, eligibility requirements, and application deadlines. Nonprofit organizations should target grants that align with their mission and objectives. A thorough review of existing grants can reveal trends and provide insights into grant applications.

- Developing Compelling Proposals: Grant proposals must clearly articulate the organization’s mission, impact, and financial needs. A strong narrative outlining the problem, proposed solution, and expected outcomes is critical for success. These proposals must demonstrate a clear understanding of the funding source’s priorities and align with their strategic goals. Detailed budgets and timelines should be included to demonstrate financial responsibility.

- Tracking and Evaluating Results: Tracking the progress of grant applications and funding allocations is vital. This involves monitoring application status, analyzing successful and unsuccessful applications, and adjusting strategies based on insights gained. Organizations should analyze the effectiveness of different approaches to maximize grant funding and ensure the funds are used effectively.

Donation Acquisition Strategies

Cultivating a strong donor base is a cornerstone of successful fundraising. A comprehensive approach encompassing direct mail campaigns, online platforms, and community engagement is often required. Building relationships with potential donors involves establishing trust and demonstrating the impact of the organization’s work.

- Developing a Donor Database: Maintaining an accurate and updated donor database is essential for personalized communication and targeted fundraising efforts. This database should include contact information, donation history, and preferences. This data allows for targeted outreach, tailored communication, and recognition of donors.

- Implementing Direct Mail Campaigns: Direct mail remains a powerful tool for reaching potential donors. Well-designed materials conveying the organization’s mission, impact, and financial needs can effectively engage donors. Targeted messaging based on donor profiles and preferences can significantly improve response rates.

- Leveraging Online Platforms: Online fundraising platforms provide accessible channels for donations. Websites and social media platforms can increase visibility and facilitate direct interaction with potential donors. This allows for broader outreach and allows for the use of multimedia to enhance engagement.

Fundraising Event Strategies

Fundraising events, such as galas and auctions, offer opportunities to engage donors and raise significant funds. Planning and executing these events requires careful consideration of costs, logistics, and marketing.

- Event Planning and Budgeting: Thorough planning is essential for successful fundraising events. A detailed budget encompassing venue costs, marketing expenses, catering, and other logistical elements should be developed. This ensures effective resource allocation and prevents overspending.

- Marketing and Promotion: Effective marketing strategies are crucial for promoting events and attracting attendees. These strategies can include social media campaigns, email marketing, and partnerships with local businesses. This ensures that the target audience is aware of the event and encouraged to participate.

- Volunteer Management: Engaging volunteers for event organization and execution can significantly reduce costs. Recruitment and training procedures should be well-defined to maximize efficiency and effectiveness. Volunteers can provide essential support in various areas, from marketing to event setup.

Staff and Volunteers

A critical component of any nonprofit organization’s operational structure is its human capital. Effective management of both staff and volunteers is essential for achieving mission goals and maximizing impact. The cost associated with these individuals, encompassing salaries, benefits, and training, directly influences the organization’s financial sustainability and long-term viability. Understanding these costs is vital for developing realistic budgets and strategic staffing plans.Understanding the potential benefits of both staff and volunteers allows for a more nuanced approach to workforce management.

Nonprofits often leverage both staff and volunteer labor to fulfill their diverse needs. This blend allows the organization to allocate resources effectively and optimize efficiency. Staff can provide consistent expertise, while volunteers can contribute valuable time and skills. This multifaceted approach contributes to a more robust and capable organization.

Staffing Costs

The cost of hiring and maintaining staff includes a range of expenses. Salaries are a primary consideration, varying significantly based on the position’s responsibilities and the geographic location. Benefit packages, including health insurance, retirement plans, and paid time off, can substantially increase the overall cost of employment. Moreover, training and development programs are crucial for staff to acquire the skills and knowledge needed to perform their duties effectively.

Volunteer Recruitment and Management

Recruiting and managing volunteers requires a distinct approach from staff management. Effective volunteer programs often involve initial screening and training to ensure alignment with the organization’s mission and the tasks assigned. Managing volunteer schedules and tasks requires clear communication and organization. Maintaining enthusiasm and engagement among volunteers is critical to ensuring ongoing participation. Strategies for recognizing and rewarding volunteers can significantly impact retention.

Staff vs. Volunteer Comparison

| Characteristic | Staff | Volunteer |

|---|---|---|

| Cost | Higher (salaries, benefits, training) | Lower (no salary or benefits) |

| Expertise | Specialized knowledge and skills | Variable; may or may not have relevant skills |

| Commitment | Regular and predictable | Variable and potentially less consistent |

| Flexibility | Limited flexibility in scheduling | More flexible scheduling |

| Training | Training typically provided | Training often required and may need to be provided |

| Accountability | Higher accountability to organization | Lower accountability compared to staff |

Volunteer Compensation

Nonprofits employ various methods to compensate volunteers for their contributions. These methods go beyond monetary compensation. Recognition and appreciation, both formal and informal, can be powerful motivators. Opportunities for professional development and skill-building are valuable incentives. Volunteer recognition events, certificates of appreciation, and public acknowledgments can be effective strategies.

Furthermore, access to networking opportunities and leadership roles within the organization can be significant incentives.

Staff and Volunteer Training and Development

Comprehensive training programs for both staff and volunteers are crucial. These programs ensure employees possess the necessary knowledge and skills to execute their duties effectively and contribute to the organization’s mission. Costs associated with training programs vary widely, depending on the program’s scope, duration, and materials. These programs can include workshops, seminars, online courses, mentoring, and on-the-job training.

Effective training contributes significantly to staff and volunteer performance and retention. A well-trained workforce translates into improved outcomes and greater organizational efficiency.

Technology and Infrastructure

Effective technology is crucial for a nonprofit’s smooth operation and efficient delivery of services. A well-structured technological framework streamlines administrative tasks, enhances communication, and enables data-driven decision-making. From basic communication tools to sophisticated data management systems, the right technological choices are essential for long-term sustainability and impact.

Essential Technology Tools

The choice of technology tools depends on the specific needs and size of the organization. Essential tools often include email platforms, project management software, accounting software, and a website. These tools are fundamental for communication, task coordination, financial management, and outreach.

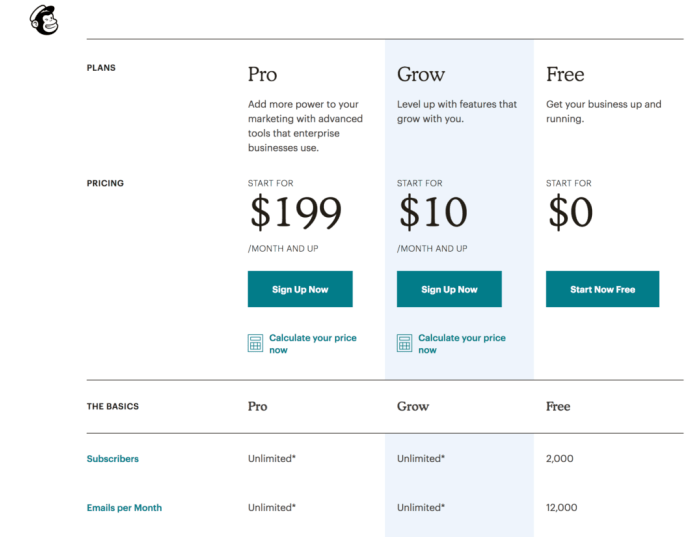

- Email Platforms: Essential for communication with donors, volunteers, and staff. Tools like Gmail or specialized nonprofit email platforms offer various features, from email marketing to contact management, impacting communication efficiency and cost-effectiveness.

- Project Management Software: Critical for managing tasks, deadlines, and team responsibilities, improving project workflow. Tools like Asana or Trello help track progress and ensure projects are completed on time and within budget.

- Accounting Software: Essential for managing finances, tracking income and expenses, and generating reports. Tools like QuickBooks or specialized nonprofit accounting software provide essential tools for financial transparency and accountability.

- Website: A critical component for online presence and outreach, allowing potential donors and volunteers to learn more about the organization’s mission and activities. A user-friendly website fosters engagement and promotes transparency.

Technology Maintenance and Updates

Regular maintenance and updates are crucial for optimal performance and security. Software updates often address security vulnerabilities, performance issues, and introduce new functionalities. This upkeep ensures data protection and efficient operations. The cost of maintenance can vary depending on the chosen tools and their features. Licensing fees, support contracts, and training costs contribute to these expenses.

- Software Updates: Regular software updates are critical to security and performance. They usually include security patches, bug fixes, and new features. The cost associated with updates often varies depending on the provider’s model and the specific tools used.

- Security Maintenance: Protecting sensitive data is paramount. Regular security checks and updates mitigate risks associated with cyber threats. This often involves employing security software, firewalls, and regular security audits.

- Staff Training: Training staff on new software and updates is crucial to maximizing efficiency and minimizing errors. Dedicated training programs improve user proficiency and promote successful implementation of the chosen tools.

Cloud-Based Software Options

Cloud-based solutions offer scalability and accessibility. They typically have a subscription model, allowing nonprofits to pay for usage or features as needed. The cost of cloud-based software depends on the features and usage.

| Software | Features | Typical Cost (per month) |

|---|---|---|

| Nonprofit-Specific CRM | Contact management, fundraising tools, reporting | $50 – $500+ |

| Project Management Software (e.g., Asana, Trello) | Task management, collaboration tools | $10 – $200+ |

| Accounting Software (e.g., QuickBooks Online) | Financial management, reporting | $20 – $200+ |

Choosing Cost-Effective Technology Solutions

A strategic approach to technology selection is essential. Prioritize essential tools and evaluate pricing models, subscription options, and feature sets. Nonprofits should consider the long-term value and sustainability of their technology choices.

- Needs Assessment: Identify the specific needs of the organization. Thorough assessment ensures that the chosen technology solutions align with the organization’s goals and activities.

- Cost-Benefit Analysis: Compare the cost of different solutions to their potential benefits. A comprehensive analysis helps make informed decisions.

- Free/Open-Source Options: Consider open-source or free alternatives where possible. These options can often offer comparable functionalities without the associated subscription costs.

Leveraging Technology for Cost Reduction

Technology can be leveraged to streamline operations and reduce costs. Automation of tasks, remote work capabilities, and efficient communication tools can significantly impact expenses.

- Automation: Automate repetitive tasks like data entry or email marketing. Automation can reduce labor costs and increase efficiency.

- Remote Work: Leverage remote work tools to reduce office space costs and enable wider access to talent pools.

- Communication Tools: Implement efficient communication tools like instant messaging or video conferencing to reduce travel expenses and improve communication.

Legal and Compliance

Establishing and maintaining a nonprofit organization necessitates meticulous adherence to legal frameworks and regulatory compliance. These requirements, while often perceived as bureaucratic hurdles, are crucial for the organization’s long-term viability and public trust. Navigating the legal landscape requires careful consideration of costs associated with initial setup, ongoing maintenance, and potential penalties for non-compliance.Compliance with legal frameworks is paramount for a nonprofit’s credibility and operational effectiveness.

Failure to adhere to these regulations can lead to legal challenges, reputational damage, and even dissolution of the organization. Understanding the costs associated with legal advice and compliance procedures is essential for effective financial planning and resource allocation.

Costs of Legal Consultations

Comprehensive legal counsel is essential during the initial stages of nonprofit formation and throughout its operational life cycle. Initial consultations are often required to draft crucial legal documents such as the articles of incorporation, bylaws, and tax exemption applications. Ongoing legal support is also vital for maintaining compliance with evolving regulations and addressing complex legal issues.

Ongoing Legal Support and Maintenance

Ongoing legal support is not a one-time expenditure. Nonprofits must anticipate the need for legal counsel to navigate compliance issues, such as changes in tax laws, grant regulations, and reporting requirements. This may include review of contracts, compliance with labor laws if employing staff, and ensuring adherence to donor regulations. The frequency and depth of legal support required will vary based on the organization’s size, complexity, and specific activities.

The costs associated with this ongoing support can be significant, and careful budgeting is essential.

Importance of Staying Compliant with Regulations

Maintaining compliance with regulations is crucial for the continued operation of a nonprofit organization. Failure to comply can lead to penalties, audits, and even legal action. These repercussions can significantly impact the organization’s financial stability and reputation. Examples of such regulations include those related to fundraising practices, financial reporting, and the use of public funds. These regulations are often intricate and subject to change, necessitating ongoing vigilance and legal expertise.

Need for Legal Counsel and Potential Costs

Engaging legal counsel can vary significantly in cost depending on the complexity of the organization’s legal needs and the chosen legal professional. Initial legal consultations for drafting key documents like articles of incorporation, bylaws, and tax exemption applications are essential. In addition, ongoing legal support for contract review, compliance with evolving regulations, and resolution of potential legal disputes can be substantial.

Larger organizations with more complex operations will require more extensive legal support, resulting in higher associated costs.

Examples of Legal Documents and Their Associated Costs

- Articles of Incorporation: The articles of incorporation establish the legal existence of the nonprofit. The associated legal costs can range from several hundred to several thousand dollars depending on the complexity of the organization’s structure and the expertise of the legal counsel. The cost will include research, drafting, and filing fees.

- Bylaws: Bylaws Artikel the internal governance of the nonprofit, including the roles and responsibilities of board members, decision-making processes, and fundraising procedures. Costs vary based on the organization’s complexity and the legal professional’s experience, potentially ranging from a few hundred to a few thousand dollars.

- Tax Exemption Application: Securing tax-exempt status is critical for a nonprofit. Legal fees for preparing and submitting the application can range from several hundred to several thousand dollars, contingent on the organization’s structure and the legal team’s expertise.

Program Costs

Program costs represent a significant portion of a nonprofit’s budget. Effective program design and management are crucial for achieving mission objectives while adhering to financial constraints. Careful planning and budgeting are essential for successful program implementation and sustainability.Program costs encompass a broad spectrum of expenses, from personnel to materials to facility rentals. Understanding these costs is critical for developing realistic budgets and securing necessary funding.

Careful allocation of resources is paramount for optimal program effectiveness.

Program Cost Components

Program costs are diverse and depend heavily on the specific programs offered. Different program types necessitate different resources, leading to varied cost structures. Factors like program scale, complexity, and location influence the overall expenses.

- Personnel Costs: Salaries, benefits, and training for staff involved in program implementation and management. For example, a youth mentoring program might require a dedicated coordinator and volunteer supervisors, incurring salaries and training costs.

- Materials and Supplies: Costs associated with the program’s physical resources. Examples include books, equipment, software, or educational materials. A literacy program, for instance, would require books, paper, and writing materials. Additionally, specific program activities might require specialized supplies.

- Venue and Facility Costs: Expenses for renting spaces or utilizing facilities for program delivery. A community outreach program might need to rent a hall or use a community center, leading to rental fees and potential utility costs.

- Travel and Transportation: Costs for transporting personnel or program participants, especially if the program involves outreach to remote locations or field work. For example, a disaster relief organization requires vehicles and fuel to reach affected areas.

- Marketing and Promotion: Expenses for publicizing the program and attracting participants. This includes advertising, promotional materials, and outreach activities.

- Technology and Infrastructure: Costs related to software, hardware, or other technological needs to support the program. A digital literacy program, for example, needs computers, internet access, and appropriate software.

Program Cost Examples

Illustrative examples of program costs highlight the variability inherent in nonprofit program implementation.

- A community garden program might involve the cost of seeds, soil, tools, and volunteer supervision, as well as the cost of a plot of land or materials for building raised beds. The cost of promoting the program and marketing it to community members also needs to be factored in.

- A job training program might include instructor salaries, training materials, and potentially the cost of securing internship opportunities for participants. Transportation expenses for participants to attend training sessions should also be included in the budget.

Program Cost Comparison

Different program models have varying cost structures. For instance, a program delivered entirely online might have lower venue costs compared to a program with in-person components. Consider the following example:

| Program Model | Primary Cost Drivers | Potential Cost Variations |

|---|---|---|

| In-person, small group | Instructor salaries, venue rentals, materials | Vary based on location, size of group, and material requirements |

| Online, self-paced | Platform subscriptions, training materials, marketing | Lower venue costs, potential for higher marketing costs to reach a wider audience |

| Outreach, community-based | Travel, materials, personnel costs, potential partnerships | Varied depending on the geographical scope of the program |

Program Budget Development

A comprehensive program budget is essential for effective program management. It involves detailed cost estimations for each activity within the program. The following steps are crucial:

- Identify all program activities: List all tasks and components involved in the program.

- Estimate costs for each activity: Determine the expenses associated with each activity, including personnel, materials, venue, and marketing.

- Develop a timeline for program activities: Artikel the schedule for program implementation to ensure accurate cost allocation across the project timeline.

- Create a detailed budget: Document all costs, including anticipated funding sources and potential contingencies.

Final Wrap-Up

So, how much does it cost to start a nonprofit organization? The answer, unfortunately, isn’t a simple number. It depends on many factors, from the type of organization to its specific goals. This exploration highlights the multifaceted financial aspects, providing a framework for planning and budgeting. Whether you’re dreaming of a global impact or a local initiative, this guide equips you with the knowledge to navigate the financial terrain and build a sustainable, impactful non-profit organization.

FAQ Insights

What are some common legal fees associated with setting up a nonprofit?

Legal fees can vary significantly, depending on the complexity of your organization’s structure and the specific legal requirements of your location. Expect costs for incorporation documents, initial consultations, and potentially ongoing legal advice to ensure compliance with regulations.

How much do typical salaries for staff members in a small nonprofit cost?

Salaries for small nonprofits often depend on the specific roles and the experience level of the employees. A general range, taking into account location and job description, will help you create a more realistic budget.

What are some cost-effective ways to find volunteers for a nonprofit?

Leveraging social media, local community groups, and partnerships with relevant organizations can be cost-effective ways to find volunteers. Building a strong volunteer base can significantly reduce operational costs.

What are some common fundraising strategies for small nonprofits?

Common strategies include crowdfunding campaigns, community events, and grants. Each strategy has varying costs and levels of complexity. Understanding these factors is crucial for creating a robust fundraising plan.