Why is car insurance so expensive in Michigan? A labyrinth of factors, interwoven like threads in a tapestry, dictates the price. From the unforgiving winter roads to the intricacies of state regulations, Michigan’s insurance landscape is a complex interplay of economic forces and societal needs. The sheer cost of repairs after an accident, coupled with the high frequency of accidents, creates a potent formula for high premiums.

This exploration delves into the multifaceted reasons behind the high cost of car insurance in Michigan, examining driving conditions, legal frameworks, and insurance company practices. We’ll uncover the interplay of these elements to understand why this state stands out in the nation’s insurance market.

Factors Influencing Michigan Car Insurance Costs

Right, so, car insurance in Michigan is, like, notorious for being pricey. It’s a bit of a pain point for everyone, from students to seasoned drivers. Let’s dissect the factors driving up those premiums.Michigan’s car insurance landscape is a complex mix of state-specific regulations, driving conditions, and demographic trends. Understanding these elements is key to figuring out why the prices are so high.

Driving Conditions and Accident Rates

Michigan’s weather plays a massive role in accident rates. Brutal winters, with ice and snow, contribute to a higher risk of collisions. Plus, the state’s road infrastructure, while improving, isn’t always top-notch in every area. This combined effect leads to more claims, and insurers need to factor that into pricing. For example, icy roads in the winter months often see a spike in accidents, requiring more payouts from insurance companies.

Demographic Factors

Age, location, and driving history all play a role. Younger drivers, naturally, tend to have higher premiums due to statistically higher accident rates. Living in certain areas, like high-crime zones, can also influence rates. This is because these areas often experience more incidents that involve car accidents, theft, or vandalism, leading to higher claims and insurance costs for those residing in these zones.

For example, a student living in a city known for high-speed driving will have a higher risk of accidents, thus a higher premium compared to a senior citizen in a quiet rural area.

Comparison with Neighboring States

Michigan’s car insurance rates often stand out compared to its neighbours. Wisconsin, for instance, sometimes has lower premiums. This disparity could be attributed to differences in driving habits, accident rates, or even state regulations regarding insurance. There are many different variables that affect the price of insurance, and it is not always easy to isolate the reasons behind these differences.

Impact of State Regulations

Michigan’s unique set of regulations and laws significantly influence insurance rates. Specific requirements for coverage, for instance, might contribute to the overall cost. These regulations are put in place to protect drivers, but they also have a tangible effect on the prices of insurance. For example, mandatory coverage requirements for certain types of insurance might increase premiums compared to states with less strict regulations.

Average Car Insurance Rates Across Michigan Cities

| City | Average Rate (per year) | Potential Reasons |

|---|---|---|

| Detroit | $2,000 | Higher accident rates, potentially higher crime rates, and specific state regulations |

| Grand Rapids | $1,800 | Lower accident rates compared to Detroit, fewer high-risk areas |

| Ann Arbor | $1,900 | Relatively lower crime rates, and more affluent population compared to other cities |

| Flint | $2,100 | Higher accident rates, potentially lower income compared to other cities, and specific state regulations |

| Lansing | $1,950 | Moderate accident rates and relatively balanced demographics compared to other cities |

Note: These are estimated average rates and can vary significantly based on individual circumstances.

Specific Regulations and Laws in Michigan

Right, so, Michigan’s car insurance landscape isn’t just about the factors we’ve already discussed. It’s heavily influenced by the state’s specific regulations and laws, which often have a significant impact on premium prices. Understanding these regulations is crucial for any student trying to navigate the complexities of car insurance in the Mitten State.

Mandatory Insurance Coverages

Michigan, like many states, mandates specific types of insurance coverage to ensure drivers are financially responsible. Failure to comply can result in hefty penalties. This compulsory coverage directly affects insurance premiums, as providers need to account for the potential claims and payouts associated with these requirements.

- Liability Insurance: This covers damages you cause to other people or their property in an accident. It’s a fundamental part of driving legally in Michigan, with minimum limits set by the state. Higher liability limits mean higher premiums, as the insurer takes on greater risk.

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for drivers and passengers in an accident, regardless of who is at fault. This is a crucial component of Michigan’s no-fault system, affecting insurance rates significantly.

- Property Damage Insurance (PD): This covers the cost of repairing or replacing the damaged property of another driver involved in an accident. It is often combined with liability coverage in a policy, but is a separate component that impacts the cost of your policy.

Cost Implications of Mandatory Coverages

The required minimum coverages in Michigan vary, and the amounts affect the premium. For example, a policy with higher liability limits will usually be more expensive than one with lower limits. Similarly, the higher the PIP coverage, the higher the cost.

| Coverage Type | Description | Cost Implications |

|---|---|---|

| Liability | Covers damages to others in an accident. | Higher limits increase premiums, reflecting increased risk. |

| PIP | Pays for medical expenses and lost wages regardless of fault. | Higher coverage amounts result in higher premiums. |

| Property Damage | Covers damage to another driver’s vehicle. | Higher limits increase premiums, reflecting increased risk. |

Michigan’s No-Fault System

Michigan’s no-fault insurance system is a key aspect impacting premiums. Under this system, drivers are compensated for their losses through their own insurance, regardless of who caused the accident. This means insurers have to account for the potential payout for medical expenses and lost wages, which is a significant factor in setting premiums.

Financial Responsibility Laws

Michigan’s financial responsibility laws stipulate the minimum amounts of insurance required for drivers to operate legally on Michigan roads. Failure to meet these requirements leads to penalties. The financial responsibility laws are in place to ensure that drivers are able to pay for damages caused by accidents. The required amounts, along with the enforcement mechanisms, directly influence the overall cost of car insurance.

Penalties for Driving Without Insurance

Driving without car insurance in Michigan has serious consequences, including hefty fines and potential suspension of driving privileges. These penalties can include significant monetary penalties and even suspension of driving licenses. The possibility of such penalties adds to the cost of car insurance for those who choose to drive without adequate coverage.

High premiums are often the result of a need to cover potential losses resulting from accidents. This includes both damage to vehicles and the medical expenses incurred by those involved.

Frequency and Severity of Accidents in Michigan

Right, so, car insurance costs in Michigan are a bit of a pickle. One major factor is the frequency and severity of accidents on the roads. Understanding these trends is crucial for grasping why premiums are so high in certain areas.The sheer number of crashes, coupled with the severity of the damage and injuries, directly impacts insurance providers’ bottom line.

Higher claims mean higher payouts, and this ultimately translates to higher premiums for everyone.

Accident Frequency Across Michigan

Accident data reveals variations in crash rates across Michigan’s regions. Urban areas, with higher traffic volumes and potentially more complex intersections, often exhibit a higher frequency of accidents. Rural areas, while seemingly safer, can experience higher rates due to lower speed limits and potential for driver fatigue. Specific types of accidents, like those involving intersections, rear-end collisions, and high-speed crashes, might also vary regionally.

Further, certain time periods, such as rush hour, might see spikes in accidents in specific locations.

Severity of Accidents in Michigan

Average damages and injuries associated with Michigan accidents are a significant concern for insurers. Property damage is a major consideration, and factors like vehicle type and crash severity play a crucial role. For instance, high-impact collisions involving larger vehicles, like trucks, are likely to result in substantial damage compared to collisions involving smaller vehicles. Similarly, the severity of injuries sustained in accidents is another crucial metric.

Severe injuries lead to prolonged medical care, higher claims payouts, and consequently, elevated insurance costs.

Accident Trends and Insurance Rates

Insurance companies closely monitor accident trends. Any consistent upward trend in accidents in a specific area or involving a particular type of vehicle would immediately trigger a response, likely involving a rise in insurance premiums for drivers in those areas. This is a straightforward correlation, and insurers have well-established systems to assess such trends. For example, if a particular intersection consistently experiences a high number of rear-end collisions, the insurance company may increase premiums for drivers in that vicinity.

This is a fundamental principle of risk assessment in the insurance industry.

Correlations Between Accident Hotspots and Insurance Costs

A clear correlation exists between accident hotspots and insurance costs in different areas of Michigan. Data reveals that areas with a high frequency of accidents, often concentrated around specific intersections or roadways, typically have higher insurance rates. This is a direct result of the increased risk of claims in these locations. Consider a stretch of highway known for frequent accidents.

Insurance companies will undoubtedly factor this into their pricing models, leading to higher premiums for drivers in that area.

Vehicle Types and Insurance Costs

The types of vehicles involved in accidents also significantly impact insurance costs. Data indicates that certain vehicle types are more susceptible to damage or more likely to be involved in accidents. This might involve specific makes and models, or even vehicle size. For example, larger, heavier vehicles are more likely to incur substantial damage in collisions, leading to higher insurance costs for their drivers.

Insurance companies often have specific pricing tiers for vehicles based on these characteristics, with premiums varying based on the vehicle’s potential for damage or involvement in an accident.

Insurance Company Practices in Michigan: Why Is Car Insurance So Expensive In Michigan

Insurance companies in Michigan, like everywhere else, operate with a complex set of practices that directly affect the cost of car insurance. Understanding these practices is key to grasping the factors driving premiums. These companies aren’t just handing out policies; they’re making strategic decisions that influence the prices you pay.

Competitive Landscape and Pricing Strategies

The Michigan insurance market is a competitive arena. Multiple companies vie for customers, and this competition can influence their pricing strategies. Some providers might focus on specific customer segments, like young drivers or families with multiple vehicles, while others prioritize a broader customer base. This varied approach leads to differences in the premiums you might see. A company focusing on a niche market may have higher premiums for that segment due to risk assessment, but lower premiums for the rest.

Influence of Profitability and Investment Returns

Insurance company profitability and investment returns are inextricably linked to pricing. Profitability is a key factor in determining how much a company can afford to offer in terms of discounts and still stay in the black. High investment returns can provide more capital for these activities. Conversely, lower returns might lead to higher premiums to maintain a certain profit margin.

A company with a strong financial standing, with high returns on investment, is more likely to offer discounts. This is akin to a business with a solid cash flow having more flexibility in its pricing strategy.

Comparative Analysis of Claims Handling

Assessing claims handling procedures across different companies can offer insights into how they impact premiums. A company known for efficient claims processing, potentially with shorter turnaround times and fewer disputes, might be able to offer competitive premiums. Companies with a reputation for lengthy claims processes or disputes could charge more, reflecting the potential costs associated with these processes.

To compare, you could look at the average time taken to settle claims for each company, as well as the number of appeals or disputes. An efficient company would show shorter times and fewer disputes, and this could be reflected in lower premiums.

Discount Types and Their Impact

Numerous discounts are available in Michigan, influencing final premiums. Examples include discounts for safe driving records, good student status, or bundling multiple policies (like car and home insurance). Discounts can substantially reduce the cost of insurance, potentially saving hundreds of dollars annually. For instance, a driver with a clean driving record could benefit from substantial savings compared to a driver with multiple violations.

Discounts for certain types of vehicles or for installing safety features could also lead to lower premiums. This reflects the risk assessment models used by the different companies.

Alternative Solutions and Cost-Saving Strategies

Michigan’s car insurance premiums can feel like a right royal pain. But fret not, future drivers! There are ways to navigate these hefty costs and potentially slash those premiums. This section delves into practical strategies for securing a more affordable policy, from defensive driving to savvy comparison shopping.

Defensive Driving Courses

Defensive driving courses are a proven method to reduce car insurance premiums. These courses equip drivers with skills to anticipate and react to hazardous situations on the road, ultimately lowering the likelihood of accidents. Completion of such a course often results in a demonstrable discount on insurance premiums. Think of it as an investment in your driving prowess and your wallet.

Many insurers offer discounts for course completion, making it a smart move for any driver seeking to save on premiums.

Safe Driving Habits and Responsible Vehicle Maintenance

Maintaining a spotless driving record and keeping your vehicle in top condition are paramount to lowering insurance costs. Avoiding speeding tickets, maintaining a safe following distance, and adhering to traffic laws are crucial for a low-risk profile. Regular vehicle maintenance, including routine check-ups and timely repairs, minimizes the risk of mechanical failures, preventing potential accidents. Responsible driving habits and preventative maintenance, in essence, contribute significantly to a favourable insurance profile.

Comparing Quotes from Various Insurance Providers

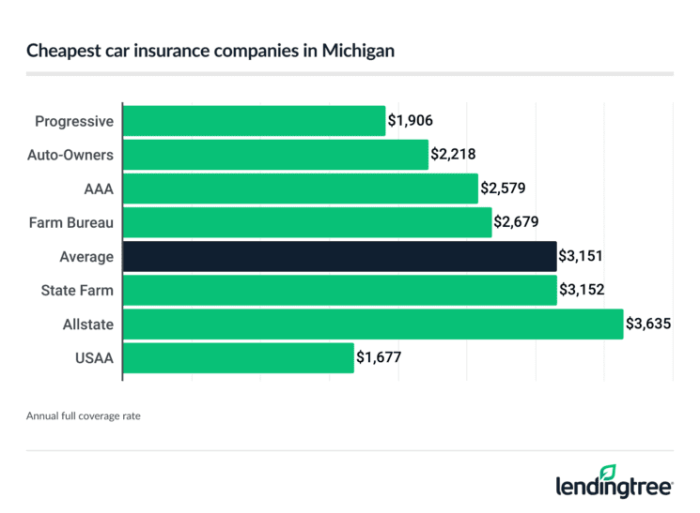

Comparing quotes from multiple insurance providers is a crucial step in securing the best possible deal. Michigan boasts a diverse range of insurers, each with varying pricing structures and policies. Directly comparing quotes from different providers allows you to pinpoint the most cost-effective option.

Using a Comprehensive Insurance Comparison Tool

Leveraging a comprehensive insurance comparison tool is a game-changer when it comes to finding the best deal. These online tools aggregate quotes from multiple insurers, simplifying the process of comparison. Such tools allow you to input your specific driving history, vehicle details, and desired coverage options, enabling you to rapidly identify the most cost-effective insurance policy. These tools are an absolute lifesaver for anyone looking to save on car insurance.

Visual Representation of Data

Visual representations are crucial for comprehending complex data related to car insurance costs in Michigan. Graphs and charts transform numerical information into easily digestible formats, enabling a quicker grasp of trends and patterns. This allows for a more effective analysis of the factors contributing to the high cost of car insurance in the Wolverine State.

Driving Experience and Insurance Premiums

A line graph showcasing the relationship between driving experience and car insurance premiums would be highly insightful. The x-axis would represent driving experience, categorized into novice, intermediate, and experienced drivers. The y-axis would depict the corresponding average car insurance premium. The graph would demonstrate a clear downward trend, where premiums decrease with increasing driving experience. This reflects the reduced risk insurance companies perceive with drivers having a proven track record.

For example, a driver with 10 years of accident-free driving might see a 20% decrease in premiums compared to a newly licensed driver.

Average Car Insurance Costs by Age Group

A bar chart, visually representing average car insurance costs across different age groups in Michigan, would provide a clear picture of the cost variations. The x-axis would display age groups (e.g., 16-25, 26-35, 36-45, etc.), and the y-axis would show the average premium for each group. The chart would likely show a noticeable peak in premiums for younger drivers, reflecting the higher risk associated with inexperience and potentially higher accident rates.

Conversely, older drivers with a longer driving history could potentially see lower premiums.

Regional Variation in Car Insurance Rates, Why is car insurance so expensive in michigan

A map of Michigan, highlighting the variation in car insurance rates across different regions, would be a practical way to illustrate geographical disparities. Different colours or shades could be used to represent varying premium levels. Areas with higher rates might correlate with higher accident frequencies or specific demographic factors. For example, urban areas with high traffic density and higher accident rates might be depicted in darker shades compared to rural regions with fewer accidents.

Vehicle Type and Insurance Premiums

A bar chart comparing average car insurance costs across different vehicle types would be useful. The x-axis would list vehicle types (e.g., economy cars, SUVs, sports cars). The y-axis would represent the average insurance premium for each vehicle type. The chart would likely reveal that sports cars and luxury vehicles typically have higher premiums than more economical vehicles. This reflects the perceived risk and cost of repairs associated with these types of vehicles.

Breakdown of Car Insurance Claims by Cause

A pie chart depicting the breakdown of car insurance claims by cause (e.g., accidents, vandalism, theft) would be a powerful visual tool. The pie chart would illustrate the relative proportion of claims arising from different causes. Accidents might be the largest slice, while theft or vandalism might contribute a smaller proportion. Understanding the distribution of claims can aid in targeting preventative measures and optimizing risk management strategies by insurance companies.

Closing Notes

In conclusion, the high cost of car insurance in Michigan is a consequence of numerous intertwined factors. From the unique challenges of Michigan’s driving environment to the specific regulations and laws governing insurance, a comprehensive understanding requires careful consideration of each element. Ultimately, while the price may seem steep, understanding these complexities allows for informed decisions and potentially more cost-effective solutions.

General Inquiries

What is the impact of Michigan’s no-fault insurance system on car insurance rates?

Michigan’s no-fault system, while designed to expedite claims, can sometimes contribute to higher premiums. This is because the system covers a broader range of expenses, which in turn affects the overall cost of insurance policies.

How do accident hotspots affect car insurance costs in different areas of Michigan?

Areas with higher accident frequencies often experience higher insurance rates due to increased risk for insurers. This correlation is closely observed by insurance companies when determining premiums.

What types of discounts are available to lower car insurance premiums in Michigan?

Various discounts, including those for defensive driving courses, good student discounts, and safe driving habits, are available to lower car insurance premiums in Michigan. Comparing quotes across providers is crucial to discover these opportunities.

How does the competitive landscape of insurance companies in Michigan impact rates?

Competition among insurance providers can influence rates. Companies often adjust their pricing strategies to remain competitive and attract customers.