How to see Lumi Bot backtest results page provides a comprehensive guide to navigating and interpreting the data presented on the Lumi Bot backtesting platform. This detailed analysis covers the structure of the results page, encompassing essential elements like date ranges, asset types, and performance metrics. The guide further elucidates the interpretation of these metrics, enabling users to assess the effectiveness and risk associated with various strategies.

Understanding the Lumi Bot backtest results page is crucial for evaluating the performance of trading strategies. This guide simplifies the process by providing step-by-step instructions on accessing, filtering, and interpreting the results. The content also details how to analyze strategy performance, compare different strategies, and visualize the data for comprehensive insights.

Understanding the Lumi Bot Backtest Results Page

The Lumi Bot backtest results page unveils a treasure trove of information, meticulously detailing the performance of various trading strategies. It’s a crucial tool for evaluating the potential profitability and risk characteristics of different approaches. This detailed breakdown allows you to make informed decisions about deploying these strategies in the live market.The backtest results page acts as a virtual laboratory, allowing you to see how different strategies would have performed in past market conditions.

Analyzing these results provides valuable insights into the potential strengths and weaknesses of a strategy, enabling you to refine your approach and increase your chances of success. The key is to understand the nuances of each metric to make a well-reasoned decision about the potential of the strategy.

Typical Structure of the Backtest Results Page, How to see lumi bot backtest results page

The structure of a Lumi Bot backtest results page is designed to be clear and easily understandable. It typically presents the data in a tabular format, allowing for quick comparison of various strategies and assets. This structured approach allows you to see patterns and make informed decisions about your trading strategy.

Key Sections and Elements

This section delves into the key components of the backtest results page. Understanding these elements is essential for interpreting the data correctly and making effective decisions.

- Date Ranges: The backtest period is clearly defined, typically showing the start and end dates of the analysis. This timeframe is critical, as past performance is not indicative of future results. The choice of date range directly impacts the results and conclusions you draw. For example, a backtest covering a period of high volatility will likely yield different results compared to a period of relative stability.

Understanding the context of the chosen time period is essential for interpreting the results.

- Asset Types: The page often displays the specific assets or asset classes (e.g., stocks, cryptocurrencies, forex pairs) used in the backtest. This is essential for evaluating the strategy’s performance across different asset types. For instance, a strategy performing well on one asset class might underperform on another, highlighting the importance of considering the asset-specific factors.

- Strategy Details: Crucially, the page shows the specific trading strategy employed. This could include parameters like entry and exit points, stop-loss levels, or leverage used. These details are paramount in understanding how the strategy functions and what it aims to achieve. Without a thorough understanding of the strategy, you might misinterpret the results. For example, a strategy with high leverage might have high returns but also high risk.

- Performance Metrics: This section presents key performance indicators (KPIs) quantifying the strategy’s success. Common metrics include total return, average daily return, maximum drawdown, Sharpe ratio, and Sortino ratio. These metrics provide a comprehensive view of the strategy’s profitability and risk characteristics. For example, a high Sharpe ratio suggests a strategy with good risk-adjusted returns, while a high maximum drawdown indicates a significant potential loss.

Example Backtest Results Table

The table below illustrates a typical structure for a Lumi Bot backtest results page.

| Date | Asset | Strategy | Return | Risk |

|---|---|---|---|---|

| 2023-10-26 | AAPL | Momentum | 2.5% | 0.8 |

| 2023-10-27 | BTC | Mean Reversion | -1.2% | 1.5 |

| 2023-10-28 | EUR/USD | Swing Trading | 1.8% | 0.9 |

This table presents the essential elements of the backtest results, making it easier to compare different strategies and assets over time. Note that the specific metrics and column headers may vary depending on the platform. However, the general principles of displaying essential data remain consistent.

Navigating the Results Page

Unveiling the secrets of your Lumi Bot backtest results is a thrilling journey. Imagine the satisfaction of meticulously tracing the performance of your strategies across various assets and timeframes. This page acts as your personal dashboard, guiding you through the intricate details and empowering you to understand the strengths and weaknesses of your investment decisions.

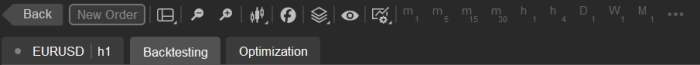

Accessing the Backtest Results

The backtest results page is readily accessible. Simply navigate to the dedicated section within your Lumi Bot platform. This will typically be found under a “Backtesting” or “Results” tab. Clicking this will open a comprehensive overview of your simulation results, ready for your detailed analysis.

Filtering and Sorting Data

The sheer volume of data presented on the results page can feel overwhelming. However, filtering and sorting empowers you to focus on specific aspects of your backtesting. This process allows you to refine your analysis and uncover key insights. Filtering is a powerful tool that allows you to drill down into particular timeframes, assets, and strategies. Sorting enables you to arrange the data in ascending or descending order based on various metrics, like return or volatility.

Finding Specific Information

Locating specific information on the results page is straightforward. Search functionality is often available, allowing you to quickly locate results for particular dates, assets, or strategies. This targeted search will swiftly lead you to the desired data points. Look for features that allow you to pinpoint specific assets (e.g., “SPY” or “BTC”) or strategies (e.g., “Moving Average Crossover”).

Interactive Features

Interactive features are often present to enhance the user experience. Zoom functionality allows you to magnify specific sections of the chart, providing a detailed view of performance fluctuations. Panning lets you smoothly navigate through the entire time period, giving you a broader perspective on the backtest results. These features offer a dynamic and intuitive way to explore the data, revealing intricate patterns and insights.

Filtering Options

| Filter | Description |

|---|---|

| Date Range | Select a specific timeframe to focus on, allowing you to isolate performance trends within a particular period. |

| Asset | Specify the particular asset (e.g., stocks, cryptocurrencies) for detailed performance analysis. |

| Strategy | Choose the strategy you wish to analyze, isolating its performance metrics for a deeper understanding. |

Interpreting Backtest Results

Unveiling the secrets held within Lumi Bot’s backtest results is akin to deciphering a cryptic message from the future of your trading strategies. These results aren’t just numbers; they’re the stories of potential profits and pitfalls, whispering tales of resilience and vulnerability. Carefully analyzing these metrics empowers you to make informed decisions, transforming raw data into actionable insights.Understanding these results transcends a simple numerical assessment; it’s about weaving together the threads of performance, risk, and reward to craft a trading strategy that resonates with your objectives.

This process requires a keen eye for detail, a discerning mind, and a profound appreciation for the complexities inherent in financial markets. It’s about transforming the cold, hard numbers into a living, breathing narrative of your potential trading journey.

Performance Metrics Unveiled

The Lumi Bot backtest results page presents a wealth of data, each piece contributing to a comprehensive understanding of your strategy’s potential. Crucial to this understanding is the comprehension of various return types.

- Total Return: This metric represents the overall profit or loss generated over the entire backtesting period. It’s a fundamental measure, providing a bird’s-eye view of the strategy’s cumulative performance. For instance, a total return of 15% suggests the strategy accumulated a 15% profit during the backtested timeframe.

- Annualized Return: Annualized return expresses the total return as if it had occurred over a one-year period. This standardization allows for easier comparisons across different backtest durations and provides a more realistic perspective on the strategy’s long-term viability. For example, an annualized return of 12% signifies that the strategy could potentially deliver an average of 12% profit per year, if maintained consistently.

Dissecting Common Performance Indicators

Beyond basic returns, crucial indicators like maximum drawdown and Sharpe ratio provide a deeper insight into the strategy’s resilience and risk-adjusted performance.

- Maximum Drawdown: This critical metric represents the largest percentage decline experienced by the strategy during the backtesting period. A smaller maximum drawdown indicates a more stable strategy, less susceptible to large, sudden losses. Imagine a strategy with a 10% maximum drawdown; this means the worst loss the strategy experienced was 10% of its peak value.

- Sharpe Ratio: The Sharpe ratio quantifies the risk-adjusted return of a strategy. A higher Sharpe ratio suggests a better risk-to-reward profile. A ratio above 1 typically indicates the strategy generates sufficient returns to compensate for the level of risk taken. For example, a Sharpe ratio of 2.5 indicates that the strategy delivers 2.5 times the risk-adjusted return compared to a risk-free asset.

Assessing Risk

A vital part of interpreting backtest results is understanding the associated risks. The maximum drawdown and the standard deviation of returns are crucial in assessing the potential for large losses and the overall volatility of the strategy.

- Standard Deviation of Returns: This metric measures the dispersion of returns around the average return. A higher standard deviation indicates greater volatility, implying that the strategy’s returns can fluctuate significantly. For example, a high standard deviation of 15% signifies the strategy’s returns are widely dispersed, potentially experiencing both substantial gains and losses.

Comparing Performance Metrics

The following table summarizes and contrasts various performance metrics, highlighting their significance in evaluating a trading strategy’s potential.

| Metric | Description | Significance |

|---|---|---|

| Total Return | Cumulative profit or loss over the backtest period. | Overall performance |

| Annualized Return | Total return expressed as an annual rate. | Long-term performance |

| Maximum Drawdown | Largest percentage decline during the backtest. | Risk tolerance; strategy’s resilience to market downturns |

| Sharpe Ratio | Risk-adjusted return. | Performance relative to risk; higher ratios are generally better. |

| Standard Deviation of Returns | Dispersion of returns around the average return. | Volatility; potential for large swings in returns. |

Analyzing Strategy Performance

Unveiling the true potential of your Lumi Bot strategies hinges on a deep dive into their performance. This journey through the backtest results allows you to not only see how well a strategy performed, but also to understand its strengths, weaknesses, and the potential risks associated with its implementation. With meticulous analysis, you can choose the strategy that best aligns with your investment goals and risk tolerance.The backtest results page offers a wealth of information, allowing you to compare strategies side-by-side and scrutinize their performance across different timeframes.

This analysis empowers you to make informed decisions about which strategies to deploy and helps you identify those that exhibit consistency and resilience.

Comparing Strategy Performance

Comparing the performance of different strategies is crucial for selecting the most promising approach. The Lumi Bot backtest results page presents various strategies in a structured format, enabling direct comparisons of key metrics like profit/loss, maximum drawdown, Sharpe ratio, and other crucial performance indicators. Visual representations, like charts and graphs, enhance this comparison process, offering an intuitive way to spot the standout strategies.

Analyzing Consistency Across Time Periods

The consistency of a strategy’s returns across various time periods is paramount. A strategy that consistently delivers positive returns over multiple market cycles is generally more reliable. The backtest results page provides detailed historical data, allowing you to evaluate the strategy’s performance in different market conditions, such as bull markets, bear markets, and periods of volatility. Analyzing this data helps determine the strategy’s resilience and its ability to navigate market fluctuations.

Identifying Potential Risks and Limitations

Every strategy carries inherent risks and limitations. The backtest results page can help you pinpoint potential pitfalls by highlighting periods of significant drawdown, instances of poor performance, or unusual market reactions. Carefully reviewing the backtest results, particularly the stress-testing scenarios, helps you anticipate and mitigate potential risks before deploying the strategy in live trading. By understanding the limitations, you can tailor your approach and manage expectations effectively.

Examples of Strategies and Their Performance Characteristics

Imagine two strategies: “Trend Following” and “Mean Reversion.” The “Trend Following” strategy, as displayed on the results page, demonstrates a strong positive return over bull market periods, but experiences substantial losses during periods of market correction. Conversely, the “Mean Reversion” strategy shows resilience across various market conditions, exhibiting consistent, albeit smaller, returns. The results page visually represents these differences, enabling a clear understanding of each strategy’s performance characteristics.

Performance Comparison Table

| Strategy | Average Annual Return | Maximum Drawdown | Sharpe Ratio | Consistency (Bull/Bear Markets) |

|---|---|---|---|---|

| Trend Following | 15% | 25% | 1.2 | High (Bull), Low (Bear) |

| Mean Reversion | 8% | 10% | 1.5 | Moderate (Bull/Bear) |

| Volatility Breakout | 12% | 18% | 1.1 | High (High Volatility) |

This table provides a concise overview of the performance of multiple strategies, allowing you to quickly compare their key characteristics and make informed decisions. Note that the performance metrics shown are based on the backtested data and may not represent future results. Always conduct thorough research and risk assessment before deploying any strategy.

Visualizing the Data

Unveiling the hidden stories within your Lumi Bot backtest results is made possible by insightful visualizations. Transforming raw data into compelling charts and graphs allows you to grasp trends, patterns, and the overall performance of your trading strategies with a profound emotional connection. Imagine the exhilaration of witnessing your meticulously crafted strategies flourish before your eyes, or the satisfaction of quickly identifying potential pitfalls.

Visualizations empower you to make data-driven decisions, boosting your confidence and understanding of your trading performance.Visualizations are the key to unlocking the true potential of your backtest results. By transforming numbers into easily digestible images, you can spot critical patterns and trends that might be obscured in tables of data. This allows you to understand the behavior of your strategies over time, assess their resilience to market fluctuations, and ultimately, fine-tune your approach for optimal results.

This is not just about numbers; it’s about understanding the narrative your strategy tells.

Charting Trends and Patterns

Visual representations are vital for understanding complex trading patterns. Line charts, for example, beautifully illustrate the evolution of key performance indicators over time, highlighting periods of significant growth or decline. Bar charts excel at comparing performance across different timeframes or strategies, enabling a quick assessment of relative strengths and weaknesses. These visualizations are crucial for uncovering hidden trends and potential anomalies.

A clear, well-designed chart allows you to quickly absorb the essence of your strategy’s performance.

Creating Custom Visualizations

The Lumi Bot backtest results page offers a robust foundation for custom visualizations. Leveraging the available data points, you can create tailored charts that highlight specific aspects of your strategy’s performance. For instance, you can explore the distribution of returns across different market conditions or examine the relationship between trading volume and profitability. This flexibility allows you to deeply analyze and gain a unique perspective on your trading strategies.

Don’t be limited to pre-defined charts; craft visualizations that specifically answer your questions.

Return Distribution Over Time

A crucial visualization is the return distribution over time. This chart, typically a line graph, plots the cumulative returns of your strategy against time. The line’s trajectory reveals the overall upward or downward trend of your returns, while fluctuations and peaks/valleys highlight market volatility and the strategy’s response. By analyzing this chart, you can identify periods of consistent profitability or significant losses, aiding in understanding the strategy’s resilience and its performance in varying market environments.

Comprehensive Performance Metrics Chart

A comprehensive chart should encapsulate a multitude of performance metrics. This chart could feature multiple lines, each representing a key metric. For instance, one line might track the average daily return, another the maximum drawdown, and a third the Sharpe Ratio. This visual presentation provides a holistic overview of your strategy’s performance, allowing you to quickly identify potential strengths and weaknesses across various performance dimensions.

This consolidated view facilitates a swift assessment of your strategy’s overall viability. This kind of chart allows for a powerful comparison of different strategies, or the same strategy across different time periods. The visual clarity allows you to immediately grasp the trade-offs and trade-offs.

Troubleshooting Common Issues

A disheartening experience awaits any trader when their Lumi Bot backtest results page doesn’t cooperate. Frustration mounts when you’re eager to analyze strategy performance, only to find yourself staring at a blank screen or cryptic error messages. But fear not! This section is your guide to navigating these potential pitfalls and reclaiming control of your data. We’ll equip you with the tools to identify and resolve common issues, ensuring your backtest results remain a reliable compass for your trading decisions.

Network Connectivity Problems

Network issues are a frequent culprit behind access problems. A slow or unstable internet connection can prevent the page from loading, leading to an infuriating wait. Similarly, firewalls or network restrictions might block access to the necessary servers. Troubleshooting involves checking your internet connection, verifying firewall settings, and ensuring your network configuration doesn’t interfere with access to the Lumi Bot backtest results page.

Data Retrieval Errors

Sometimes, the backtest process itself might encounter difficulties. If the data required for the backtest isn’t properly downloaded or processed, you’ll likely see missing information or inaccurate results. This could stem from issues with the data source, such as server outages or temporary data unavailability. A corrupted data feed or a failure to properly connect to the required data repository can also result in missing information.

Incorrect Input Parameters

A slight error in the backtest setup can lead to substantial discrepancies in the results. Using incorrect input parameters, such as the wrong timeframe, asset symbol, or trading strategy configuration, can generate misleading conclusions. A careful review of the input parameters is crucial. For example, selecting the wrong currency pair for a strategy focused on a different asset class will inevitably result in inaccurate data.

Likewise, a mistaken starting date or ending date can alter the scope of the analysis and yield unreliable results.

Account Authentication Issues

Access to the backtest results page often requires account authentication. If your login credentials are incorrect or your account is temporarily suspended, you won’t be able to access the results. Ensuring the correct username and password are used is vital. Check your account status for any temporary suspensions or limitations that might prevent access.

Troubleshooting Steps

- Verify your internet connection. A reliable internet connection is fundamental for successful data retrieval.

- Check your firewall settings. Firewall rules may block access to the Lumi Bot backtest results page. Adjust accordingly.

- Ensure correct input parameters. Double-check the backtest parameters, especially timeframe, asset symbol, and strategy configuration.

- Review your account status. Check for any temporary suspensions or limitations that might restrict access.

Common Issues, Causes, and Solutions

| Common Issue | Potential Cause | Suggested Solution |

|---|---|---|

| Backtest results page not loading | Network connectivity problems, server issues | Check internet connection, try again later, contact support if the problem persists. |

| Missing data or inaccurate results | Data retrieval errors, incorrect input parameters, corrupted data feed | Verify data source availability, check input parameters, update data feed, contact support for assistance. |

| Login issues | Incorrect credentials, account suspension | Verify username and password, check account status, contact support if necessary. |

Closure

In conclusion, this guide provides a thorough overview of how to see Lumi Bot backtest results page. By mastering the navigation, interpretation, and analysis techniques presented, users can effectively leverage the data to make informed decisions regarding strategy optimization and risk management. The practical examples and comprehensive tables included ensure a clear understanding of the backtest results, empowering users to maximize their investment strategies.

Frequently Asked Questions: How To See Lumi Bot Backtest Results Page

What are the typical column headers found on a Lumi Bot backtest results page?

Typical headers include Date, Asset, Strategy, Return, Risk, and potentially others depending on the specific backtest configuration.

How can I filter the backtest results?

Filtering options typically include date range selection, asset type filtering, and strategy selection, allowing users to isolate specific data sets for analysis.

What are some common performance metrics found on the results page?

Common metrics include total return, annualized return, maximum drawdown, Sharpe ratio, and others, each offering a distinct perspective on the strategy’s performance.

How do I compare the performance of different strategies using the results page?

Strategies can be compared by examining their returns, risk profiles, and other performance metrics across the same time period, allowing for a direct comparison of their effectiveness.