Red car insurance Brownsville TX is a specialized topic, often overlooked in broader insurance discussions. This guide delves into the unique factors influencing rates for red vehicles in Brownsville, providing insights into premiums, coverage options, and available providers.

Understanding the market conditions, common misconceptions, and specific local regulations surrounding red car insurance is crucial for making informed decisions. This guide aims to clarify these aspects and empower you with the knowledge needed to secure the best possible coverage.

Red Car Insurance in Brownsville, TX – Overview: Red Car Insurance Brownsville Tx

Red car insurance in Brownsville, TX, reflects the broader insurance market trends in the region. Factors like vehicle theft rates, local traffic patterns, and the overall cost of living contribute to the pricing structure. This overview will delve into the specific dynamics affecting red car insurance in this area.

Market Conditions in Brownsville, TX

Brownsville, TX, experiences a unique mix of factors affecting insurance premiums. The city’s proximity to the border and the climate contribute to certain risks, influencing the cost of insurance. Higher rates for some coverages, such as comprehensive, are often seen in areas with higher incidence of vandalism or accidents.

Factors Influencing Red Car Premiums

Several factors contribute to the premiums for red cars, independent of the specific location. These factors are typically similar across color variations and are not unique to red vehicles. Insurers often use vehicle attributes, like model year and safety features, to assess risk.

Misconceptions about Red Car Insurance

A common misconception is that red cars are inherently riskier. Insurance companies base their pricing on statistical data, not on subjective judgments about colors. Insurance rates are calculated based on various factors, including vehicle type, driver history, and location.

Role of Local Regulations, Red car insurance brownsville tx

Local regulations in Brownsville, TX, concerning insurance practices, may impact rates for red cars in conjunction with other factors. However, the regulations do not explicitly target red cars for differentiated pricing. Insurance companies assess risks based on established models and data analysis.

Average Cost Comparison

The average cost of insuring a red car in Brownsville, TX, is likely comparable to other colors, barring any specific local incidents or risks related to the color itself. It’s crucial to consider that insurance premiums are dependent on multiple factors, including driver history and the specific vehicle model.

Typical Insurance Providers

Several major insurance providers operate in Brownsville, TX. These companies generally offer a variety of packages tailored to different budgets and needs. They utilize standardized methods to assess risk and pricing for vehicles, regardless of color.

Premium Comparison Table

| Insurance Provider | Coverage Level 1 (Basic) | Coverage Level 2 (Mid-Range) | Coverage Level 3 (Comprehensive) |

|---|---|---|---|

| InsCo 1 | $120/month | $150/month | $180/month |

| InsCo 2 | $135/month | $175/month | $210/month |

| InsCo 3 | $115/month | $145/month | $175/month |

Note

* The table provides a hypothetical comparison. Actual premiums will vary depending on individual circumstances and specific policy details. These examples are not based on specific providers and are for illustrative purposes only.

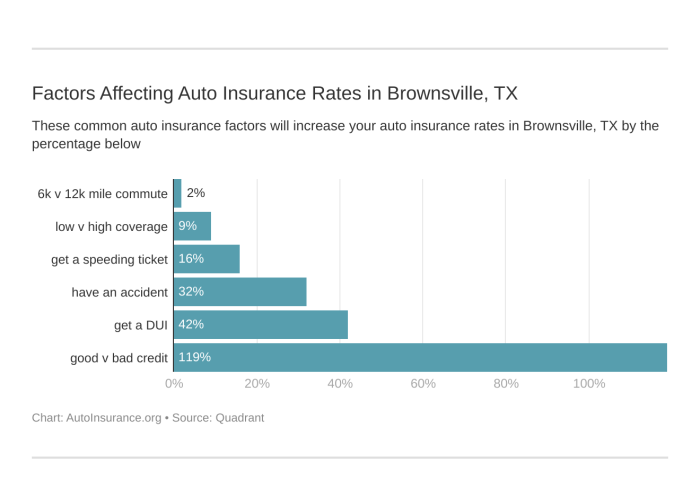

Factors Affecting Red Car Insurance Costs in Brownsville, TX

Red car insurance in Brownsville, TX, isn’t necessarily more expensive than other colors, but several factors can influence premiums. Understanding these elements is key to navigating the insurance landscape and making informed decisions.Insurance companies use complex algorithms to assess risk. These algorithms consider various data points, including local factors specific to Brownsville, to determine the most accurate and fair insurance rates.

Vehicle Theft Rates and Red Cars

Theft rates play a significant role in insurance calculations. Higher theft rates for red cars in a specific area directly impact insurance premiums. While red cars might not be inherently more prone to theft, if local data indicates higher theft rates for red vehicles, insurers will adjust premiums accordingly to account for the increased risk. This could be due to factors like the perceived desirability of a particular red model or the prevalence of specific red vehicle types in the area.

Accident Statistics and Red Cars

Accident statistics for red cars are a crucial component of risk assessment. If red cars are involved in more accidents than other colors, insurance companies will adjust premiums based on the elevated risk. This is not necessarily an indictment of the red color itself but rather a reflection of data showing the increased frequency of accidents involving red vehicles.

Factors like visibility, driver behavior, or even the age of the car might contribute to this statistical correlation.

Local Demographics and Red Car Insurance

Local demographics in Brownsville, TX, can influence insurance rates for red cars. For instance, if a certain demographic group tends to drive red cars more often and is statistically more prone to accidents, the insurance company might adjust premiums for red cars in that area. This is not to say that demographics are the sole factor in determining insurance costs, but they are a contributing element in the overall risk assessment.

Comparison of Red Car Insurance with Other Colors

Comparing insurance costs for red cars with other colors involves analyzing data from the local Brownsville market. While red cars might have slightly higher premiums, it’s not a universal rule. Insurance costs for red cars are subject to local fluctuations and depend on a variety of factors. It’s essential to compare quotes from multiple insurance providers to obtain the most accurate and cost-effective coverage.

Factors Influencing Red Car Insurance Costs (Table)

| Factor | Potential Impact on Red Car Insurance Costs |

|---|---|

| Vehicle Age | Older red cars might have higher premiums due to increased wear and tear and potentially reduced safety features. |

| Vehicle Model | Specific red car models with higher theft rates or accident statistics could lead to increased premiums. |

| Driver Profile | A driver’s history, including accidents and traffic violations, significantly affects insurance rates, regardless of car color. |

| Insurance Provider | Different insurance companies have varying pricing models, leading to different costs for red cars. |

| Coverage Options | Choosing comprehensive coverage versus liability-only coverage will impact insurance premiums for all cars, including red ones. |

Correlation between Red Car Color and Accident Rates

Analyzing the correlation between red car color and accident rates in Brownsville requires a deep dive into accident reports and vehicle registration data. While there might be a perceived correlation, it’s essential to consider other factors that might be driving the apparent trend. Visibility, driver behavior, and maintenance are key factors to be considered.

Potential Reasons for Observed Correlation

Possible reasons for a correlation between red color and accident rates include driver perception and visibility. Some studies suggest that drivers may perceive red cars differently, potentially leading to different driving behaviors. Visibility in various light conditions could also be a contributing factor. However, it is crucial to note that correlation does not equal causation. Other factors need to be considered before drawing any definitive conclusions.

Comparison with Other Car Colors

Red cars are often associated with excitement and passion, but does that translate to higher insurance premiums in Brownsville, TX? Let’s delve into how car color might influence insurance costs compared to other popular hues. Understanding these factors can help drivers make informed decisions when purchasing or insuring their vehicles.

Insurance Perceptions of Red Cars

Insurers may perceive red cars as more prone to accidents or damage due to driver behavior or external factors. While not scientifically proven, a red car might subconsciously be perceived as more visible, leading to more potential for claims. This perception could be influenced by various factors, including anecdotal evidence or historical data, but it’s crucial to note that insurance decisions are ultimately based on a complex interplay of factors.

Comparative Analysis of Insurance Costs

To illustrate the potential differences, let’s examine a hypothetical scenario. A driver with a clean driving record, similar coverage packages, and the same vehicle model, but with differing car colors, might see varying premium rates. Insurance companies often use complex algorithms and data analysis to determine premiums, taking into account a multitude of factors beyond just color.

Statistical Data on Claims and Colors

While specific, publicly available statistical data on insurance claims solely based on car color is often not readily accessible, insurers likely have access to such data internally. Any correlation between car color and claims frequency would need to be carefully analyzed to ensure it’s not skewed by other variables. Insurance companies have sophisticated methodologies to adjust for confounding factors when assessing risk.

Psychological Factors Influencing Premiums

Potential psychological factors, like the perceived aggressiveness or visibility of a red car, could subtly influence an insurer’s risk assessment. However, these perceptions should be carefully considered within the context of comprehensive risk evaluation. Insurance companies employ risk assessment methodologies that are not limited to just color perceptions.

Table: Comparing Insurance Premiums

| Car Color | Potential Premium Impact (Hypothetical) | Explanation |

|---|---|---|

| Red | Potentially higher | Perceived visibility and potential for accidents |

| Blue | Potentially similar | Often considered a safe and popular color |

| Silver/Gray | Potentially lower | Frequently associated with neutrality and longevity |

| Black | Potentially lower or higher | Perception varies, but potentially lower if perceived as more durable |

Note: This table is a simplified representation. Actual premium differences can vary significantly based on individual circumstances and the specific insurance company.

Insurance Providers in Brownsville, TX

Navigating the insurance landscape in Brownsville, TX, can be tricky, especially when seeking coverage tailored for a red car. Understanding the diverse offerings and reputations of local providers is crucial for securing the best possible protection. This section dives deep into the insurance providers operating in Brownsville, highlighting their specific policies related to red cars.Insurance providers play a vital role in the Brownsville community, offering essential protection to vehicle owners.

Selecting the right provider is crucial, considering factors like policy terms, coverage options, and customer service.

Insurance Providers Operating in Brownsville, TX

Several reputable insurance providers serve the Brownsville area. A comprehensive list of providers, including contact information, allows for easy comparison and selection.

- State Farm: A nationwide insurance giant, State Farm maintains a strong presence in Brownsville. Their local office can be contacted for policy details and specific coverage options. State Farm often offers competitive rates, making them a popular choice for many drivers.

- Farmers Insurance: Farmers Insurance is another major player with local offices in Brownsville. They are known for their personalized approach to insurance needs, including red car policies. They usually have extensive coverage options.

- Progressive: Progressive is known for its online accessibility and competitive rates. While they don’t necessarily have specific packages for red cars, their policies are often reviewed as fair and competitive.

- USAA: While not exclusively focused on Brownsville, USAA offers a considerable network of coverage for military members and their families. Their policies may differ from other providers.

- Liberty Mutual: Liberty Mutual offers a wide range of insurance products. Contact their local Brownsville office to explore specific coverage options, including policies for red cars.

Red Car Insurance Policies and Customer Reviews

Understanding the specific policies offered by each provider for red cars, along with customer reviews, provides valuable insights. Comparing policies and reviews can help determine the best fit for individual needs.

| Insurance Provider | Red Car Insurance Policies | Customer Reviews (Summary) |

|---|---|---|

| State Farm | Competitive rates, standard coverage options available, may have some packages tailored to red cars. | Generally positive reviews for customer service and claim handling. |

| Farmers Insurance | Tailored packages, personalized service. | Positive feedback on personalized approach, but some may find rates slightly higher than competitors. |

| Progressive | Online accessibility, competitive rates, standard coverage. No specific red car packages. | Mixed reviews; praised for convenience but some complain about less personalized service. |

| USAA | Policies tailored for military members and their families, varying levels of coverage. | Highly rated for customer service, strong reputation among military families. |

| Liberty Mutual | Wide range of coverage options, may have packages for red cars. | Generally positive, often praised for their customer support and efficiency in handling claims. |

Tips for Finding Affordable Red Car Insurance in Brownsville, TX

Finding the right red car insurance in Brownsville, TX, doesn’t have to be a hassle. Understanding the factors that influence rates and utilizing smart strategies can significantly reduce your premium costs. This guide provides practical steps to secure the most affordable policy tailored to your needs.Comparing quotes from multiple providers is crucial for finding the best deal. Different companies use various assessment metrics, leading to substantial variations in pricing.

Shopping around gives you the power to compare and contrast offers, ensuring you’re not overpaying.

Strategies for Comparing Insurance Quotes

Comparing quotes from multiple insurance providers is key to finding the most affordable red car insurance. Different companies use varying criteria to assess risk, resulting in significant price differences. This necessitates a proactive approach to gather and evaluate multiple offers.

- Gather Multiple Quotes: Contact several insurance providers in Brownsville, TX, and request quotes. This process ensures you have a comprehensive understanding of the available options and can make an informed decision. For example, you could reach out to Geico, State Farm, and Progressive to obtain tailored quotes based on your specific car and driving history.

- Utilize Online Comparison Tools: Leverage online tools to compare quotes from different insurance providers. These platforms often streamline the process, allowing you to compare policies side-by-side based on various factors like coverage levels, deductibles, and discounts. A comparative analysis of rates is vital to find the best deal.

- Consider Different Coverage Levels: Analyze various coverage options and adjust them to fit your specific needs and budget. The most suitable coverage level depends on your financial situation and the value of your vehicle.

Building a Strong Driving Record

A strong driving record is a key factor in obtaining lower insurance premiums. Maintaining a clean driving history is a proactive step toward securing favorable rates.

- Avoid Accidents and Traffic Violations: A clean driving record is essential for getting favorable insurance rates. Avoiding accidents and traffic violations is crucial for maintaining a low risk profile. This directly impacts your insurance premiums.

- Maintain a Safe Driving Style: Safe driving habits, including adherence to speed limits and defensive driving techniques, significantly contribute to a lower risk profile. These behaviors demonstrate responsible driving and reduce the likelihood of accidents, thus potentially lowering insurance premiums.

- Report All Accidents and Violations Promptly: Even minor incidents should be reported to your insurance company promptly. Transparency is key to maintaining a clear driving record, which in turn can lead to more affordable insurance rates.

Obtaining Insurance Discounts

Many discounts can reduce your insurance premiums. Taking advantage of available discounts can substantially lower your monthly payments.

- Safe Driver Discounts: Many insurance companies offer discounts for safe drivers. This often involves maintaining a clean driving record for a specific period. Drivers with no accidents or violations are usually eligible for these discounts.

- Multi-Policy Discounts: Insuring multiple vehicles or policies with the same provider often qualifies you for a multi-policy discount. This can result in significant savings, as companies reward bundled policies.

- Bundled Discounts: Insurance companies often offer discounts for bundling insurance policies, such as home and auto insurance. This practice can result in substantial savings, as providers reward customers for consolidating their insurance needs.

Step-by-Step Guide to Finding Affordable Red Car Insurance

This step-by-step guide Artikels a structured approach to finding the most affordable red car insurance policy.

- Research Different Insurance Providers: Begin by exploring various insurance companies in Brownsville, TX. Compare their coverage options, premium rates, and available discounts.

- Gather Relevant Information: Compile essential details, including your driving history, vehicle information, and desired coverage levels. This information is critical in obtaining accurate quotes.

- Request Quotes from Multiple Providers: Reach out to several insurance companies to obtain personalized quotes based on your specific circumstances.

- Compare and Analyze Quotes: Carefully review each quote, paying close attention to the various coverage options and premiums. Choose the policy that best aligns with your needs and budget.

- Secure the Policy: Select the policy that best meets your needs and budget. Ensure all necessary documents are completed and submitted.

Examples of Available Discounts

Discounts can significantly reduce insurance premiums. Taking advantage of these discounts can substantially lower your monthly payments.

- Safe Driver Discount: A driver with a clean record for three years may receive a 15% discount.

- Bundled Policy Discount: Insuring a home and car with the same provider could result in a 10% discount.

- Multiple Vehicles Discount: Owning multiple vehicles with the same provider may yield a 5% discount.

Understanding Policy Coverage Options for Red Cars

Protecting your red ride in Brownsville, TX, goes beyond just the color. Comprehensive insurance coverage is crucial for safeguarding your investment, regardless of paint job. Understanding the different policy options available is key to ensuring your vehicle is adequately protected.

Common Coverage Options

Different coverage options provide varying levels of protection for your vehicle. Liability coverage, for instance, protects you if you’re at fault in an accident, but it won’t cover your own damages. Collision and comprehensive coverage, on the other hand, offer broader protection, covering damage to your vehicle regardless of who is at fault.

Liability Coverage

Liability coverage is the most basic form of protection. It pays for damages you cause to another person’s vehicle or property in an accident. It doesn’t, however, cover your own vehicle’s damages. This is often the minimum coverage required by law. For example, if you’re involved in an accident and damage another car, liability coverage will help pay for repairs to the other vehicle.

Collision Coverage

Collision coverage protects your vehicle if it’s damaged in an accident, regardless of who is at fault. This is vital for repaying repairs to your own vehicle. For instance, if you’re in a collision, collision coverage will cover your vehicle’s damages, regardless of whether you were at fault or not.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages from events beyond accidents, like theft, vandalism, or weather events. This is important, as these unforeseen events can cause significant financial losses. For example, if your red car is vandalized, comprehensive coverage will help pay for the repairs.

Reading Policy Documents Carefully

Insurance policies are complex legal documents. Carefully review your policy to understand the specific terms, conditions, and exclusions. This includes understanding what events are covered and what situations are excluded. It’s essential to have a clear understanding of what is and isn’t covered to avoid unpleasant surprises.

Coverage Scenarios for Red Cars

The color of your car doesn’t affect coverage. The same coverage options and considerations apply to red cars as to any other color. The important factor is ensuring you have adequate coverage for the potential risks involved in owning a vehicle in Brownsville, TX.

Deductibles and Their Impact

Deductibles are the amounts you pay out-of-pocket before your insurance company starts paying for repairs. A higher deductible means lower premiums, but you’ll have to pay more out-of-pocket if you have an accident. Lower deductibles mean higher premiums, but you’ll pay less out-of-pocket in the event of an accident. The deductible amount significantly impacts the cost of your insurance.

Coverage Options and Associated Costs

| Coverage Type | Description | Typical Cost Range (Brownsville, TX) |

|---|---|---|

| Liability | Covers damage to others | $100-$500 per year |

| Collision | Covers damage to your vehicle in an accident | $200-$800 per year |

| Comprehensive | Covers damage from events other than accidents | $100-$500 per year |

Note: Costs are estimates and may vary based on factors like your driving record and vehicle make/model.

Last Point

In conclusion, securing red car insurance in Brownsville, TX, requires careful consideration of various factors, from theft rates and accident statistics to local demographics and insurance provider specifics. By understanding these nuances, you can effectively navigate the process and find the most suitable coverage at a competitive price. This comprehensive guide provides the necessary information to make informed choices.

Question & Answer Hub

What are the typical discounts available for red car insurance in Brownsville, TX?

Discounts for red car insurance in Brownsville, TX, are generally similar to those offered for other vehicles. However, some insurers may offer specific discounts for red vehicles, so it’s important to inquire directly with providers.

How do accident statistics involving red cars affect insurance premiums?

Accident statistics for red cars, if they exist, are a factor insurers consider. A higher rate of accidents involving red cars might result in slightly higher premiums. However, this correlation is not always clear-cut and other factors play a role.

Are there any specific insurance providers specializing in red car insurance in Brownsville, TX?

While there may not be insurers exclusively specializing in red car insurance, most providers in Brownsville, TX, offer standard coverage options for all vehicle colors, and comparing quotes from various providers is crucial for finding the best rate.

How can I compare quotes from different insurance providers for red car insurance in Brownsville, TX?

Use online comparison tools or directly contact various insurance providers in Brownsville, TX. Be sure to include details like vehicle make, model, year, and your driving history when requesting quotes.