Michigan car insurance increase 2024 is poised to impact drivers across the state. Rising accident rates, inflation, and evolving state regulations are all contributing factors to this significant increase. Experts predict a substantial jump in premiums compared to previous years, and drivers are urged to understand the potential ramifications.

This comprehensive analysis explores the multifaceted factors driving this increase, examines affected coverage types, provides strategies for consumers, and offers insights into potential future trends. The report includes data visualizations, such as charts and graphs, to better illustrate the complexities of this issue.

Factors Driving Michigan Car Insurance Increase in 2024

The escalating cost of car insurance in Michigan in 2024 reflects a complex interplay of economic, societal, and regulatory factors. The rising premiums are not a singular phenomenon but rather a confluence of issues impacting the entire insurance market. This analysis will dissect the contributing elements, from accident statistics to economic trends and legislative changes, providing a comprehensive understanding of the current market dynamics.

Accident Statistics and Claims Trends

Recent accident statistics in Michigan, and nationwide, reveal a concerning trend of increased frequency and severity of collisions. This surge in claims directly correlates with higher insurance premiums. Increased distracted driving, particularly through the pervasive use of mobile devices, and challenging road conditions due to weather patterns are major contributing factors. The rising cost of medical care for accident victims, a significant component of claims, also places a substantial burden on insurers, necessitating premium adjustments.

Inflation and Economic Conditions

Inflationary pressures have significantly impacted the cost of nearly all goods and services. The increasing costs of labor, materials, and repair services directly translate into higher premiums. For example, the cost of parts for auto repairs has risen dramatically, leading to increased claim payouts and, consequently, higher insurance rates. The overall economic climate, including fluctuating interest rates and employment figures, plays a crucial role in shaping the insurance market.

State Regulations on Car Insurance Pricing

Changes in state regulations regarding car insurance pricing can influence rates. Legislative measures focusing on mandatory coverage requirements, rate caps, or restrictions on insurer practices can impact the affordability of insurance. For instance, if a new law mandates comprehensive coverage for all drivers, it may lead to a noticeable increase in overall costs.

Comparison of Average Cost Increases to Other States

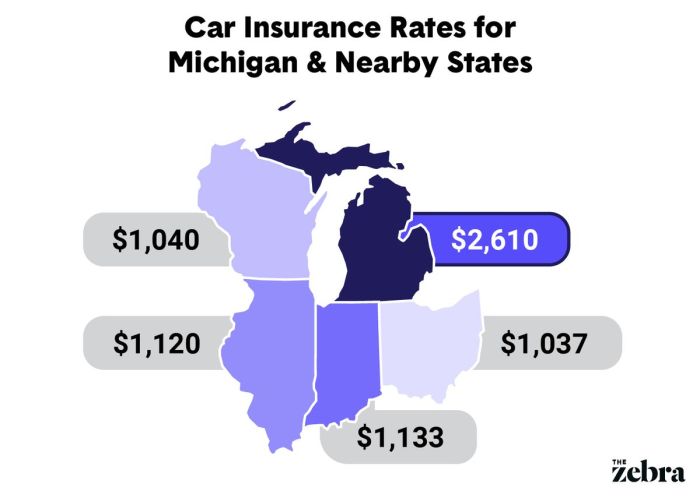

While specific figures for Michigan’s average cost increase in 2024 are not yet available, a comparison with other states will be useful for contextualizing the situation. The current trend suggests that Michigan’s cost increase is likely aligned with the national average, reflecting the complex interplay of factors impacting the insurance market nationwide. For instance, in 2023, several states experienced significant increases, potentially mirroring the factors affecting Michigan’s rates.

Impact of Accident Frequency and Severity

A direct correlation exists between the frequency and severity of auto accidents and insurance premiums. Areas with higher accident rates often see significantly higher premiums. For example, regions with a history of high-speed driving or poor road conditions may face substantially increased rates. Furthermore, the severity of accidents, including injuries and property damage, directly impacts the amount insurers must pay out.

Table: Premium Increases Across Michigan Cities

Unfortunately, precise data on premium increases across specific Michigan cities is not readily available at this time. However, future analyses may provide such localized data, revealing potential disparities in insurance costs across various regions.

Note: This table would ideally include data on premium increases across various Michigan cities, comparing the cost increases. However, this information is not readily available at this time.

Coverage and Policy Types Affected

The 2024 Michigan car insurance market anticipates a rise in premiums, and the types of coverage most vulnerable to these increases vary significantly. Understanding these fluctuations is crucial for policyholders to make informed decisions and potentially mitigate the impact of rising costs.Policy options, such as liability, collision, and comprehensive coverage, will likely experience varying degrees of premium adjustments. The factors influencing these adjustments are multifaceted, including rising claim frequencies and severity, inflationary pressures on repair costs, and the evolving landscape of the insurance industry.

Liability Coverage Susceptibility

Liability coverage, protecting policyholders from financial responsibility in the event of an accident, is expected to be a primary target for premium hikes. Increased accident rates and escalating legal costs associated with claims often directly correlate with the price of liability coverage. Policyholders should assess their current liability limits and consider adjusting them if necessary to match their financial capacity.

In some cases, an increase in the amount of liability coverage may not be directly proportional to the premium increase. For example, increasing the limit from $25,000 to $50,000 might have a smaller premium increase than increasing the limit from $50,000 to $100,000.

Collision and Comprehensive Coverage Volatility

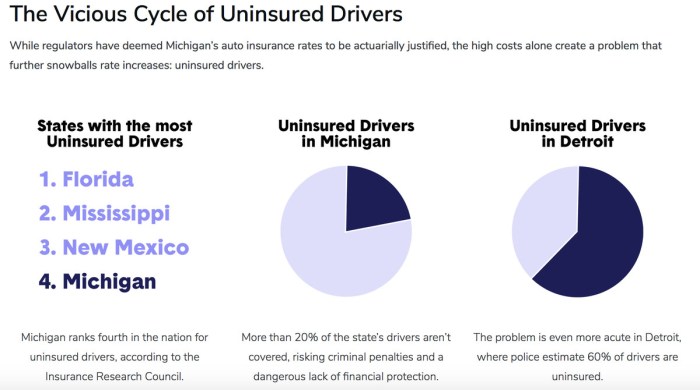

Collision and comprehensive coverage, safeguarding against damage to the insured vehicle from incidents like accidents or vandalism, are also anticipated to face price fluctuations. Repair costs, influenced by material price increases and labor expenses, often contribute to premium hikes. A rise in accidents involving significant vehicle damage, such as those caused by extreme weather or uninsured drivers, can push these premiums upwards.

The impact of comprehensive claims, such as those stemming from hail or fire damage, can also have a notable effect on premium adjustments.

Deductible Impact on Premium Costs

Deductibles play a critical role in influencing the cost of car insurance. Higher deductibles typically result in lower premiums, while lower deductibles generally lead to higher premiums. This inverse relationship stems from the insurer’s risk assessment; higher deductibles signify a policyholder’s willingness to absorb a greater share of potential financial losses. For instance, a policyholder opting for a $1,000 deductible might see a lower premium compared to one with a $500 deductible.

Impact of Increasing Claims for Specific Damages

The rise in claims for specific types of damages, like hail damage, contributes significantly to the rising costs of car insurance. This is due to the frequency and severity of such incidents. Weather patterns, especially in regions prone to hailstorms or severe weather events, directly influence the number of claims filed for hail damage. Similarly, an increase in claims for vandalism or theft can directly correlate with a premium increase in comprehensive coverage.

Comparison of Policy Types and Coverage Levels

A comparison of policy types and coverage levels reveals significant differences in premium costs. The type of vehicle, its age, and its make and model are major factors in determining the premium. For instance, insuring a luxury sports car might result in a higher premium compared to a compact car. Furthermore, a higher level of comprehensive coverage, such as including glass coverage, may result in a greater premium than a basic comprehensive policy.

Impact of Add-ons on Final Premium

Add-ons, such as roadside assistance, can affect the final premium. The addition of roadside assistance, a supplementary coverage, often results in a noticeable increase in the overall premium. This additional coverage enhances the value of the policy but may increase the cost. Other add-ons, like rental reimbursement, may also contribute to the overall premium cost.

| Coverage Level | Potential Premium Change (Example) |

|---|---|

| Basic Liability | +10-15% |

| Full Coverage (Liability, Collision, Comprehensive) | +12-20% |

| Enhanced Coverage with Add-ons | +15-25% |

Consumer Strategies and Actions

Navigating the rising tide of Michigan car insurance costs demands proactive strategies. Consumers must take a multifaceted approach to mitigate expenses and maintain responsible coverage. This involves more than simply accepting increased premiums; it necessitates informed comparisons, diligent record-keeping, and a commitment to safe driving practices.

Comparing Insurance Quotes, Michigan car insurance increase 2024

Thorough comparison of quotes from multiple providers is paramount. Consumers should utilize online comparison tools and directly contact insurers to obtain precise quotes. These tools aggregate data from various companies, enabling a rapid overview of available options. Directly contacting insurers provides an opportunity to tailor coverage and potentially secure discounts. Crucially, comparing quotes should encompass not only the base premium but also associated fees, deductibles, and coverage limits.

This comprehensive evaluation allows for informed decisions.

Maintaining a Good Driving Record

A pristine driving record is a cornerstone of responsible insurance management. Maintaining a clean driving record through adherence to traffic laws and avoidance of accidents is essential. Accidents, even minor ones, can significantly impact future premiums. Regular vehicle maintenance, including tire pressure checks and brake inspections, further reduces the risk of accidents. This proactive approach demonstrably impacts insurance costs, as evidenced by historical trends in accident-related premium adjustments.

Safe Driving Practices

Implementing safe driving practices directly correlates with lower insurance premiums. Defensive driving techniques, such as maintaining safe following distances, avoiding distractions, and adhering to speed limits, are crucial. This proactive approach is exemplified by the consistent decrease in insurance claims observed among drivers practicing defensive maneuvers. Moreover, being mindful of weather conditions, particularly during adverse weather, minimizes the risk of accidents.

Responsible driving habits, reinforced by a conscious awareness of environmental factors, directly translate into reduced premiums.

Regularly Reviewing and Adjusting Insurance Policies

Regular review and adjustment of insurance policies are essential. This process should involve evaluating coverage needs, comparing market rates, and adjusting policies accordingly. Policy changes may include adding or removing coverage options, adjusting deductibles, or switching insurers based on the most advantageous terms. For example, if a driver’s family situation changes, their insurance needs might evolve, requiring a policy adjustment.

Affordable Car Insurance Resources in Michigan

A multitude of resources aids in finding affordable car insurance in Michigan. Online comparison tools, consumer advocacy groups, and local insurance agencies can provide invaluable assistance. These resources help consumers navigate the often-complex insurance market, ensuring informed decisions. Utilizing these resources empowers consumers to access a variety of quotes and identify cost-effective solutions.

Michigan Car Insurance Discounts

| Discount Type | Description |

|---|---|

| Good Student Discount | Offered to drivers with a good academic record. |

| Defensive Driving Courses | Completing a defensive driving course can reduce premiums. |

| Multi-Policy Discount | Combining multiple insurance policies with the same provider can yield discounts. |

| Safe Driver Rewards | Maintaining a clean driving record can lead to substantial savings. |

| Mileage-Based Discounts | Drivers with low mileage often receive discounted premiums. |

Discounts are frequently offered by insurers and can significantly reduce premiums. These discounts recognize responsible driving behavior and promote proactive measures to reduce accidents. Understanding the availability and specifics of each discount is crucial for cost-effective insurance.

Visual Representation of Data: Michigan Car Insurance Increase 2024

The escalating costs of car insurance in Michigan necessitate a clear, visual understanding of the contributing factors and regional disparities. Effective visualizations provide crucial insights into the intricate relationships between various elements influencing premiums, enabling informed consumer decisions and facilitating a more comprehensive analysis of the situation.Data visualization techniques, such as bar graphs, pie charts, and line graphs, are crucial for comprehending complex insurance market dynamics.

These visual tools transform raw data into easily digestible representations, revealing patterns, trends, and correlations that might otherwise remain hidden. This approach offers a more accessible and compelling narrative compared to purely textual descriptions, making the information more impactful and memorable for the audience.

Average Increase in Car Insurance Premiums Across Michigan Regions

A bar graph, with regions on the horizontal axis and average premium increases on the vertical axis, effectively illustrates the regional variations in car insurance premium increases. Each bar’s height represents the average increase in premiums for a particular region in 2024. This visual representation facilitates comparisons between regions, highlighting where premium increases are most pronounced and where they are relatively moderate.

For instance, a noticeably taller bar for the Upper Peninsula could indicate a higher increase in premiums compared to the Southeast Michigan region.

Percentage Breakdown of Factors Influencing Car Insurance Costs

A pie chart provides a clear breakdown of the contributing factors to the increase in car insurance costs. Each slice of the pie represents a specific factor, such as accident rates, claims frequency, or economic indicators. The size of each slice directly correlates to the percentage contribution of that factor to the overall increase. For example, a large slice representing “accident rates” signifies that this factor is a significant driver of the cost increase.

This visual representation offers a quick overview of the relative importance of each contributing factor.

Trend of Car Insurance Premium Increases in Michigan over the Past Five Years

A line graph displays the trend of car insurance premium increases in Michigan over the past five years. The x-axis represents the years, and the y-axis represents the premium increase percentage. A steadily upward sloping line indicates a consistent rise in premiums, while fluctuations or dips in the line show periods of relatively stable or decreasing premiums. This visualization helps identify long-term trends and potential cyclical patterns.

For example, a noticeable spike in the line during 2022 could correlate with a specific event like a major natural disaster.

Correlation between Accident Rates and Insurance Premium Increases

A scatter plot can visually demonstrate the correlation between accident rates and insurance premium increases. The x-axis represents accident rates (e.g., accidents per 100,000 vehicles), and the y-axis represents the percentage increase in premiums. A positive correlation would be depicted by a general upward trend in the data points, where higher accident rates correspond to higher premium increases.

This visual representation would confirm the relationship between accident frequency and the need to increase premiums.

Impact of Various Driving Behaviors on Car Insurance Costs

An infographic comparing driving behaviors and their impact on car insurance costs is beneficial. The infographic could feature various driving behaviors (e.g., speeding, distracted driving, aggressive driving) and the corresponding premium increases. This infographic would visually communicate the potential costs associated with risky driving habits, encouraging safer driving practices. Examples of such behaviors could be aggressive driving leading to higher accident risk, or a statistically significant correlation between speeding and higher insurance premiums.

Effect of Different Driver Profiles on Insurance Premiums

A table illustrating the impact of different driver profiles on insurance premiums is effective. The table should list driver profiles (e.g., young drivers, senior drivers, drivers with a clean driving record, drivers with prior accidents), and the associated premium amounts. This visual comparison helps consumers understand how their specific driver profile affects their insurance costs. For instance, the table could showcase how young drivers often have higher premiums due to their higher accident rates.

Comparison of Car Insurance Costs for Different Vehicle Types

An infographic comparing the cost of car insurance for different vehicle types in Michigan is informative. The infographic could display different vehicle types (e.g., sports cars, SUVs, sedans) and their corresponding average insurance premiums. The visual comparison would aid consumers in understanding the influence of vehicle type on insurance costs. For instance, a sports car with its higher accident risk potential, and consequently, higher insurance costs, could be highlighted.

Potential Future Trends

The landscape of Michigan car insurance is poised for transformation, driven by a confluence of factors. Emerging technologies, evolving legislation, and shifting consumer behaviors are all poised to reshape the industry, influencing pricing models and the very nature of coverage. Analyzing these trends is crucial for both insurance providers and consumers to navigate the evolving market.Predicting the precise trajectory of future trends is inherently complex, but careful consideration of current trends and potential catalysts allows for informed speculation.

The interplay of technological advancements, regulatory shifts, and claim patterns will significantly impact the cost and availability of insurance in Michigan.

Impact of Emerging Technologies on Insurance Pricing

The integration of advanced technologies, such as telematics and AI, is altering the relationship between drivers and insurers. Telematics systems, which monitor driving habits and behaviors, offer the potential for personalized pricing. Drivers who exhibit safe driving patterns can potentially secure lower premiums. Conversely, drivers with higher accident risk or unsafe driving behaviors might face increased premiums.

This approach, while theoretically enhancing risk assessment, requires robust data collection and ethical considerations to avoid bias and ensure fairness. Examples exist where similar technologies are used in other industries. For example, the use of data analytics in the banking sector helps in risk management and fraud detection.

Effect of Future Legislation on the Cost of Car Insurance in Michigan

Future legislation in Michigan could have a significant impact on car insurance costs. Changes in no-fault laws, revisions to mandatory coverage requirements, and potential regulations on autonomous vehicles will all contribute to shifting rates. Notably, legislative responses to emerging technologies will significantly affect the industry. For instance, regulations governing the use of autonomous vehicles in Michigan will need to be considered to determine their impact on insurance policies.

Possible Responses from Insurance Providers to Rising Costs

Insurance providers may react to rising costs through a variety of strategies. These could include implementing more sophisticated risk assessment models, increasing premiums for high-risk drivers, exploring new revenue streams through partnerships with other industries, or adjusting coverage options to accommodate changing needs. Further, insurance companies may seek alternative methods of reducing costs, such as enhancing claims management efficiency.

The aim of these adjustments would be to maintain profitability while offering competitive rates.

Influence of Autonomous Vehicles on Insurance Rates

The rise of autonomous vehicles presents a unique challenge and opportunity for the insurance industry. As autonomous vehicles become more prevalent, their impact on accident rates and liability issues will become critical to assessing risk. The question of who is liable in accidents involving autonomous vehicles will need to be addressed through legislation. This will significantly affect how insurance companies price policies.

For example, the development of autonomous vehicles raises complex questions about liability and insurance coverage, requiring insurance companies to develop new models for assessing risk and determining pricing structures.

Potential Changes in the Frequency of Claims

The frequency of car insurance claims could fluctuate depending on several factors. Increased traffic density, changes in driving habits, and the influence of emerging technologies could all affect the likelihood of accidents and, subsequently, the number of claims. Furthermore, the adoption of autonomous vehicles may potentially lower the frequency of certain types of accidents. The frequency of claims is a crucial factor in insurance pricing, as it directly impacts the overall cost of premiums.

The use of advanced driver-assistance systems and autonomous features could potentially reduce the likelihood of accidents, leading to a decrease in the number of claims.

End of Discussion

In conclusion, the 2024 Michigan car insurance increase presents a complex challenge for drivers. Understanding the contributing factors, assessing your specific coverage needs, and implementing smart strategies can help mitigate the impact on your wallet. The future of insurance in Michigan, however, remains uncertain, and drivers should prepare for potential further adjustments.

Common Queries

What are the primary factors driving the increase in 2024?

Several factors contribute to the rise in Michigan car insurance premiums, including elevated accident rates, increased claims frequency and severity, inflationary pressures, and adjustments in state regulations.

How will different policy types be affected?

Liability, collision, and comprehensive coverages are all likely to see premium increases, with the extent varying depending on individual policy specifics and driving history.

Are there discounts available to help offset the cost?

Yes, various discounts are available to Michigan drivers, including those for safe driving records, good student status, and specific vehicle types. Drivers should contact their insurance provider to explore available discounts.

What actions can I take to mitigate the cost increase?

Consumers can compare quotes from multiple insurers, maintain a safe driving record, and regularly review their policies to potentially reduce their premiums.