How to calculate accreations of interest in leased liability provides a step-by-step guide for figuring out interest charges on leased assets. Understanding these calculations is crucial for accurate financial reporting and sound business decisions.

This guide covers everything from defining accrued interest to analyzing the impact of lease terms and accounting treatments. It’s designed to be accessible to anyone needing to understand these calculations, from finance professionals to business owners.

Defining Accrued Interest on Leased Liabilities: How To Calculate Accreations Of Interest In Leased Liability

Accrued interest on leased liabilities represents the interest expense that a lessee has incurred but hasn’t yet paid. This interest expense arises from the time value of money, as the lessee uses the leased asset for a period of time before making the full payment. Understanding this accrual is crucial for accurate financial reporting and for assessing the true cost of leasing.

Accounting Principles Governing Accrued Interest

The recognition of accrued interest on leases adheres to the principle of accrual accounting. This principle dictates that expenses and revenues should be recognized when they are incurred, not necessarily when cash changes hands. In the context of leased liabilities, this means interest expense is recognized during the lease term, even if the cash payment for that interest isn’t due until a later date.

This is essential for presenting a fair and accurate picture of the lessee’s financial position and performance. Further, International Financial Reporting Standards (IFRS) and US Generally Accepted Accounting Principles (GAAP) provide detailed guidelines on the appropriate treatment of lease interest.

Types of Leased Liabilities Accruing Interest

Various types of leased assets can lead to accrued interest on leased liabilities. These include finance leases, where the lessee assumes substantially all the risks and rewards associated with ownership of the asset, and operating leases, which involve a shorter-term agreement where the lessee does not assume the risks of ownership. Although operating leases do not typically result in the recognition of a lease liability, interest may still accrue on the lease obligation.

A critical aspect is that the specific lease terms and the accounting treatment of the lease directly impact the recognition and calculation of accrued interest.

Calculating Accrued Interest: Key Components

Accurate calculation of accrued interest hinges on several key components. Understanding these components is crucial for financial reporting and compliance with accounting standards.

| Component | Description |

|---|---|

| Lease Liability | The present value of the lease payments, including principal and interest, over the lease term. |

| Interest Rate | The interest rate implicit in the lease, or a pre-determined rate if no implicit rate can be readily determined. |

| Lease Term | The period over which the lease payments are made. |

| Lease Payment Schedule | The timing and amount of each lease payment, crucial for accurate accrual calculations. |

| Date of Accrual | The specific date for which the accrued interest is being calculated. |

Accrued interest is calculated as the product of the lease liability, the interest rate, and the period of time between the beginning of the lease term and the accrual date.

A hypothetical example: A company leases equipment for $100,000 over five years at a 5% interest rate. The lease payments are made annually. At the end of year one, the accrued interest would be calculated based on the lease liability at that point in time, the interest rate, and the one-year period. Accurate calculations are vital for financial statement integrity and compliance with accounting standards.

Identifying Relevant Interest Rate Information

Accrued interest on leased liabilities is a critical component of financial reporting, directly reflecting the time value of money. Understanding the precise interest rate applied is paramount for accurate calculations. This necessitates a deep dive into various interest rate data sources, appropriate selection criteria, and the nuanced impact of market fluctuations. The journey to accurately calculate accrued interest involves navigating a complex landscape of financial information.Interest rate information is not a monolithic entity.

Its extraction and application to leased liability calculations require meticulous attention to detail. The accuracy of the calculation hinges on selecting the correct interest rate reflecting the economic realities of the lease. Determining the most appropriate rate necessitates a clear understanding of the different interest rate models and their strengths and limitations.

Sources of Interest Rate Data

Accurate calculation of accrued interest relies on accessing reliable interest rate data. This data forms the bedrock of the calculation, ensuring financial statements reflect the true economic value of the leased liability. Primary sources include:

- Market-based interest rates: These are observed rates from active markets, such as treasury yields or comparable market-based debt instruments. These rates often provide the most relevant benchmark for assessing the economic cost of the lease.

- Company-specific borrowing rates: These are rates at which a company can borrow funds, reflecting its creditworthiness. Companies with stronger credit profiles will typically have lower borrowing costs, which directly impacts the calculated accrued interest.

- Implicit interest rates: These are derived rates, calculated from the lease agreement terms, which reflect the economic substance of the lease agreement. These are crucial for determining the appropriate rate when explicit market rates are not directly comparable.

Determining the Appropriate Interest Rate

Selecting the right interest rate for accrued interest calculations is a critical step. It requires careful consideration of various factors to ensure the calculation accurately reflects the economic substance of the lease. The selected rate must align with the risks and rewards inherent in the leased liability.

- Matching the Lease Term: The chosen interest rate should match the term of the lease. If the lease term is short, a short-term interest rate might be appropriate. Conversely, for longer-term leases, a longer-term rate is required to reflect the risk over the entire lease period.

- Creditworthiness of the Lessee: The lessee’s creditworthiness significantly influences the interest rate. A higher credit risk will necessitate a higher interest rate to compensate for the increased risk of non-payment.

- Market Conditions: Market conditions significantly impact interest rates. During periods of rising interest rates, the appropriate interest rate for accrued interest calculations will also increase. Conversely, during periods of falling interest rates, the rate will also decrease.

Interest Rate Models

Various models exist for determining appropriate interest rates. The choice of model depends on the specifics of the lease and the availability of data.

- Explicit Market Rate Model: This model uses observable market interest rates, such as treasury yields or comparable market debt instruments, as the basis for the calculation. This model is most appropriate when market rates directly reflect the economic substance of the lease.

- Implicit Interest Rate Model: This model derives the interest rate from the lease agreement terms, considering factors like lease payments, lease term, and the present value of lease payments. This model is essential when explicit market rates are not readily available or do not accurately reflect the lease’s economic substance.

- Company-Specific Borrowing Rate Model: This model utilizes the company’s specific borrowing rates to reflect the cost of borrowing for the lessee. This is a suitable model when the lease is a substantial component of the company’s borrowing activities.

Impact of Market Interest Rate Changes

Changes in market interest rates directly impact the calculation of accrued interest on leased liabilities. This impact needs careful consideration.

- Rising Rates: When market interest rates rise, the accrued interest expense will also increase. This is because the present value of future lease payments decreases, leading to a higher interest expense recognition.

- Falling Rates: Conversely, when market interest rates fall, the accrued interest expense will decrease. The present value of future lease payments increases, resulting in lower interest expense recognition.

- Impact on Financial Reporting: Changes in market interest rates necessitate adjustments in the financial reporting of leased liabilities. Companies must carefully monitor and reflect these changes to maintain the accuracy and reliability of their financial statements.

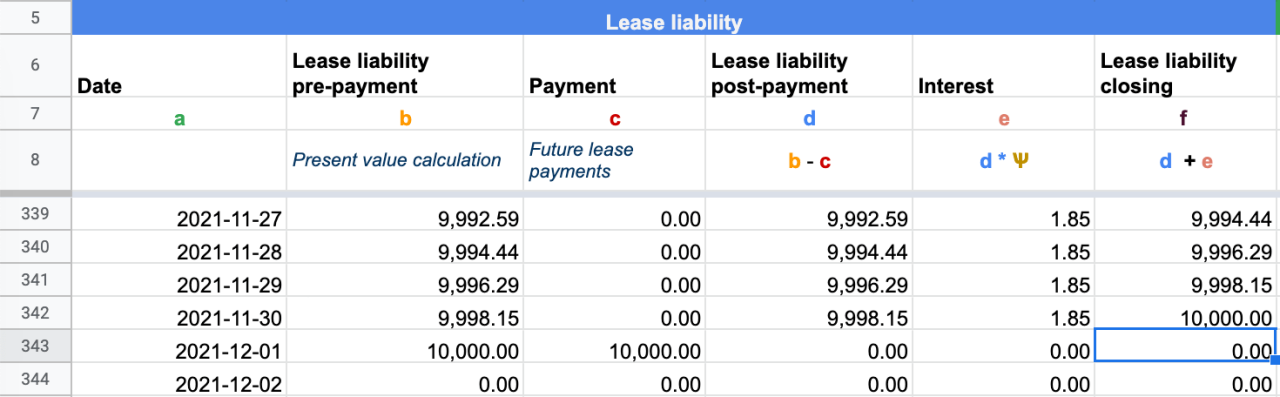

Calculating Accrued Interest

Accrued interest on leased liabilities represents the interest expense that has accumulated over a period but hasn’t yet been paid. Understanding how to calculate this is crucial for accurate financial reporting and compliance with accounting standards. The calculation is pivotal for companies to fairly reflect the cost of borrowing and the time value of money associated with leased assets.

Step-by-Step Procedure for Calculating Accrued Interest

This meticulous process ensures precise accounting for interest expense. Follow these steps to determine the accrued interest on a leased liability:

- Identify the relevant interest rate information. This includes the lease’s stated interest rate, the effective interest rate, and the relevant period for which interest is being calculated.

- Determine the outstanding principal balance. This is the principal amount of the lease liability that is still outstanding at the specified point in time.

- Calculate the interest expense for the period. Use the effective interest method to compute the interest expense for the relevant time period. This involves applying the effective interest rate to the outstanding principal balance.

- Record the accrued interest. Document the calculated interest expense as an accrued liability on the company’s balance sheet.

Effective Interest Method for Interest Calculation

The effective interest method is a crucial accounting technique for calculating interest on leased liabilities. It recognizes that the interest expense isn’t constant throughout the lease term, reflecting the time value of money and the changing outstanding principal.

The effective interest method involves applying the effective interest rate to the carrying amount of the liability, which changes over the lease term. This method accurately reflects the interest expense for each period.

This method ensures that the interest expense reflects the actual cost of borrowing over the lease term.

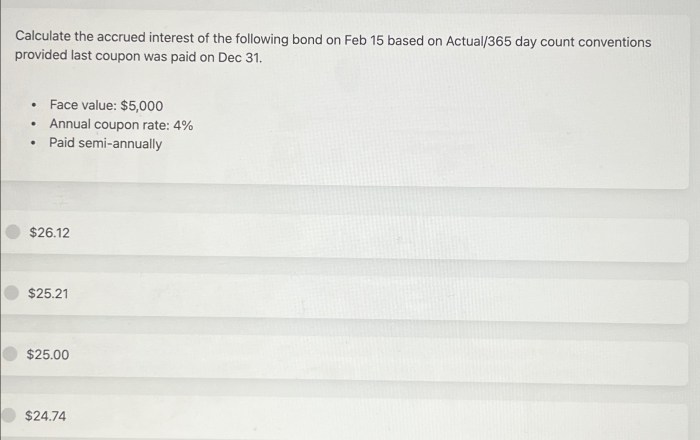

Formula for Accrued Interest on an Accrual Basis

Accrued interest is calculated based on the outstanding principal balance, the interest rate, and the time period.

The fundamental formula for calculating interest on an accrual basis is: Interest Expense = Outstanding Principal Balance × Interest Rate × Time Period

This straightforward formula allows for easy calculation, ensuring accuracy in financial reporting. The time period is often expressed as a fraction of a year (e.g., 3/12 for three months).

Table of Interest Calculation Formulas

The following table Artikels various formulas used in interest calculation, highlighting their applications.

| Formula | Description | Use Case |

|---|---|---|

| Interest Expense = Outstanding Principal Balance × Interest Rate × Time Period | Basic formula for accrued interest calculation. | General accrual basis interest calculation for leased liabilities. |

| Effective Interest = (Carrying Amount of Liability × Effective Interest Rate) × Time Period | Calculation using the effective interest rate. | Accruing interest when the effective interest rate differs from the stated interest rate. |

Time Period Considerations

Accrued interest on leased liabilities, a crucial component of financial reporting, is intricately linked to the passage of time. Understanding how the time period impacts the calculation is paramount for accurate financial statements. Different accounting periods, such as monthly, quarterly, and annually, significantly influence the accrued interest amount, demanding careful consideration.

Impact of Accounting Periods on Accrued Interest

The duration of the accounting period directly affects the calculation of accrued interest. A shorter period, like a month, necessitates a more frequent calculation compared to a longer period, such as a year. This difference stems from the compounding nature of interest; the longer the time frame, the more significant the accrued interest. Understanding the periodicity is vital to ensuring consistency in financial reporting.

Accrued Interest Calculation for Different Time Periods

Accrued interest calculation involves determining the interest accumulated over a specific time frame. This calculation is fundamental to financial accounting. The formula for calculating accrued interest is crucial for correct application. Different accounting periods necessitate adjustments to the formula, ensuring accuracy.

Monthly Accrued Interest Calculation

Calculating accrued interest monthly requires a detailed understanding of the lease agreement terms, the interest rate, and the lease period. Monthly calculations allow for a more precise tracking of interest accumulation, a key aspect of lease accounting. Consider a lease with a 10% annual interest rate and a $10,000 liability. For a month, the accrued interest is calculated as:

(Interest Rate/12)

- Liability Amount

- Time Period in Months

Example: (0.10/12)

- $10,000

- 1 month = $83.33

Quarterly Accrued Interest Calculation

Quarterly interest calculations involve a similar process but consider a three-month period instead of a month. A quarterly calculation is appropriate for businesses that prefer to report interest accruals on a three-month basis. In the same example, for a quarter:

(Interest Rate/4)

- Liability Amount

- Time Period in Quarters

Example: (0.10/4)

- $10,000

- 1 quarter = $250

Annual Accrued Interest Calculation

Annual interest calculations are simpler, as the entire year’s interest is calculated at once. This method is suitable for businesses that report annually. In the example:

Interest Rate

- Liability Amount

- Time Period in Years

Example: 0.10

- $10,000

- 1 year = $1,000

Impact of Lease Terms on Accrued Interest

The intricate dance of accrued interest in leased liabilities hinges on the specifics of the lease agreement. Understanding these terms is crucial for accurate financial reporting and compliance with accounting standards. Lease terms, like the commencement date, duration, and payment schedule, directly impact the calculation of accrued interest, shaping the financial picture of both the lessee and lessor.

A nuanced comprehension of these variables is vital for both theoretical and practical applications.

Lease Commencement Date Influence

The lease commencement date marks the starting point for accruing interest. Interest accrues from this date, not necessarily the date the lease agreement was signed. For example, if a lease agreement is signed on January 1st, 2024, but the lease commences on April 1st, 2024, accrued interest is calculated from April 1st, reflecting the effective start of the lessee’s obligation.

This crucial date impacts the period over which interest is calculated and thus, the overall interest expense.

Lease Term Impact

The lease term, the period over which the lessee is obligated to make lease payments, directly influences the total accrued interest. A longer lease term results in a larger accumulated interest amount compared to a shorter term, all other factors being equal. This is because the interest accrues over a longer period. A shorter term will lead to a smaller total accrued interest amount.

For instance, a 5-year lease will accumulate more interest than a 2-year lease, assuming the same interest rate and other conditions remain constant.

Payment Schedule Considerations

The lease payment schedule, detailing when and how lease payments are made, plays a pivotal role in accrued interest calculations. Uneven payment schedules, with varying payment amounts or intervals, require a more complex calculation than a fixed payment schedule. For example, a lease with monthly payments will accrue interest monthly, while a lease with annual payments will accrue interest annually.

The timing of payments directly influences the amount of interest that accrues during each period.

Impact of Lease Type on Interest Calculation

Different lease types (finance leases and operating leases) require distinct approaches to interest calculation. The classification significantly impacts the recognition and measurement of interest expense. Finance leases are treated as if the lessee has effectively purchased the asset, recognizing interest expense over the lease term, whereas operating leases typically do not recognize interest expense.

Comparison of Lease Types

| Lease Type | Interest Calculation | Accounting Treatment |

|---|---|---|

| Finance Lease | Interest is calculated using the effective interest method, reflecting the time value of money. Accrued interest is a significant component of the lease liability. | Interest expense is recognized over the lease term, reflecting the lessee’s borrowing cost. |

| Operating Lease | Interest is not explicitly calculated or recognized as part of the lease liability. | Interest expense is not recognized directly in the lease liability. |

This table highlights the contrasting treatment of interest calculations for different lease types, showcasing the fundamental difference in how interest is handled in accounting for each.

Illustrative Examples

Accrued interest on lease liabilities, a crucial component of lease accounting, demands meticulous calculation. Understanding the nuances of different lease structures and interest rates is essential for accurate financial reporting. These examples illuminate the process, demonstrating calculations for various scenarios, from simple to complex, to highlight the critical role of precise calculations in lease accounting.

Comprehensive Example of Calculating Accrued Interest on a Lease Liability

This example demonstrates the calculation of accrued interest on a lease liability using a straightforward lease structure. Consider a five-year lease with a fixed annual payment of $10,000. The lease liability is initially recognized at $40,000, and the implicit interest rate is 5%. The lease payments are made annually at the end of each year.

- Year 1: The interest expense is calculated as $40,000

– 5% = $2,000. The portion of the lease payment applied to principal reduction is $10,000 – $2,000 = $8,000. The lease liability is reduced to $32,000 ($40,000 – $8,000). - Year 2: The interest expense is calculated on the remaining lease liability of $32,000

– 5% = $1,600. The portion of the lease payment applied to principal reduction is $10,000 – $1,600 = $8,400. The lease liability is reduced to $23,600 ($32,000 – $8,400). - Year 3, 4, and 5: The calculation process repeats for each subsequent year, using the current lease liability balance and the implicit interest rate to determine the interest expense and principal reduction components of each lease payment.

Demonstrating Calculation with Different Lease Structures and Interest Rates

Different lease structures, including variable payments and different interest rates, necessitate adjustments in the calculation method. A variable lease payment scenario might involve annual increases tied to an inflation index. The interest calculation would need to reflect these adjustments in the payment amount. Similarly, a lease with an escalating interest rate would require updating the interest calculation each period to reflect the changing rate.

Detailed Example of a Complex Lease Scenario

A complex lease scenario might involve a lease with an initial fixed payment followed by a variable payment period based on production output. The calculation would need to incorporate a detailed methodology for calculating interest expense and principal reduction for each payment period. For example, a manufacturing equipment lease might have initial payments based on a fixed schedule and then switch to a production-based variable payment structure.

The calculation would need to dynamically adjust to these changes.

Example Using Different Time Periods and Interest Rates, How to calculate accreations of interest in leased liability

This example illustrates the impact of different time periods and interest rates on accrued interest calculations. Consider a lease with a 10-year term, annual payments, and a 6% implicit interest rate. A similar lease with a 15-year term, semiannual payments, and a 7% interest rate would yield significantly different accrued interest amounts over the lease term. The frequency of payments and the duration of the lease are crucial factors.

The calculations would need to reflect these changes in payment frequency and time period.

Error Analysis and Troubleshooting

Accurately calculating accrued interest on leased liabilities is crucial for financial reporting and compliance. Errors in this calculation can lead to significant discrepancies, impacting financial statements and potentially incurring penalties. Understanding common pitfalls and troubleshooting strategies is essential for maintaining accuracy and reliability.

Common Errors in Accrued Interest Calculation

Several factors can contribute to errors in accrued interest calculations. These errors often stem from misinterpretations of lease terms, incorrect application of interest rates, or overlooking crucial time period considerations. Inaccurate identification of the applicable interest rate or incorrect calculation of the time period for which interest is accrued can significantly affect the final result. These errors, if left uncorrected, can lead to substantial misstatements in the financial records.

Troubleshooting Issues in Accrued Interest Calculation

Troubleshooting issues in accrued interest calculations requires a systematic approach. First, meticulously review the lease agreement to ensure accurate identification of the relevant interest rate and the precise dates of the interest accrual period. This meticulous review ensures a correct understanding of the lease’s specifics, reducing errors. Next, double-check the calculations using a separate method or a specialized tool to verify the accuracy of the initially calculated value.

Comparing the results from different methods helps identify any inconsistencies.

Review and Validation of Accrued Interest Calculations

Validation of accrued interest calculations is paramount for accuracy. This involves a multi-step process that starts with a thorough verification of the initial data. Ensure that the interest rate used is consistent with the lease agreement and applicable accounting standards. Next, meticulously check the calculation for any mathematical errors. Using a separate calculation method or a dedicated spreadsheet program to verify the outcome is recommended.

These steps ensure the calculations are both accurate and compliant with established accounting principles.

Detailed Procedure for Checking Calculations

A detailed procedure for checking calculations can minimize the risk of errors and increase the reliability of the final result. This includes:

- Verify Lease Agreement Data: Carefully review the lease agreement to confirm the interest rate, the effective date of the lease, and any other relevant terms. This meticulous review is critical to avoid misinterpretations and ensure accurate data input for the calculation.

- Independent Calculation: Perform the calculation using a different method or a separate spreadsheet to ensure consistency and catch any discrepancies in the initial calculation. Using a separate method introduces an additional layer of validation.

- Time Period Confirmation: Confirm the exact time period for which interest is accruing. This is crucial for accurate calculations and avoids errors in calculating the interest accrued during the specific period.

- Mathematical Accuracy Check: Verify the mathematical accuracy of each step of the calculation. This step involves checking every calculation, from the initial formula application to the final result. This attention to detail ensures accurate calculations.

- Comparison with Previous Periods: Compare the current accrued interest calculation with previous periods’ figures. Inconsistencies might indicate errors or changes in the underlying assumptions.

Illustrative Example of Error Analysis

A company incorrectly applied the wrong interest rate when calculating accrued interest on a leased liability. This resulted in an overstatement of accrued interest expense. The error was identified by comparing the calculated accrued interest with the interest expense reported in the previous period. By comparing the results and reviewing the lease agreement, the error was discovered and corrected.

This example demonstrates the importance of meticulous data verification and independent calculation.

Accounting Treatment of Accrued Interest

Accrued interest on leased liabilities, a crucial component of financial reporting, represents the interest expense incurred but not yet paid. Proper accounting treatment ensures accurate reflection of a company’s financial position and performance. This treatment is critical for investors and stakeholders, providing transparency and enabling informed decisions.Understanding how accrued interest is accounted for on the balance sheet and income statement is vital for a thorough financial analysis.

This process, meticulously detailed below, allows for a precise depiction of the company’s financial health and the impact of its leasing activities.

Impact on the Balance Sheet

Accrued interest, representing a liability, is recorded as a current liability on the balance sheet. This reflects the company’s obligation to pay interest in the near future. The precise amount of accrued interest is determined by the outstanding lease liability and the applicable interest rate. The balance sheet’s presentation of this liability is critical for assessing a company’s short-term obligations.

Impact on the Income Statement

Accrued interest expense directly impacts the income statement. It’s recognized as an expense during the period in which it accrues. This recognition is consistent with the accrual accounting principle, which requires expenses to be matched with the revenues they generate. The accrual of interest expense affects the net income of the reporting period.

Presentation in Financial Reports

The presentation of accrued interest in financial reports follows established accounting standards. This presentation ensures consistency and comparability across different companies. Accrued interest is typically reported as a separate line item within the current liabilities section of the balance sheet and as an expense within the income statement. Specific disclosures may also be required depending on the lease terms and relevant accounting standards.

Example: Accounting for Accrued Interest

Consider a company with a lease liability of $100,000 and an interest rate of 5% per annum. The lease period is for one year.

- Calculation of Interest Expense: Annual interest expense is calculated as $100,000

– 5% = $5,000. Assuming a 12-month period, monthly interest expense is $5,000 / 12 = $416.67. - Accrued Interest at the End of the First Quarter: For the first quarter (3 months), the accrued interest is $416.67

– 3 = $1,250. - Balance Sheet Impact: A current liability of $1,250 is recorded on the balance sheet.

- Income Statement Impact: An expense of $1,250 is recognized on the income statement for the first quarter.

This example illustrates the straightforward application of accrual accounting for leased liabilities. Variations may occur depending on the specific lease terms and accounting standards. The accrual method provides a more accurate reflection of the company’s financial performance.

Epilogue

In conclusion, calculating accrued interest on leased liabilities requires careful attention to details like interest rates, lease terms, and time periods. Following the steps Artikeld in this guide will ensure accurate calculations and compliance with accounting standards. Remember to always double-check your work and seek professional help if needed. A thorough understanding of this process will help businesses manage their financial obligations effectively.

Q&A

What are the different types of leased liabilities that accrue interest?

Different lease types, such as finance leases and operating leases, have varying impacts on how interest is calculated. Finance leases typically involve more complex accrual calculations, whereas operating leases might have simpler accruals.

How do changes in market interest rates affect accrued interest calculations?

Fluctuations in market interest rates directly influence the interest rates used in calculating accrued interest. Using the appropriate interest rate for the lease is crucial for accurate reporting.

What is the effective interest method for calculating interest?

The effective interest method is a common approach for calculating interest on an accrual basis. It considers the effective interest rate on the lease liability over the lease term.

How do I handle accrued interest calculations for different accounting periods (e.g., monthly, quarterly)?

The time period directly affects the calculation. For monthly or quarterly periods, you’ll calculate interest for the specific portion of the period. Annual calculations encompass the entire year.