A letter of cancellation of car insurance marks the end of a contract, a transition from one stage to another. This document Artikels the process, from understanding its purpose and key components to navigating the legal and regulatory aspects, practical considerations, and common mistakes. It’s a journey through the complexities of ending your car insurance coverage.

The letter of cancellation of car insurance is crucial for ensuring a smooth and legally sound termination of your policy. This guide provides a comprehensive overview, including a detailed template, legal requirements, and practical steps. Whether you’re canceling due to a move, a change in circumstances, or simply looking for a better deal, this resource is designed to help you through the process.

Understanding the Document

A letter of cancellation for car insurance formally notifies the insurance company of your intent to discontinue coverage. This document serves as a crucial record, ensuring both parties understand the termination of the policy and associated obligations. It’s a vital step to avoid any future misunderstandings or financial penalties.This letter Artikels the process for effectively terminating your car insurance policy.

It details the necessary information to include, common reasons for cancellation, and the proper structure for a formal and legally sound document. By understanding these components, you can ensure a smooth and hassle-free cancellation process.

Purpose of a Cancellation Letter

A letter of cancellation for car insurance officially terminates your policy with the insurance company. It signifies your intent to no longer be covered by the policy and clarifies the effective date of cancellation. This formal communication protects both you and the insurance company, avoiding any ambiguity regarding your insurance status.

Key Components of a Cancellation Letter

A comprehensive cancellation letter includes several essential elements:

- Policy Information: This includes your policy number, your name, the vehicle identification number (VIN), and the effective date of the policy. This helps the insurance company quickly identify the correct policy.

- Cancellation Date: The specific date on which your insurance coverage will end. This date must be clearly stated and should align with your notification period as per your policy terms.

- Reason for Cancellation: While not always mandatory, a brief explanation of why you’re canceling can be helpful. Common reasons include moving to a new location, no longer needing coverage, or finding a better insurance rate.

- Contact Information: Your name, address, phone number, and email address. This ensures the insurance company can contact you if needed for clarification or further details.

- Signature and Date: Your handwritten signature and the date of the letter are essential for legal verification. This demonstrates your acknowledgment of the cancellation request.

Common Reasons for Cancellation

Individuals might cancel their car insurance for a variety of reasons, including:

- Moving: A change in residence often leads to the need for different insurance coverage in a new location. A new address might require a different insurance provider or a different coverage amount.

- No Longer Owning the Vehicle: If the car is sold, the insurance policy becomes irrelevant and requires cancellation. This is a common reason for canceling a policy when the insured vehicle is no longer owned.

- Finding a Better Rate: Comparing insurance rates from different providers is a prudent step. If a more affordable rate is found elsewhere, canceling the current policy is a practical option.

- Changes in Driving Needs: If driving habits or needs change, such as no longer needing the coverage due to reduced driving, the existing policy may become unnecessary.

Structuring a Formal Cancellation Letter

A formal letter of cancellation should follow a clear structure to ensure its effectiveness. It should be concise, professional, and clearly convey your intent to cancel the policy.

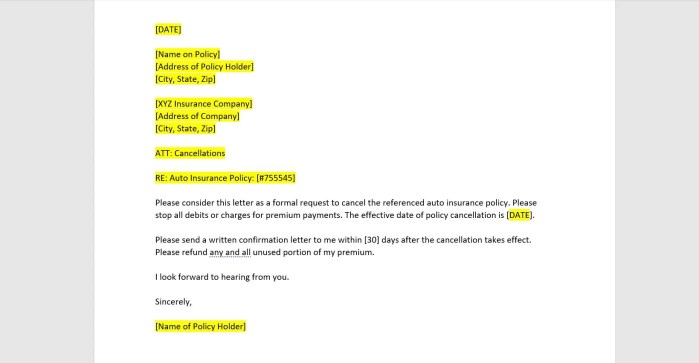

Template for a Cancellation Letter

[Your Name] [Your Address] [Your Phone Number] [Your Email Address] [Date] [Insurance Company Name] [Insurance Company Address] Subject: Cancellation of Car Insurance Policy Dear [Insurance Company Representative Name or "Insurance Company"], This letter formally requests the cancellation of my car insurance policy, policy number [Policy Number]. The vehicle covered under this policy is [Vehicle Make, Model, Year] with VIN [Vehicle Identification Number]. I request the cancellation of this policy effective [Cancellation Date]. [Optional: Briefly state the reason for cancellation, e.g., "I am moving to a new location and no longer require this coverage."] Thank you for your prompt attention to this matter.Please confirm receipt of this request and the steps required for a smooth cancellation process. Sincerely, [Your Signature] [Your Typed Name]

Legal and Regulatory Aspects

Navigating the legal landscape of car insurance cancellation requires a keen understanding of jurisdictional differences and company-specific policies. Each jurisdiction has its own set of regulations governing insurance contracts, impacting the process of cancellation. A thorough knowledge of these regulations ensures a smooth and compliant cancellation process.

The procedures for terminating an insurance policy are not uniform across all insurance providers. Thorough research and careful adherence to the specified steps within the policy document are crucial to avoid complications and ensure a legitimate cancellation. Understanding the nuances of these processes helps prevent misunderstandings and potential financial repercussions.

Legal Requirements for Cancellation

Different jurisdictions have varying legal requirements for canceling car insurance policies. These requirements often dictate the necessary notice period, the documentation needed, and the specific procedures for initiating the cancellation process. Failure to adhere to these guidelines could lead to legal issues or the inability to claim a cancellation.

Procedures for Notifying the Insurance Company

The process for notifying the insurance company about a cancellation varies among insurers. Typically, a written notification is required, outlining the specific details of the cancellation, including the policy number, effective date, and any other relevant information. Insurance companies often require confirmation through signed documents, ensuring a clear record of the cancellation request.

Implications of Not Following Proper Cancellation Procedures

Failure to adhere to the prescribed cancellation procedures can result in penalties, including but not limited to the inability to cancel the policy, or continued billing for premiums. For instance, a policyholder who fails to meet the required notice period might be held responsible for the full premium until the end of the policy term. This underscores the importance of meticulously following the cancellation instructions as Artikeld by the insurance provider.

Comparison of Cancellation Policies Across Different Providers

Insurance providers may have different cancellation policies. Some may impose penalties for early cancellation, such as a pro-rated refund for the unused portion of the policy. Others might have specific clauses regarding the circumstances under which a policy can be canceled, and the conditions under which a full refund is issued. This difference in cancellation procedures necessitates a comparative analysis of different insurance policies before choosing one.

Potential Penalties for Premature Cancellation

Depending on the insurance provider and the policy’s terms, prematurely canceling a car insurance policy can lead to financial penalties. These penalties often involve a loss of the premium paid, or a partial refund based on the unused policy period. A policyholder may be required to pay additional fees or charges for any incurred administrative costs or incurred expenses by the insurer.

Understanding these potential penalties in advance allows for a more informed decision about canceling a policy.

Practical Considerations

Navigating the cancellation process for your car insurance requires careful attention to timing and procedure. Understanding the deadlines and steps involved ensures a smooth transition and avoids potential complications. This section details the practical aspects of canceling your policy, from initiating the process to securing the necessary documentation.

Effective cancellation of your car insurance policy requires a structured approach. This involves adhering to the specified deadlines and completing the necessary procedures to ensure a seamless and compliant termination of your coverage.

Timing and Deadlines

Cancelling car insurance is typically governed by specific deadlines, often found in your policy documents. These deadlines vary by insurer and policy type. Failure to meet these deadlines may result in the policy continuing without your desired cancellation or the application being rejected. Be sure to check your policy documents or contact your insurer directly to confirm the exact deadlines for cancellation.

Common deadlines may include a specific timeframe for notifying the insurer of your intent to cancel or a date by which the cancellation must be processed.

Steps for Online or Phone Cancellation

A clear step-by-step approach is crucial for a smooth online or phone cancellation. These methods often require access to your policy details and account information.

- Initiate the cancellation process: Log in to your account online or contact your insurer’s customer service department. Clearly express your intent to cancel the policy.

- Verify your information: Provide accurate policy details and identification information to ensure the cancellation request is processed correctly. Double-check the details to avoid any mistakes. Mistakes in providing your policy number or other details can delay or prevent the cancellation.

- Confirm the cancellation: Once you have submitted your request, obtain confirmation of the cancellation from the insurer. This confirmation often comes in the form of an email or a phone call. Record the confirmation number or date of the cancellation for your records.

Necessary Documents

Collecting the necessary documents is essential for a smooth cancellation process. These documents vary depending on the insurer and the cancellation method.

- Policy Documents: The insurance policy itself, including the policy number and the details of your coverage, are essential for verification. Having a copy of the policy will allow you to confirm the specifics of the cancellation process.

- Proof of Identity: A valid government-issued photo ID is typically required to verify your identity and prevent fraudulent cancellations. Providing your driver’s license or passport is common practice.

- Payment Records (if applicable): Records of any premium payments or outstanding balances may be needed to ensure accurate cancellation processing.

Cancellation Methods

This table Artikels the different ways to cancel car insurance. Each method has specific steps and documents required.

| Method | Steps | Documents Needed |

|---|---|---|

| Online | Log in to your account, find the cancellation section, provide policy details, confirm cancellation, and receive confirmation. | Policy documents, proof of identity. |

| Phone | Contact your insurer’s customer service department, provide policy details, confirm cancellation, and obtain confirmation of cancellation. | Policy documents, proof of identity. |

| Complete a cancellation form, enclose policy documents and proof of identity, and mail it to the insurer’s designated address. | Cancellation form, policy documents, proof of identity, payment records (if applicable). |

Important Clauses and Provisions

Navigating the intricate details of a car insurance policy is crucial, especially when considering cancellation. Understanding the specific clauses governing cancellation, including associated fees and refund policies, is paramount for a smooth and informed decision. This section dissects key provisions, enabling you to comprehend the terms and conditions and their implications.

Cancellation Clauses in Car Insurance Policies

Car insurance policies often contain specific clauses outlining the conditions for cancellation. These clauses vary between insurers and policy types, but typically address situations like early cancellation, address changes, and policy modifications. A careful review of these clauses is essential to ensure that you understand the implications of your decision.

Cancellation Fees and Refund Policies

Insurance policies frequently impose cancellation fees. These fees might be dependent on the reason for cancellation, the duration of the policy, or the specific terms Artikeld in the policy document. It is vital to note that early cancellation typically results in a reduced or non-refundable premium. Some policies offer partial refunds if cancellation occurs before a specific date, and certain policies may include clauses that allow for refunds under certain circumstances.

The specific terms of the refund policy are a critical part of understanding the cancellation process.

Coverage Termination and Waiting Periods

Insurance policies often specify the effective date of coverage termination. This date is generally the date on which the insurance company receives the formal cancellation request. Some policies might include a waiting period before coverage terminates, allowing a period for the insurance company to process the cancellation. This waiting period is explicitly detailed in the policy document.

Interpreting the Fine Print

The fine print within a car insurance policy can be complex, but it’s essential to understand its significance. This section highlights the crucial aspects of the policy terms to help decipher the policy’s language. Seek clarification from the insurance company or a legal professional if anything remains unclear.

Cancellation Scenarios and Outcomes

| Scenario | Outcome |

|---|---|

| Early Cancellation (within the first 30 days) | Typically, a full or partial refund may be possible, depending on the policy’s terms. Cancellation fees and any administrative charges are common in such cases. |

| Cancellation due to a Change of Address | Cancellation due to address changes is usually straightforward, though the policy might have specific procedures. The insurance company might require updated address documentation for the cancellation to proceed. |

| Cancellation due to Non-Payment | Failure to make required payments often results in the immediate cancellation of the policy, with no refund. The policy’s terms usually specify the consequences of non-payment. |

| Cancellation due to Policy Modifications | Policy modifications might lead to changes in coverage, premiums, or even policy cancellation. The insurer’s terms usually address this, outlining the steps required for modifying the policy. |

| Cancellation due to a Dispute | In cases of disputes, the policy may specify procedures for resolving conflicts. A detailed understanding of the policy’s dispute resolution process is crucial. |

Common Mistakes and Issues: Letter Of Cancellation Of Car Insurance

Cancelling car insurance can be straightforward, but overlooking crucial steps can lead to complications. Understanding potential pitfalls and their remedies empowers you to navigate the cancellation process smoothly. Common errors often stem from miscommunication, missed deadlines, or a lack of clarity regarding policy terms.

Identifying Common Errors

Incorrectly completing cancellation forms, failing to provide proper documentation, or neglecting to notify the relevant parties can lead to a stalled or disputed cancellation. These errors can result in unexpected consequences, such as continued billing or the inability to secure coverage for a new policy. Furthermore, missing deadlines, often stipulated in the policy agreement, can render the cancellation request invalid.

Consequences of Errors

Errors in the cancellation process can lead to various undesirable outcomes. Continued insurance premiums can be charged, potentially causing financial strain. A failure to cancel promptly could also result in the inability to acquire insurance elsewhere, especially if there are existing policy limitations. Furthermore, complications may arise during the claims process, hindering access to coverage in the event of an accident or damage.

A delayed cancellation might inadvertently result in coverage gaps or an extension of the existing policy term.

Steps to Take If Issues Arise

When issues arise during the cancellation process, it’s crucial to act promptly. First, meticulously review the policy agreement and cancellation procedures. Contact the insurance company immediately to clarify any doubts or resolve discrepancies. Maintaining detailed records of all communications, including emails and phone conversations, is essential. Seeking legal counsel is a valuable step to explore if the issue remains unresolved despite efforts to resolve it internally.

Disputed Cancellations

Policyholders may dispute a cancellation request in various scenarios. Misinterpretations of policy terms or clauses can lead to disagreements. If the insurance company fails to process the cancellation properly, it can be disputed. Similarly, if the company presents unclear or contradictory information about the cancellation procedure, the policyholder may have grounds for a dispute. For example, if the company incorrectly calculates the refund due upon cancellation, the policyholder can dispute the calculation.

Examples of Situations Where a Cancellation Might Be Disputed

A common scenario involves a policyholder who misunderstands the cancellation policy’s grace period. If a cancellation is submitted after the deadline, it might be rejected. Another example includes instances where a policyholder pays a premium and requests cancellation, but the insurance company fails to reflect this payment in their records. This discrepancy could lead to a dispute. Furthermore, issues related to inaccurate documentation or conflicting statements during communication can lead to disputes.

Summary of Common Mistakes and Remedies

| Common Mistake | Potential Remedy |

|---|---|

| Incomplete or inaccurate cancellation forms | Review the cancellation form, ensure all sections are correctly filled out, and provide accurate details. If necessary, seek clarification from the insurance company. |

| Missing required documentation | Provide the necessary documentation (e.g., proof of payment, identification) promptly. |

| Failure to notify the insurance company | Contact the insurance company via phone or mail, confirming receipt of the cancellation request. |

| Missing deadlines | Contact the insurance company immediately to request an extension, if applicable, or discuss the possibility of a refund for the unused portion of the policy. |

| Misinterpretation of policy terms | Carefully review the policy terms and conditions related to cancellation. If necessary, seek legal counsel or clarification from the insurance company. |

Future Considerations and Trends

The landscape of car insurance cancellation policies is constantly evolving, driven by technological advancements, shifting consumer expectations, and evolving regulatory frameworks. Understanding these future trends is crucial for both insurers and policyholders to navigate the complexities of the cancellation process effectively.

The future of car insurance cancellation policies will likely see a significant integration of technology, streamlining processes and enhancing transparency. Online platforms are already transforming the way policies are managed, and this trend is expected to accelerate. Evolving regulations will also play a critical role in shaping the future of cancellation procedures.

Potential Technological Advancements

Technological advancements will undoubtedly reshape the car insurance cancellation process. For example, the use of AI-powered chatbots can provide instant support and guidance during the cancellation process, addressing common queries and streamlining the procedure. Automated systems can analyze policy data and identify potential eligibility for early termination, potentially saving time and effort for both the insurer and the policyholder.

Blockchain technology could also enhance transparency and security, ensuring the integrity of cancellation records and facilitating faster settlements.

Impact of Online Platforms

Online platforms are transforming the entire insurance industry, and car insurance cancellation is no exception. Digital portals allow policyholders to access their policy details, submit cancellation requests, and track the progress of their cancellation requests online, significantly reducing the need for phone calls or physical visits to an office. This shift towards online platforms is making the cancellation process more accessible, convenient, and transparent for policyholders.

Furthermore, insurers can leverage data analytics to identify and target specific segments of policyholders who might be considering cancellation, allowing for proactive engagement and retention strategies.

Evolving Regulatory Landscape

Changes in regulations will undoubtedly influence car insurance cancellation procedures. New laws may impose stricter requirements on insurers for providing timely and clear communication regarding cancellation options, as well as additional provisions to protect consumers from unfair practices. Furthermore, evolving consumer protection laws may mandate specific requirements for the cancellation process, such as the provision of detailed reasons for cancellation or offering alternative insurance options.

For instance, regulations may be implemented to prevent insurers from arbitrarily denying cancellation requests without justifiable reasons.

Future Trends in Car Insurance Cancellation

Several key trends are shaping the future of car insurance cancellation. A move towards more personalized cancellation options is expected, tailored to individual policyholder needs and circumstances. For example, a policyholder with a specific claim history might be offered a faster or more streamlined cancellation process, while a policyholder with a clean record might be offered additional incentives for renewal.

Furthermore, the use of data-driven insights for predictive modelling and early identification of policyholders considering cancellation is expected to gain traction, allowing for proactive intervention by insurers.

Illustrative Examples

Illustrative examples of car insurance cancellation scenarios provide practical insights into the process, highlighting potential challenges and successful outcomes. Understanding these examples can aid both policyholders and insurance companies in navigating the cancellation procedure effectively.

Sample Cancellation Letters

Different situations necessitate tailored cancellation letters. These examples showcase the variations in approach.

- Cancellation due to relocation: This letter would clearly state the policyholder’s intention to cancel due to permanent relocation. It should include the policy number, effective cancellation date, and the reason for cancellation. This ensures clarity and avoids any ambiguity regarding the cancellation request.

- Cancellation due to dissatisfaction: This letter would express the policyholder’s dissatisfaction with the services or terms of the policy. The letter should be polite but firm, outlining the reasons for dissatisfaction and requesting the formal cancellation. Specific instances of dissatisfaction, such as inadequate customer service or policy adjustments, should be highlighted.

- Cancellation due to policy lapse: This letter, issued by the insurance company, would inform the policyholder of the policy’s lapse due to non-payment of premiums. The letter would detail the outstanding amount, the required payment to reinstate the policy, and the final date for payment. The process of reinstating the policy after lapse is crucial to highlight.

Examples of Cancellation Notices

Insurance companies employ standardized formats for cancellation notices. These examples demonstrate typical notices.

| Insurance Company | Notice Type | Key Features |

|---|---|---|

| ABC Insurance | Policy Lapse Notice | Clearly states the policy number, outstanding balance, and reinstatement procedure. Includes contact information for inquiries. |

| XYZ Insurance | Policy Cancellation Request Acknowledgment | Confirms receipt of the cancellation request, outlining the next steps in the cancellation process. Includes a projected date for cancellation completion. |

| Prime Insurance | Policy Cancellation Due to Non-Compliance | Details the specific policy violations leading to cancellation. Includes a summary of the policy’s terms and conditions. |

Successful Cancellation Process Scenario, Letter of cancellation of car insurance

A policyholder, Sarah, moved out of state. She notified her insurance company, XYZ Insurance, via certified mail of her intention to cancel her policy. XYZ Insurance acknowledged the request, confirmed the cancellation date, and processed the refund for unused coverage. This scenario illustrates a straightforward and efficient cancellation process.

Cancellation Challenge Scenario

John attempted to cancel his policy due to a perceived lack of service. However, the insurance company, ABC Insurance, cited a clause in the policy preventing cancellation within the first year. John challenged this, arguing the clause was unfairly restrictive. This scenario demonstrates a situation where a policyholder might dispute the cancellation process.

Incorrect Cancellation Processing Scenario

Emily canceled her policy, but the insurance company, Prime Insurance, failed to process the refund correctly. The cancellation was finalized, but the refund was not processed within the stipulated timeframe. This scenario demonstrates a common mistake in the cancellation process, highlighting the importance of accurate documentation and timely processing.

Concluding Remarks

In conclusion, canceling car insurance requires careful attention to detail and adherence to the terms Artikeld in your policy. This guide has provided a comprehensive overview of the process, from understanding the legal aspects to navigating practical considerations. Remember, understanding your rights and responsibilities is key to a successful cancellation. By following these steps, you can ensure a smooth transition and minimize potential issues.

FAQ Explained

What happens if I don’t follow the cancellation procedures?

Failure to follow the proper cancellation procedures might result in continued billing, penalties, or even legal action. Always ensure you meet the deadlines and follow the steps Artikeld by your insurance company.

What if I need to cancel my insurance due to a change of address?

You should notify your insurance company of the address change promptly. Often, the process involves updating your policy details within the company’s online portal, or contacting them directly by phone or mail to inform them of your address change and your intention to cancel.

How long does it typically take for an insurance company to process a cancellation request?

Processing time can vary depending on the insurance provider and the method of cancellation. It’s best to check your policy’s terms and conditions or contact your insurance company directly for specific information on their processing timelines.

Can I cancel my car insurance policy if I’m not satisfied with the coverage?

Yes, you can cancel your policy if you’re not satisfied. However, it’s essential to review your policy terms and conditions, especially regarding cancellation fees or waiting periods.