Progressive vs State Farm car insurance, nih! Perbandingan dua raksasa asuransi mobil di Amerika Serikat. Banyak faktor yang harus dipertimbangkan, mulai dari harga, pelayanan, hingga fitur-fitur yang ditawarkan. Yuk, kita bongkar rahasia di balik kedua perusahaan asuransi ini, biar kamu bisa pilih yang paling pas buat kantong dan kebutuhanmu.

Perbandingan ini akan meneliti sejarah, strategi harga, reputasi pelayanan pelanggan, dan berbagai pilihan polis dari Progressive dan State Farm. Kita juga akan membahas ulasan pelanggan, fitur-fitur polis, proses klaim, dan bagaimana kedua perusahaan ini memposisikan diri di pasar. Jadi, siap-siap buat keputusannya!

Introduction to Car Insurance Comparison

The US car insurance market is a complex landscape, with numerous companies offering varying policies and coverage options. Consumers often face the challenge of navigating these options to find the best fit for their needs and budget. Understanding the fundamentals of car insurance comparison is crucial for making informed decisions and ensuring adequate protection. This process involves evaluating different providers, comparing coverage options, and understanding the features that best address individual circumstances.Comparing car insurance providers is a proactive approach to securing the most favorable terms.

This process involves examining the policies offered by different companies, considering factors such as premiums, coverage levels, and customer service. A thorough comparison helps consumers identify the insurance provider that best balances affordability with comprehensive protection.

Understanding Different Coverage Options

Different coverage options address various potential risks associated with car ownership. Understanding these options is essential for selecting a policy that meets individual needs. These options typically include liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Liability coverage protects against damages caused to others, while collision and comprehensive coverage address damage to your own vehicle.

Uninsured/underinsured motorist coverage provides protection if another driver is at fault but lacks adequate insurance. The specific types and levels of coverage vary significantly between insurance companies, so careful consideration is necessary.

Common Car Insurance Features

Numerous features are included in car insurance policies. These features add value and enhance protection. Examples include roadside assistance, rental car reimbursement, and accident forgiveness. Roadside assistance provides support in case of a breakdown or accident, while rental car reimbursement covers the cost of a rental vehicle if your car is damaged or unusable. Accident forgiveness programs can improve future rates for drivers who avoid accidents.

These features can influence the overall cost and value of a policy.

Key Factors to Consider When Selecting a Policy

Several factors play a crucial role in selecting the right car insurance policy. These factors include your driving record, vehicle type, location, and desired coverage levels. A clean driving record generally translates to lower premiums, as does having a newer, less expensive vehicle. Your location can impact rates, as some areas have higher accident rates than others.

Finally, carefully consider the level of coverage you require, considering factors like your financial situation and personal risk tolerance. The combination of these factors can influence the premium and the overall value of the policy. Consider using a car insurance comparison tool to gain a better understanding of the various options available.

Progressive Car Insurance

Progressive, a prominent name in the auto insurance industry, has carved a unique niche by focusing on innovative approaches to pricing and customer engagement. Founded in 1937, the company has adapted to changing market trends and consumer expectations, solidifying its position as a major player in the insurance arena.

Progressive’s Business Model

Progressive’s business model revolves around several key strategies. They actively utilize technology to streamline processes, enabling faster claims handling and a more efficient customer experience. Their commitment to digital channels, including online quotes and policy management tools, caters to a modern consumer base. This approach, combined with aggressive advertising campaigns, has helped build a recognizable brand and a substantial customer base.

They also focus on competitive pricing strategies, aiming to provide cost-effective coverage while maintaining a robust financial standing.

Pricing and Discounts

Progressive’s pricing strategy is data-driven, utilizing factors such as driving history, vehicle type, and location to calculate premiums. They offer a range of discounts to incentivize customers to choose their services, including discounts for safe driving habits, bundling policies, and vehicle features like anti-theft systems. These discounts can significantly reduce the overall cost of insurance for eligible drivers.

For instance, a driver with a clean driving record and a newer vehicle with anti-theft technology might qualify for multiple discounts, leading to a considerable reduction in premiums compared to competitors.

Customer Service Reputation

Progressive’s customer service reputation is a mixed bag. While many customers praise the ease of online interaction and quick claim processing, some report difficulties with phone-based support or navigating complex issues. Customer reviews highlight both positive and negative experiences, suggesting that customer service quality can vary depending on the specific situation and the channel used. The company’s online resources and FAQs are generally considered helpful in resolving basic inquiries.

Coverage Options

Progressive’s coverage options align with industry standards. Their policies typically include liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. However, specific policy details and available add-ons may vary based on individual needs and preferences. To ensure appropriate protection, customers should carefully review policy details and understand the implications of different coverage levels.

Insurance Plans

| Plan Name | Description | Key Features | Premium Example |

|---|---|---|---|

| Basic Liability | Provides minimum required legal protection. | Covers property damage and bodily injury to others in an accident. | $500-$1000 annually |

| Full Coverage | Comprehensive protection for your vehicle. | Covers damage to your vehicle from various incidents (e.g., accidents, vandalism, weather). | $1000-$2000 annually |

| Enhanced Protection | Includes additional benefits for enhanced peace of mind. | May include roadside assistance, rental car coverage, and other value-added services. | $1500-$3000 annually |

Note: Premium examples are estimates and may vary based on individual circumstances.

State Farm Car Insurance

State Farm, a household name in the insurance industry, has a long and storied history. Its commitment to providing comprehensive insurance solutions has resonated with millions of customers across the United States. Understanding State Farm’s business model, pricing strategies, and customer service is crucial for making an informed comparison with other insurance providers.State Farm’s business model is rooted in a broad range of insurance products beyond auto coverage, including homeowners, renters, and life insurance.

This diversification allows them to build strong customer relationships and offers a comprehensive insurance package. Their wide reach and established network contribute significantly to their overall market presence.

State Farm’s History and Business Model

State Farm was founded in 1922 by George J. Mecherle and continues to be a privately held company. Its initial focus was on rural areas, building trust and establishing a strong presence in communities. This early commitment to localized service and community engagement has played a significant role in shaping its reputation. Today, State Farm operates a large network of agents across the United States, providing personalized service and local expertise.

State Farm’s Pricing Strategies and Discounts

State Farm employs a variety of factors to determine insurance premiums, including driving record, vehicle type, location, and claims history. They offer various discounts to incentivize responsible driving habits and customer loyalty, such as safe driving programs, good student discounts, and multi-policy discounts. These discounts often significantly reduce the overall cost of insurance, making State Farm an attractive option for budget-conscious customers.

State Farm’s Customer Service Reputation

State Farm is recognized for its extensive network of agents, who provide a valuable point of contact for policyholders. This personal touch allows for tailored service and proactive communication, addressing policyholder needs effectively. Customer reviews and feedback often highlight the accessibility and helpfulness of State Farm agents in handling claims and addressing policy questions.

State Farm’s Coverage Options

State Farm’s coverage options are generally aligned with industry standards, offering comprehensive protection against various risks. Their policies typically include liability coverage, collision coverage, and comprehensive coverage. Policyholders can customize their coverage based on individual needs and risk tolerances, ensuring a fit for diverse situations.

Comparison of State Farm’s Insurance Plans

| Plan Name | Description | Typical Coverage | Pricing |

|---|---|---|---|

| Basic Auto Insurance | A fundamental policy for liability coverage. | Liability coverage, minimal collision and comprehensive. | Variable, based on factors like location and driving record. |

| Enhanced Auto Insurance | Includes additional coverage beyond the basic policy. | Liability, collision, comprehensive, and potentially uninsured/underinsured motorist coverage. | Generally higher than basic plans, but with more comprehensive coverage. |

| Luxury Auto Insurance | Tailored for high-value vehicles and specific needs. | Full coverage options, including high-value vehicle replacement coverage, potentially additional extras. | Usually the most expensive option, but offers comprehensive protection for high-value assets. |

Comparing Progressive and State Farm

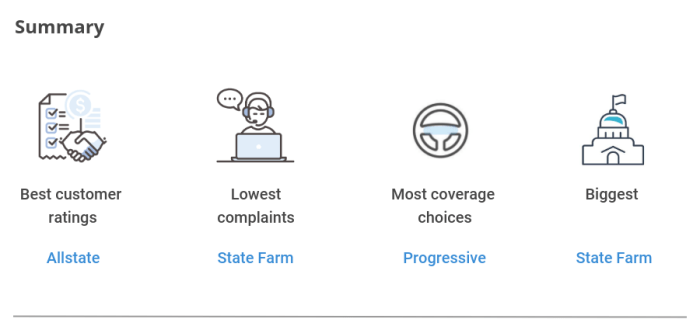

Choosing the right car insurance can be a daunting task, especially when faced with multiple options. Understanding the nuances between different providers is crucial for making an informed decision. This comparison focuses on two prominent players, Progressive and State Farm, examining their pricing strategies, customer service approaches, discounts, and coverage options for various vehicles.Progressive and State Farm are two of the largest and most well-known car insurance providers in the United States.

They cater to a wide range of drivers and vehicle types, offering varying levels of coverage and pricing. Analyzing their specific strengths and weaknesses is important to find the best fit for individual needs.

Pricing Strategies

Progressive and State Farm employ different approaches to pricing. Progressive often utilizes a more dynamic pricing model, adjusting premiums based on factors like a driver’s driving history and location. State Farm, while also considering these factors, may have a slightly more standardized approach, with premiums potentially influenced by broader market trends and company financial projections.

Customer Service Approaches

Progressive emphasizes a more streamlined and digital customer service experience. Their online portals and mobile apps offer 24/7 access to information and claim management. State Farm, while also improving its online presence, traditionally maintains a strong network of local agents, providing in-person assistance and potentially a more personalized approach for some customers.

Discounts Offered

Both companies offer a range of discounts, but their specific programs and eligibility criteria may differ. Progressive often highlights discounts for good driving records, multi-car policies, and usage-based insurance programs. State Farm frequently promotes discounts for bundling insurance products (like home and auto), safe driving habits, and loyalty programs.

Coverage Options for Various Vehicles

Insurance needs vary based on the vehicle type. Classic cars, for example, require specialized coverage due to their historical value and potential for restoration costs. Motorcycles, due to their unique characteristics, also have specific coverage requirements. Both Progressive and State Farm typically offer options to cater to these different vehicle types. Their approaches to covering classic cars might involve specialized endorsements or separate add-ons, while motorcycle coverage may have separate pricing structures or riders.

Coverage Feature Comparison

| Feature | Progressive | State Farm |

|---|---|---|

| Basic Liability Coverage | Covers damages to other vehicles or injuries to others in an accident where you are at fault. | Covers damages to other vehicles or injuries to others in an accident where you are at fault. |

| Collision Coverage | Pays for damage to your vehicle regardless of who is at fault. | Pays for damage to your vehicle regardless of who is at fault. |

| Comprehensive Coverage | Covers damage to your vehicle from events other than collisions, such as vandalism, fire, or theft. | Covers damage to your vehicle from events other than collisions, such as vandalism, fire, or theft. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are in an accident with a driver who doesn’t have insurance or has insufficient coverage. | Protects you if you are in an accident with a driver who doesn’t have insurance or has insufficient coverage. |

| Discounts | Multi-car discounts, good student discounts, and usage-based programs. | Bundled policies, safe driver discounts, and loyalty programs. |

Customer Reviews and Feedback

Understanding customer experiences is crucial when comparing insurance providers. Customer reviews offer valuable insights into the strengths and weaknesses of Progressive and State Farm, helping consumers make informed decisions. This section examines common complaints and praises, alongside satisfaction ratings, to provide a comprehensive picture of each company’s service.

Progressive Customer Reviews

Customer feedback on Progressive often highlights both positive and negative aspects. A common praise centers around the company’s user-friendly online platform. Many customers appreciate the ease of managing their policies, making changes, and accessing information online. Furthermore, the competitive pricing often cited as a strong point.

- Ease of Online Management: Customers frequently praise the intuitive design and functionality of Progressive’s online portal. This allows for easy policy updates, bill payments, and claim reporting, which can save time and effort.

- Competitive Pricing: Progressive often receives positive feedback for its competitive rates, making it an attractive option for budget-conscious drivers.

- Common Complaints: Some customers report issues with customer service responsiveness, particularly during claim processing. A few also express dissatisfaction with the complexity of their online policy documents.

State Farm Customer Reviews

State Farm, a long-standing insurance provider, has garnered considerable customer feedback. Positive reviews often cite the company’s extensive network of agents and local presence. This personal touch is a significant advantage for many policyholders.

- Extensive Agent Network: State Farm’s vast network of local agents provides personalized service and support, which is highly valued by many customers. This in-person interaction allows for tailored advice and assistance.

- Strong Local Presence: State Farm’s extensive regional presence ensures that customers have readily available support and resources within their communities. This often leads to quicker claim resolution and more personalized service.

- Common Complaints: Some customers express concerns about the complexity of their claim process and lack of clarity in policy details. A few also mention difficulty reaching customer service representatives by phone during peak hours.

Customer Satisfaction Ratings

Customer satisfaction ratings are another critical indicator of a company’s performance. While specific ratings can vary depending on the source and methodology, general trends provide valuable context. Progressive often receives high ratings for its online platform and pricing, while State Farm generally receives high scores for agent support and local presence.

Summary of Customer Reviews

| Feature | Progressive | State Farm |

|---|---|---|

| Online Management | High praise for ease of use | Mixed reviews; some difficulty navigating online portal |

| Pricing | Often cited as competitive | Competitive pricing, but some variations based on location |

| Customer Service | Some complaints regarding responsiveness | High praise for agent support; some complaints about phone wait times |

| Claim Process | Mixed reviews; some complaints about complexity | Mixed reviews; some concerns about claim clarity |

Policy Features and Benefits

Understanding the specific features and benefits of car insurance policies is crucial for making an informed decision. This section delves into the common coverages offered by Progressive and State Farm, highlighting their similarities and differences. Comparing these aspects allows you to tailor your insurance to your needs and budget.

Common Policy Features

Both Progressive and State Farm offer fundamental coverages that are standard in the industry. These include liability coverage, protecting you from financial responsibility if you cause an accident. Collision coverage safeguards your vehicle if it’s damaged in an accident, regardless of who is at fault. Comprehensive coverage protects against damages caused by events other than collisions, such as vandalism, hail, or theft.

Comprehensive Coverage Options

Comprehensive coverage options vary slightly between the two companies. State Farm often includes a broader range of events covered under comprehensive, potentially including more unusual incidents. Progressive may have specific exclusions for certain types of damage or a higher deductible for comprehensive claims. Policyholders should carefully review the specifics of each policy’s comprehensive coverage to understand what’s included and what isn’t.

This comparison is vital to ensure you’re adequately protected.

Liability Coverage Details

Liability coverage, protecting you from financial responsibility in case of an accident, is a key element of any car insurance policy. Both Progressive and State Farm offer varying liability limits. It’s essential to assess the policy limits to ensure they align with your financial situation and potential liabilities. This is crucial to avoid financial burden in an unforeseen event.

For instance, a higher limit offers greater protection in the case of significant damage or injuries.

Additional Add-on Options

Beyond the standard coverages, both insurers offer add-on options like roadside assistance, rental car coverage, and uninsured/underinsured motorist protection. These extras enhance your policy’s benefits. For example, roadside assistance can be invaluable if you experience a flat tire or car trouble, while rental car coverage can ease the burden of transportation during repairs. These supplementary options provide additional support in unforeseen situations.

Summary Table

| Feature | Progressive | State Farm |

|---|---|---|

| Liability Coverage | Available in various limits, potentially with discounts | Available in various limits, potentially with discounts |

| Collision Coverage | Covers damages from collisions, with deductibles | Covers damages from collisions, with deductibles |

| Comprehensive Coverage | Includes a range of events, specific exclusions | Includes a broader range of events, potential for higher coverage |

| Roadside Assistance | Offered as an add-on | Offered as an add-on |

| Rental Car Coverage | Offered as an add-on | Offered as an add-on |

Claims Process and Handling

Navigating the claims process can be a stressful experience, especially after an accident. Understanding how different insurance companies handle these situations can significantly impact the resolution time and overall satisfaction. This section delves into the claims processes of Progressive and State Farm, examining their procedures, typical settlement timelines, and customer experiences.

Progressive Claims Process

Progressive’s claims process is generally streamlined, aiming for a relatively quick resolution. They utilize various communication channels, including phone, online portals, and email, for efficient interaction.

- Initial Reporting: Progressive encourages immediate reporting of accidents, regardless of perceived fault. This involves providing details about the incident, including the location, time, involved parties, and any damages. Filing a claim online or via phone is common.

- Documentation & Assessment: Progressive requires detailed documentation, including police reports, medical records, and repair estimates. Their adjusters assess the claim and determine the appropriate coverage. This may involve an inspection of the damage to the vehicle.

- Settlement Options: Progressive offers various settlement options, including direct payment for repairs, or arranging repairs at an authorized repair shop. They generally aim for a fair and efficient resolution.

- Settlement Timelines: Typical settlement timelines for Progressive vary, often depending on the complexity of the claim, the availability of documentation, and the availability of repair shops. However, they typically aim for a timely resolution.

State Farm Claims Process

State Farm, known for its extensive network of agents and claims adjusters, offers a robust claims process.

- Initial Reporting: State Farm allows claims to be filed through their network of agents, online portals, or by phone. Initial reports should include details of the accident, involved parties, and any damages.

- Documentation & Assessment: Like Progressive, State Farm requires detailed documentation. This includes police reports, medical records, and repair estimates. A claim adjuster will review this documentation and assess the claim.

- Settlement Options: State Farm offers various settlement options, often involving direct payment for repairs or arranging repairs at a State Farm-approved repair shop. The chosen option depends on the specifics of the claim.

- Settlement Timelines: State Farm’s settlement timelines can vary. Factors such as claim complexity, the availability of supporting documentation, and the scheduling of repairs influence the timeframe.

Customer Experiences, Progressive vs state farm car insurance

Customer experiences with both companies’ claims processes can vary. Some customers report positive experiences with quick resolutions and helpful adjusters, while others express frustration with delays or perceived lack of communication.

- Positive Experiences: Many Progressive customers praise the company’s ease of filing claims online and their efficient handling of the process, especially for minor accidents. State Farm also receives positive feedback for the accessibility of their network of agents, allowing customers to directly interact with claim adjusters.

- Negative Experiences: Some Progressive customers reported delays in claim settlements, especially for complex cases. Similarly, some State Farm customers have noted challenges with obtaining timely communication or resolving disputes regarding repair estimates.

Comparison Table

| Feature | Progressive | State Farm |

|---|---|---|

| Claim Filing Methods | Online, Phone, Mail | Online, Phone, In-Person with Agent |

| Typical Settlement Time | Generally quick for minor accidents | Generally timely, but may vary by case complexity |

| Customer Service | Generally efficient | Extensive network of agents |

Value Proposition

Choosing the right car insurance can feel like navigating a complex landscape. Understanding how different companies position themselves is key to making an informed decision. This section delves into the value propositions of Progressive and State Farm, highlighting their unique approaches and key differentiators.

Progressive’s Market Positioning

Progressive distinguishes itself through its innovative approach to customer service and technology. They emphasize personalized insurance options, leveraging data analysis to tailor policies to individual needs and driving habits. Their aggressive use of advertising, particularly through television commercials, has established a strong brand recognition. Progressive often emphasizes their commitment to making car insurance more accessible and affordable, particularly through their mobile app and online tools.

State Farm’s Market Positioning

State Farm, a long-standing insurance giant, focuses on reliability and a comprehensive range of insurance products. Their strong local presence and extensive network of agents foster a sense of community and personalized service. State Farm emphasizes financial security and comprehensive coverage options, aiming to protect customers from various risks. Their brand is deeply rooted in trust and stability, appealing to those seeking a reliable, long-term partner for insurance needs.

Comparison of Value Propositions

Both Progressive and State Farm aim to provide affordable and comprehensive car insurance. However, their strategies differ significantly. Progressive prioritizes technology, customization, and a streamlined online experience, while State Farm emphasizes local presence, personal service, and a broad range of products. These contrasting approaches reflect the diverse needs and preferences of their target customer bases.

Key Differentiators

Progressive’s primary differentiator lies in its use of technology to personalize and streamline the insurance process. State Farm’s strength rests in its extensive agent network and strong local presence, providing personalized guidance and support. Understanding these key differences is crucial for choosing the insurer that best aligns with your individual needs and preferences.

Value Proposition Table

| Feature | Progressive | State Farm |

|---|---|---|

| Customer Service | Primarily online and mobile-focused, with 24/7 online support. | Extensive network of local agents providing personalized service. |

| Pricing | Often competitive, potentially lower for good drivers through usage-based programs. | Generally competitive, often offering comprehensive coverage options at a slightly higher price point. |

| Technology | Highly advanced, emphasizing mobile apps, online tools, and data-driven pricing. | Modern technology incorporated, but less emphasis on digital platforms compared to Progressive. |

| Coverage Options | Comprehensive coverage options available, potentially with more specialized options based on customer profiles. | Standard coverage options available, often with strong emphasis on comprehensive and collision protection. |

| Customer Experience | Streamlined online experience, emphasis on easy access and convenience. | Personalized service, focusing on building long-term relationships with customers. |

Conclusion

This comprehensive comparison of Progressive and State Farm car insurance provides valuable insights for consumers seeking suitable coverage. By analyzing various factors, including policy features, claims handling, and customer feedback, we can help drivers make informed decisions. Understanding the strengths and weaknesses of each company empowers consumers to choose the insurance that best meets their individual needs and budget.

Summary of Findings

Both Progressive and State Farm are reputable insurers with strong market presence. Progressive tends to be more competitive on price, particularly for younger or higher-risk drivers, while State Farm often offers a wider range of coverage options and a more established reputation. Customer satisfaction varies depending on individual experiences and specific circumstances. Claims handling times and processes were observed to differ between the two companies, impacting the overall customer experience.

Potential Implications for Consumers

Consumers should carefully consider their individual driving history, budget, and coverage needs when choosing between Progressive and State Farm. Understanding the nuanced differences in policy features, claim processes, and customer reviews allows drivers to select the insurance best suited for their specific circumstances. Comparing quotes from both companies before making a decision is crucial for ensuring optimal value and protection.

Pros and Cons of Each Company

| Characteristic | Progressive | State Farm |

|---|---|---|

| Pricing | Generally more competitive, especially for specific driver profiles. Offers discounts for certain actions, such as safe driving habits. | May have higher premiums than Progressive, particularly for higher-risk drivers. Offers a variety of discounts, including those for multi-policy holders. |

| Coverage Options | Offers a range of standard coverages but may have fewer specialized options than State Farm. Focus on simple, straightforward plans. | Provides a broader selection of coverages, including comprehensive options and specialized policies, catering to a wide variety of needs. Often more complex plans. |

| Claims Process | Generally faster and more streamlined claims process, with emphasis on efficiency and digital tools. May be more reliant on online interactions. | May involve a slightly more traditional claims process, with potentially more personal interaction but potentially longer response times. |

| Customer Reviews | Often praised for ease of use and online tools, but some negative feedback regarding claim handling has been noted. | Generally viewed as reliable and trustworthy, with a reputation for dependable service but some customers have experienced delays in claims resolution. |

| Value Proposition | Progressive often prioritizes affordability and convenience, making it a good choice for drivers seeking lower premiums and user-friendly online platforms. | State Farm focuses on a broader range of options and comprehensive coverage, appealing to those seeking comprehensive protection and a well-established brand. |

Closure

Kesimpulannya, pilihan antara Progressive dan State Farm bergantung pada kebutuhan dan prioritas masing-masing. Progressive mungkin lebih cocok untuk mereka yang mencari harga terjangkau dan fitur inovatif, sedangkan State Farm mungkin lebih tepat untuk mereka yang menginginkan pelayanan pelanggan yang konsisten dan rekam jejak yang kuat. Semoga perbandingan ini membantumu dalam menentukan pilihan yang tepat!

FAQ Overview: Progressive Vs State Farm Car Insurance

Apa perbedaan utama dalam strategi harga antara Progressive dan State Farm?

Progressive cenderung menawarkan harga yang lebih kompetitif dengan memanfaatkan teknologi dan diskon yang agresif. State Farm, meskipun mungkin tidak selalu yang termurah, seringkali menawarkan nilai tambah dalam pelayanan pelanggan dan jaminan yang lebih komprehensif.

Bagaimana proses klaim di kedua perusahaan ini?

Proses klaim di kedua perusahaan biasanya cukup mudah, tetapi ada perbedaan dalam waktu penyelesaian dan persyaratan administrasi. Pastikan kamu memahami persyaratan dan prosedur masing-masing sebelum mengajukan klaim.

Apa saja diskon yang ditawarkan oleh Progressive?

Progressive menawarkan berbagai diskon, termasuk diskon untuk pengemudi muda, pengemudi aman, kepemilikan mobil yang baik, dan diskon untuk program keselamatan. Periksa situs web mereka untuk detail selengkapnya.

Apakah State Farm menawarkan perlindungan khusus untuk mobil klasik?

Ya, State Farm biasanya menawarkan opsi perlindungan khusus untuk mobil klasik. Tetapi, pastikan untuk memeriksa detail polis dan cakupan perlindungan secara spesifik untuk menghindari masalah di kemudian hari.