Is insurance more expensive for new cars? The answer isn’t always a simple “yes” or “no,” my friend. It’s a wild ride through a maze of factors, from the car’s sparkling newness to your driving habits and the insurance company’s quirky pricing strategies. Get ready for a crash course into the world of car insurance, where even the safest, shiniest models can have a surprisingly high price tag.

New cars, often seen as a symbol of sleek modernity, can sometimes come with a hefty price tag, not just in terms of the car itself but also in the form of insurance premiums. Factors such as the car’s make, model, safety features, engine type, and even your location can all influence how much you pay for your policy.

Let’s dive deep into the intriguing world of new car insurance costs and uncover the truth behind those seemingly exorbitant premiums.

Factors Influencing Insurance Costs for New Cars

Yo, new car owners! Insurance costs can be a right pain in the neck, especially when you’ve just splashed out on a brand new ride. Knowing what factors are making those premiums go through the roof is key to saving some serious dosh. Let’s dive into the nitty-gritty.

Factors Affecting New Car Insurance Premiums

Insurance companies use a whole load of factors to work out how much they’ll charge you. It’s not just about the car itself; they look at a whole bunch of stuff, including your driving history and where you live. This table breaks down some key factors:

| Factor | Brief Description | Potential Impact on Insurance Premiums |

|---|---|---|

| Vehicle Make and Model | The brand and specific model of the car. | Different brands and models have varying reputations for safety and reliability, influencing insurance rates. For example, some makes are known for higher accident rates, which leads to higher premiums. |

| Safety Features | Presence of features like airbags, anti-lock brakes, and electronic stability control. | Cars with more advanced safety features tend to have lower insurance premiums, as they’re statistically less likely to be involved in accidents. |

| Engine Type | Whether the car runs on gasoline, diesel, or electricity. | Electric cars often have lower insurance premiums compared to petrol or diesel vehicles, as they’re usually less powerful and involved in fewer accidents. |

| Vehicle Value | The price of the car. | Higher-value cars often come with higher insurance premiums. Insurers need to cover a larger sum in case of damage or theft. |

| Driver’s Age and History | The age of the driver and their driving record. | Younger drivers and those with a history of accidents or speeding tickets will typically face higher premiums. |

| Location | The area where you live and drive. | Areas with higher accident rates or crime can lead to higher premiums. |

| Coverage Options | Chosen levels of comprehensive and third-party insurance. | More comprehensive coverage options will usually result in higher premiums. |

Make and Model Impact on Insurance Rates

The make and model of your car can seriously affect your insurance. Luxury brands, like some German or Japanese models, might come with higher premiums because they’re often more expensive to repair and replace. Conversely, some budget-friendly cars might have slightly lower premiums, but it’s not always a straightforward correlation. A car’s reputation for reliability and safety plays a huge role.

New vs. Used Car Insurance Costs

New cars usually have higher premiums than similar used models. Insurance companies consider the new car’s higher value and the fact that it’s less likely to have sustained pre-existing damage. Used cars, on the other hand, often have lower premiums due to their lower value and potential pre-existing damage.

Safety Features and Insurance Premiums

Safety features are a major factor. Cars with advanced safety tech, like lane departure warnings or automatic emergency braking, are often associated with lower insurance premiums. Insurance companies recognise that these features make accidents less likely. This makes sense, right? A car with more safety features is less likely to be involved in an accident.

Engine Type and Insurance Costs

Engine type does matter. Electric vehicles, for example, are often cheaper to insure than petrol or diesel cars. They tend to be less powerful and involved in fewer accidents, though the market is still relatively new, and this could change over time.

Vehicle Value and Insurance Premium

The value of your vehicle is directly linked to your insurance premium. A more expensive car means a higher insurance premium. The insurance company needs to cover a bigger amount in case of theft or damage. It’s a simple equation: the more the car is worth, the more you’ll pay to insure it.

Insurance Company Practices: Is Insurance More Expensive For New Cars

Insurance companies ain’t exactly handing out freebies, right? They gotta make a profit, and that means figuring out the best way to price policies. It’s all about risk assessment – and new cars are a bit of a wildcard. They’re often packed with fancy tech, meaning potential for more expensive repairs, but also sometimes more robust safety features.

Figuring out the sweet spot for insurance premiums is key for both the company and the customer.Insurance companies employ various strategies to set premiums for new cars, tailoring their approaches based on a multitude of factors. They need to balance providing competitive rates to attract customers while also covering potential losses and maintaining profitability. This intricate balancing act shapes how premiums are set for new vehicles.

Different Approaches to Pricing

Insurance companies use several methods to calculate premiums for new cars. They often look at factors like the car’s make, model, and specific features, including safety technologies and advanced driver-assistance systems. These systems can influence how risky the car is to insure.

Factors Considered in Determining Rates

Insurance companies scrutinise several key factors when deciding on rates for new vehicles. This is a crucial part of their risk assessment process. Vehicle safety ratings, repair costs, and the vehicle’s overall value all play a significant role. The area where the vehicle is primarily used is also considered, as accident rates vary from one area to another.

- Safety Features: Insurance companies analyse the car’s safety features, such as airbags, anti-lock brakes, and electronic stability control. Cars with better safety ratings often attract lower premiums, as they’re deemed less risky to insure.

- Repair Costs: The cost of repairing a new car is a major factor. Cars with complex components and high-tech features can be more expensive to fix, leading to higher insurance premiums.

- Vehicle Value: The higher the value of the new car, the higher the potential loss for the insurance company in case of damage or theft. Consequently, higher premiums are often associated with more expensive vehicles.

- Usage Location: Areas with higher accident rates or more challenging driving conditions might result in higher premiums, as the insurance company accounts for a higher risk of damage or accidents.

Comparison of Pricing Strategies

Different insurance providers employ varying pricing strategies for new cars. Some might focus on a comprehensive assessment of the vehicle’s features and safety, while others might use a more generalized approach. Some might even focus on specific segments of the market, like luxury or electric vehicles, to fine-tune their pricing strategies. Comparing pricing strategies among different insurance providers is crucial for finding the best deal.

Data Gathering Methods

Insurance companies collect data from various sources to assess the risk associated with insuring new cars. This data includes crash test results, repair cost estimates, and information from car manufacturers. Data from government agencies, consumer reports, and industry associations is also used to understand the characteristics of the new car.

Risk Assessment Model

Insurance companies use sophisticated risk assessment models to determine the appropriate premiums for new cars. These models take into account various factors, including the car’s safety features, repair costs, and market value. The models also factor in the frequency and severity of accidents in different areas. The accuracy of these models is crucial for setting fair premiums that reflect the actual risk.

Insurance Company Types and Pricing

| Insurance Company Type | Approach to Pricing for New Cars |

|---|---|

| Regional | Tend to focus on local accident data and driving conditions when setting premiums for new cars in their specific region. |

| National | Use broader data sets to determine rates for new cars across the entire country, taking into account national averages in accident rates and repair costs. |

| Specialty | May focus on specific vehicle types (e.g., luxury cars, electric vehicles) or customer demographics (e.g., young drivers) to develop targeted pricing strategies for new cars. |

Driving Habits and Insurance

Right, so you’re after the lowdown on how your driving style affects your insurance premiums, especially if you’re a fresh-faced newbie behind the wheel of a brand spanking new whip. It’s a total game-changer, mate. Insurance companies look at your driving history like a hawk, and your habits play a huge role in the price tag.

Comparing Insurance Costs for New vs. Experienced Drivers

Insurance companies generally charge new drivers more than experienced drivers for a new car. This is because new drivers are statistically more likely to have accidents and get into trouble on the road. It’s all about risk assessment, and new drivers represent a higher risk profile. Experienced drivers, on the other hand, have proven their driving skills and safety record over time.

| Driver Category | Insurance Cost (Example – £ per year) | Reasoning |

|---|---|---|

| New Driver (under 25) | £1,800 – £2,500 | Higher risk of accidents, fewer years of driving experience, higher likelihood of claims. |

| Experienced Driver (over 25) | £1,000 – £1,500 | Lower risk of accidents, longer driving history, fewer claims. |

Impact of Driving Record on Insurance Rates

A new driver’s driving record is a major factor in determining insurance premiums. Any accidents, speeding tickets, or other violations will significantly increase insurance costs. It’s a no-brainer – the more incidents on your record, the higher the risk, and the higher the price you’ll pay. Insurance companies use these records to assess your driving behaviour and predict future risk.

Influence of Driving History on Insurance Costs

Your driving history, regardless of whether you’re a new or experienced driver, impacts your insurance costs. A clean driving record, free from accidents and violations, will result in lower premiums. Conversely, a history of traffic violations or accidents will result in substantially higher premiums.

Impact of Location on Insurance Rates

Insurance rates can vary considerably depending on your location. Areas with higher crime rates, higher accident rates, or harsher driving conditions often have higher insurance premiums. Think of it like this: If you live in a place known for crazy rush-hour traffic, insurers will factor that in.

Impact of Age on Insurance Premiums

Age is a crucial factor in insurance pricing, especially for new drivers. Younger drivers are generally considered higher-risk than older drivers, due to factors like inexperience and a higher likelihood of taking risks. This is why insurance companies often charge a premium for younger drivers, especially those under 25.

Coverage Options and Premiums

Right, so you’ve nailed down the basics of insurance, now let’s get into the nitty-gritty of different coverages and how they whack your premium. Knowing your options is key to getting the best deal without getting ripped off. Choosing the right level of coverage can save you a ton of dosh.Insurance companies use a complex formula to calculate premiums, and coverage is a major factor.

Different levels of protection result in different costs. Understanding these factors helps you avoid overpaying and get the best bang for your buck.

Different Types of Car Insurance Coverage

Understanding the various coverage options is crucial for making informed decisions. Different levels of coverage provide varying degrees of protection, impacting your premium. Here’s a breakdown of the common types:

| Coverage Type | Description | Impact on Premium |

|---|---|---|

| Liability | Covers damages you cause to others’ vehicles or injuries to them. | Generally the cheapest option, but offers limited protection for your own car. |

| Collision | Covers damage to your vehicle in an accident, regardless of who’s at fault. | Increases the premium, providing crucial protection for your investment. |

| Comprehensive | Covers damage to your vehicle from events other than collisions, like vandalism, theft, or natural disasters. | Further increases the premium, offering protection against a wider range of risks. |

| Uninsured/Underinsured Motorist | Protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage. | A vital addition, safeguarding you from financial ruin in such scenarios. |

Comprehensive and Collision Coverage Impact, Is insurance more expensive for new cars

Comprehensive and collision coverage significantly affect your premiums for a new car. A new whip is a big investment, and you need to protect it. Comprehensive coverage, for instance, protects your pride and joy from perils beyond accidents, like theft or fire. Collision coverage, on the other hand, steps in if you’re involved in a crash, regardless of fault.

These add-ons, while boosting your premium, provide essential financial safeguards.

Additional Coverage Options

Additional coverage options, like roadside assistance, can also influence your insurance costs. Roadside assistance is often a worthwhile addition, providing help in emergencies like flat tires or lockouts. It’s a relatively small cost for peace of mind. Think of it as a safety net for when you’re stranded on the side of the road. These extras, though, add to your overall premium.

Liability-Only vs. Full Coverage

Liability-only coverage is the most budget-friendly option, but it offers minimal protection for your vehicle. Full coverage, on the other hand, provides comprehensive protection, shielding your investment from various risks. Liability-only coverage is often sufficient for older cars, but a new car deserves more robust protection.

Level of Coverage and Insurance Cost

The level of coverage directly impacts the insurance cost for new cars. A higher level of coverage means more comprehensive protection, but it also results in a higher premium. Choosing the right balance between protection and cost is essential. For example, a new sports car, a prized possession, might warrant a higher level of coverage to mitigate the financial impact of potential damage or theft.

Additional Factors Affecting Insurance

Right, so you’ve got your new whip sorted, sorted out your insurance cover, and you’re all set to cruise. But there’s more to it than just the car and your driving style. Other factors can totally change your insurance rates, mate. It’s not just about the model, it’s about the whole picture.Insurance isn’t just about the car; it’s a whole package deal, considering the full picture.

Factors like financing, location, and even registration procedures can significantly affect your premiums. Understanding these extras is crucial to getting the best deal.

Financing Terms and Insurance Costs

Financing your new ride plays a major role in your insurance costs. Lenders often require you to take out comprehensive insurance to protect their investment. This means your insurance needs to cover the full value of the car, not just your share. If you finance through a dealership, the terms of the finance agreement could also affect the premium.

Some lenders might require proof of insurance before approving the loan, and some finance plans have higher premiums to compensate for the risk involved.

Location of Use and Insurance Premiums

Where you mainly use your new car can drastically impact your insurance rates. High-risk areas, like those with a higher crime rate or accident history, usually have higher insurance premiums. Similarly, areas with a lot of traffic or bad weather conditions might also affect your insurance costs. Think about it – if you live in a town with a history of high-speed chases or areas with lots of accidents, you’ll probably pay more for insurance than someone who lives in a quieter, safer place.

Regional Variations in Insurance Costs

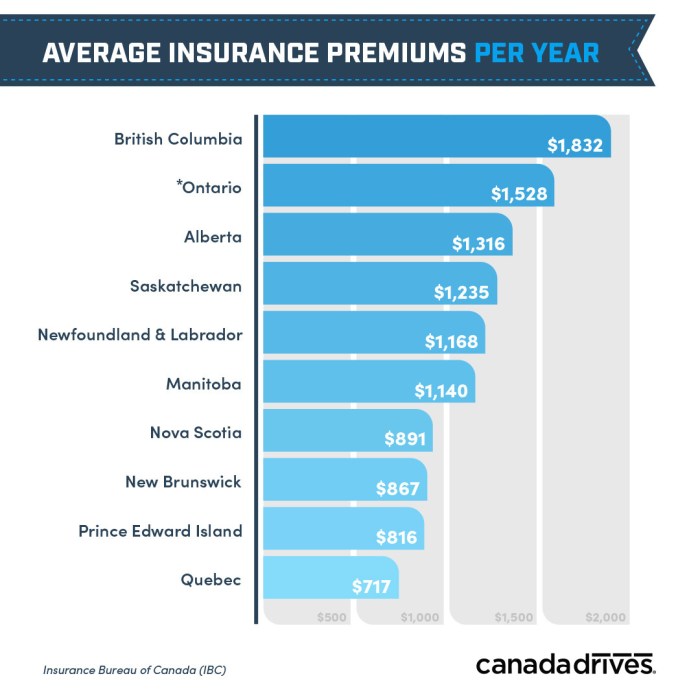

Insurance costs vary wildly between states and regions. Laws, regulations, and even the local driving culture can influence premiums. For example, states with stricter driving laws might have higher insurance costs. Certain areas with a higher rate of accidents or particular driving conditions may also see higher insurance rates. This is something you need to be aware of if you plan on moving around.

Vehicle Registration and Titling Procedures

The process of registering and titling your new car can also affect your insurance rates. If you have issues with completing these procedures or any problems with paperwork, it could impact your premium. Things like delays in getting the registration or titling issues can affect the insurance companies’ assessment of your risk. It’s crucial to be aware of these potential delays, so you can be prepared.

Summary Table of Factors Influencing Insurance Costs

| Factor | Potential Impact on Premiums |

|---|---|

| Financing Terms | Higher premiums if comprehensive insurance is required; variations in premiums based on finance agreements. |

| Location of Use | Higher premiums in high-risk areas, areas with high traffic, or bad weather conditions. |

| Regional Variations | Significant variations in premiums based on state laws, regulations, and local driving culture. |

| Vehicle Registration/Titling | Potential for higher premiums due to delays or issues with paperwork. |

Epilogue

So, is insurance more expensive for new cars? The truth is, it depends. A plethora of factors, from the car itself to your driving record and location, all play a role in shaping your insurance costs. Understanding these factors empowers you to make informed decisions and potentially negotiate favorable rates. Armed with this knowledge, you can navigate the often-confusing world of car insurance with confidence, ensuring your new ride is protected without breaking the bank.

Q&A

Does the car’s age affect insurance premiums?

Absolutely! A brand-new car is generally perceived as a higher-risk investment, so insurance companies often charge more for it, just like a younger driver is viewed as more risky than an experienced one.

What about the car’s safety features?

Cars with advanced safety features like airbags and anti-lock brakes usually come with lower insurance premiums, as they’re less likely to result in accidents.

Can financing terms affect my insurance?

Yes! The financing terms of your car loan can potentially influence your insurance rates, as some factors related to loan terms could be viewed as an increased risk.

How do insurance companies collect data on new car models?

Insurance companies use various data sources, including testing results, accident statistics, and even customer feedback on the car model’s performance to assess the risk involved.