Is gap insurance worth it on a used car? This critical question haunts many used car buyers, a perplexing dilemma demanding careful consideration. Understanding the nuances of gap insurance and its implications for used vehicles is essential before making a commitment. The value proposition depends heavily on the vehicle’s condition, purchase price, and potential for depreciation. This comprehensive guide will unravel the complexities, helping you determine if this often-overlooked coverage is truly necessary for your used car investment.

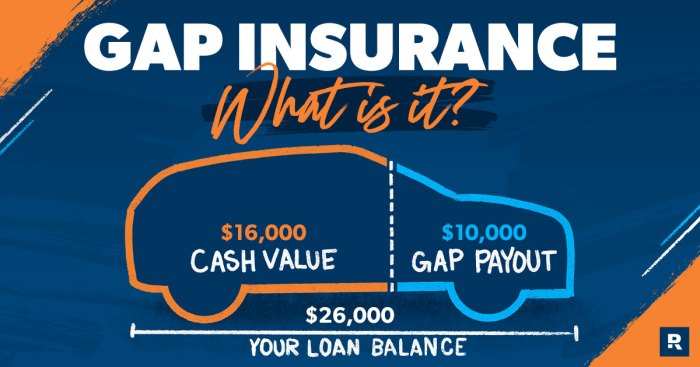

Used cars, often bargains, can be subject to unforeseen circumstances. A collision or total loss can swiftly leave you with a substantial financial burden, potentially exceeding the vehicle’s current market value. Gap insurance acts as a safety net, stepping in to cover the difference between the loan amount and the vehicle’s depreciated value. Navigating this intricate web of factors is key to making an informed decision.

Understanding Gap Insurance

Marga ni gap insurance, sada usaha na ringgas jala penting i bas jaman na on. I bas sektor otomotif, gap insurance mambahen perlindungan tambahan i bas situasi na mungkin terjadi. Ingkon dipahami ma na mungkin terjadi, agar dapat diantisipasi.

Definition and Purpose

Gap insurance merupakan jenis asuransi tambahan yang melindungi selisih antara nilai pasar kendaraan dan nilai utang yang belum dilunasi. Hal ini penting, terutama untuk pembelian mobil bekas, karena nilai mobil bekas cenderung menurun seiring waktu. Gap insurance bekerja dengan cara membayar selisih tersebut jika terjadi kerugian total atau pencurian. Jadi, walaupun mobil sudah rusak total atau dicuri, pemegang polis tetap akan mendapatkan pengembalian sejumlah utang yang belum dilunasi.

Ini merupakan perlindungan tambahan terhadap kemungkinan kerugian finansial yang mungkin timbul.

Difference from Other Vehicle Insurance

Gap insurance berbeda dengan asuransi kendaraan lain seperti comprehensive dan collision. Asuransi comprehensive dan collision umumnya hanya menanggung kerusakan fisik kendaraan, sedangkan gap insurance fokus pada perlindungan terhadap utang yang belum dilunasi. Gap insurance tidak menutupi kerusakan fisik, melainkan selisih nilai antara harga beli dan utang. Asuransi kendaraan lain fokus pada perbaikan atau penggantian kendaraan, sementara gap insurance fokus pada pelunasan utang.

Scenarios Requiring Gap Insurance

Gap insurance sangat penting dipertimbangkan dalam beberapa situasi pembelian mobil bekas. Jika Anda membeli mobil bekas dengan pinjaman, dan nilai mobil tersebut menurun drastis, gap insurance akan membantu melindungi Anda dari kerugian finansial jika terjadi kerusakan total atau pencurian. Misalnya, jika Anda membeli mobil bekas seharga Rp100 juta dengan utang Rp80 juta, dan mobil tersebut mengalami kecelakaan total, asuransi gap insurance akan melunasi utang tersebut.

Dengan demikian, Anda tidak perlu menanggung kerugian finansial yang cukup besar.

Comparison Table

| Scenario | Gap Insurance Coverage |

|---|---|

| Membeli mobil bekas dengan pinjaman, dan nilai mobil menurun drastis. | Melindungi selisih antara nilai mobil saat pembelian dan nilai utang yang belum dilunasi. |

| Mobil mengalami kerusakan total akibat kecelakaan. | Membantu melunasi utang mobil yang belum dilunasi. |

| Mobil dicuri. | Membantu melunasi utang mobil yang belum dilunasi. |

| Mobil mengalami kerusakan berat dan tidak layak pakai. | Membantu melunasi utang mobil yang belum dilunasi, jika nilai mobil sudah tidak mencukupi untuk melunasi utang. |

Factors Affecting Gap Insurance Value

Marga ni, di naeng marende, angka faktor na manggutuhi nilai asuransi gap di mobil terpakai. Penting siboan na mambagi di hita asa boi dipahami naeng manang pe gabe penting naeng manjalo asuransi gap. Ikkon dipatoguhon jala dipahami faktor-faktor na manggutuhi nilai asuransi gap asa boi diputushon secara tepat.

Vehicle Age and Mileage

Usia dohot jarak tempuh mobil mambahen pengaruh signifikan tu kebutuhan asuransi gap. Mobil na umbotosa usiana, umbalos jarak tempuh, jotjotna umbalos nilai tukar. Hal on mambahen kemungkinan “gap” di antara nilai pasar dohot nilai asuransi mobil na umbotosa. Mobil na umbotosa usiana, umbalos kemungkinan depresiasi, jadi penting dipertimbangkan faktor on.

Original Purchase Price

Harga beli awal mobil mambahen pengaruh penting tu kemungkinan “gap”. Mobil na umbalos harga belina, umbalos kemungkinan “gap” antara harga beli dohot nilai tukar. Penting diingat bahwa harga beli awal bukanlah satu-satunya faktor. Faktor-faktor na asing, songon umur mobil dohot kondisi mobil pe mambahen pengaruh.

Trade-in Value and Depreciation

Nilai tukar dohot depresiasi mobil mambahen pengaruh penting tu kebutuhan asuransi gap. Jotjotna, nilai tukar mobil na umbotosa usiana, umbalos. Depresiasi dohot nilai tukar na rendah mambahen kemungkinan “gap” umbalos. Penting diingat bahwa nilai tukar dohot depresiasi gabe faktor na dinamis, jala boi berubah-ubah sesuai kondisi pasar.

Examples of Used Car Scenarios

| Vehicle Age | Mileage | Purchase Price | Trade-in Value | Gap Insurance Recommendation |

|---|---|---|---|---|

| 3 years | 30,000 km | Rp 200 juta | Rp 150 juta | Strongly recommended. |

| 5 years | 50,000 km | Rp 180 juta | Rp 120 juta | Recommended. |

| 7 years | 70,000 km | Rp 150 juta | Rp 90 juta | Recommended, but consider carefully. |

| 10 years | 100,000 km | Rp 120 juta | Rp 60 juta | Possibly not recommended, tergantung kondisi mobil. |

Tabel on mambagi contoh-contoh skenario mobil terpakai dohot kemungkinan kebutuhan asuransi gap, dibahen sesuai umur, jarak tempuh, harga beli awal, dohot nilai tukar. Penting dipahami bahwa on hanyalah contoh-contoh, jala kebutuhan asuransi gap di setiap kasus berbeda-beda.

Evaluating the Cost-Benefit of Gap Insurance

Marga ni, understanding the financial implications of gap insurance on a used car is crucial. It’s not just about the initial cost; it’s about weighing the potential savings against the premium paid. This section delves into the cost-benefit analysis, examining situations where gap insurance is a sound investment and when its expense outweighs the potential return.

Comparing Costs and Potential Savings

Determining the value of gap insurance involves a careful comparison of the insurance premium against the potential savings in case of a total loss or significant damage. The premium is a fixed cost, while the potential savings are contingent on the actual value of the car and the extent of damage. Factors like market depreciation, accident severity, and the car’s condition play a significant role in the equation.

Situations Where Gap Insurance is Worthwhile

Gap insurance can be a prudent choice in several scenarios. A prime example is when the car’s market value significantly depreciates below the outstanding loan amount. If the car is damaged beyond repair, the insurance payout may not cover the full loan, leaving a substantial shortfall. Gap insurance would bridge this difference, protecting the buyer from financial loss.

Furthermore, a car involved in an accident that results in a total loss would benefit from gap insurance. In such instances, the insurance proceeds might not fully compensate for the loan amount.

Situations Where the Cost Outweighs the Benefit

There are also situations where the cost of gap insurance may not justify the potential benefits. For example, if the car’s value remains close to the loan amount, the potential savings from gap insurance might be minimal. Furthermore, if the buyer has a significant amount of equity in the vehicle, the need for gap insurance is reduced. Moreover, if the buyer has sufficient personal savings to cover any shortfall in the event of a total loss, the cost of gap insurance may be considered unnecessary.

Scenario-Based Analysis of Gap Insurance Application

The following table illustrates how gap insurance coverage applies in various scenarios of vehicle damage. It highlights the circumstances where gap insurance would offer protection and those where its cost may be excessive.

| Damage Type | Gap Insurance Coverage | Cost Analysis |

|---|---|---|

| Minor fender bender (repair cost less than depreciated value) | No coverage | Gap insurance premiums are not recovered. |

| Total loss due to fire or flood | Full coverage (covers the difference between the vehicle’s value and the outstanding loan) | Significant savings if the loan amount exceeds the vehicle’s value. |

| Total loss due to accident (loan amount exceeds vehicle’s value) | Full coverage (covers the difference between the vehicle’s value and the outstanding loan) | Significant savings, protecting against financial loss. |

| Major accident, vehicle repairable (loan amount close to vehicle’s value) | No coverage | Minimal benefit as the loan amount is close to the vehicle’s value, making the cost of gap insurance excessive. |

| Car is stolen and fully recovered (loan amount close to vehicle’s value) | Full coverage | Significant savings, as it covers the difference between the vehicle’s value and the outstanding loan. |

Alternatives to Gap Insurance

Marga naposo ni Tuhan, dibahen hita mamahaman taringot tu alternatif na asing sian asuransi gap asa unang mansai torang jala jelas. Adong alternatif na asing na boi dipake laho mangalului perlindungan, jala paboaon ma dison cara mangalului perlindungan na asing i.

Additional Car Insurance Coverage

Penting ma patuduhonon taringot tu alternatif na asing, asa boi dipahami secara komprehensif. Asuransi mobil komprehensif marlapatan na mencakup kerusakan mobil akibat kejadian tak terduga, seperti tabrakan, pencurian, atau bencana alam. Asuransi komprehensif boi mangalului perlindungan di hal na mungkin tidak tercakup di dalam asuransi gap. I dohot i, asuransi komprehensif pe boi mangurupi di kasus-kasus tertentu, na boi mangganti kerugian na di alami.

Negotiating a Lower Price

Boi do dipahami, laho mangalului alternatif na asing sian asuransi gap, boi do diusahahon marunding jala mandapatkan harga yang lebih murah di saat membeli mobil bekas. Mungkin saja, pemilik mobil bekas boi setuju mangurangi harga mobil na di jual, jala hita boi mambuat keputusan di tingki na tepat. Mungkin, di tingki marunding, boi dibahen tawaran na asing.

Extended Warranty

Asuransi ekstensi garansi boi do dipake laho mangalului alternatif na asing sian asuransi gap. Ekstensi garansi marlapatan na mangalului perlindungan di komponen mobil na mungkin rusak. Na boi mangganti biaya perbaikan di masa depan, jala mangurupi di hal na mungkin tidak tercakup di dalam asuransi gap. Na penting diingat, ekstensi garansi boi mangurupi di hal na mungkin terjadi di masa depan, tapi tidak seluruh kasus na mungkin terjadi.

Comparison Table: Gap Insurance vs. Comprehensive Coverage

| Feature | Gap Insurance | Comprehensive Coverage |

|---|---|---|

| Coverage | Menutupi selisih antara nilai pasar mobil dan jumlah utang | Menutupi kerusakan atau kehilangan mobil akibat kejadian tak terduga, seperti kecelakaan, pencurian, atau bencana alam |

| Cost | Biaya tambahan, biasanya dihitung sebagai premi | Biaya tambahan dihitung sebagai premi asuransi mobil |

| Coverage for Depreciation | Secara khusus menutupi depresiasi | Tidak secara khusus menutupi depresiasi, tetapi boi mencakup hal na mungkin terjadi |

| Coverage for Theft | Mencakup pencurian | Mencakup pencurian |

| Coverage for Accidents | Tidak secara langsung mencakup kecelakaan | Mencakup kerusakan akibat kecelakaan |

Illustrative Examples of Gap Insurance

Di dunia mobil bekas, memahami pentingnya asuransi gap merupakan kunci untuk melindungi investasi Anda. Asuransi ini dapat memberikan perlindunga tambahan ketika terjadi hal tak terduga, seperti kecelakaan atau kerusakan total pada kendaraan Anda. Berikut ini beberapa contoh nyata yang akan membantu Anda memahami manfaatnya.

Scenario of High Benefit

Bayangkan Anda membeli mobil bekas dengan harga Rp 150 juta. Nilai pasar mobil itu saat ini sekitar Rp 100 juta. Jika terjadi kecelakaan dan mobil mengalami kerusakan total, asuransi kendaraan Anda mungkin hanya membayar Rp 90 juta. Dengan demikian, Anda akan mengalami kerugian sebesar Rp 10 juta. Namun, dengan asuransi gap, Anda akan mendapatkan tambahan dana hingga mencapai harga pembelian mobil, mengurangi kerugian yang Anda alami.

Ini sangat membantu Anda menutupi selisih harga antara harga beli dan nilai yang dibayarkan oleh asuransi.

Scenario of Limited Need

Sebaliknya, bayangkan Anda membeli mobil bekas dengan harga Rp 80 juta. Nilai pasarnya saat ini sekitar Rp 70 juta. Jika terjadi kerusakan total, asuransi kemungkinan besar akan membayar nilai yang mendekati harga pasar, yakni Rp 70 juta. Perbedaannya, hanya Rp 10 juta. Dalam kasus ini, asuransi gap mungkin tidak terlalu krusial, karena kerugian finansial yang mungkin terjadi relatif kecil.

Perlu dipertimbangkan apakah biaya premi asuransi gap sebanding dengan potensi kerugian yang mungkin dialami.

Comprehensive Example of Total Loss

Misalkan Pak Budi membeli mobil bekas tahun 2018 dengan harga Rp 200 juta. Nilai pasar mobil tersebut saat ini hanya Rp 150 juta. Karena suatu kecelakaan, mobil Pak Budi mengalami kerusakan total. Asuransi kendaraan hanya membayar Rp 140 juta. Tanpa asuransi gap, Pak Budi akan mengalami kerugian sebesar Rp 60 juta (Rp 200 juta – Rp 140 juta).

Dengan asuransi gap, Pak Budi akan menerima tambahan dana hingga mencapai harga pembelian mobil, yaitu Rp 200 juta. Ini berarti kerugian finansial Pak Budi akan berkurang signifikan, membantu mengurangi dampak finansial akibat kerusakan total kendaraan.

Mitigation of Financial Loss

Asuransi gap berperan penting dalam meringankan beban finansial ketika terjadi kerusakan total pada mobil bekas. Dengan menutupi selisih antara harga beli dan nilai yang dibayarkan asuransi, asuransi gap membantu meminimalkan kerugian dan memastikan bahwa Anda tetap terlindungi secara finansial. Sebagai ilustrasi, jika asuransi gap tidak ada, kerugian finansial dapat mencapai angka yang signifikan, berpotensi membuat Anda mengalami kesulitan finansial.

Addressing Potential Misconceptions: Is Gap Insurance Worth It On A Used Car

Marga ni, naeng, hita mangalusi mauliatehon di angka salah paham taringot tu asuransi gap di mobil terpakai. Asa holan angka na denggan do na taingot, asa unang adong na salah paham.Sada hal na ringkot sipahami ma, asuransi gap ndang songon asuransi mobil na biasa. Asuransi gap holan mambahen angka kerugian ni mobil, molo terjadi kecelakaan. I do na ringkot dipadomu.

Asa unang ma adong na salah paham, naeng sipahami ma.

Common Misconceptions Regarding Gap Insurance, Is gap insurance worth it on a used car

Marhite sian pengalaman ni angka na ummuli, adong ma angka salah paham taringot tu asuransi gap na ringkot sipatahi ma. Disi, marhite pamingkiron na benar do, hita mampu mangalusi mauliatehon di angka salah paham i.

- Gap insurance is mandatory for all used cars.

Ndang songon i. Asuransi gap ndang wajib di pakai di setiap mobil terpakai. I do na benar. Asuransi gap maruntung di keadaan tertentu, jala ndang setiap mobil terpakai mangkilala keuntungan i.

- Gap insurance is always beneficial.

Ndang selalu. Adong keadaan dimana asuransi gap ndang memberikan keuntungan. Misalnya, molo harga mobil terpakai i tarpatolhas. Di situasi na songon i, asuransi gap mungkin ndang perlu.

- Gap insurance covers all damages.

Ndang. Asuransi gap holan mambahen kerugian mobil na melebihi nilai pasaran ni mobil. Asuransi mobil na biasa do na mambahen kerugian di kecelakaan. Asa unang ma salah paham.

Situations Where Gap Insurance Might Not Be Beneficial

Adong situasi na mungkin ndang perlu di pakai asuransi gap. Di situasi i, mungkin hita mampu mangalusi mauliatehon marhite pengalaman ni angka na ummuli.

- The vehicle’s current market value is close to or equal to the loan amount.

- The vehicle has a low market value.

- The vehicle is very old and has low residual value.

- The loan term is short.

Di situasi i, asuransi gap ndang pasti memberikan keuntungan na nyata. Hita pe butuh mempertimbangkan biaya na di perluhon untuk asuransi gap.

Why Gap Insurance Isn’t Always Necessary

Gap insurance, mungkin ndang dibutuhkan di setiap keadaan. Mungkin maruntung di keadaan na tertentu, jala ndang setiap mobil terpakai mangkilala keuntungan i.

- Financial prudence. Hita mampu mangalusi mauliatehon di biaya na tambahan, asa hita dapat mempertimbangkan angka alternatif.

- High deductible. Asuransi mobil na biasa do na mambahen angka kerugian na besar, molo terjadi kecelakaan.

Na ringkot do diingat, keputusan na tepat do na mambahen hita mampu mangalusi mauliatehon di kondisi na berbeda.

Summary

Ultimately, deciding whether gap insurance is worth it on a used car hinges on your individual circumstances. Thoroughly evaluating the vehicle’s condition, potential depreciation, and financial situation are paramount. Considering alternatives, like adjusting the loan amount or exploring comprehensive coverage options, is also wise. This detailed exploration of gap insurance on used cars empowers you to make an informed, financially sound choice.

By understanding the potential benefits and drawbacks, you can confidently protect your investment and safeguard yourself from financial surprises.

Questions and Answers

Is gap insurance mandatory for all used cars?

No, gap insurance is not mandatory. It’s a supplemental coverage option, not a requirement.

How does gap insurance work with comprehensive coverage?

Comprehensive coverage often overlaps with some aspects of gap insurance. However, they are distinct and often address different financial risks.

What are the common misconceptions about gap insurance?

A common misconception is that gap insurance is always a necessary purchase. This is not always the case. The value proposition hinges on your specific circumstances and the vehicle’s potential for depreciation.

Can I negotiate the gap insurance cost?

Yes, you can sometimes negotiate the gap insurance premium with the lender or insurance provider.