How to plot atr in pinescript – How to plot ATR in Pine Script? This guide breaks down everything you need to know, from the basics of Average True Range (ATR) to advanced plotting techniques. We’ll cover calculating ATR in Pine Script, using it for trading strategies, and even optimizing your code for speed and efficiency. Get ready to level up your Pine Script skills!

ATR, or Average True Range, is a crucial technical indicator used to measure market volatility. Understanding how to plot it in Pine Script can significantly enhance your trading strategies, allowing you to identify high-risk periods and adjust your position sizing accordingly. This comprehensive guide walks you through the entire process, from calculating ATR using different methods to visualizing it effectively on your charts.

Introduction to Average True Range (ATR) in Pine Script

Welcome, fellow traders! Ever felt like volatility is a wild beast, constantly shifting and changing? The Average True Range (ATR) is your trusty, albeit slightly complicated, tamer. It’s a vital indicator that helps you understand price swings, estimate potential moves, and ultimately, make more informed trading decisions.ATR is a technical analysis tool that measures price volatility over a specified period.

It’s not just about the highs and lows; it’s about thetrue* range, encompassing the extremes of price movement. Understanding ATR can give you a leg up in predicting potential price swings, and help you to set stop-loss orders more effectively. Essentially, it’s your secret weapon against the unpredictable market.

Definition of Average True Range (ATR)

Average True Range (ATR) is a technical indicator that measures the average price range of an asset over a specified period. It quantifies price volatility by focusing on the true range, encompassing the highs, lows, and previous closing prices, providing a more comprehensive view of price movement than simply the high minus the low.

Significance of ATR in Technical Analysis

ATR plays a crucial role in technical analysis by providing insights into price volatility. Knowing the volatility helps traders in several ways. For instance, it can be used to set stop-loss orders, manage risk, and even identify potential trading opportunities. It’s like having a crystal ball, but instead of predicting the future, it helps you understand the

likelihood* of price fluctuations.

How ATR is Calculated

The calculation of ATR is not as straightforward as high minus low. It’s a bit more involved, using the True Range (TR) as a building block. The True Range is calculated as the greatest of three values: the absolute difference between the current high and low, the absolute difference between the high and the previous close, and the absolute difference between the low and the previous close.

The ATR is then calculated by taking the average of these True Ranges over a specified period. Mathematically, it’s like a moving average, but instead of prices, it’s using the True Range.

True Range (TR) = MAX(HIGH – LOW, ABS(HIGH – PREVIOUS CLOSE), ABS(LOW – PREVIOUS CLOSE))

ATR = Average of True Ranges over a specified period.

Comparison of ATR Calculation Methods

Different methods exist for calculating ATR. While the standard method is widely used, modifications exist to address potential limitations. Here’s a quick comparison:

| Method | Description | Pros | Cons |

|---|---|---|---|

| Standard ATR | Averages the True Range over a specified period. | Simple to understand and implement. | Potentially less responsive to rapid changes in volatility. |

| Modified ATR | Adds a smoothing factor to the calculation, potentially reducing volatility. | Can offer a more stable measure of volatility. | May not capture sharp, short-term fluctuations. |

The choice of method often depends on the specific trading strategy and the desired level of responsiveness to volatility. Each method has its strengths and weaknesses, much like a finely tuned trading strategy. Each trader will find a method that fits their style.

Implementing ATR Calculation in Pine Script: How To Plot Atr In Pinescript

Alright, traders! Let’s dive into the nitty-gritty of calculating Average True Range (ATR) in Pine Script. This isn’t just some abstract financial concept; it’s a powerful tool to gauge price volatility and help you make more informed trading decisions. Understanding how to implement ATR in your Pine Script strategies is key to unlocking its potential.The ATR, in a nutshell, measures the average price fluctuation over a specified period.

A higher ATR indicates greater price volatility, while a lower ATR suggests a calmer market. This understanding is fundamental for setting stop-loss orders, managing risk, and fine-tuning your trading strategies.

Standard ATR Calculation in Pine Script

This section details the standard ATR calculation in Pine Script. The core of this calculation revolves around the True Range (TR) calculation. The True Range (TR) is the highest of the following: the absolute difference between the high and low, the absolute difference between the high and the previous close, and the absolute difference between the low and the previous close.

TR = max(high – low, abs(high – close[1]), abs(low – close[1]))

The Average True Range (ATR) is then calculated by taking the simple moving average of the True Range over a specified number of periods.“`pinescript//@version=5study(“Standard ATR”, overlay=true)length = input.int(14, minval=1, title=”ATR Length”)tr = max(high – low, abs(high – close[1]), abs(low – close[1]))atr = ta.sma(tr, length)plot(atr, color=color.blue)“`This code snippet calculates the True Range, then employs the `ta.sma()` function (simple moving average) to determine the ATR over the specified `length`.

The `plot()` function visualizes the calculated ATR on the chart.

Customized ATR Calculation (Different Timeframe)

Let’s spice things up! You might want to calculate the ATR on a different timeframe than your chart’s default. No problem! Just adjust the `timeframe` parameter within the `ta.sma()` function.“`pinescript//@version=5study(“Custom ATR”, overlay=true)length = input.int(14, minval=1, title=”ATR Length”)timeframeInput = input.timeframe(“1D”, title=”Timeframe for ATR”)tr = max(high – low, abs(high – close[1]), abs(low – close[1]))atr = ta.sma(tr, length, timeframe=timeframeInput)plot(atr, color=color.red)“`Here, the crucial addition is the `timeframeInput` variable, allowing you to specify a different timeframe for the ATR calculation.

Now, you can calculate the ATR on a daily, weekly, or any timeframe you desire, providing a more nuanced understanding of price action.

ATR Calculation Variables and Functions

The code relies on several key Pine Script elements:

high: Represents the highest price for the current bar.low: Represents the lowest price for the current bar.close: Represents the closing price for the current bar.close[1]: Represents the closing price of the previous bar. This is crucial for calculating the True Range.ta.sma(source, length, [timeframe]): This function calculates the Simple Moving Average of the specified source (in this case, the True Range) over the specified length. The optional `timeframe` parameter allows for calculations across different timeframes.max(a, b, c): This function returns the highest value among the given inputs, fundamental to the True Range calculation.abs(x): This function returns the absolute value of `x`, necessary for the True Range calculation.

Modifying ATR Calculation for Specific Price Data

To tailor the ATR calculation to incorporate specific price data points, you can modify the True Range calculation. For example, if you want to focus on the high and low prices without considering the previous close, the True Range calculation would change.

| Parameter | Effect |

|---|---|

length |

Determines the period over which the ATR is calculated. |

timeframe |

Specifies the timeframe for the ATR calculation. |

Remember, the key to effective ATR use is understanding its sensitivity to price volatility. Different parameters will yield different results, allowing you to find the best settings for your trading strategies.

Using ATR for Trading Strategies in Pine Script

Alright, traders! Let’s dive into the thrilling world of using Average True Range (ATR) to craft truly profitable Pine Script strategies. Forget the mundane; let’s turn volatility into your friend, not your foe! ATR isn’t just a fancy calculation; it’s a powerful tool for risk management and strategy refinement.ATR, essentially, measures the volatility of an asset. Higher ATR values signal more volatile markets, while lower values indicate calmer waters.

This volatility insight is crucial for adaptive trading. Using ATR in Pine Script allows you to dynamically adjust your trading parameters, making your strategies more resilient to market fluctuations. This is your key to unlocking consistent profits, not just fleeting gains!

Stop-Loss Levels Using ATR

Dynamic stop-loss levels are crucial for managing risk. By incorporating ATR, your stop-loss orders are no longer static. They adapt to the current market volatility, preventing significant losses during periods of high volatility and allowing you to maintain profitable positions during calm periods. This ensures you don’t get caught off guard by sudden market swings.“`pinescript//@version=5strategy(“ATR Stop Loss”, overlay=true)atr = ta.atr(14)longCondition = close > open and close > close[1] and close > strategy.position_avg_priceshortCondition = close < open and close < close[1] and close < strategy.position_avg_price if (longCondition) strategy.entry("Long", strategy.long) strategy.exit("Stop Loss", "Long", stop=close - atr) if (shortCondition) strategy.entry("Short", strategy.short) strategy.exit("Stop Loss", "Short", stop=close + atr) ``` This Pine Script code dynamically adjusts stop-loss levels based on the 14-period ATR. Notice how it differentiates between long and short positions. This adaptability is what makes this strategy stand out!

Risk/Reward Ratio Calculation with ATR

Calculating risk/reward ratios becomes remarkably straightforward with ATR.

You can establish a clear relationship between potential profit and potential loss, providing a solid framework for decision-making. This crucial step is often overlooked, but it’s the foundation of successful trading!“`pinescript//@version=5strategy(“ATR Risk/Reward”, overlay=true)atr = ta.atr(14)longCondition = close > open and close > close[1]shortCondition = close < open and close < close[1] stopLoss = atr - 2 if (longCondition) strategy.entry("Long", strategy.long, stop=close - stopLoss) strategy.exit("Take Profit", "Long", profit=close + atr) if (shortCondition) strategy.entry("Short", strategy.short, stop=close + stopLoss) strategy.exit("Take Profit", "Short", profit=close - atr) ``` This code calculates a stop-loss based on twice the ATR, allowing for a 1:2 risk-reward ratio.

Trend-Following Strategy Using ATR

Trend-following strategies, when combined with ATR, can identify strong trends and dynamically adjust positions.

The ATR provides a clear way to determine whether a trend is weakening or strengthening. This allows traders to capitalize on consistent upward or downward movements while mitigating risk.“`pinescript//@version=5strategy(“ATR Trend Following”, overlay=true)atr = ta.atr(14)longCondition = close > open and close > close[1] and close > strategy.position_avg_priceshortCondition = close < open and close < close[1] and close < strategy.position_avg_price if (longCondition) strategy.entry("Long", strategy.long) strategy.exit("Stop Loss", "Long", stop=close - 2 - atr) if (shortCondition) strategy.entry("Short", strategy.short) strategy.exit("Stop Loss", "Short", stop=close + 2 - atr) ``` This code sets up a trend-following strategy with stop-losses based on the ATR. This is the key to capitalizing on the momentum of the trend.

Comparative Analysis of ATR-Based Strategies

| Strategy Type | Stop Loss | Risk/Reward | Trend Following ||—|—|—|—|| Simple Stop Loss | Based on ATR | Not directly calculated | No || Risk/Reward Ratio | Based on ATR

2 | Explicitly calculated (1

2 ratio) | No || Trend Following | Based on ATR | Implied in strategy | Yes |This table highlights the key features of each strategy, providing a quick overview. Remember, the best strategy for you will depend on your individual trading style and risk tolerance.

Advanced ATR Applications in Pine Script

The Average True Range (ATR) isn’t just a simple volatility measure; it’s a versatile tool that can be wielded like a seasoned trader’s trusty sword. Mastering its advanced applications in Pine Script unlocks a world of opportunities to fine-tune your strategies and gain a competitive edge. This section delves into how to use ATR beyond basic calculations, revealing its power in identifying volatility shifts, optimizing position sizing, and pinpointing potential breakouts.

Identifying Volatility Changes with ATR

ATR excels at pinpointing significant shifts in market volatility. By tracking the ATR’s fluctuations, you can identify periods of heightened or reduced price swings. A soaring ATR suggests increased volatility, potentially signaling heightened risk and demanding careful attention. Conversely, a plummeting ATR indicates a calmer market, presenting opportunities for more conservative trades.

Combining ATR with Other Indicators

The true power of ATR often lies in its synergistic relationship with other technical indicators. Combining ATR with indicators like RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) can provide a more comprehensive market picture. This synergy allows traders to develop more nuanced trading signals.

| Indicator | Combination with ATR | Potential Strategy |

|---|---|---|

| RSI | High ATR combined with oversold RSI conditions suggests a potential reversal. | Look for entry points when the market is likely to bounce back. |

| MACD | High ATR combined with a bullish MACD crossover signals a high-volatility, potentially profitable uptrend. | Look for opportunities to capitalize on the upward momentum. |

| Moving Averages | High ATR combined with a strong trend following a moving average can increase the probability of successful trades. | Capitalize on trends with high volatility. |

ATR for Position Sizing

Position sizing is crucial for risk management. ATR offers a dynamic approach to adjusting position sizes based on current market volatility. By incorporating ATR into your position sizing strategy, you can adapt to market conditions and potentially reduce risk. A higher ATR typically necessitates a smaller position size to mitigate the risk of large losses during volatile periods. This ensures that you are not overexposed to the market when volatility is high.

Position sizing formula: Position size = (Account equity

- Risk tolerance) / (ATR

- Price).

Identifying Potential Breakouts with ATR

ATR can be a powerful tool for identifying potential breakouts. A breakout occurs when the price decisively moves beyond a significant resistance or support level. High ATR values during these periods often precede significant price movements, signaling potential breakouts.

Dynamic Stop-Loss Adjustment Strategy using ATR in Pine Script

This strategy dynamically adjusts stop-loss levels based on ATR, offering a more adaptive risk management approach. The stop-loss is adjusted in response to market volatility, helping to preserve profits and limit losses.“`pinescript//@version=5strategy(“ATR Stop Loss”, overlay=true)// Input parametersatrLength = input.int(14, “ATR Length”)stopLossMultiplier = input.float(2.0, “Stop Loss Multiplier”)// Calculate ATRatr = ta.atr(atrLength)// Calculate stop loss levelstopLossLevel = strategy.position_avg_price – (atr – stopLossMultiplier)// Plot stop loss levelplot(stopLossLevel, color=color.red, linewidth=2, title=”Stop Loss Level”)// Enter long position if price crosses above a moving averagelongCondition = close > ta.sma(close, 20) and close > stopLossLevelif (longCondition) strategy.entry(“Long”, strategy.long)// Exit long position if price crosses below the stop-loss levelexitCondition = close < stopLossLevel if (exitCondition) strategy.close("Long") ```

Optimizing ATR Calculations in Pine Script

Alright, traders! Let’s ditch the sluggish ATR calculations and turbocharge our Pine Script strategies.

We’re diving deep into optimizing ATR, so your charts won’t be lagging behind like a sloth on a treadmill. We’ll explore different calculation methods, timeframes, and strategies to squeeze every ounce of performance from your code.

Performance Implications of Different ATR Calculation Methods

Different ATR calculation methods have varying performance implications. The classic method, while reliable, might not always be the fastest. Modern techniques, leveraging optimized algorithms, can significantly reduce calculation time, especially when dealing with large datasets. For instance, pre-calculating ATR values over smaller periods and then aggregating them can drastically improve efficiency. Consider using Pine Script’s built-in functions where possible; they’re usually optimized for speed.

Impact of Different Timeframes on ATR Calculations

Timeframes play a crucial role in ATR calculations. A shorter timeframe, like 5 minutes, will generate more frequent ATR values, potentially leading to more volatile readings. Conversely, a longer timeframe, such as a day or week, provides a smoother, less erratic view of price volatility. Choosing the right timeframe depends heavily on your trading strategy and the time horizon you’re focusing on.

Think of it like this: a hummingbird’s flight path is quite different from a migrating eagle’s.

Strategies to Optimize ATR Calculation for Speed and Efficiency

Optimizing ATR calculations for speed and efficiency involves several strategies. Pre-calculating ATR values for smaller intervals and then aggregating them is one powerful technique. This reduces the computational burden during the main calculation. Leveraging Pine Script’s built-in functions, where applicable, is another critical step. Avoid redundant calculations; if you’ve already computed something, reuse it! Also, consider using specialized libraries, if available, that can streamline the ATR calculation process.

Think of it like streamlining a factory line – fewer bottlenecks mean faster output.

Code Examples for Optimized ATR Calculations

Let’s illustrate with a concise example. The following code snippet calculates the 14-period ATR using a pre-calculated 5-minute ATR. Note that this is a simplified example; a production-ready strategy would need error handling and more robust validation.

//@version=5

strategy("Optimized ATR Example", overlay=true)

// Pre-calculate 5-minute ATR

atr_5min = ta.atr(5)

// Calculate 14-period ATR based on 5-minute ATR

atr_14 = ta.atr(14)

plot(atr_14, color=color.blue)

Memory Management and Performance Considerations

Memory management is critical when using ATR in Pine Script. Avoid storing massive datasets of ATR values, as this can lead to performance issues and potential crashes. Instead, focus on storing only the necessary ATR values relevant to your current trading timeframe and strategy.

Employ techniques to efficiently manage memory allocation and deallocation to avoid unnecessary memory leaks. Think of it as managing your inventory: only keep what you need, and discard the rest.

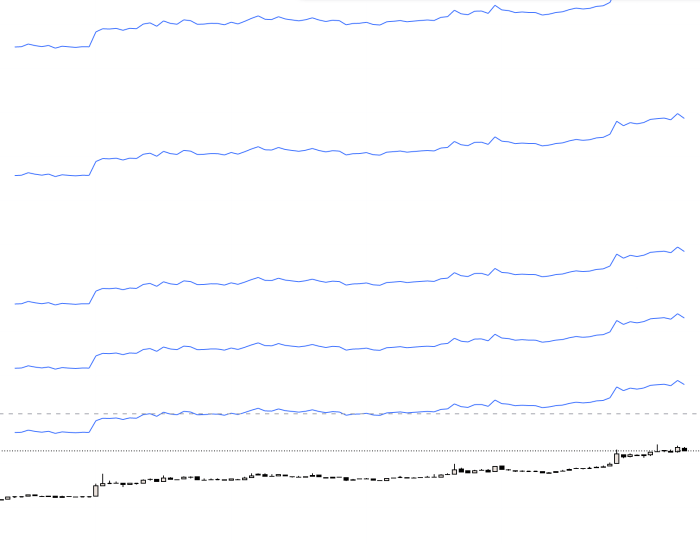

Visualization and Interpretation of ATR Data in Pine Script

Unveiling the secrets hidden within the Average True Range (ATR) requires more than just calculation; it’s about visualizing its power and understanding its whispers about market volatility. Imagine ATR as a market’s pulse—strong beats signify wild swings, while gentle ones hint at calmer waters. Proper visualization allows us to see these rhythms clearly.

Visualizing ATR Values on a Chart

Pine Script offers a plethora of ways to display ATR on your trading charts. The key is to choose a method that enhances your understanding of price action. This involves more than just a simple line; it’s about strategically layering ATR to complement price charts.

Interpreting ATR Values in the Context of Price Action

Understanding the relationship between ATR and price action is crucial. A high ATR suggests significant price fluctuations, signaling potential opportunities for both traders and investors. Conversely, a low ATR indicates calmer market conditions, potentially offering more stable opportunities. Consider ATR as a volatility compass, guiding you through the market’s ebb and flow.

Various Ways to Visualize ATR Data

Pine Script provides several ways to visually represent ATR, allowing traders to adapt their strategies to different preferences. These include using different chart styles, colors, and even line thicknesses.

| Chart Style | Color | Description |

|---|---|---|

| Line | Green | A simple, straightforward way to visualize ATR, allowing for easy identification of high and low volatility periods. |

| Area | Light Blue | Provides a more comprehensive view of volatility by shading the area above and below the ATR line, highlighting periods of increased and decreased price movement. |

| Histogram | Orange | Emphasizes the magnitude of ATR fluctuations over time. Bars of higher magnitude suggest greater price swings. |

| Scatter Plot | Red | Useful for identifying specific ATR values at key price levels, enabling traders to identify potential support and resistance levels affected by volatility. |

Identifying Periods of High and Low Volatility

By observing the ATR values, you can spot periods of high and low volatility. High ATR values often signal periods of increased price swings, suggesting potential opportunities or risks. Conversely, low ATR values point to calmer market conditions, potentially offering a more stable trading environment. A high ATR could indicate a breakout or a continuation of a trend, while a low ATR suggests a consolidation phase.

Consider ATR as a market’s heartbeat. A racing heart signals potential instability, while a slow pulse suggests calm.

Error Handling and Debugging in ATR Pine Script

Pine Script, while powerful, can sometimes throw a wobbly when dealing with the volatile world of Average True Range (ATR). Just like a seasoned trader knows to expect market fluctuations, a savvy Pine Script programmer needs to anticipate potential glitches in their ATR calculations. This section arms you with the tools to diagnose and fix these issues, ensuring your ATR indicators function flawlessly.Troubleshooting ATR Pine Script code is like navigating a tricky market – you need a strategy, not just blind luck.

Understanding potential errors and possessing effective debugging techniques is key to identifying and resolving issues swiftly. By mastering these techniques, you’ll build more robust and reliable trading strategies.

Potential Errors in ATR Calculations

ATR calculations, while seemingly straightforward, can trip up even the most experienced Pine Script coders. Common pitfalls include incorrect input data, faulty formula implementation, and unforeseen edge cases. These can manifest as unexpected values, illogical results, or even script crashes.

Strategies for Debugging Pine Script Code Related to ATR

Debugging Pine Script code, especially when it comes to ATR, requires a systematic approach. This involves understanding the logic of your code, isolating the problematic area, and then meticulously checking the data flow.

- Reviewing Code Logic: Carefully examine each line of code related to ATR calculation. Ensure that variables are correctly defined, calculations are performed according to the ATR formula, and data types are consistent. Look for any logical errors, such as typos or incorrect operators. This is like reviewing a trading strategy’s fundamentals – every element needs to be robust.

- Inspecting Variable Values: Utilize Pine Script’s built-in debugging tools to inspect the values of key variables at different stages of the ATR calculation. This helps identify unexpected or incorrect intermediate values. This is like using market analysis tools to monitor how variables are changing over time – it reveals hidden problems.

- Testing with Sample Data: Use a set of sample data (historical price data) to test your ATR script. Compare the results of your script with a known, accurate ATR calculation. This helps ensure the correctness of the code and to identify discrepancies between your calculation and the reference result. It’s similar to backtesting a trading strategy to validate its performance.

- Simplifying the Code: To pinpoint the source of the error, break down your complex ATR calculation into smaller, manageable functions or steps. This isolates the problem area more effectively. It’s analogous to reducing a complicated trading signal into its core elements for easier understanding.

Examples of Common Errors and Their Solutions in ATR Pine Script, How to plot atr in pinescript

Identifying and fixing errors in Pine Script ATR calculations involves careful examination of the code.

- Incorrect Variable Type: If a variable used in the ATR calculation is not the correct type (e.g., a string instead of a number), Pine Script might produce unexpected results. This is akin to entering incorrect data into a spreadsheet for a trading analysis.

- Solution: Explicitly convert variables to the correct type (e.g., using `int` or `float` functions) or ensure data input is correctly formatted.

- Incorrect ATR Formula Implementation: If the ATR calculation formula is not correctly implemented in Pine Script, the results will be inaccurate. This is like applying a trading strategy incorrectly, which may lead to negative results.

- Solution: Double-check the ATR formula, ensuring that all calculations are performed according to the specified steps. Review the correct ATR formula to avoid incorrect implementation.

- Incorrect Data Handling: If the script fails to handle missing or invalid data correctly, this can lead to errors. This is similar to missing data points when backtesting a trading strategy, which can skew the results.

- Solution: Use Pine Script’s built-in functions (e.g., `na()`) to handle missing or invalid data appropriately. Check if your data has any gaps that could cause issues.

Best Practices for Error Handling in Pine Script ATR Calculations

Implementing robust error handling is crucial for any Pine Script code, including ATR calculations. This prevents unexpected behavior and ensures the reliability of your trading strategies.

- Input Validation: Check the validity of input data before performing calculations to prevent unexpected errors. This is like validating your trading assumptions before deploying a strategy. Ensuring correct data input helps maintain accurate results.

- Conditional Statements: Use conditional statements (e.g., `if`, `else`) to handle different scenarios, such as missing data or invalid inputs. This ensures your code doesn’t break under unforeseen circumstances.

- Error Messages: Include informative error messages within your Pine Script to provide debugging clues. This is like having detailed feedback on your trading strategy to know what went wrong.

Troubleshooting Issues with ATR Calculations in Different Trading Platforms

Different trading platforms may have slightly different Pine Script environments. Familiarizing yourself with the specific environment is important for effective troubleshooting.

- Platform-Specific Documentation: Consult the documentation of your specific trading platform for details on Pine Script support and debugging tools. Knowing the platform’s specific quirks will help you pinpoint the problem faster.

- Community Forums: Engage with online communities and forums related to your trading platform and Pine Script. Others might have encountered similar issues and provided solutions.

- Pine Script Editor: Utilize the debugging tools and features available in your Pine Script editor. These tools are designed to help you understand the flow of your script and pinpoint the source of errors.

Final Summary

So, there you have it—a complete guide on plotting ATR in Pine Script. From fundamental calculations to advanced applications, this guide provides you with the knowledge and tools to effectively leverage ATR in your Pine Script strategies. Remember to tailor your approach to your specific trading style and market conditions. Happy trading!

Key Questions Answered

What is the difference between standard and modified ATR calculations?

Standard ATR uses the highest high, lowest low, and previous close price to calculate the True Range. Modified ATR might incorporate additional factors, like a smoothing technique, to adjust for volatility fluctuations.

How can I optimize ATR calculations for speed in Pine Script?

Using efficient variable declarations, avoiding unnecessary calculations, and potentially utilizing built-in Pine Script functions can significantly speed up ATR calculations.

What are some common errors in ATR Pine Script calculations, and how can I debug them?

Common errors include incorrect variable assignments, miscalculations in the True Range, and using outdated or incorrect data. Debugging involves carefully checking your Pine Script code, utilizing the Pine Script debugger, and thoroughly understanding the data inputs.

Can I use ATR to identify potential breakouts?

Yes, ATR can be used to identify potential breakouts by highlighting periods of high volatility. Look for significant spikes in the ATR value, often accompanied by a strong price movement. Combine this with other indicators for a more comprehensive analysis.